Updated Financial Planning Spreadsheets

In order to keep track of my finances I utilize several financial planning spreadsheets that I have built over the years. Over the past few months I have made some substantial improvements to these spreadsheets and have decided that it would be a good idea to offer them for purchase online. My current offering of spreadsheets includes a retirement planning spreadsheet, a house payment spreadsheet, and a tax planning spreadsheet. All of these spreadsheets are available here for $5 each, or buy all 3 for $12.

Why Buy My Financial Planning Spreadsheets?

Most likely with some time and effort, someone could make similar spreadsheets to these for themselves. Although it would be possible to do, it would be very time consuming. I have spent over a hundred hours combined developing all of these sheets, Lets say you are great at excel and could make a sheet almost as good in 10 hours, my guess is you value your time much greater than at 50 cents per hour? And most likely some key features would be missing.

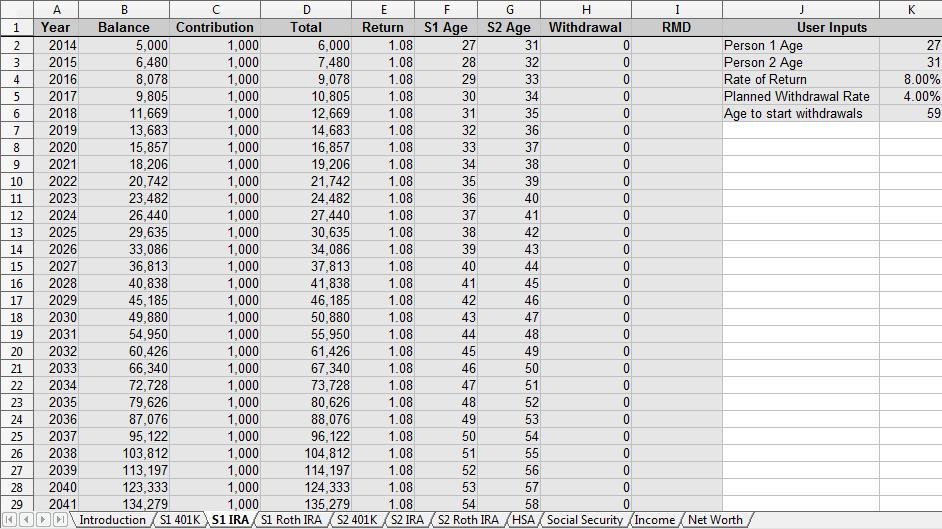

Retirement Planning Spreadsheet:

This spreadsheet is used to project income and net worth in the future. At its heart it is a compound interest sheet, but it has more to offer than just that. I have built 7 compound interest sheets into this spreadsheet to represent 7 different accounts. For a married couple this would be a 401K, traditional IRA, and Roth IRA for each person and an HSA. For single people and for people with fewer accounts, simply inputting zeros into the contribution column will take these sheets out of further equations. There is also a Social Security sheet which gives examples of how the Social Security formula works and given a user input of Average Indexed Monthly Earnings or AIME, will calculate future social security benefits taken at different ages.

Each sheet has a collection of user inputs that will automatically adjust the entire sheet. This makes large changes such as expected interest rate, expected withdrawal rate, and age to start taking withdrawals easy to customize.

This spreadsheet then links all of the above mentioned sheets together in a retirement income sheet. This sheet takes the data from the withdrawal column in each individual sheet and adds them up, showing each line item, to give a total for retirement income.

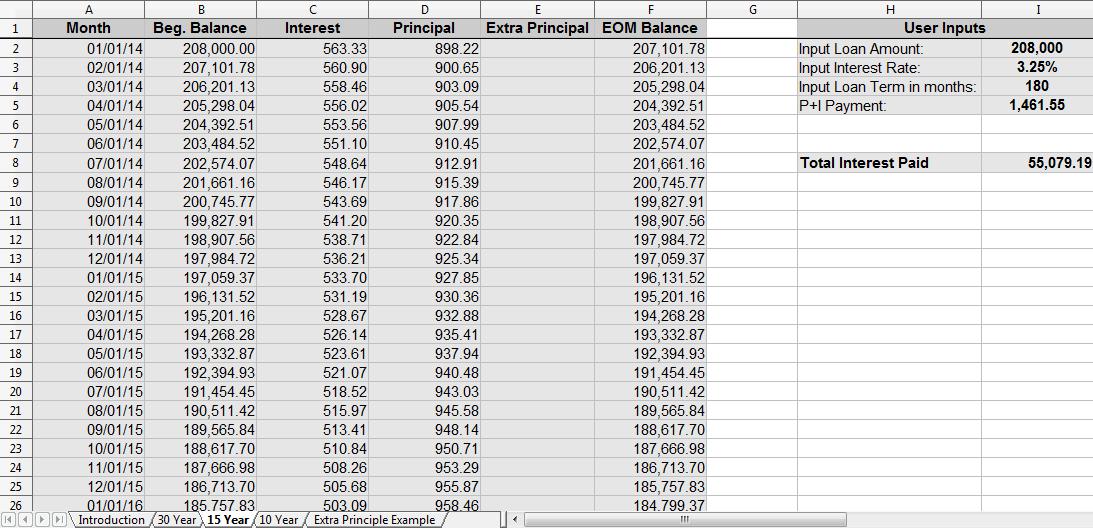

House Payment Spreadsheet:

This spreadsheet is simply designed and very user friendly. The user can input his or her data into the right hand column defining loan amount, interest rate, and term, and the sheet will calculate a monthly payment and amortization table. Although several other amortization calculators exist online, this spreadsheet has a few features that are more desirable.

For years I used the bankrate.com mortgage calculator because it allowed me to enter early payoff information. The problem is that it only allows one variable. For example, in the first 5 years If I wanted to pay an extra $300 per month, but then change it to $500 per month after that, the calculator was no good. Another problem is that you can’t save it and adjust it for later, or compare different mortgage scenarios easily. With this spreadsheet you can do all of that. Each month in the amortization table can be adjusted to reflect any amount of prepayment. Another strong feature is that although I have the examples set up for a 30 year, 15 year, and 10 year amortization, the user can change it to any other duration. Say for example you have a car loan that is 6 years long and want to run numbers on that, the sheet will quickly change by utilizing the User Input section on the right hand side.

This is an excellent spreadsheet for anyone with a goal of paying off their mortgage earlier and for anyone considering buying a home or refinancing a home.

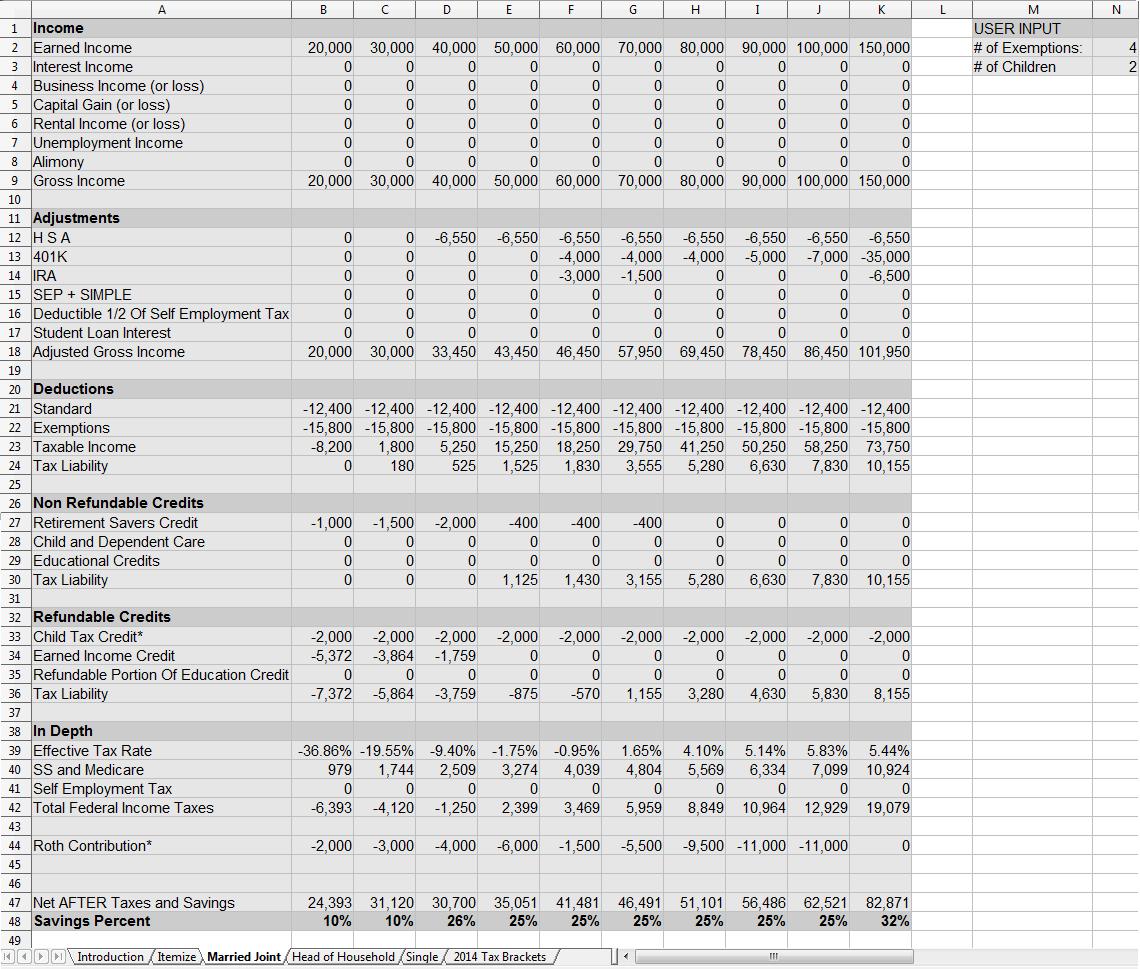

Tax Planning Spreadsheet:

This is the sheet I am most proud of, and yes I use this to plan my taxes every year. Although the other two sheets may stay the same for several years, a new version of this will be released every year to keep up with current tax codes. This spreadsheet is divided into three sheets, each based on your filing status. The columns each show different income levels and each one can be changed easily to fit your situation. I love that I can compare what my tax situation will be against earning different amounts for the year, and then decide what contribution levels make sense to make to pre-tax and post tax retirement savings.

This spreadsheet is very user friendly. The income tax formula works great and the spreadsheet can also calculate the retirement savers tax credit. What I love most about this sheet is the side by side comparison, you can compare over a half dozen scenarios side by side, how cool is that! If it looks like too much is going on, you can easily delete columns, each column is independent so if you only want to run 1 or 2 scenarios side by side you can.

Another great feature is the itemize sheet. Here you can enter your itemized deductions and the sheet will tell you if it make sense to itemize or take the standard deduction. It then adjusts the rest of the sheets based on your entries. The default is to take the standard deduction.

Limitations:

Unfortunately there are too many variables to properly calculate the earned income credit in this spreadsheet, so in order to calculate this credit an online calculator such as this should be used.

I think I have made several very useful products that I am offering at a reasonable price for the value they represent. If you have any questions at all about using the spreadsheets, please contact me.

Leave a Reply