Double Your Money…Again and Again.

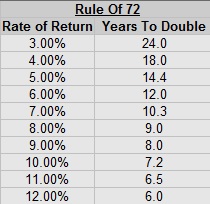

There’s a famous Will Rogers quote that the easiest way to double your money is to fold it over and put it back in your pocket, which for the most part is true. When people advocate doubling your money, generally speaking there is a scam afoot and you will end up loosing it, with one shining exception, investing in the stock market and waiting 10 years. The Rule of 72 states that if you divided 72 by the interest rate you expect to receive, you will get the time it will take for your investment to double. If we expect a 7.2% return, then it will take 10 years for our investment to double. The Vanguard Total Stock Market Index Fund has returned an annualized 7.23% over the past 10 years.

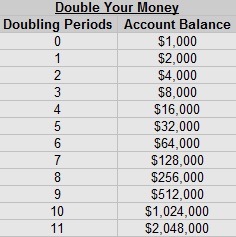

Using the rule of 72 if you put $1,000 in the Total Stock Market Index Fund, in 10 doubling periods, or roughly 100 years, you will have over $1 million…but you don’t have 100 years do you? You know what else, if you waited 60 years instead of 100 years instead of $1 million you would have just $64,000. What??? 60% of the time only gets you to 6.4% of the goal? What the heck?!?! That’s the power of compounding interest. To make this work in our favor we need to save extremely well early on. Saving to $64,000 quickly eliminated 6 of these 10 doubling periods on the way to $1 million.

Since we only have so many doubling periods available (generally 2 to 4) we need to focus on building up our nest egg extremely fast with savings. Here is a chart detailing these doubling periods, starting with $1,000.

What I’m telling you is that the goal of save X% is not going to work. Saving 5%, 10%, 20%, not gonna do it when starting out. Yes, we always want to challenge ourselves to save a higher percentage of our income, but starting out we need to kick our savings into overdrive. Aim to knock out as many doubling periods as fast as you can in your investment account. I’ll be the first to tell you, I screwed up on this. I am 30 years old and I’m just now approaching the 6th doubling period of $64,000. Don’t tell your kids and your friends in their teens and 20s to save 20% of their income. Tell them to save every single cent they can and hustle like crazy to knock out these doubling periods.

Step 1: Save $4,000

No matter where you are in life look at this as a major milestone. Once you’ve figured out how to find savings in your budget, you can start to expand the savings window by increasing income and reducing expenses. There are always competing priorities in life, but this needs to be a high one. I think about kids in high school working part time jobs. I know that when I was in high school any income I made I wanted to spend either on immediate wants such as fast food and video games, or on short term goals like a nicer car.

Getting $4,000 into an investment account early on is the first major step. It isn’t unreasonable to think that for anyone in America who is at least 16 this can’t be done in under 1 year. That’s only around 500 hours of work at minimum wage. I’m not saying it will be easy, I’m saying that it is possible. In order to have every dollar invested and be invested in a diverse portfolio, I recommend starting an IRA at Betterment and investing in the 100% stock allocation. I set up my account last year and it took around 5 minutes, and was extremely easy to do.

Step 2: Save $64,000:

This is the most important step to maximizing lifetime savings. Save $64,000 as quickly as possible. Going from $4,000 to $64,000 is a huge step, but it covers 4 doubling periods (40 years at 7.2% returns!!!) Even if you save nothing else, in 40 years you will be a millionaire. I’m not advocating to stop at $64,000, just noting that if you do just this, you can have a nice retirement at a standard retirement age.

Take advantage of employer matching, work while in college and save every dime you can.

Step 3: Double Your Money: Save $64,000 Again:

It didn’t take 10 years to save $64,000, and the next $64,000 should come even quicker. This is the next substantial doubling period to knock out. This will get you to $128,000. Now it will only take 30 years to get to a million. By the time you are at this step, you should be in an established career and able to earn and thus save a ton of money.

I know this might sound crazy, but there is no reason with proper planning and a bit of time that you can’t save $20,000, $30,000, or even $40,000 per year. For the past two years I’ve saved over $30,000 which if someone told me 10 years ago that would be happening I would have laughed in their face. If you make it a goal to expand your income and to reduce expenses every single year, it doesn’t take a long time to start saving some serious money.

Step 4: Double Your Money One More Time: Save $128,000:

This is the largest stone you should have to push, unless you are choosing to retire insanely early (say in your 30s). Once you have saved $256,000 then without any further investment it is only about 10 years until you are at a half million or 20 years to 1 million. At least for this step investment gains will also help get you to the goal to a significant degree. If you can save $30,000 per year, with 7% returns you should be just about to $256,000 from $128,000 after 3 years.

Help Your Kids Double Their Money:

I find the idea of large inheritances when someone passes away to be extremely inefficient. I think it is much more useful to pass on smaller sums of money to heirs earlier in life. In Sam Walton’s book “Made In America” he spoke about the advantages of giving away your assets before they appreciate. This has led to the Walton kids becoming extremely wealthy without having to pay large estate taxes. Walton split his company up between his kids when he only had 1 store. The kids even though they were very young all owned a major percentage of Walmart, long before it became a retailing giant, or was even called Walmart..

One of the key ways of transferring assets to children before they appreciate is to provide retirement savings matching funds. (Note: Only do this if you are in a financial position where your retirement won’t be affected by this match).

My personal goal is to match my kids retirement funds up to $5,000 per year dollar for dollar. Doing this it is conceivable that they will reach $64,000 by the time they are 23 years old.

Advantages Of This Strategy:

- Knocking out 6 doubling periods that quickly gives a ton of time for portfolio growth.

- It assists during their lowest earning years: Right out of high school and during college are most likely the lowest earning years of anyone’s career. Providing extra savings during this time is a major help. $5,000 per year for 5 years in their teens and 20s is worth more than well over 10X that amount when they are in their 60s and 70s.

- It develops strong savings muscles: By providing this extra incentive saving money is extremely rewarding. If someone told you you could double your money instantly, all you had to do was save the match wouldn’t you jump at the chance? You would probably do anything you could to hustle up the money to make it happen. If they can save $5,000 in their lowest earning years to earn my matching funds, then once they start out in a career saving $5,000 per year or more should not be difficult.

- It Builds on other incentives: The retirement savers tax credit provides up to a 50% tax credit on retirement contributions based on income, on up to $2,000 in contributions per person. Many employers match $1 for $1 for the first 5% of retirement savings. A standard first job at McDonald’s offers an amazing $3 to $1 match for the first 1%, then $1 to $1 match on the next 4%.

- It prioritizes retirement savings: Retirement savings is not a major priority in your teens and early 20s. Because of this extra incentive retirement savings becomes a priority when it needs to be, rather than being on the far back burner behind other goals like buying a nicer car, lifestyle inflation, and saving for a house.

The Other Way To Double Your Money:

The majority of this article is fixated on building up savings extremely fast, which is necessary to knock out these doubling periods, however there is a second area of attack, reducing the time it takes for your money to double. This is done by seeking a higher rate of return on your investments. For the most part we don’t have control over what the market does and picking individual stocks is extremely risky. Once you have around $30,000 saved it is a good time to ensure you have a proper asset allocation. Before you have this much money it is much easier to keep your money invested at Betterment in their 100% stock allocation IRA. The main advantage Betterment has is that you are instantly invested across a half dozen index funds. In order to do that directly through Vanguard and save a few dollars per year on fees you need over $3,000 per mutual fund to get started. If you want to be in 6 funds, that’s a minimum of $18,000 and even then, they would all have to have the same weight.

I personally see 10 years as the standard doubling time. This historically is about what you would get over the long term in a Total U.S. Stock Market Index Fund. Most people are drawn to these funds because they are simple, they carry much less risk than individual stocks, and they return you what the market returns. The problem is that investing solely in a Total US Stock Market Fund, like Vanguard’s Total Stock Market Index ignores major market sectors that can potentially provide higher returns.

I recommend a diverse collection of Index Funds. I currently am invested in the following 5 index funds:

- Vanguard Total Stock Market Index

- Vanguard Mid Cap Index

- Vanguard Small Cap Index

- Vanguard REIT Index

- Vanguard Emerging Markets Index

Each of these sectors is relatively high risk, but they have different risks, which makes the portfolio as a whole less risky, while also bolstering my chances to outperform the Total Stock Market Index Fund (by actually buying more than what they call the total stock market). I think that this portfolio will outperform the Total Stock Market Index by 2% over the long run. If this comes to pass, then instead of my doubling periods being 10 years, they would be closer to 8 years. It doesn’t sound like much, but over the course of 3 doubling periods that’s a reduction from 30 years to 24 years.

As always I must state the past performance is NO indication of future results. It is entirely possible that over the next 5, 10, 20, 50 years the stock market will perform very differently than it has in the past 90 years. Only time will tell. This is why focusing on savings is a far bigger deal than focusing on investment returns.

Are you working on doubling your money? At what age did you reach $64,000 in invested assets? Hey…get off your computer and go make some money to put in your IRA! Remember, without action knowledge is useless!

Leave a Reply