How Much Should I Save Each Month

The answer to the question “How much should I save each month” is based on what goals you have. Are you saving for the down payment on a house? Are you saving for retirement? Do you plan to retire early? There are many factors involved in deciding how much money you should save every month. As a short answer, many financial professionals recommend saving 15% to 20% of your gross income. This is over simplified advice and is extremely difficult to do if you are earning minimum wage and way too little to be saving if you are bringing in 6 figures. Personal finance is PERSONAL and one size doesn’t always fit all. The suggestions I have here are goals to strive for, not numbers that you should have already hit that everyone else is hitting (because they aren’t; Most American’s can’t cover a $1,000 emergency and on average save under 5% of their income). It’s OK to aim for a difficult goal and come up short, that’s what challenging yourself is. Make the commitment to consistently challenge yourself on your savings goals and run your own race.

The answer to the question “How much should I save each month” is based on what goals you have. Are you saving for the down payment on a house? Are you saving for retirement? Do you plan to retire early? There are many factors involved in deciding how much money you should save every month. As a short answer, many financial professionals recommend saving 15% to 20% of your gross income. This is over simplified advice and is extremely difficult to do if you are earning minimum wage and way too little to be saving if you are bringing in 6 figures. Personal finance is PERSONAL and one size doesn’t always fit all. The suggestions I have here are goals to strive for, not numbers that you should have already hit that everyone else is hitting (because they aren’t; Most American’s can’t cover a $1,000 emergency and on average save under 5% of their income). It’s OK to aim for a difficult goal and come up short, that’s what challenging yourself is. Make the commitment to consistently challenge yourself on your savings goals and run your own race.

How Much Should I Save Each Month Based On Income?

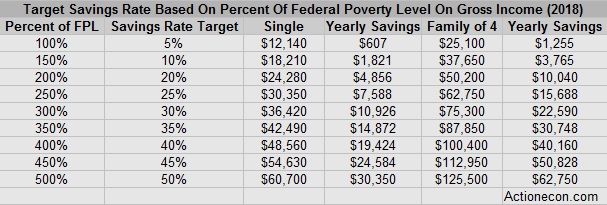

I wasn’t really sure the best way to do this because income is tricky. It makes a world of difference if you are single and earn $30,000 or if you are married with 4 kids and earn $30,000. I ultimately decided to look at this as a percentage of the federal poverty level. I understand that everyone has a different situation and living in extremely high priced areas like Silicon Valley or New York City will make these targets laughable. I think for the vast majority of people these are good targets to shoot for.

Usually the federal poverty level is assigned at the Adjusted Gross Income level. For the numbers below I am using gross income because your AGI is what you have AFTER most savings have already been distributed into traditional IRAs and 401K accounts. These are aggressive, yet achievable goals to strive for. The “average” American saves under 5% of his income, so doing anything beyond that has you well above average. Average by the way is working until you are 70 and always worrying about money, so we certainly don’t want average to be our goal.

<Poverty Level: Saving money is extremely difficult at this income level. Your effort is best concentrated on finding ways to work more hours and find higher paying jobs than finding ways to cut the corners on your expenses. Most of the time people at this income level are able to save money at tax time when Earned Income Credits and Child tax credits are distributed. Getting and keeping $1,000 in the bank as a starter emergency fund should be the primary goal at this income level.

<Poverty Level: Saving money is extremely difficult at this income level. Your effort is best concentrated on finding ways to work more hours and find higher paying jobs than finding ways to cut the corners on your expenses. Most of the time people at this income level are able to save money at tax time when Earned Income Credits and Child tax credits are distributed. Getting and keeping $1,000 in the bank as a starter emergency fund should be the primary goal at this income level.

100% of Poverty Level: Once you are above the poverty level although difficult, it becomes a lighter burden to save some money. At 100% of the poverty level I would target a 5% savings rate. This would allow you to get a full employer match in a 401K plan and would also give you a decent sized retirement savers tax credit based on income. If your employer doesn’t offer a 401K it is still worth it to save 5% of your income to build your saving discipline and start taking advantage of compounding interest.

200% of Poverty Level: At 200% of the Federal poverty level most people are experiencing lifestyle creep because they have finally worked themselves into a position where they have disposable income. They can now buy a lot of the things they have been going without. If you are at 200% of the federal poverty level you are making twice what someone at the poverty level is making, so saving 35% of this increase should be feasible. Saving 20% of your income is a lofty goal to have at this income level, and remember it isn’t all or nothing. If you strive to hit 20% but only end up saving 15% you are still doing great!

250% of Poverty Level: Saving 25% puts you in a new class of savers. Saving 25% of your income ensures that you will be able to own your own home, retire with dignity, and will most likely be a millionaire in the next 25 years. Saving 25% of your income while at 250% of the federal poverty level is challenging because effectively you will be living off of 187.5% of the federal poverty level. At this income and savings level you will be eligible for cost sharing subsidies and low cost medical plans through the federal health care exchange. You may also be eligible for the retirement savers tax credit as well.

300% to 500% of Poverty Level: Saving 25% of your income ensured your financial future, increasing your savings rate further increases how soon you will be financially independent. Saving more is always better. If you can save half your income every year then you should be financially independent and never have to work again after 15 short years.

Where am I? I strive to hit a 50% savings rate, but have not achieved it yet. Mrs. C. and I were able to save 44% of our net income last year. Last year was our best year ever and as a percent of the federal poverty level our total gross income was around 275% of FPL and our gross savings rate was right around 40%. This is a little bit better than the goals I have set here, but I am an anomaly. I’ve been working steadily on increasing my saving rate for 5 years now. A few years ago I wrote a blog post called “The Quarterly Savings Rate Challenge” Designed to push myself (and help others push themselves) to increase their savings rate every quarter with broken down action steps of HOW to achieve these gains.

How Much Should I Save For A House Down Payment?

I always recommend people put 20% down when buying a home. This is often met with groans because they want to buy their dream house now. My counter to this is DON’T buy “the dream house” If you have your eyes on a $200,000 dream home and a $40,000 down payment will take you half a decade to save, then it is the wrong house. Look for a starter home for $75,000. The $15,000 down payment is much easier to come up with and you will be buying a cheaper house. Banks will often lend you 3 – 4X your annual income on a home with 3.5% down. If you instead borrow 1X – 1.5X your annual income with 20% down on a 15 year mortgage your house payment will be lower, you will buy a home sooner, and your house will gain equity much, much faster. Saving a 20% down payment also keeps you from paying private mortgage insurance which is basically throwing money away.

In the section above I created a chart detailing savings targets based on where you stand as a percentage of the federal poverty line. If your goal is to buy a house that costs 1.25 times your annual income and you are going to put down 20%, then you need to save a total of 25% of your annual income. If you are saving 10% of your income per year then it will take 2.5 years, if you are saving 50% of your income per year it will take only 6 months.

In addition to the down payment on your home purchase you will also want to have a few thousand dollars for closing costs and 6 months of house payments in cash reserves. When I was saving for a house down payment I stopped contributing to retirement accounts entirely to speed up the process.

I really hope you will put down 20% when you buy a house, if you don’t, at the very least still buy a cheaper home in the 1X – 1.5X income range and get it on a 15 year or 20 year mortgage. Someone getting a 15 year mortgage with 3.5% down ends up ahead of someone getting a 30 year mortgage with 20% down.

How Much Should I Save Each Month If I’m Expecting A Baby?

First of all congratulations! Nothing will change your world like becoming a parent. Before I had a kid being broke wasn’t scary at all. I wanted more money to invest and for fun, but I didn’t worry about money seriously until I became a father. Right before my son was born in 2008 my wife and I had around $10,000 in savings which was an insane amount of money for us, I had this great idea to buy a house at the tax auction and fix it up to rent it out. Yeah, buying a $6,000 house at the tax auction with the vast majority of your savings a few weeks before your child is born is D U M B. I felt fear like I never had before, like there was a saber tooth tiger chasing me (and an angry wife who didn’t want me to by that stupid house). You want to have as much cash as possible available for when you have a new child. This means don’t invest in anything and don’t buy anything you don’t absolutely have to in order to build up a war chest for the arrival of your kid.

Babies cost money and time. Everything around a baby is expensive. Having the baby at the hospital, getting a car seat, a stroller, a playpen, a bassinet, clothes and diapers that they grow out of quickly, Dr. visits and missed work, baby sitters and daycare. All of these things add up. If I were expecting today and had no money in savings my goal would be to hit $5,000 in savings before the baby arrived. With a 9 month window this is around $550 a month. And keep in mind that baby stuff can be found ridiculously cheap at thrift stores and yard sales, just because a baby is new doesn’t mean all their stuff has to be new.

How Much Should I Save Each Month For Retirement

$0 per month. That is until you are out of consumer debt (car loans, personal loans, student loans, payday loans) and have an emergency fund of 3 – 6 months of expenses. Too many people try to put the cart before the horse because they get an employer match in their 401K. I’m all about taking advantage of incentives, but just because an incentive exists, doesn’t mean it’s in your best interest to take advantage of it. Focus on 1 thing at a time or you will be in debt forever. Would you borrow money from your retirement account to finance a car? I didn’t think so.

Once you are out of debt and have an emergency fund in place then you want to save enough each month to get the full value of an employer match and the retirement savers tax credit. The retirement savings tax credit maxes out at $2,000 of contributions and can be up to $1,000 based on your AGI. A common employer match is 50 cents on the dollar for the first 5 percent but some are much more.

I split my savings roughly 50:50 between paying extra on my mortgage and investing in retirement accounts. Use the tables above based on your income to figure out how much total you should be saving each month and then decide how much of your savings you want to put towards your house and how much towards retirement. Dave Ramsey recommends saving 15% for retirement then putting anything extra on the house. I personally felt like I was “behind” on retirement savings because I saved up for my down payment for a house while putting nothing towards retirement, so my 50:50 strategy is balancing that out a bit.

How Much Should I Save Each Month To Retire at 55?

In my article the secret to becoming a millionaire I discuss one of the simplest pieces of financial planning I have found. Save 25% of your money for 25 years and you will become a millionaire. The math checks out. If you earn a median income of $57,000 and save 25% which is $14,250, then in 25 years with 7.2% average annual returns you will have over $1 million. Saving 25% of your income starting at age 30 and going to age 55 should make you a millionaire and give you enough money to retire on.

The overall long term goal is to save up 20X spending. I think the 4% rule that advocates 25X spending is too conservative and results in people working too long. Get yourself on track to hit 20 times your expenses in your retirement account.

Using a 5% withdrawal rate $1 million will produce $50,000 per year in income. Since you are no longer saving for retirement your available income would actually increase from the $43,750 you were spending to $50,000 per year.

How Much Should I Save Each Month To Retire At 40?

Retiring extremely early, like at age 40 requires starting early and having a really high savings rate. If you start seriously saving money at 25 this gives you a 15 year window before reaching 40.

It is possible to retire early earning a median income, but it is much easier if you have an above average income. For argument sake I will use the same figure as I used above and go with a $57,000 income.

If you save 40% of your income for 15 years at 7.2% annualized returns you will have around $640,000. Using a 5% withdrawal rate this would provide an income of $32,000 per year. If you were earning $57,000 and saving $22,800 (40%) each year, then you would have $34,200 as your normal spending, from which you would at the very least have to subtract Social Security and Medicare taxes from, giving total income of $34,200 – $4,360 = $29,840. Since you don’t pay payroll taxes on retirement account withdrawals you would end up with a greater income in early retirement.

So there you have it, save 40% of your income for 15 years and you should be able to retire. I would highly advise anyone planning to retire this early to also build up a high paying part time job to ensure if needed you can generate some cash income without having to go back to full time work. Retiring at 40 means you could have a retirement of over a half century and a lot can happen in that time.

How Much Should I Save For Kids College?

I’m probably not the best example for this. I haven’t saved for kids college at all, despite having a 40%+ savings rate. Paying off our house and building our retirement nest egg have taken precedent over saving for kids college. When our oldest kid is ready to go to college we will have a paid off house and will be able to dedicate that cash flow towards college expenses.

For our kids it is a requirement that they attend community college for the first 2 years. Our kids will also be heavily involved in applying for scholarships and will be working to pay for some of their college expenses.

If you are in a position to save money for kids college I think a good target to shoot for is $30,000. I know, this is much less than the doom and gloom $100,000+ numbers we hear from the media. Here’s how I arrived at that number: Community college is extremely inexpensive. For my kids it is free thanks to the Benton Harbor Promise. Community college is often free through the Pell Grant system because the amount of the Pell Grant for students demonstrating financial need is often more than the cost of community college. That covers the first 2 years. Otherwise you may be looking at around $3,500 to $5,000 per year for tuition and fees. I am assuming your kid will live at home for this time period too. We live 3 miles down the road from a community college and it would be throwing money away for them to rent a dorm or apartment.

For the subsequent 2 years the current retail price for an instate public school including room and board is around $25,000 a year. If you have a Pell grant of $4,000 per year this cuts it down to $21,000 per year. Now throughout this process the kids should be preparing for and taking CLEP exams to at a minimum finish a semester early. 15 credits from CLEP exams will then knock $10,000 of the cost of the 2nd year because they won’t be in school. Now we are down to needing a total of $32,000 and this doesn’t even include income from the student working during the summer, any scholarships your child receives, or cash flow that you can cover. If your kid earns $6,000 a year working part time all the way through college at least half of that can go towards paying for college expenses. That’s $12,000! Now we are down from needing $32,000 to needing only $20,000.

One more thing. You (or your child if they are independent) will receive a tax credit for college costs of up to $2,500 per year. The American Opportunity tax credit give a 100% credit for the first $2,000 spent per year and then a 25% credit for the next $2,000 spent per year. 40% of this credit amount is refundable if you hit a $0 tax return. Since in the above situation we didn’t have any college expenses for the first 2 years we would only receive the credit for the 2nd 2 years. This will reduce college costs further by $5,000, now we are looking at only needing $15,000.

Since college expenses will increase between now and when your kids are in school it is a good idea to aim higher than the $15,000 it looks like we need, so I doubled that number. This is all assuming your kid gets NO scholarships and involves you not cash flowing any of it.

In order to save $30,000 over 18 years you would need to save and invest $70 per month for 18 years with a 7.2% real return. If you only have 10 years of time then you would want to save around $170 per month. Saving for your kids college doesn’t have to be a scary endeavor. Using the strategies I outlined above you can get the total cost down substantially

As long as you are focused on improving your financial situation your savings rate will follow. Keep cutting back on expenses, keep increasing your income and set goals 5, 10, 20 years in the future. If you are only looking at next week and next month you won’t reach lofty goals. Keep challenging yourself and in a few years you will be amazed at how much you are saving.

How much do you save each month? Do you think the targets I set here are realistic?

Leave a Reply