Pay Off The Mortgage

I’m on a mission to pay off the mortgage quickly, I hope you will join me as well. In 2011 I bought the home of my dreams, but in doing so Mrs. C. and I bought a house valued at 3 times what our previous house was. We moved to a much nicer neighborhood with a 3 acre yard. Since we purchased the house we even bought an additional 8.5 acres of adjoining land in the form of a wooded abandoned railroad bed. I love my house, but what I don’t love is paying the bank $570 every month…for 30 years. To combat this in 2014 we started paying an extra $200 per month on the house and are making a large payment at the end of each year to accelerate the mortgage faster. Last year we paid an extra $5,000 on our mortgage. This year we plan to triple that.

I’m on a mission to pay off the mortgage quickly, I hope you will join me as well. In 2011 I bought the home of my dreams, but in doing so Mrs. C. and I bought a house valued at 3 times what our previous house was. We moved to a much nicer neighborhood with a 3 acre yard. Since we purchased the house we even bought an additional 8.5 acres of adjoining land in the form of a wooded abandoned railroad bed. I love my house, but what I don’t love is paying the bank $570 every month…for 30 years. To combat this in 2014 we started paying an extra $200 per month on the house and are making a large payment at the end of each year to accelerate the mortgage faster. Last year we paid an extra $5,000 on our mortgage. This year we plan to triple that.

Why Pay Off The Mortgage Early?

1. The 30 Year Mortgage Is A Curse:

With a typical 30 year mortgage it takes about 5 years to pay down 10% of the original balance. The vast majority of the mortgage payment in these early years goes to interest. Any time the interest rate on a 30 year mortgage is over 5.5% you actually end up paying more in interest than in principal over the life of the loan. Comparatively a 20 year mortgage will have you paying 42% less in interest and the house payment is only about 23% greater.

The big question to ask when looking at getting a 30 year mortgage is will you actually be in the house that long? Most people move within 5 – 7 years. With a 30 year mortgage without making extra payments you will be looking at the potential of being upside down on the property. Real Estate markets can easily fluctuate 10%, the last place you want to be is trying to sell a house and realizing you may need to come up with several thousand dollars to close.

2. The Mortgage Interest Tax Deduction Is A Joke:

If I told you I would give you 15 cents if you give my wife a dollar, you would probably look at me like I was crazy, but this is the rationale people use to justify keeping their mortgage. The home mortgage interest tax deduction at it’s best is a bad deal even for those select few who actually qualify to receive it, but most home buyers don’t see any benefit from the mortgage interest tax deduction. In order to receive the mortgage interest tax deduction you must itemize your deductions instead of taking the standard deduction.

This means that for a married couple the total of their itemized deductions would have to be greater than $12,600 in order for it to make sense to itemize. The primary itemized deductions are state income tax, mortgage interest, property taxes, and medical insurance premiums. For a median home with a $180,000 mortgage on a 3.5% loan this would be $6,300 in the first year; meaning just to itemize the total of state income taxes, property taxes, and medical insurance premiums would need to be over $6,300 just to break even. In Michigan we are taxed 4.25% on our Adjusted Gross Income. For a median family with an AGI of $50,000 this would work out to $2,125 in state income tax. We paid $1,400 in property tax last year. This brings our total up to $9,825. If your medical insurance premiums are covered by your employer, or are for a high deductible health care plan, then they are not deductible. In this scenario it makes more sense to use the standard deduction, the mortgage interest deduction did no good.

Let’s say that somehow you already itemize all your deductions and every bit of the mortgage interest is tax deductible; you still would have paid $6,300 in interest to save $945 in taxes. Doesn’t sound like a winning move to me. Pay off the mortgage.

3. Your Primary Residence Is Not An Investment:

Your primary residence is the roof over your head. Yes interest rates for a home are extremely low compared to other loans, but there is a reason for this, the bank can come and take your house from you and sell it if you don’t pay them. For me that is not a risk I want to take. This is why I view my primary residence as the roof over my head and not as an investment. People always tell me that I’m missing out by paying extra on my house instead of putting all of that money into stocks, which over time should have a substantially higher return than the 4.25% guaranteed return I am getting by paying extra on the mortgage. Surprisingly enough, none of these people will take out a 2nd mortgage on their homes to invest in stocks.

I believe that it is important to save for retirement and pay extra on the house. I personally am paying $200 extra on the house first, which is the amount extra it would take to change my 30 year mortgage to a 15 year mortgage. Then I am putting 20% of my income into retirement savings, and after that I am paying everything else on the mortgage. This strategy keeps me from paying the vast majority of the interest that comes with a 30 year mortgage first, but still allows me to save a lot of money for retirement before going super intense on paying off the house.

Tools To Help Pay Off The Mortgage:

The Action Economics Mortgage Payment Spreadsheet

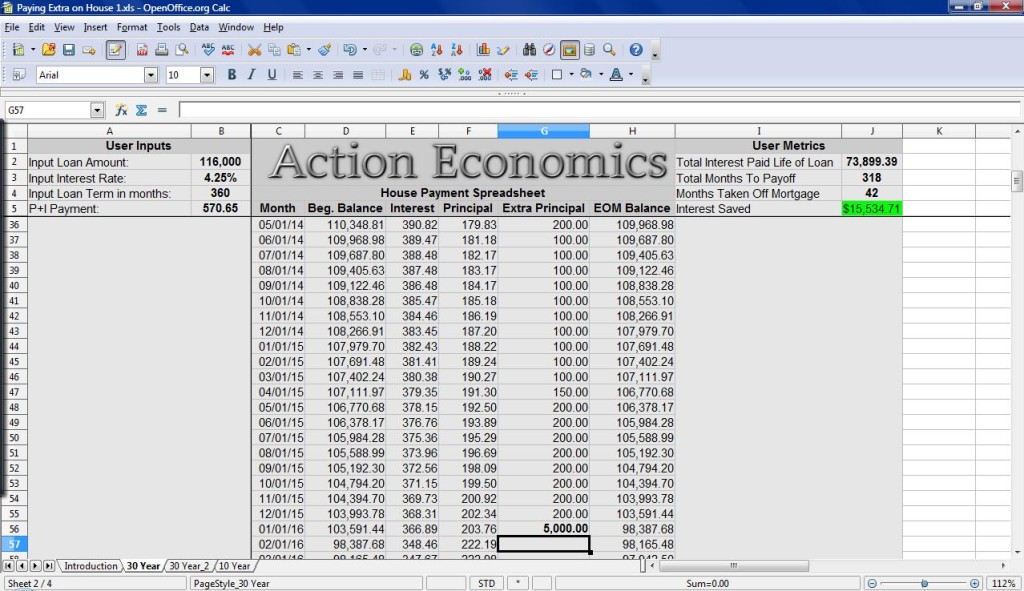

I built my Mortgage Payment Spreadsheet from my desire to accurately track the progress I was making in paying off my mortgage.

1. This spreadsheet will calculate an amortization table for any fixed rate mortgage with the simple inputs of interest rate, duration, and loan amount.

2. This spreadsheet will allow you to enter any number in the extra principal column each month. Life isn’t always steady, so some months you can pay a bit more and some months might not contribute any extra to paying off the mortgage.

3. This spreadsheet calculates out how much interest you have saved to date with extra payments and how much time has been saved to date on extra payments. This is a huge boost to motivation. When paying off the mortgage it seems like such a daunting task because there is no reward until it is complete. With this spreadsheet you know exactly how much money and time you have saved with the actions already taken. From the image above you can see that I have saved over $15,500 in interest and 42 months by paying extra on my mortgage to date.

4. This spreadsheet provides a side by side comparison of 4 different mortgage options. Enter in any duration, rate, and amount into the 4 mortgage amortization sheets and the 5th sheet will compare the mortgages side by side. I use this feature to compare different early payoff methods, but it works great for comparing a 20 year mortgage against a 30 year mortgage or a $150,000 loan against a $100,000 loan.

Mortgage rates are at historic lows right now. When rates started dropping in 2010 I didn’t bother to try to refinance my first home because with how low the loan value was (around $50,000) I thought it would be more hassle than it was worth. When I finally refinanced in 2014, I realized I left a TON of cash on the table. By refinancing my 15 year 7.37% mortgage to a 10 year 3.5% mortgage I saved over $100 per month on interest payments.

As a general rule, when you refinance always refinance to a loan with a shorter term than what’s left in your amortization. Never refinance into another 30 year mortgage. If you are 5 years into a loan, go with a 20 year, or even a 15 year mortgage. Refinancing is a great option to pay off your mortgage early. You take action 1 time and are set up to get it knocked out at a much faster amortization. Lending Tree compares several different lenders to assist you in finding the best option. I used Lending Tree when I refinanced my last house and had 3 banks calling me within minutes to give me the loan I was looking for.

Stay Motivated While Paying Off The Mortgage

I know this sounds silly, but one of my big motivators is when I turn on the radio while on my way to pick up the kids from school and I hear the intro to the Dave Ramsey show “Welcome to the Dave Ramsey Show where debt is dumb, cash is king, and the paid off home mortgage has taken the place of the BMW as the status symbol of choice…” Nailed it. I don’t know about you, but I would feel much better with a paid off home than with a shiny BMW. Anytime I hear this intro it reminds me of the primary mission of paying off the mortgage, I especially like listening on Fridays when people call in who have finished paying off all their debt and describe how it feels and what they did to get there.

Another way I stay motivated is by writing about personal finance and discussing my goals with others both in my daily life and online. If staying motivated is difficult, automate as much of the process as possible so you don’t have to think about it. My bank automatically takes an extra $200 per month out of my account and I never have to think about it, or do anything to pay extra on the mortgage.

Are you taking steps to pay off the mortgage?

Leave a Reply