Systemic Changes To Address Racial Inequality

This is going to be the longest post I’ve ever written. This is another article where I will lose some libertarian street cred. Be forewarned, some of my proposals will frustrate a lot of Republicans, and others will frustrate a lot of Democrats. A good chunk of these ideas are not new and similar ideas have been proposed in the past by others. This isn’t about towing a party line, it’s about leveling the playing field for everyone and helping our society build wealth. I have accepted that we will never have a small government, so IF we are going to have a large government that engages in social engineering, lets at least have our social engineering being positive actions that ACTUALLY help people improve their lives.

This is going to be the longest post I’ve ever written. This is another article where I will lose some libertarian street cred. Be forewarned, some of my proposals will frustrate a lot of Republicans, and others will frustrate a lot of Democrats. A good chunk of these ideas are not new and similar ideas have been proposed in the past by others. This isn’t about towing a party line, it’s about leveling the playing field for everyone and helping our society build wealth. I have accepted that we will never have a small government, so IF we are going to have a large government that engages in social engineering, lets at least have our social engineering being positive actions that ACTUALLY help people improve their lives.

Some background on me. I’m White and my parents started out poor as very young parents. My parents have worked their way up in America from the lowest quintile to the highest quintile of both income and wealth over 4 decades. As an adult I have been in quintiles 1 – 4 for both earning and wealth, and should break into the fifth in the next few years. Economic mobility is real and can be achieved, but it is much harder for people of color and for people who live in economically disadvantaged areas. I live just outside of city that is 85% Black and has a poverty rate of 48%. I lived in that city for 7 years and we moved outside the city when we could afford a house with a larger yard. My sister in law died of a drug overdose at 21 and Mrs. C. and I are raising her two boys who are mixed.

I think the problems I identified here if corrected would solve a good chunk of the financial, achievement, and incarceration gaps in our society. I’m sure there are more systemic issues that need to be addressed, but at 12,000+ words I think those can be saved for another article. I believe these are the heaviest hitters. These solutions would be applied to everyone. But John, If everyone gets these benefits how do these actions specifically help racial inequality? The answer to that is that what helps one race of people will help all races of people. We have a very diverse country and several generations of interracial marriages. We have people who have immigrated from every country on Earth. The last thing I want to do is create a bureaucracy where people have to prove their race in order to receive benefits. Any solution that divides us as a country is not the route I would want to go. Because this is a personal finance blog I do focus on money, income, and wealth quite a bit. This focus is also because if these problems are addressed, then the problems caused by poverty will start to fix themselves. I wrote an in depth article on the racial wealth gap 2 years ago, but I did not address all of the problems that caused it nor did I come up with as wide of a range of potential solutions.

I’m going to talk about criminal justice reform, employment, government assistance, housing, education, access to credit, and retirement. I absolutely appreciate any and all feedback that you can provide to these idea, as well as the sharing of other ideas you have. This blog is just as much about me learning new information and viewpoints as it is for me sharing information and my viewpoints. I did a ton of research for this article and I highly recommend following the links in this article for further reading on the individual subjects below.

I also don’t want this article to seem like it is “doom and gloom” or that Black people can’t succeed without these changes. This is far from the truth. There are barriers and obstacles in the way for all of us to succeed in life, and these barriers are different for each person. Regardless of what the barriers are and if they are fair or not, we all have to run our own race and strive to get to that finish line. What I talk about in this article are ways that we can do better the way our society is set up. I strongly believe that every individual can achieve greatness. I love this country and we have come a long way since the end of slavery, and even since the start of the 1960s civil rights movement. That doesn’t mean that we are done. Patriotism is more closely linked to dissent than to conformity, and by criticizing the structures in our federal government please understand that this is coming from a place of love for my country and those in it, and not about being Anti-America.

Criminal Justice Reform To Address Racial Inequality:

End the War on Drugs: The war on drugs has been a colossal failure. From a libertarian standpoint I don’t believe the government should tell free men and women what they can and can’t put in their body. Are most illegal drugs bad for you? Yes. Addiction is a real problem. My sister in law died of an overdose of legal, prescription drugs. We need to treat drug addiction as a medical / mental health disorder and not as a criminal justice matter. My Sister in law struggled with addiction but was hesitant to seek help, fearing that she would risk getting losing her kids and potentially going to jail.

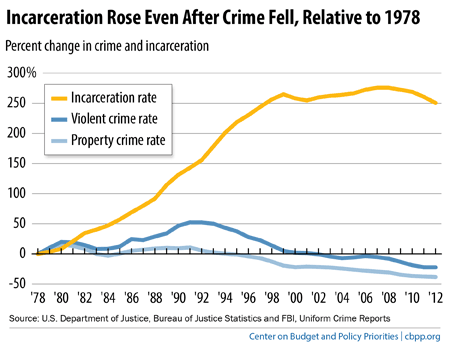

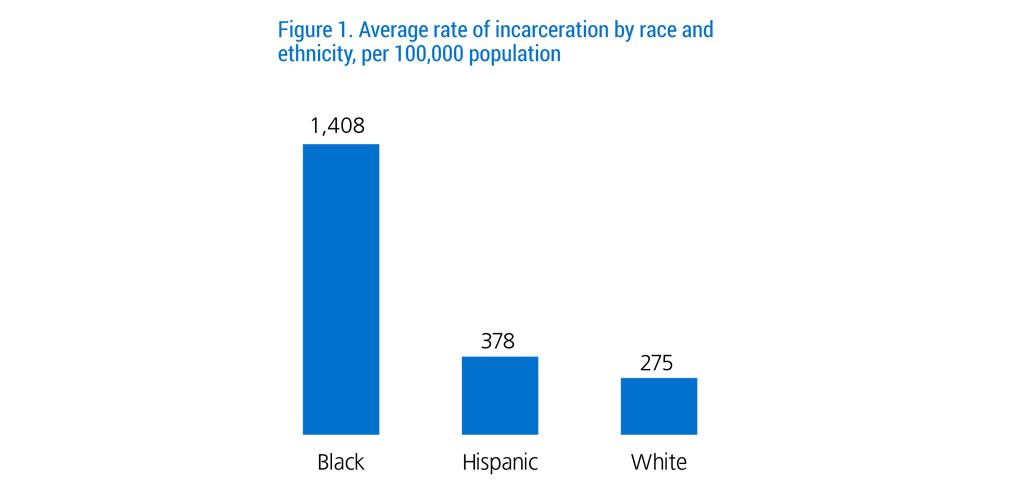

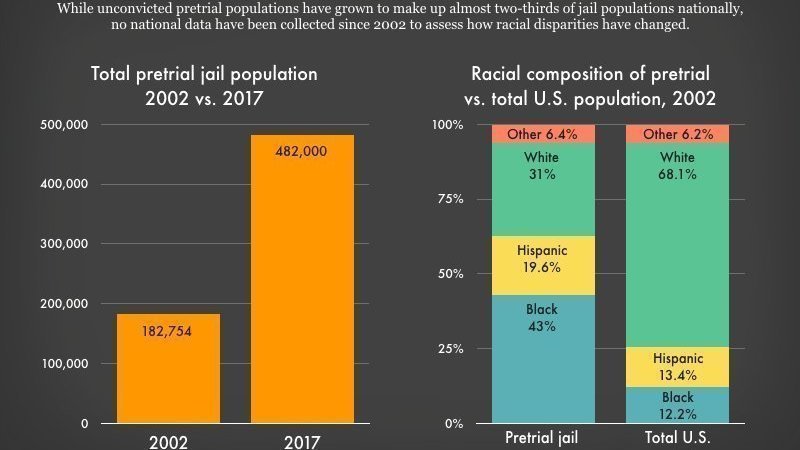

The war on drugs has caused mass incarceration and the war on drugs causes far more human suffering than the drug use itself does. We have the highest percentage of our population in prison of any other country in the world, and the majority of them are for drug offenses. Locking people up for drugs accelerates the breakdown of families, permanently destroys that individuals earning power, and costs society a ton of money because prisons aren’t cheap. I highly recommend checking out the book “The New Jim Crow: Mass Incarceration in the Age of Colorblindness” about how mass incarceration is destroying black families.

The war on drugs also allows for a ton of bias in how it is carried out. People choose who to report for drug use. Cops chose who to charge and who to let slide. Judges chose who to give a 2nd chance and who to throw the book at. The war on drugs in not be any means equitably enforced. The war on drugs is also used to completely shred our Fourth amendment rights. Arbitrary searches and seizures are routinely conducted under the flag of the war on drugs.

End Mandatory Minimum Sentencing: Mandatory Minimum sentencing requires judges to put people away for X amount of years if convicted of a specific crime. This completely takes away the circumstances of the crime, and is magnified by the cash bail / plea deal problem. Mandatory minimums transfer sentencing power to prosecutors from judges, which gives a conflict of interest. The prosecutors threaten extra charges with guaranteed prison time, and thus defendants take plea deals, even if innocent. 95% of defendants of federal drug charges plead guilty. Mandatory minimum sentencing throws lives away and needs to end.

Mandatory minimums are largely in place for drug offenses, however certain gun charges and other crimes also carry mandatory minimums. Currently nearly 40% of all prison inmates are serving sentences with mandatory minimums. As an example anyone with the following amounts of drug possession faces a mandatory minimum sentence of 5 years in prison, from the Criminal Justice Policy Foundation: 5 grams of crack, 500 grams of cocaine, 1 kilogram of heroin, 40 grams of a substance with a detectable amount of fentanyl, 5 grams of methamphetamine, or 100 kilograms or 100 plants of marijuana.

Pardon ALL Non Violent Offenders With No Victim: Reduce prison population by over 50%. Ending the war on drugs doesn’t automatically end mass incarceration. There are people in this country today who are in prison for acts that are completely legal now. Mass pardons are needed and expungement for all crimes with no victim. One major check in our criminal justice system is the presidential pardon. The president has blanket authority to pardon anyone convicted of a federal crime, with no limits. Pardons have historically been used very sparingly, whereas with our current system of mass incarceration a whole-scale method is needed.

The most pardons issued by any president was FDR with 2,819 at a time when the total prison population was under 200,000 people. With a prison population of over 7 times what FDR had, our recent presidents have issued far fewer pardons. George W. Bush issued 189, Barack Obama issued 212, and Donald Trump has issued 25. For state inmates Governors and State Parole boards are needed to issue pardons.

Independent Review Boards for Judges: This is extremely important. You see comparisons on social media all the time of 1 person who got an extremely lenient sentence compared to another with the exact same “crime” who gets an extremely harsh sentence. While our criminal justice system needs reform overall in this regard, I think specifically looking into every judge’s history for patterns is needed. The review board would be composed of a diverse group of citizens, NOT prosecutors and state bureaucrats. Their reports would be made public for all the see and they could also convene resentencing hearings for offenders with another judge or panel of judge(s)

Independent Review Board for Police: The same as above. These review boards although focused on the police department as a whole could also look at the statistical behavior of individual officers.

End Qualified Immunity and Hold Bad Cops Responsible: Not all police officers are good, and there are police officers who use excessive force and murder people, and disproportionately people of color. When these CRIMES occur the police departments and police unions tend to protect the officers to an amazing degree and its rare if charges are ever brought to the officers involved, let alone convictions. Ending qualified immunity would open up these officers to civil suit in addition to criminal suit. When cops know they will be held accountable behavior will change.

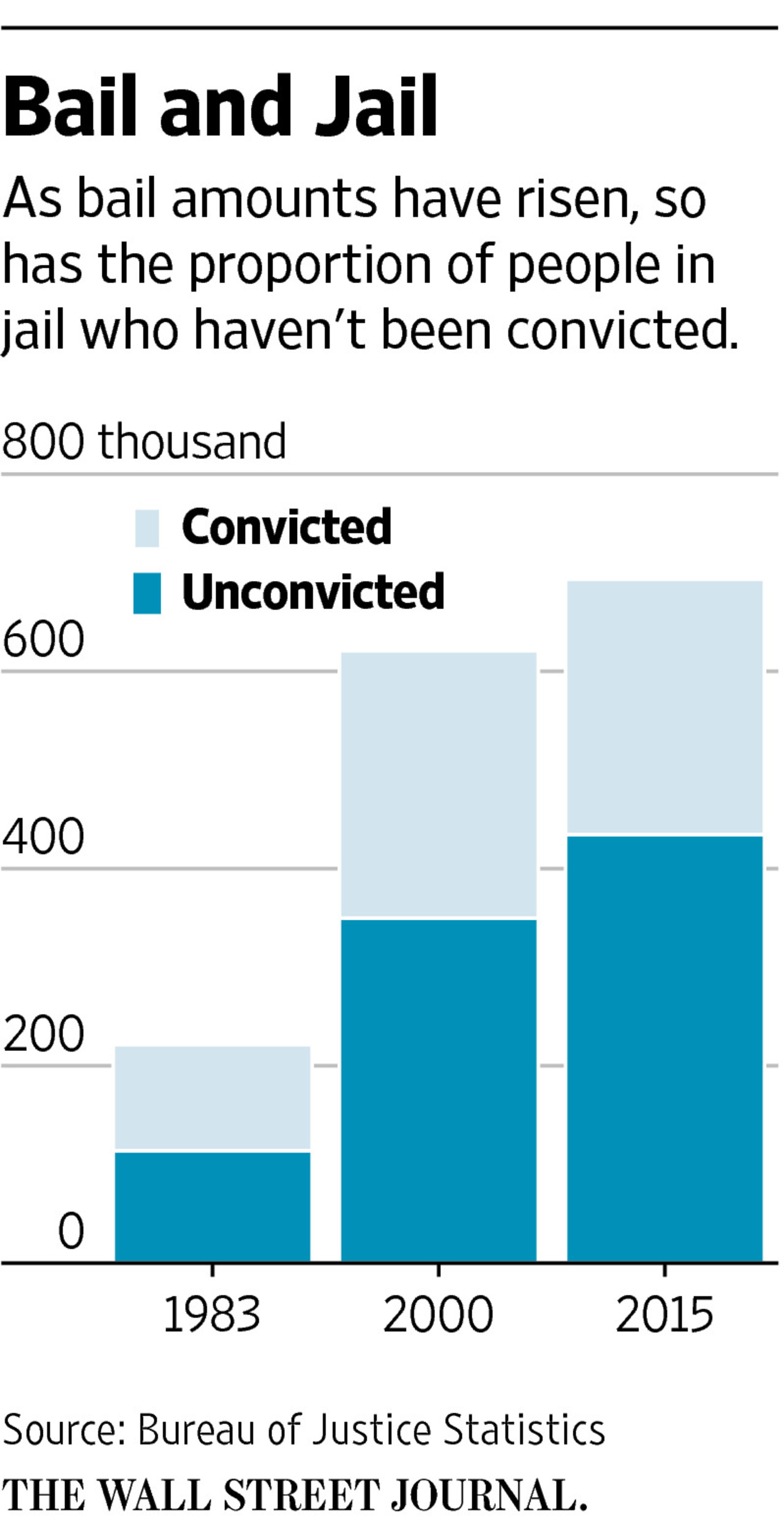

End Cash Bail: The cash bail system 100% turns being poor into a crime. Depending on what individual county or city a crime took place and the severity of the alleged crime, people who can’t make bail can spend weeks, sometimes months in jail awaiting trial. Being in jail for this period of time will often cause job losses, home losses, and the destruction of relationships. For people unable to pay bail a plea deal, even when completely innocent becomes the logical path forward. People plead guilty to crimes they didn’t commit to avoid being locked up for months.

End Cash Bail: The cash bail system 100% turns being poor into a crime. Depending on what individual county or city a crime took place and the severity of the alleged crime, people who can’t make bail can spend weeks, sometimes months in jail awaiting trial. Being in jail for this period of time will often cause job losses, home losses, and the destruction of relationships. For people unable to pay bail a plea deal, even when completely innocent becomes the logical path forward. People plead guilty to crimes they didn’t commit to avoid being locked up for months.

End Plea Deal Forcing: In addition to awaiting trial in jail, it is common practice for prosecutors to charge people with additional charges that they know won’t hold up in court as leverage to force a plea deal. They tell the defendant that they will go for all charges if he takes the case to court, OR he can take a plea.

Note: All of these criminal justice reforms would reduce federal and state expenditures, not increase them.

Employment Reform To Address Racial Inequality:

End Employment Discrimination: Get rid of the box, and eliminate the need to report if you have been convicted of a crime. People who have served their time and made right with society should not be punished again when looking for a job.

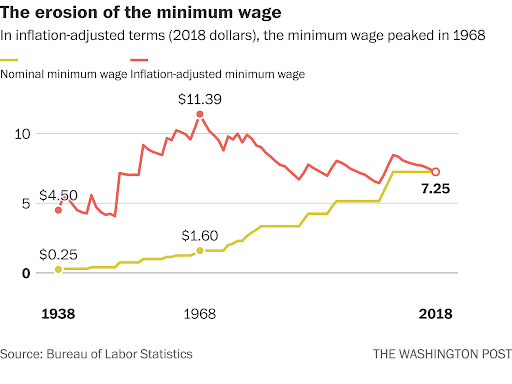

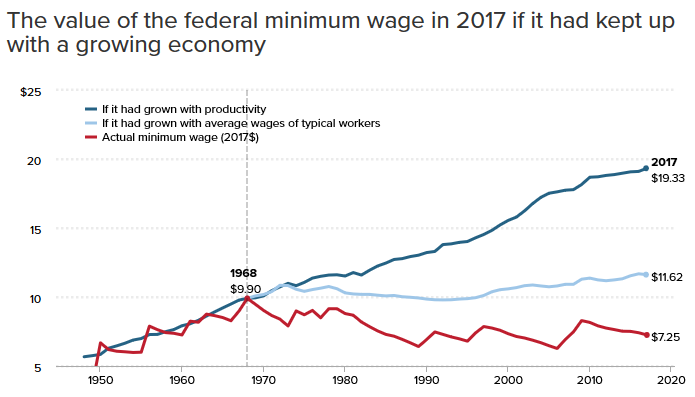

Minimum Wage: We need a one time increase followed by tie to inflation. I am so sick of the debate on increasing the minimum wage. We need to set it up so that it is not a constant fight. We also can’t have long periods of it not changing followed by a large jump. Those against the minimum wage increasing often argue that the labor being provided is not worth more than the current minimum wage and that increasing it will cause massive job losses, even though the inflation adjusted value of the minimum wage has greatly decreased.

The problem with never increasing the minimum wage is that our government, through the Federal Reserve, continues to print money out of thin air and those with fewer assets and lower income are squeezed the most, with the minimum wage being one of these pressures. If we keep making the dollar worth less and less we have to increase the minimum wage!

I propose we reset the federal minimum wage to be in line with the purchasing power it had in the 1960s and 1970s, which would be around $10 to $11 per hour, then tying to inflation through CPI-W. By tying it to inflation we increase the minimum wage in lock step with the economy and employers don’t get a massive sticker shock every 10 years or so when congress decides to get around to changing the law. It is extremely important to tie the minimum wage to inflation. In addition to making it easier for employers to adjust, it also keeps wage squeezing where the newest, lowest skilled employers get a large raise, while those who were paid $1 or $2 more per hour are now also getting paid minimum wage or barely above it. With a constant small increase every year in the minimum wage wage increases as a whole will naturally flow for all employees.

Reduced Occupational License Requirements:

Many occupational licenses are created by large corporations in industries that they control a large market share in and they lobby state governments to impose them. Today 1 in 3 occupations requires a license, in 1950 only 1 in 20 did. These licences rarely are to actually train people to competently perform the task, they exist to create a barrier of entry to the field and to reduce competition. They also tend to stop at the state line, meaning if you relocate, you must start all over. University of Minnesota analysts estimate that 2.85 MILLION JOBS don’t exist due to these barriers.

I know women who are great at braiding hair and want to run their own business, but to be licensed they have to go through an entire year long cosmetology program, even though the majority of what is taught has nothing to do with the service they will be providing. This goes for specializing in virtually any facet of cosmetology. From the Hoover Institution:

“Take hair braiding, which came to the United States from West Africa and is particularly popular among black women in the United States. The process involves zero use of chemicals. Yet in 16 states of the union, hair braiders must get a cosmetology license if they want to legally do hair braiding for pay. And what do you think is one of the main things one learns to get a cosmetology license? If you guessed “the proper use of chemicals,” you win. Angela C. Erickson, in Barriers to Braiding, a 2016 study for the Institute for Justice, notes that hair braiders in these 16 states must train for between 1,000 and 2,100 hours and must spend thousands of dollars on tuition. To put those hours in perspective, a standard 40-hour-a-week work year with two weeks vacation adds up to 2,000 hours a year. The good news is that the Institute for Justice has won some big victories against these licensing requirements. In California, for example, the organization sued against the state’s cosmetology laws for hair braiding in 1997, and a federal court struck down the requirements in 1999. The Institute for Justice has had similar victories in other states since then.”

Another example is the artificial limit on cars sold per year before you must get a dealers licence. If you sell more than 5 cars a year you need a dealers license in my state. This is crazy. Anyone should be able to sell a car.

These occupational licenses then circle back to criminal justice. To obtain many of these licenses there are “good character clauses” that will stop someone from getting a license if they had previously been convicted of any crime, even drug possession. Locking people out of careers entirely based on a “crime” that the individual has already served time, paid fines, etc. for is not right.

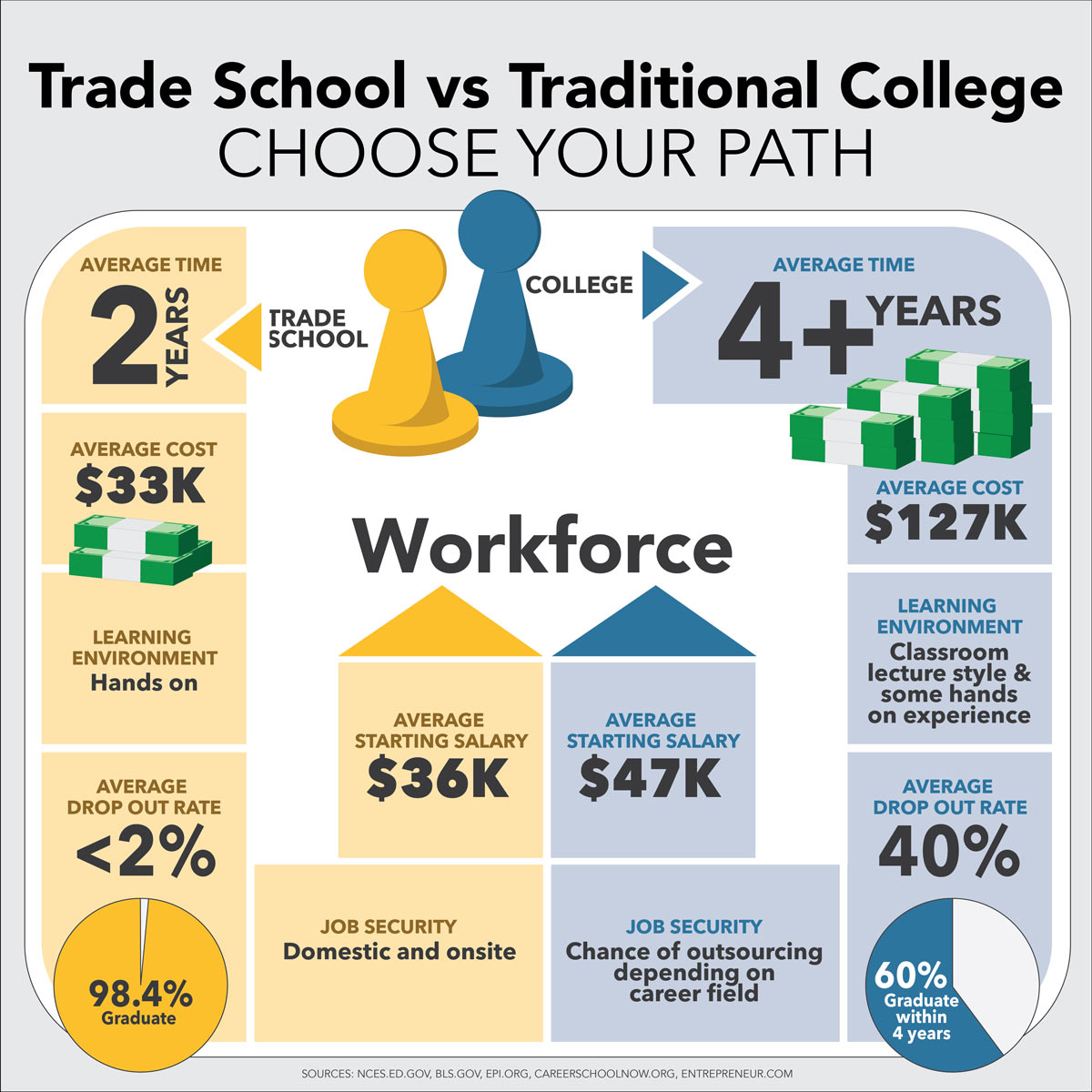

Increased Funding for Skills Training: This can be paid for by using existing funding methods for college. A friend of mine was looking into increasing her skill set and becoming a CNA. The closest course requires a fee of $1,500 and 4 weeks of solid full time courses. She could get a Pell grant worth $6,000 and go to college, where she may or may not finish a degree and would most likely have to take on a lot of debt. Alternatively, this program in 4 weeks could double her earning power and provide another worker in a highly in demand profession, but the $1,500 and 4 weeks off of work (equivalent to around $1,200) is a barrier. If a Pell grant would cover these types of courses we could increase opportunity greatly in this country.

Pell grant funding should cover skills training in a variety of sectors. These programs have a much quicker return on investment and build careers much faster than a 4 year college degree. Graduation rates and job placement rates are also substantially higher. We also push our kids into going to college which results is massive amounts of student loan debt, often for unfinished degrees or for degrees that their cost greatly outweighs the increase in income they provide.

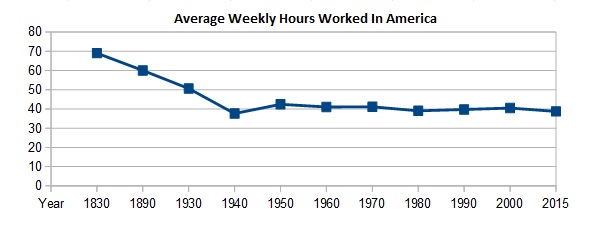

Go to a Standard 24 Hour Work Week: I wrote about this earlier in the year. With a shorter work week we will be more productive, there will be more jobs and people who want to get ahead will be able to work multiple jobs and will have more time freed up to start their own businesses. The 40 hour work week is highly arbitrary and was the result of over 100 years of continued reductions in the American work week, followed by over 80 years of NOT changing at all, despite massive increases in productivity and national wealth. The fact that the work week has become stagnant despite the 1830-1940 stark downward trend and the velocity at which the nature of work has shifted in the last 80 years, heck even the last 25 years, is disheartening. It took 60 years to drop from 70 hours to 60 hours a week. Then it took 40 years to drop to 50 hours a week, and only 10 years to drop to 40 hours a week, then we stopped in our tracks.

Scale Back Ordinance Requirements Against Running a Home Business: People should be able to run a business out of their homes, provided that doing so does not violate other laws, such as noise pollution after 10 pm and blocking fire hydrants or neighbors driveways with customers vehicles. I have friends who have been hassled by government officials, fined, and even shut down for running small home businesses ranging from wrenching on cars, to hair cutting, to chainsaw carving. Running a home business should be encouraged by our government, not penalized. Heck some of these power drunk local governments go around shutting down little kids lemonade stands!

Reform Child Labor Laws: This is a pet peeve of mine. These laws were put in place to protect children from exploitation, like working in the coal mines and sweat shops for 70 hours a week, as well as to lower the official unemployment rate during the Great Depression by labeling everyone under 18 as not part of the workforce. The pendulum has swung hard the other way, with most places of employment unable to hire anyone under 16. For those between 16 and 18 it varies by state, but in Michigan these workers are required to take extra breaks, can operate less equipment, and are greatly limited on total hours they can work. Employers are greatly discouraged from hiring minors. This may be a slight inconvenience for teenagers who are working a few hours for some weekend spending money, but what about for teens contributing substantially to their household bills?

Being economically limited to a total of only 48 hours between school and work is ludicrous, holds back an economic engine of our country, prohibits teenagers from learning workplace skills, and harms lower income families the most. The workaround for this for all parents is to encourage your children to start their own businesses. There are no laws against them working for themselves. Check out the books Kid Start-Up: How YOU Can Become an Entrepreneur as well as The Kid’s ROTH IRA Handbook: Securing Tax-Free Wealth From a Child’s First Paycheck or Money Answers for Employed Children, Their Parents, the Self-Employed and Entrepreneurs

.

Government Assistance And Tax Credits To Address Racial Inequality:

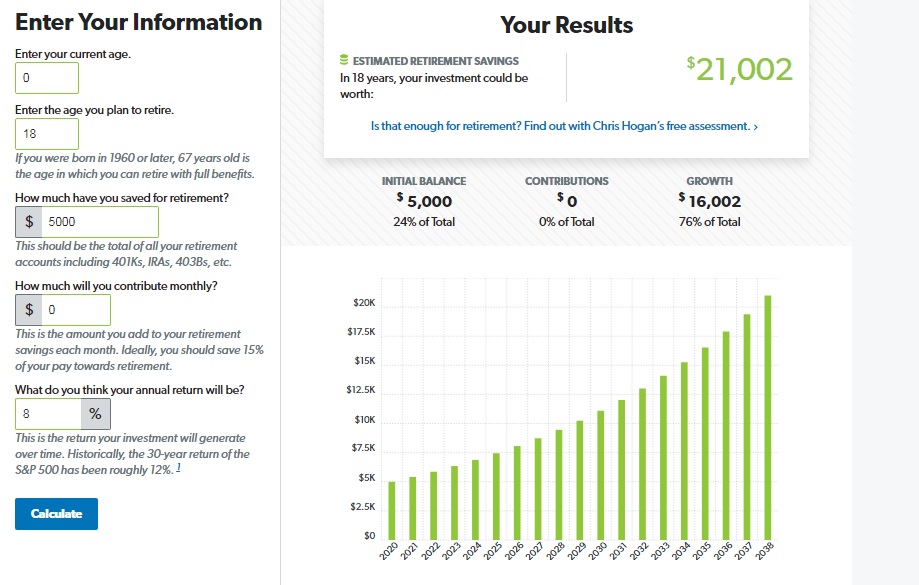

Baby Stocks: $5,000 at Birth: My first proposal to government assistance will perhaps make the largest dent in the wealth gap. This proposal is similar to the Baby bonds proposal introduced by Senator Corey Booker, but using the stock market for higher returns. Compounding interest is the best way to build long term wealth and the easiest intervention is at birth, because this gives the most time for the money to grow. 18 years is a long enough window that a total stock market index fund makes a lot more sense than bonds. We have about 3.8 million births per year in this country. 3.8 million births X $1,000 is 3.8 billion. X 5 is $19 Billion per year. pocket change for our country. If we can spend close to $1 trillion a year on military spending, we can spend $20 billion on investing in our citizens early on. This early intervention is the most bang for your tax dollars we can get. I decided that this would be a great way to go as a national program when I researched building generational wealth and decided one of the items on that list would be a large gift in an investment account to my grandchildren at their birth, the math just works well.

As a way to reduce costs we could even have an adjustment here where a phaseout begins for families at 300% of FPL and drops it to a floor of 25% of the total credit for families at 500% of FPL or above. This could cut the total yearly cost to under $15 billion.

Corey Booker’s plan, which is a bit more complicated and has yearly contributions based on family income shows that by JUST doing this would increase the median wealth among young Black Americans from $2,900 to $57,845, and for young White Americans from $46,000 to $79,159. Instead of White Americans having 16 times the wealth of Black Americans, this would drop to under 1.5X.

This $19 Billion a year plan is 1/3 the cost of Corey Booker’s plan, but the median result is about the same due to funding more money earlier and to stock market returns of 8% over government bond returns of 3% or less. Don’t get me wrong, I am not opposed to Corey Booker’s plan, I just think this is a better overall solution. Alternatively it could follow his plan 100%, with the parent being able to choose between an all bond, an all stock, and a “target retirement date” mixed fund. ANY steps towards some sort of gift at birth for children of this country is a step in the right direction.

$5,000 invested at 8% will be $21,000 at 18. This money would NOT count as assets against any means tested programs. Starting out with roughly $21,000 will give every child a major leg up in launching in life. This is an emergency fund, education expenses, retirement savings, or business and investing seed money. This step alone can solve a major part of the wealth gap.

My parents paid $13,000 for my college costs (over a 8 year period of time, I was slow being a young parent and working full time or close to full time through it.), $2,000 in down payment assistance for our first home out of the $10,000 we needed to move in, and roughly $3,000 for a car they let me drive that they eventually signed over to me. This roughly $20,000 in help I received as a White child of fiscally well off parents helped substantially in me becoming wealthy. If every kid had the same start I did, then we could close a big portion of this gap.

Changing the Current Government Assistance Programs: Current government assistance programs have several problems. They cause the breakdown of the family, they make work have a negative return, they discourage saving and investing, and they create a giant confusing bureaucracy with a massive amount of government control.

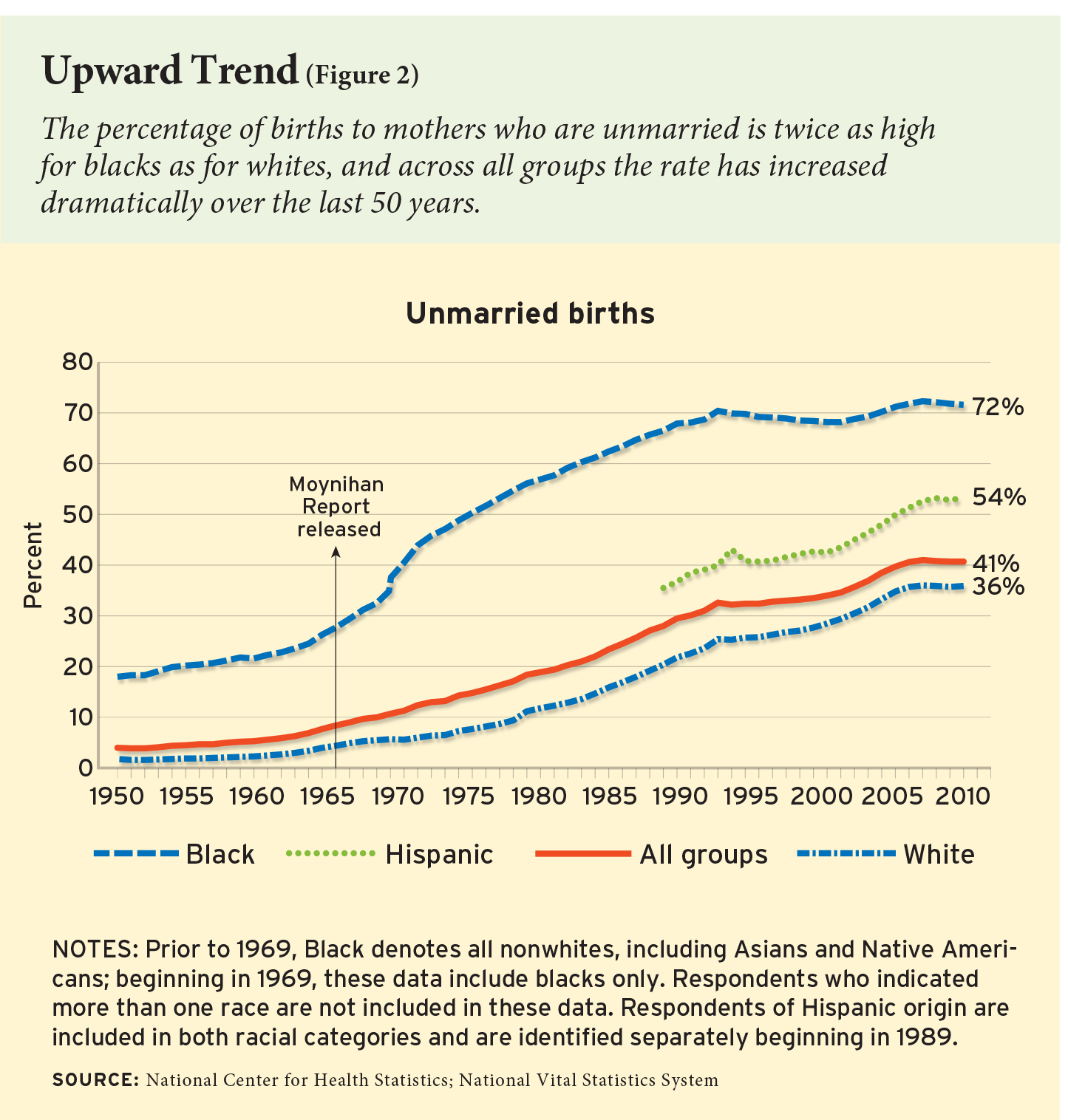

Breakdown of Family: Our welfare system is set up in a way that traps people and destroys families. Our system economically requires the breakdown of family. In 1940 only 13.6% of Black children lived in a home without their father, today it is 65%. (For White families it is 24%.) This is most likely one of the largest demographic changes in household composition in history, outside of slavery and genocides.

Married couples, especially low income married couples with children face an extremely high negative tax rate compared to being separated. Responding to economic incentives, being married, and fathers even living in the home doesn’t make sense. You lose massive amounts of income to be together. These short term incentives prevent long term wealth from being created from 2 parents working together to build wealth and raise their children.

Here’s an example just based on the Earned Income Credit. A mom with 3 children earns $20,000 per year. She would receive $6,347. If she married a man who earned the same amount as her, this would drop to $3,354. Food stamps and housing assistance would also be cut.

Children who grow up without a father in the home are more likely to drop out of school, go to jail, live in poverty as adults, and have children out of wedlock. This then causes the cycle to repeat. The incentives that encourage fatherless homes are a major culprit in the extreme barriers to economic mobility for people of color and for poor White families. When you couple the welfare incentives with the mass incarceration of primarily Black men no wonder we have such a low rate of Black fathers in the home.

The overall decline in marriage rates over the past 70 years has disproportionately affected lower income people. For Americans between 18 and 55, 26% of poor people are married, 39% of working class are married, and 56% of middle and upper class are married. This closely follows the tax code. Marriage is a penalty for lower income people and is rewarded for higher income people in our tax code.

Disincentive to Work: work is disencitivized with several major drop off cliffs that sometimes carry tax rates of several thousand percent. A single mom may not see any increase in standard of living and in fact will be faced with several decreases in economic earning moving from $25,000 a year in income to $50,000 a year in income. Remember the comparison isn’t jumping from a $25,000 a year job to a $50,000 a year job, it’s moving up $2,000 to $5,000 a year, and doing so will result in several years where working more hours, increasing education, and taking on leadership roles will actually cause her standard of living to fall! For most, there is no light at the end of the tunnel.

Disincentive to Save: For food stamps, housing assistance and other programs there are asset tests that vary by state. These asset tests prevent people from saving money. Depending on the state, if you have $2,000 in assets you can lose $7,000+ in yearly income. Facing these incentives would you keep an emergency fund, which is the first major stepping stone out of poverty?

Winner Take All In Housing: For the Section 8 program there are way more people that need housing assistance than there is budgeting for it. Section 8 vouchers are awarded on a first come first serve basis. In most cities there is a multiple year waiting list, and most wait lists are closed to new applicants. Once people get on Section 8 there is a strong incentive to never lose it. If 10 people qualify for the help, most likely only 1 is getting it, and that 1 is having greater than half his or her rent covered for several years. The average voucher recipient stays on Section 8 for 6.6 years. On the flip side of this government regulations cause fewer landlords to accept Section 8 which can trap people from being able to move. Because Section 8 amounts are determined by very wide geographical areas, Section 8 voucher holders are most likely to only find places to rent in the lower valued neighborhoods. There are a lot of other issues with this program that I will tackle in another article.

Giant Bureaucracy and Government Control: The bureaucracy of administration of these programs is intense. They employ thousands of people and make people jump through an insane amount of hoops, including reporting all their income and assets. I don’t think that our government should know what assets you have and who is living in your home.

This bureaucracy has a tie in to criminal justice. This system is also used as part of mass incarceration. My Sister in law had a job once where she was working really long hours (12+ per day). She let her babysitter use her food stamps card to get food for her kids (the babysitter was a family friend). This was caught (someone noticed it and called a tip line) she had to go to court and almost went to jail. She had to pay steep fines and be on probation.

Solution: End all means tested programs and replace with a Universal Basic Income (UBI) of $800 a month per adult tied to CPI. This includes the earned income tax credit and the child tax credit. I originally was strongly opposed to a UBI, however when I realized all of the bad government incentives we can get rid of and how much more equitable the system would be than our current system, I started becoming a supporter of it.

This does the following:

- Removes the disincentive to work: Now work has the exact same tax rates for everyone. No cliffs to fall off of. Working extra lets you keep most of your money. It is always better to work more.

- Removes the disincentive to save: With a UBI you aren’t penalized for saving money.

- Removes the incentive of single motherhood: Now a dual parent household makes sense. In addition to another adult bringing in $9,600 a year from the UBI his income from work will not cause you to lose your apartment, food assistance, etc.

- Removes the bureaucracy: All that is needed is when people turn 18 to set up their account. No forms, no hoops, no asset / income reporting.

- Removes the leaches: Poor single moms have a target on their backs for manipulative loser men. These guys know she’s getting a big tax check etc, so they sweet talk her and do everything they can to mooch off her for a free place to live, free food, etc, but without contributing to the household. Worse, many of them become controlling and abusive, so in addition to mooching off her income to take care of her kids, they also add in domestic abuse. Of course moochers and losers will still exist, but their targets won’t exclusively be poor single moms. The UBI would also give these men a basic standard of living and make them able to see a path to be economically self reliant.

How do we pay for it?

With 210,000,000 US citizens over 18 the cost of this UBI would be right at $2 trillion. 1 Action is not going to pay for this. We need to make major changes to federal tax revenues and expenses to cover this cost. At freedom-dividend.com there is a breakdown of one method of making the numbers work for a $1,000 a month plan. I believe that a $800 a month plan will be just as effective and will cost 20% less. The plan at Freedom Dividend does not go as far as I would in providing funding. He does not fully eliminate all welfare programs including child tax credit and the EIC. He also does not advocate for cutting our military spending.

We remove the other programs. Earned income credit, the child tax credit, the mortgage interest deduction, food stamps, Section 8, cash assistance, daycare assistance. All of those go away. Then we cut our military spending in half and use that money because we spend more than the next 10 countries combined. (We actually spend more than the next 40 combined when you add in all our “Alphabet soup “defense” agencies.) Our lopsided “guns and butter equation” has destroyed our country financially and we see no benefit from the marginal expenditures. This is not radical. We are talking about scaling down our military spending to year 2000 levels, and we would still be spending more than the next 2 countries combined. In cooperation with these actions we need to push other NATO countries to cover the cost of their own defense.

Replacing the current welfare system accounts for about $600 Billion of the cost. The mortgage interest tax deduction, child tax credit, and EIC add in another roughly $200 Billion. The economic growth caused by the UBI will bring in another $550 Billion. The stepped up income tax on income that is now in a higher tax bracket will add another $250 Billion. This adds up to $1.6 trillion that is revenue neutral. Lowering current military spending to year 2000 levels adds another $400 Billion of the cost, putting us at $2 trillion without increasing taxes. Additionally every year Americans could choose to “opt out” for the year and return the money to the treasury. Many high earner and high net worth people would choose to do so, if for nothing else, for political reasons. If 10% of the population opted out it would reduce the cost by $200 Billion. Even if we had to increase tax rates to pay for this, I think it makes sense. The negative effects of our current welfare systems are too detrimental to our society to keep them in place.

Opponents to the UBI have said that the UBI will result in fewer people working and cause a net loss in GDP. I strongly believe that the opposite is true. The number one rule of economics is that people respond to incentives. For the past 6 decades we have had incentives in place to keep people from earning more money. With the UBI we can get rid of those incentives and people will not be penalized for working and earning more. “Go as far as you can see, when you get there, you will be able to see further” More people will start businesses, more people will work, and the standard of living for all our citizens will greatly improve. For more on how a UBI may look, check out the book: Give People Money: How a Universal Basic Income Would End Poverty, Revolutionize Work, and Remake the World.

Increased Marriage Rates: Since the UBI encourages dual earner households, then it stands to reason that marriage rates will increase. Wealth building is a team exercise. Now working together more people will be able to save money and buy homes. Marriage also brings long term protections including social security benefits, custody of children, workplace benefits, and automatic inheritance. With households composed of 2 working adults and most household costs being fixed, there is more discretionary money in the budget for saving and investing, as well as for buying more goods and services. The proportion of married families in poverty compared to non-married families in poverty is very stark. Just fixing this incentive will make a major change.

Housing Changes to Address Racial Inequality:

For decades after slavery Black people couldn’t buy homes in many areas. It was illegal to sell a home to Blacks and it was even written into the deeds that in the future you couldn’t sell a home to a Black person. Loans were also harder to get and discrimination on loans was legal. When Black banks were created, they were robbed by white administrators who invested in high risk loans. Our government created a system of intentional laws that created extremely segregated communities. This kept generations of Black people from owning their homes, which in turn kept them from building generational wealth. Home ownership is the largest component of the average Americans wealth and is one of the larger pieces in the current wealth gap. For continued reading check out the book: The Color of Law: A Forgotten History of How Our Government Segregated America.

65.3% of White Americans own their home and 44% of Black Americans own their home. When we look at total household wealth, for every age group home equity is the largest piece. This 21% discrepancy of home ownership rate accounts for a massive chunk of the wealth gap. Closing this gap will greatly tighten the overall wealth gap.

The UBI being enacted will make it much easier for people to stay current on bills and keep their credit in good standing, as well as build up a down payment for a house. This alone will solve a big chunk of the home ownership gap. With dual earner households being encouraged through our tax code instead of heavily discouraged more Black Americans will be able to afford buying a home. Here are some additional ideas that would also collectively eliminate the gap and make home ownership easier to obtain for everyone.

Down Payment Assistance Programs: Down payments and credit scores are the two largest barriers to home ownership. Down payment assistance programs already exist in many states, but should be standardized across the country. These should be up to 3.5% to cover the minimum FHA down payment of the home, provided they otherwise qualify for the loan and go through a first time home buyer class to ensure first time home buyers learn how to protect themselves when buying a home. My state has a program similar to this, but it is poorly promoted. Every bank should be advertising these programs. These classes should also include in them negotiating for the seller to pay for some of their closing costs, further reducing total cash out of pocket to buy a home.

End the Worship of FICO: FICO scores should improve after a UBI passes, however the way FICO scores are calculated greatly punish people for relatively minor credit blemishes. As a landlord I see credit applications from potential tenants all the time and it does not take much to end up with a low score. I had one applicant who paid on time for multiple accounts for several years, but had 3 items in collections that were all low dollar amounts, totaling well under $1,000. If I remember correctly I think 1 was for a Comcast bill and 2 were medical. These negatives caused her score to be well under the 650 mark that most lenders use as a hard and fast litmus test for getting a home loan.

Manual underwriting to actually see a persons habits and what is going on should be the norm, not the exception. Alternatively the FICO score needs to weigh negatives by dollar amount AND have reporting of more items for credit, such as paying utility bills and rent on time. With the rental program I use tenants can choose to have their rent payments reported to the credit bureaus. There are banks that do manual underwriting but they are few and far between.

Improve Access to Credit: Here’s what’s crazy. You can walk into pretty much any car dealership in the country and with a very high Debt to Income ratio, no down payment, and horrible credit and drive away in a $40,000 vehicle the same day. I’ve worked with guys who earn $12 an hour who got loans on $40,000+ trucks. The only way people with a non ideal financial situation can get credit is to buy depreciating assets! What’s really crazy is that I can drive that car anywhere in the world and hide it!, with a house not so much. This encourages poor people to get into bad loans, to buy expensive depreciated assets, and have all of their net worth tied up in vehicles. You can even roll in bad debt from a previous loan and sign up for a $50,000 loan on a purchase of a new $40,000 car! All things being equal, you will get laughed out of a mortgage office for a $40,000 home loan. Since 2009 lending standards on home loans have tightened drastically. Some of these drastic regulatory laws and guidelines need to be scaled back.

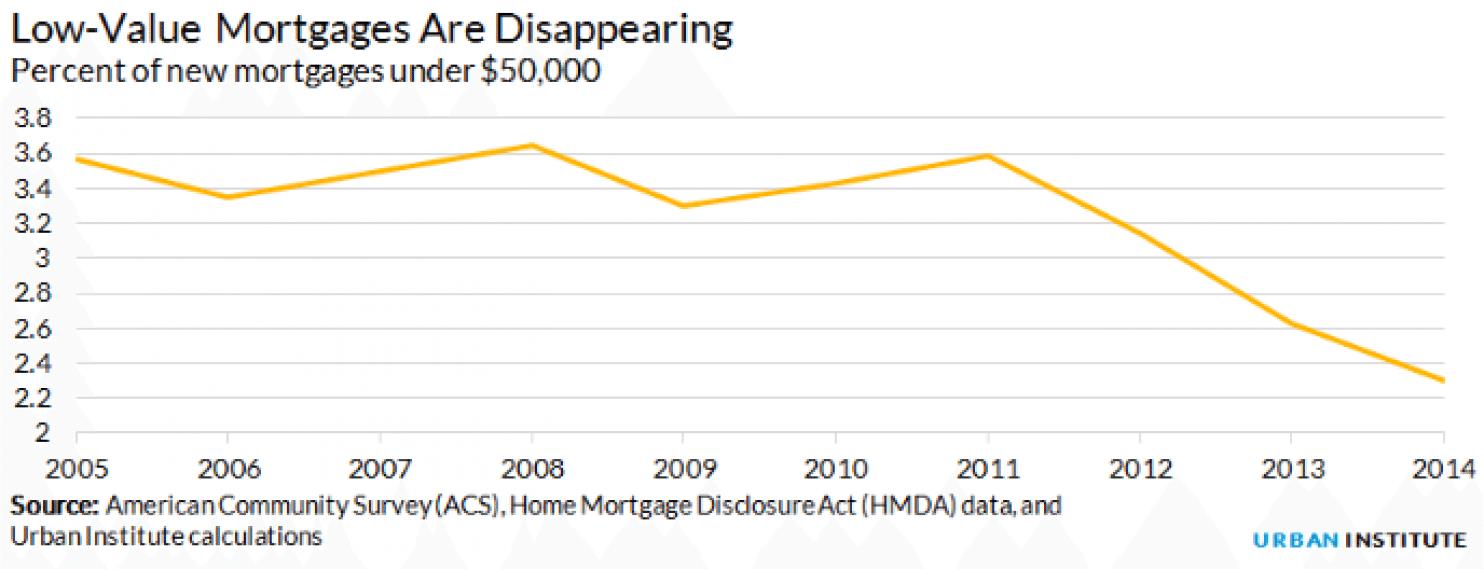

Open up Sub $50K Loans: Another problem is that many lenders won’t issue home loans under $50,000. This magnifies the wealth gap further because in many poor Black neighborhoods the median house costs under $50,000. Instead of needing to come up with a 3.5% down payment, or even a 20% down payment, the barrier to buying a home becomes a 100% cash purchase.

Since the federal government underwrites most mortgages through the FHA/Freddie Mac/Fannie Mae programs, there is room here to encourage lending on low dollar homes. I think the easiest method to encourage banks to lend on these properties is to add a $1,000 bounty for closing owner occupied loans to qualified applicants. The banks would earn an extra $1,000 and credit would flow. This is a relatively low cost social engineering method that will bring way more than its cost back into the value of the community. This small incentive, even if 1 million people become home owners from it per year would still only cost $1 billion in total funding.

Alternatively produce a “fast track” program where loans under $50,000 for qualified owner occupant buyers and for houses that are in acceptable condition can go through a speedier process, similar to the “liar loans” before the subprime meltdown or even similar to vehicle loans. The bank needs to spend less time and resources on the loan, which would make the volume of loans they can do with fewer man hours a profitable endeavor.

As a real estate investor I have applied for several loans and following the BRRRR method I do cash out refinances on investment properties. The banks see this as additional risk and charge more in points, which are loan origination costs to borrow the money. Banks should do the same thing with low priced home loans and borrowers with less than stellar credit in order to qualify more people.

Being able to buy a house with a 6% interest rate (2.5% above current advertised rates) and an extra 1% due in closing costs is still better than not being able to buy a house at all. On a $50,000 loan in this scenario someone with a higher credit risk would pay an extra $500 to get the loan, and would pay $75 more in a monthly payment ($225 at 3.5% vs. $300 at 6%). The bank would be compensated for their risks. Instead they won’t take any risks. They could also only offer these higher risk / lower dollar homes on 15 year mortgages.

Side Note: I would not have been able to build the wealth I have, or at least at the rate that I have without a subprime mortgage. In 2006 When I was 20 Mrs. C. and I wanted to buy our first home. We scrimped and saved for a down payment and paid off some bad debt that Mrs. C. had that totaled around $2,000. Both of us were working “part time” minimum wage jobs (we routinely got 39.9 hours). We applied for our loan and everything looked like it would go through. At the last minute the large bank our mortgage broker resells loans to denied us. Our broker offered to finance it in his own business. We got our mortgage for a $48,000 foreclosure house that had been on the market for a year with 20% down as a 1 year, 9.25% interest only loan, that we had to refinance in a year. When we did refinance we paid a ton of closing costs and we got a 15 year mortgage at 7.37%. The loan was expensive, but it allowed us to own our own home and build some equity. We still own that house, on a different loan (now 15 year 4.25%) and we now rent that house out.

Remove Barriers to Affordable Housing:

Affordable housing is housing that low income people can get that costs no more than 30% of their income. Luxury apartments cost only a small amount more to make than affordable apartments. There is no money in building low cost housing so it doesn’t happen. The cost of construction is too great. A big reason for this is that building codes drive up construction costs through the roof. Millions of affordable housing units have not been built because of over regulation and the relatively small incremental cost to make units high end over low end. I know the federal government can’t dictate to the states to take these actions, but what they can do is tie this to block grant funding for any number of federal programs that bring dollars into the state. If you want federal dollars, don’t stop people from building small affordable homes.

Reduce Zoning Laws and Building Codes: Building moderate priced housing will result in low income housing becoming available. Middle income people will move into the brand new apartments and the prices on the older existing apartments where they moved out of will begin to drop. In addition to building codes driving up costs, a major factor in driving up costs in larger cities is zoning ordinances. Silicon Valley is atrocious for this. Many municipalities in Silicon Valley fight tooth and nail against high rise apartment construction, wanting to maintain the feel and look of single family housing. They also have property tax provisions that provide a major incentive for homeowners to never sell and move. Combined with rapid job growth, this is why a 1 bedroom apartment can cost $2,500 in San Jose. If we look at another city that has experienced similar population growth, Austin, TX, a 1 bedroom apartment can be found for $600 a month. This is only a fix for high population, high growth areas with sky high costs of living. We need other solutions for the rest of America.

Reduce or Eliminate Ordinances on Housing Sizes. In my small township in a rural area the building ordinance requires new construction homes to be at least 1,000 square feet. Why? There is no reason for this, although some suspect these ordinances were originally targeting against mobile homes. There are hundreds of perfectly fine houses half this size. A 500 square foot 2 bedroom 1 bath home is much more affordable to build than a 1,000 square foot home. In addition to eliminating the square footage designation for traditional construction homes, ordinances also needs to be lifted for accessory dwelling units and tiny houses. Both of these appeal to a wide range of people and are much more affordable than stand alone housing. This should also happen for single room rental units, studio apartments, and hotel to permanent housing conversions. I just read an interesting article on a proposal for NYC to buy up vacant, empty hotels during this pandemic at rock bottom prices and turning them into long term low cost housing units.

Reduce or Eliminate Ordinances Against Establishing Mobile Home Parks. Mobile homes are one of the most affordable housing options, especially in areas where land is not at a premium. Unfortunately most municipalities have chosen to go the “not in my backyard” route and prohibited new mobile home parks from being created. This has resulted in their being a lower supply of mobile home lots than people who want to live there, resulting in higher lot rents. If there were more lots available the rent for all lots would face downward pressure and more people would have access to affordable housing. Although mobile homes in general depreciate over time, they are a more affordable form of housing than renting a house in most circumstances and can be a stepping stone to purchasing a single family home in the future. (My family lived in a mobile home park when we moved to Michigan for roughly the first 6 years of my life.)

Invest in 3D Printed Housing: Initial systems for 3D printed houses have shown great promise to deliver low cost affordable housing where traditional construction methods can not. I think our government should award an X-prize, similar to what they did with the commercial crew program with Nasa to developers to encourage 3D printed houses. This could be done with a relatively small amount of prize money, something in the realm of $100 million. The houses would need to be able to be connected to municipal water, sewer, and electric. Have 2-3 bedrooms, a kitchen, bathroom, and electrical outlets and lights, like every other home. There could be requirements based on total 100% complete costs and timeline to go from arriving at a new site to having a fully move in ready house.

Invest in 3D Printed Housing: Initial systems for 3D printed houses have shown great promise to deliver low cost affordable housing where traditional construction methods can not. I think our government should award an X-prize, similar to what they did with the commercial crew program with Nasa to developers to encourage 3D printed houses. This could be done with a relatively small amount of prize money, something in the realm of $100 million. The houses would need to be able to be connected to municipal water, sewer, and electric. Have 2-3 bedrooms, a kitchen, bathroom, and electrical outlets and lights, like every other home. There could be requirements based on total 100% complete costs and timeline to go from arriving at a new site to having a fully move in ready house.

The end goal should be a house that is printed in under 1 day (some claim to already be able to do this) and 100% finished in 2 weeks at a total price of under $30,000 and a printing system that can be quickly scaled. A $30,000 home with 10% down would result in a 15 year loan at 4% costing $200 a month. Add in taxes, insurance, and PMI and the total payment in most locations would still be under $400 a month. With 3D printed houses utility bills would also be lower due to the thermal mass of concrete construction. This same technology could also be used for building apartment buildings in areas where land is at a premium.

To receive funding from the government the houses made would have to be sold to owner occupants. Once a reliable system is developed and proves to be profitable, the construction loans would be backed by Fannie Mae/Freddie Mac. Thousands of printers would produce millions of units a year. In partnership with city land bank programs the land for the homes would often be free. Once again for this to work local ordinances on house size and construction would need to be scaled back.

Change the Tax Code for House Flips:

Currently there is a credit problem with homes in predominately Black neighborhoods. Houses in disrepair can’t be sold with a loan because they need too much work, and because they need too much work and the repairs would (according to the bank) cost more than the house is worth, they don’t get fixed up and fall further into disrepair, creating a cycle of blight, which in turn lowers the average property value further. Most appraisals are done by comparing the house someone wants to get a loan for to 3 or more houses of similar size, condition, and age in the same general area. If the majority of houses in the neighborhood are facing similar challenges, the comparables will be low, making qualifying for loans more difficult.

Once again, as a real estate investor I look very hard at the incentives that exist when deciding on how to invest in real estate. Right now rental real estate works best for me, however in the future I plan on doing some house flips, but the problem is, I have to wait a year to do them, which means I have to flip houses slowly. The current tax code requires assets held for under 1 year that are sold for a gain to be taxed at the individuals tax rate. For assets held for over a year, they are taxed at a lower rate, which is 0% for those in the 12% tax bracket or lower, and 15% for everyone else.

This tax rate makes a huge difference, which is why for a flip I would have to buy a house, rehab it and hold it, and most likely rent it our for a year before selling it. This slows down the velocity of my money to a crawl. If it takes me a month to rehab a property, a month to get it rented, I have to rent it out for a year, then it takes me another month to get it ready to sell and sold, it takes close to 15 months before I can flip my money. Alternatively, if I could buy the house, rehab it and immediately sell it, it would take me closer to 2 months from purchase to sale, meaning instead of rehabbing 1 house every 15 months I could rehab 7 houses! Doing only 1 house every 15 months also slows down my ability to learn from mistakes and to streamline my processes. Doing 6 a year may allow me to learn enough to increase my volume to 8, 10, or even 12 a year. These changes would instead of greatly influencing investors to become long term landlords, they would influence investors to flip houses to owner occupants. They would also encourage part time investors like me to go full time. If I could pay 15% income tax on my short term gains from flips, I would have a strong incentive to quit working my W2 day job and to concentrate on providing affordable housing.

Why does anyone care if a rich guy saves some money on his taxes? Well as I discussed above banks won’t lend for these properties. The primary way these properties get sold is with a cash buyer. In many of these neighborhoods people are not investing, and those who are have an unfortunate penchant for becoming slum lords. If I can buy a house with cash, rehab it so it can qualify for a loan, and sell it to an owner occupant, that repeated action can change communities. 1 guy doing 1 house every 15 months doesn’t make much of a difference. 1 guy doing 6 houses a year starts to move the needle, and when other investors see how well he is doing they may replicate the activity. To be clear, I’m not talking about gentrification and turning houses into high end luxury homes. I see some flippers doing this and a lot of them end up losing a ton of money, and it isn’t good for the neighborhoods. I focus on making the house clean, functional, and safe. I return it to being usable.

The only way these neighborhoods get rebuilt is with cash buyers rehabbing the properties and rehabbing them correctly to keep them affordable. The way to encourage this is through the tax code. Either make all real estate flipping transactions taxed as Long Term Capital gains, or assign renaissance zones where any flips done in a certain area will qualify as long term capital gains. Another option would be to make Capital gains of under $X per asset to fall into a lower tax category. People flipping Mcmansions don’t get the tax benefit, but those providing low cost housing would.

Access to Banking and Credit to Address Racial Inequality:

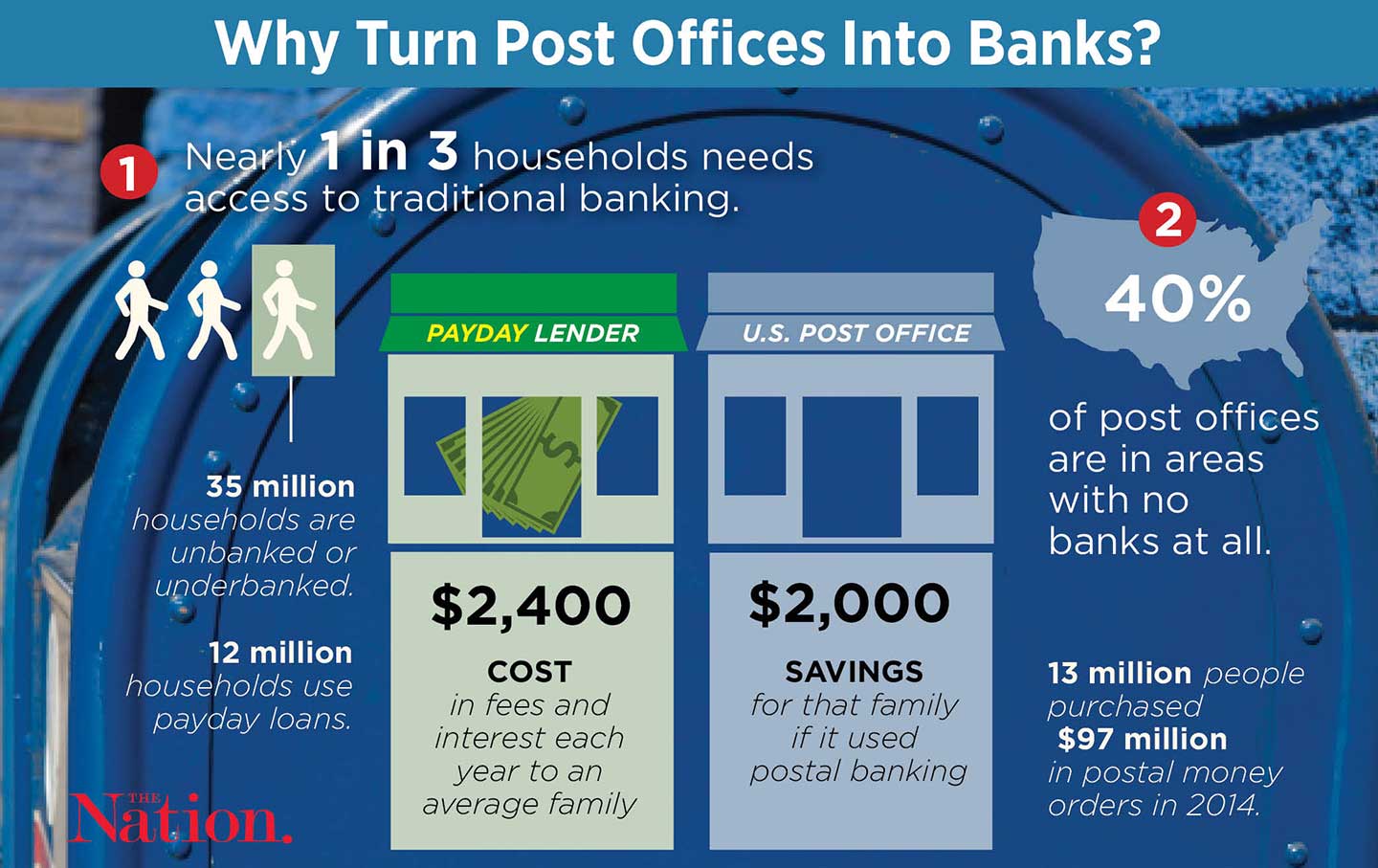

According to the FDIC 16.9% of Blacks, 14% of Hispanics, and 3% of Whites are unbanked. Not having a normal bank account greatly inhibits savings and prevents people from being able to even cash their paychecks for free, let alone obtain loans. A lack of access to credit is detrimental to anyone who is experiencing poverty. Access to credit is a major factor in people being able to get out of poverty. (Now instead of angering the Republicans and Democrats, my Dave Ramsey friends are gonna throw mud at me.) When people can’t afford a necessity and do not have access to credit, they make financially detrimental decisions based on their short term emergency. Although instating a UBI and some of the other solutions I have proposed will eliminate the need for taking credit in many instances, this will remain a problem as long as credit is not available. For further reading check out the book The Color of Money: Black Banks and the Racial Wealth Gap.

Reinstate Postal Banking:

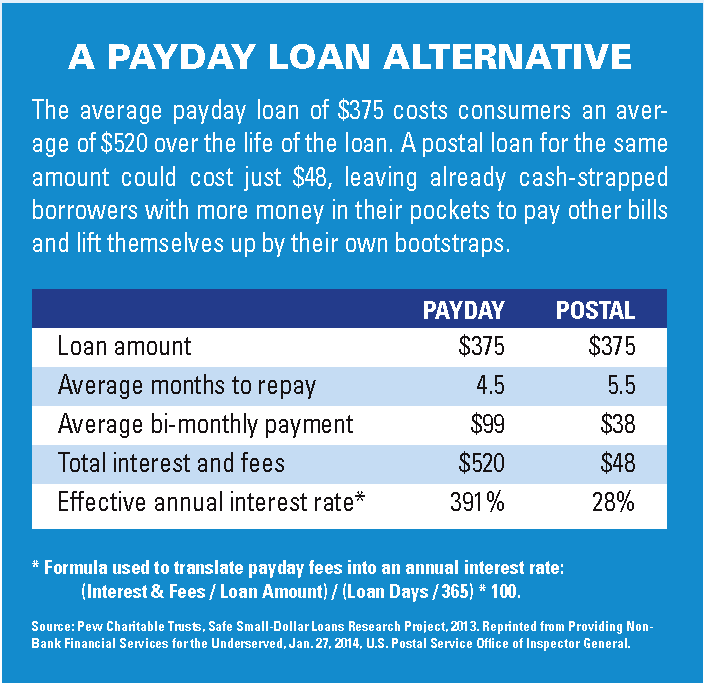

This solution is a twofer. It gives another source of revenue to the postal system and it provides a service that is provided inefficiently in the marketplace. Additionally, most banks don’t want to give out small unsecured loans and they certainly don’t want to give out unsecured short term loans. This has led to the rise of the cash advance industry. Please follow the link to the page above about postal banking, it a really interesting concept and solves a lot of problems.

The cash advance industry has insanely high interest rates and costs of capital that absolutely traps people. It goes beyond risk level pricing. The Cash Store published their cost of credit online. For a 14 day cash advance in Illinois they charge a 404.11% APR. For a $400 advance $462 is due 2 weeks later. The risk of someone who has a job and is getting an unsecured short term loan is not 40X higher than the risk of me with my 10% APR credit card. People don’t go to these stores because they think its a good deal, they go there because in the market there is no other option.

The cash advance industry has insanely high interest rates and costs of capital that absolutely traps people. It goes beyond risk level pricing. The Cash Store published their cost of credit online. For a 14 day cash advance in Illinois they charge a 404.11% APR. For a $400 advance $462 is due 2 weeks later. The risk of someone who has a job and is getting an unsecured short term loan is not 40X higher than the risk of me with my 10% APR credit card. People don’t go to these stores because they think its a good deal, they go there because in the market there is no other option.

A lack of banking and access to credit also feeds the predatory Rent to Own sector: Talk about misleading advertising! The 3 rent to own places in my city advertise heavily. They claim the finance costs follow state laws and are not that high. Well the big thing they do is charge 2 to 3 times as much in list price for the same item you can buy anywhere else. So although the financing charge may be under the state law maximums, the purchase prices are ratcheted up to make up the difference. The true APR on these items is very close to what the cash advance places charge, except instead of it being a 2 week loan, its over the course of 1 to 2 years.

Health Care:

One of saddest health statistics in our country is about infant mortality and race. For White Americans there are 4.9 deaths per 1,000, while for Black Americans there are 11.4 deaths per 1,000. That disparity represents a total per year of 3,770 Black children who die at birth more than if the infant mortality rate was the same for White children. These stark disparities could be a reflection of a greater percentage of Black Americans living in poverty. This is another area where solving economics will alleviate a lot of the current problems.

Our healthcare system is a mess. Earlier I talked about how our government assistance programs created disincentives to work, well our current healthcare system has a major one. Under Obamacare there are several drop offs where earning $1 more can cost thousands of dollars in subsidies, most notably at 400% of the federal poverty line. Our healthcare system also has a major disconnect between who receives care and who pays for it (typically the government or insurance companies), allowing for runaway costs. These proposals will not fix everything wrong with our healthcare system, but they could make a dent in it.

Insurance Negotiated Rates for All: The main benefit to having health insurance for the most part isn’t even the amount of money they are supposed to pay, its the discounts they receive from healthcare providers. If cash patients received the same pricing as insured patients the economic toll of going to the hospital would not be so large. What other business operates like this? “Oh, you are a customer of a company that does a lot of business with us, here, let’s reduce your price by 70%.” In any other industry you may see a 5% to 15% reduction, but 70%?

Transparency in Service Pricing Before Services Rendered: I hate that you have no idea how much a visit to the hospital is going to cost, sometimes you can’t even guess how many digits the bill will be. When people know what the pricing is they can shop around and attempt to negotiate for lower pricing.

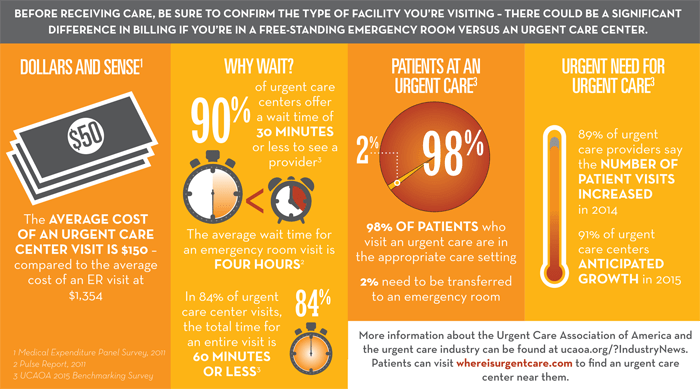

More Urgent Care Clinics: Urgent care clinics perform an important service and cost way less than an Emergency room visit. The average visit to an urgent care clinic costs around 10% of a visit to the ER. They also alleviate the strain emergency rooms face by taking care of patients who are not facing a life threatening situation.

Repeal ALL Certificate of Need Laws: Certificate of need laws have created a monopoly for hospitals, costing patients thousands of dollars. In 1 example, Dr. Singh in North Carolina has had to file suit to be able to buy an MRI machine and offer imaging services at his office for typically under 25% of what the hospital charges. These same laws also drive up the cost of ambulance services and other routine medical exams and treatments.

Support Medial Debt Relief: Medical debt is a factor in the majority of bankruptcies in this country. RIP Medical Debt buys debt on the open debt market in bulk quantities for around 1 cent on the dollar. They then forgive this debt, which results in no tax liabilities or negative consequences for the people who owed the money. So far RIP Medical Debt has paid off over 1.5 BILLION of medical bills. Ever $1 donated to RIP Medical Debt pays off $100 in past medical bills for low income Americans, which in addition to reducing economic strain will also in the long term help raise credit scores, making home ownership easier.

Education:

Literacy: In 2020 we should not have to talk about literacy rate in America being a problem. Our schools are failing us, and failing Black children in particular. In Washington DC only 30% of 4th grade students read at grade level, in Baltimore it’s only 13%. Nationwide 56% of white 4th graders read below grade level while 86% of Black 4th graders read below grade level. Another study of 4th grade boys found an even worse rate, 42% of white students and 14% of black students read at or above their grade level. Our school system and our society are failing us. Two major factors that affect literacy rate are fatherless homes and living in economic poverty. If both of those issues are greatly improved, then literacy will follow. We need our schools and our parents to be focused on not just having kids reading, but finding books that are engaging and identifiable for the students. Bringing fathers back into Black homes will make a major improvement in this gap.

One of the largest factors in long term reading level is kids having books in the home and being exposed to reading books prior to the start of school. A great program that helps with this is the Dolly Parton Imagination Library. My Sister in Law signed her kids up for this program and every month they were sent a new book in the mail until they started Kindergarten. The average middle income home has 13 books per child, the average poor income neighborhood has 1 book per 300 children. This statistic floored me. The Dolly Parton Imagination Library is a great source of age appropriate books for these kids at no cost. For community support organizations that facilitate her program on the local level the wholesale cost per book is $2.10 each. $25 a year to make a major impact in the literacy of a child is a great investment. I encourage anyone reading this to consider donating to their local organization that facilities these book deliveries. I grew up in a middle income house with literally thousands of books. I had over a hundred books in my room (and so do my children today). We also went to the library every week and participated in the library reading programs.

“Growing up in a home with 500 books would propel a child 3.2 years further in education, on average, than would growing up in a similar home with few or no books… A child from a family rich in books is 19 percentage points more likely to complete university than a comparable child growing up without a home library.” – Evans, M.D.R., J. Kelley, J. Sikora, and D. J. Treiman. 2010. “Family Scholarly Culture and Educational Success: Evidence From 27 Nations.” Research in Social Stratification and Mobility 28(2):171-197.

School of Choice And Charter School: Part of the education and achievement gap is that students are trapped by where they live into a monopoly for schooling. If your school system is garbage, oh well. The school districts that perform poorly are also school districts that are in lower priced (red lined) areas with higher Black populations. When the schools are not able to function due to a variety of factors, children and parents should have options. That’s what’s great about America, capitalism and competition, if a product or service is delivered poorly, competition will increase the options and ultimately improve the quality and costs of the product. Charter schools and school of choice are important as well as state intervention to overhaul failing school systems.

Graduation Rate: Having a high school diploma is a major stepping stone to steady employment and building wealth. Many entry level jobs require a high school diploma, even though someone without a high school diploma would most likely have no problems executing the job.

88% of Whites graduate high school while 80% of Black Americans graduate high school. This isn’t as stark of a difference as some of the other statistics we have covered, but that 8% difference represents tens of thousands of kids each year entering a world where their earning power is substantially reduced.

Financial Education: The vast majority of the wealth gap between White and Black Americans is due to system problems in this country. Over the past 4 decades person finance has become more and more complex and its a travesty that our schools do not teach personal finance at every grade level. Many schools don’t teach personal finance at all. How can we really expect our kids to go into this world and thrive if they haven’t been taught the rules of the game? Our kids are in school for 14,300 hours from K-12 and in most schools NOT A SINGLE HOUR is spent teaching them personal finance. A couple great books for kids on basic financial education that are fun to read are Danny Dollar Millionaire Extraordinaire – The Lemonade Escapade and How to Turn $100 into $1,000,000: Earn! Save! Invest!

Retirement Policy and Stock Market Participation To Address Racial Inequality:

Increase Stock Market Participation Rate: Black Americans with the same education level and same income as White Americans are 35% less likely to own stocks. I think this falls under the systemic challenges of not having parents / grandparents who owned stocks. I got interested in stock market ownership because my parents owned stocks. My children all own stocks that they have purchased with money they earned from doing chores around the house. My youngest is 7! They of course didn’t do this on their own, it was from me pushing them towards it and teaching them about investing. If we can get financial education in place, reduce mass incarceration, install a UBI, and rebuild families then I think stock market participation will follow. During the past 15 years access to the stock market has improved greatly which will ultimately help with this disparity. Today we can download apps on our phone and have our debit cards round up change from everyday transactions and invest it. We can buy fractional shares and open retirement accounts in under 10 minutes will less than $50.

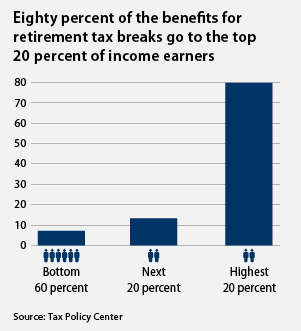

Change the Retirement Incentives: We do incentives for saving for retirement backwards. We highly reward people with high incomes for saving for retirement, while giving sometimes zero incentive for people with low incomes to save for retirement. If you are in the 0% tax bracket a tax deduction does you no good, and saving any for retirement is a really hard thing to do.

If you are in the 35% tax bracket saving for retirement is easy because you have a lot of disposable income, you get a 35% assistance from the federal government, AND you’re more likely to have employer matching. A dual earning household earning $300,000 a year and maxing their 401Ks at $38,000 per year will receive over $13,000 in retirement assistance per year from the federal government. These high earners are also more likely to already have an incentive to save for retirement in the form of an employer match. In this income bracket a 5% match would gain them another $15,000 in additional retirement savings. By saving $38,000 they received another $28,000 in incentives. By contrast, a single mom earning $30,000 a year and saving $3,000 will receive no tax benefit from saving for retirement and is less likely to receive a 401K match from an employer.

What about the existing retirement savers tax credit? The idea is good, but since it is not refundable there is no incentive for low earners with kids to save for retirement. With the doubling of the child tax credit this has become an unusable vestige of the old tax code. What we need to do is have a refundable retirement savers tax credit with incentives up to $5,000 instead of $2,000 and pay for it by reducing the tax deduction on 401K plans. I envision making the 401K tax deduction freeze at 20% for those in higher tax brackets. This flattening of the bracket will lower the benefit received by top earners, while still keeping a strong incentive to save in place. Low income earners would then be able to use a refundable retirement savers tax credit that is between 20% to 50% of the value of their retirement savings based on income, with a maximum benefit based off $5,000 in contributions, so a maximum of $2,500 of benefit per year.

What I would like to see is this integrated into tax prep software like Turbotax and H+R Block. When someone is filing their taxes a blurb will pop up before they hit submit stating that their current refund is X, however if they invest $X into a Roth IRA now, the refundable retirement savers tax credit will give them a 50% credit. Investing $1,000 will only reduce their tax check by $500. Also have a blurb about how $1,000 invested at 8% each year over 40 years will grow to $300,000.

Psychologically a low earner weighing the trade off of investing in a retirement account vs. not investing is seeing instead of $1 going into an account he or she can’t touch for decades, that $1 can go to an immediate need. A high earner who has all his or her immediate needs covered anyways will psychologically see not investing in a retirement account as throwing away between 35 cents and $1.35 (depending on the employer match). In the higher tax bracket its absolutely crazy to not max your retirement accounts, its an automatic minimum of a 35% return right off the bat. For a low earner its a break even game with where to allocate money, and with no incentives very few actually go with putting it away for the long term. Our incentives make savings for retirement a no brainer for high earners (who likely have more education and more assets than low earners) and a really difficult decision for lower earners.

For a high earner there is an instant gratification of both the employer match and the tax deduction as well as the long term reward of tax free compounding. For low earners there is no instant gratification, only the long term reward of tax free compounding. Since we are wired to think for short term, instant gratification, we are tipping the scales in an even greater direction to the high earners than what the tax code already is doing.

We also need to have automatic enrollment of 401K plans for ALL workers, regardless of age. We need setting up a 401K plan for employers to be a simple inexpensive process so that there are no barriers for the account to exist and for contributions to start automatically with 5% of earnings.

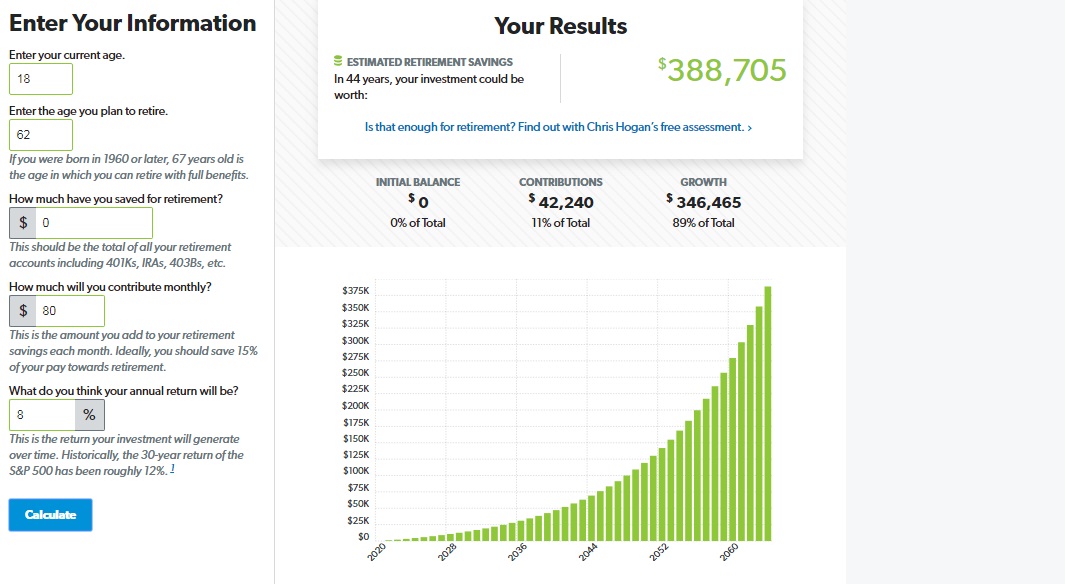

Automatic Investing:

As part of the UBI in my plan, 10% of the total ($80 per month) is automatically invested in a Roth IRA for the recipient in a total stock market index fund by default, the other $720 is received in cash. The recipient can increase this amount, but CAN NOT decrease it below 10%, or take the money out until retirement. This will automatically increase by 1% per year until it hits 20% without opting out. Just like with a 401K there will be a choice of multiple different funds, including retirement date funds that balance domestic stocks, international stocks, and bonds, based on when the person plans to retire.

Even if they opt out of the automatic increases, from 18 to 62 at 8% annualized gains the account would grow to just under $400,000. At a 5% withdrawal rate this is $20,000 per year in income. Added to the UBI is around $30,000 per year. A dual earner household would then be at $60,000 per year, without counting any income from work or social security.

Conclusion:

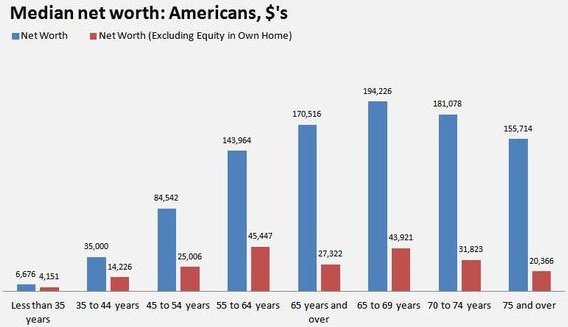

We have a lot of work to do with addressing systemic racial inequalities. These societal overhauls are not easy from a political, financial, or structural standpoint, but they need to be undertaken. Our politicians constantly talk about making things better, but they rarely take real action. Currently the wealth gap is large as a percentage basis, but in total whole dollars compared to lifetime earnings it is very small. We are horrible at building wealth in this country. If we have financial education in our schools and enact at least some of the other proposals outlined here, the median net worth by age figures in this country should increase by 5 – 10 fold. I’m especially hopeful for something along the lines of the Baby Stock proposal. Even if a racial gap persists with these changes in place (I don’t think it will because opportunity will be much more equal), the gap as a percentage will be exceedingly small because we will all be building wealth at a much fast clip.

I know that not everyone will agree with these ideas, but I wanted to get these thoughts out there and start a discussion. There are so many aspects to this large problem and we need to look at multiple ways to take steps in the right direction. I also an not so naive as to think that our government can or will solve all or any of these problems. I think know that the human spirit is stronger than all of these obstacles. When the playing field is not level we just have to work 10X harder.

Actions YOU can take to make things a bit better, especially for Black Americans struggling to build wealth:

- Know that the future can be better than the present and that you have the ability to make it so.

- Develop your WHY for financial independence

- Spend 2 hours of the day reading about money and finances, in 3 months you will be an expert. Change your life at literally no cost.

- Follow the Dave Ramsey Baby Steps

- Teach your kids about money and start them a bank account and an investment account. Even a few dollars a week adds up to a lot over 18 years. This costs very little to do.

- Encourage entrepreneurship.

- Keep your circle motivated, in doing so you will stay motivated and everyone will build up together.

- Set long term goals: Having thoughts that are 1 year, 5 years, 10 years down the road help you to turn down short term incentives that while great for this month are bad for you for the long term.

- Donate to your community agency that facilitates Dolly Parton’s Reading Library.

- Write to your congressman or senator about adopting one or several of these ideas.

- Spread the word about free home ownership classes and down payment assistance programs in your area.

- Don’t get discouraged when it feels like the deck is stacked against you, keep running your own race towards success.

What do you think of the ideas I’ve talked about here? What are your thoughts on Systemic changes to address racial inequality? Please share any thoughts you have, even if you think my ideas are terrible! What are individual actions any of us can take to improve things?

Leave a Reply