Systemic Changes To Address Racial Inequality: Part 5 Housing

Housing is at the root of the systemic issues of racial inequality. A lack of wealth is the driving force, and the driving force of building wealth for most Americans is home ownership. Without home ownership the Black community will not be able to close the wealth gap. More of our attention needs to be focused on this aspect of the wealth gap.

Housing Changes to Address Racial Inequality:

For decades after slavery Black people couldn’t buy homes in many areas. It was illegal to sell a home to Blacks and it was even written into the deeds that in the future you couldn’t sell a home to a Black person. Loans were also harder to get and discrimination on loans was legal. This isn’t ancient history, this was happening in the 1960s. Only in 1950 did the FHA stop explicitly recommending racial covenants to lenders. Between 1934 and 1968 98% of FHA loans were to White Americans. When discriminated based on race for loans became illegal banks simply decided not to lend to certain area codes, which of course were area codes that were primarily in Black neighborhoods this is much more recent history, and is still happening. When Black banks were created, they were robbed by white administrators who invested in high risk investments. Our government created a system of intentional laws that created extremely segregated communities. This kept generations of Black people from owning their homes, which in turn kept them from building generational wealth. Home ownership is the largest component of the average Americans wealth and is one of the larger pieces in the current wealth gap. For continued reading check out the books: The Color of Law: A Forgotten History of How Our Government Segregated America and The Color of Money: Black Banks and the Racial Wealth Gap.

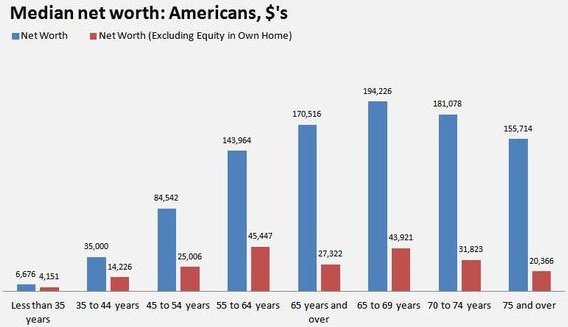

65.3% of White Americans own their home and 44% of Black Americans own their home. When we look at total household wealth, for every age group home equity is the largest piece. This 21% discrepancy of home ownership rate accounts for a massive chunk of the wealth gap. Closing this gap will greatly tighten the overall wealth gap.

The Universal Basic Income being enacted will make it much easier for people to stay current on bills and keep their credit in good standing, as well as build up a down payment for a house. This alone will solve a big chunk of the home ownership gap. With dual earner households being encouraged through our tax code instead of heavily discouraged more Black Americans will be able to afford buying a home. Here are some additional ideas that would also collectively eliminate the gap and make home ownership easier to obtain for everyone.

Down Payment Assistance Programs: Down payments and credit scores are the two largest barriers to home ownership. Down payment assistance programs already exist in many states, but should be standardized across the country. These should be up to 3.5% to cover the minimum FHA down payment of the home, provided they otherwise qualify for the loan and go through a first time home buyer class to ensure first time home buyers learn how to protect themselves when buying a home. My state has a program similar to this, but it is poorly promoted. Every bank should be advertising these programs. These classes should also include in them negotiating for the seller to pay for some of their closing costs, further reducing total cash out of pocket to buy a home.

Part of this could also be accomplished through the Section 8 program. In some municipalities, like Indianapolis, Section 8 recipients can go through a home ownership program in which HUD will cover a large chunk of the minimum 3% down payment. This program is a good example of one option for increasing home ownership opportunities.

End the Worship of FICO: FICO scores should improve after a UBI passes, however the way FICO scores are calculated greatly punish people for relatively minor credit blemishes. As a landlord I see credit applications from potential tenants all the time and it does not take much to end up with a low score. I had one applicant who paid on time for multiple accounts for several years, but had 3 items in collections that were all low dollar amounts, totaling well under $1,000. If I remember correctly I think 1 was for a Comcast bill and 2 were medical. These negatives caused her score to be well under the 650 mark that most lenders use as a hard and fast litmus test for getting a home loan.

Manual underwriting to actually see a persons habits and what is going on should be the norm, not the exception. Alternatively the FICO score needs to weigh negatives by dollar amount AND have reporting of more items for credit, such as paying utility bills and rent on time. With the rental program I use tenants can choose to have their rent payments reported to the credit bureaus. There are banks that do manual underwriting but they are few and far between. The FICO formula should also more aggressively reward people with a higher score for paying off old debts.

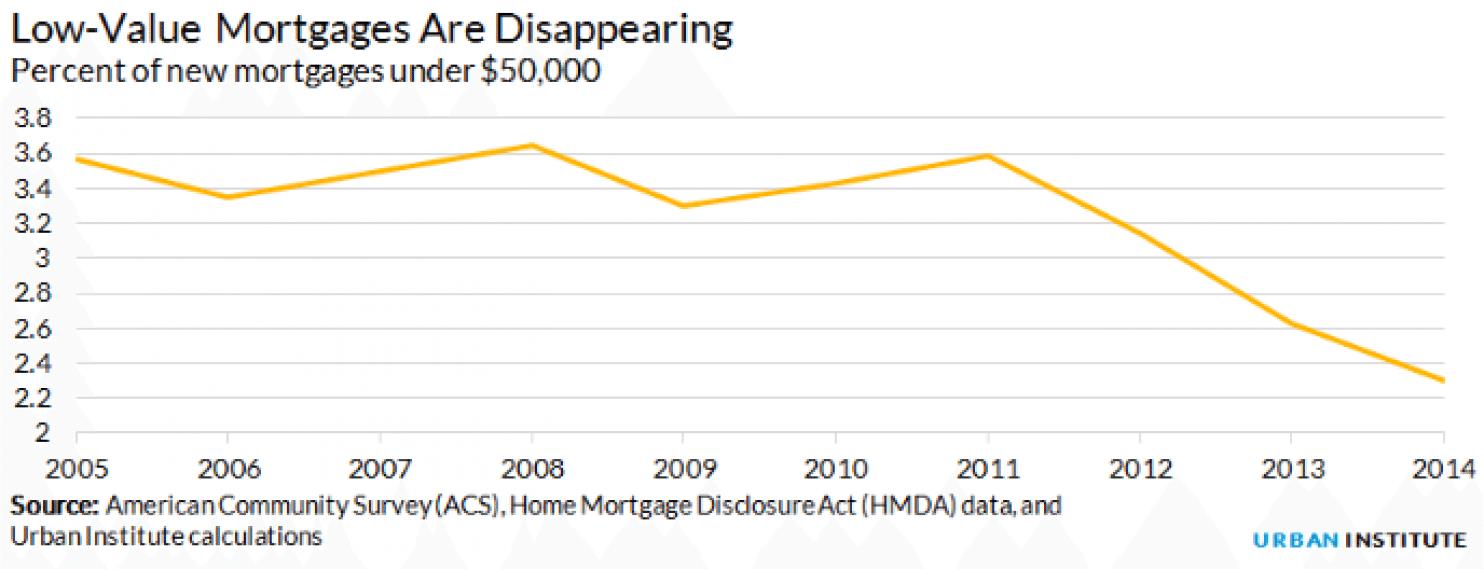

Improve Access to Credit: Here’s what’s crazy. You can walk into pretty much any car dealership in the country and with a very high Debt to Income ratio, no down payment, and horrible credit and drive away in a $40,000 vehicle the same day. I’ve worked with guys who earn $12 an hour who got loans on $40,000+ trucks. The only way people with a non ideal financial situation can get credit is to buy depreciating assets! What’s really crazy is that I can drive that car anywhere in the world and hide it!, with a house not so much. This encourages poor people to get into bad loans, to buy expensive depreciated assets, and have all of their net worth tied up in vehicles. You can even roll in bad debt from a previous loan and sign up for a $50,000 loan on a purchase of a new $40,000 car! All things being equal, you will get laughed out of a mortgage office for a $40,000 home loan. Since 2009 lending standards on home loans have tightened drastically. Some of these drastic regulatory laws and guidelines need to be scaled back.

Open up Sub $50K Loans: Another problem is that many lenders won’t issue home loans under $50,000. This magnifies the wealth gap further because in many poor Black neighborhoods the median house costs under $50,000. Instead of needing to come up with a 3.5% down payment, or even a 20% down payment, the barrier to buying a home becomes a 100% cash purchase.

Since the federal government underwrites most mortgages through the FHA/Freddie Mac/Fannie Mae programs, there is room here to encourage lending on low dollar homes. I think the easiest method to encourage banks to lend on these properties is to add a $1,000 bounty for closing owner occupied loans to qualified applicants. The banks would earn an extra $1,000 and credit would flow. This is a relatively low cost social engineering method that will bring way more than its cost back into the value of the community. This small incentive, even if 1 million people become home owners from it per year would still only cost $1 billion in total funding.

Alternatively produce a “fast track” program where loans under $50,000 for qualified owner occupant buyers and for houses that are in acceptable condition can go through a speedier process, similar to the “liar loans” before the subprime meltdown or even similar to vehicle loans. The bank needs to spend less time and resources on the loan, which would make the volume of loans they can do with fewer man hours a profitable endeavor.

In the 2009 financial crisis subprime loans were a major issue and a disproportionate amount of Black homeowners lost their homes.

The risky subprime loans that were issued did not have much in the way of a safety valve built in. In order to reduce risk on the subprime loans I am advocating for the loans could be only issued for 15 year mortgages. In the event of another mortgage crisis the banks would have a profitable option of loan modification to a 30 year loan which would give the bank more interest income and lower the monthly payments for the home owner. With today’s interest rates a 15 year loan 5 years in will be 35% paid off.

Someone who bought a $50K house with 5% down would have a monthly payment of $340 a month. 5 years in he would only owe $31,000 on the house. If a loan modification was needed he could recast to a new 15 year with a $31,000 balance with new payments of $222 a month, or to a 30 year with payments of $140 a month. The quick equity building that a 15 year mortgage allows gives a ton of margin for both the homeowner and the bank. These options weren’t realistic during the subprime crisis because many of the loans were with $0 down payments and on 30 year mortgages, which would only build around 13% equity in 5 years, leaving a balance on a $50K house of almost $44,000. There isn’t enough equity to make any difference with a recast, and since it was already on a 30 year loan making a longer term also wouldn’t make much of a difference. Furthermore, only having $6,000 of paid in equity isn’t enough to weather a 20%+ change in home values, making several borrowers upside down owing more than what their homes are worth.

As a real estate investor I have applied for several loans and following the BRRRR method I do cash out refinances on investment properties. The banks see this as additional risk and charge more in points, which are loan origination costs to borrow the money. Banks should do the same thing with low priced home loans and borrowers with less than stellar credit in order to qualify more people.

Being able to buy a house with a 6% interest rate (2.5% above current advertised rates) and an extra 1% due in closing costs is still better than not being able to buy a house at all. On a $50,000 loan in this scenario someone with a higher credit risk would pay an extra $500 to get the loan, and would pay $75 more in a monthly payment ($225 at 3.5% vs. $300 at 6%). The bank would be compensated for their risks. Instead they won’t take any risks and the sub prime market has dried up post 2009.

Side Note: I would not have been able to build the wealth I have, or at least at the rate that I have without a subprime mortgage. In 2006 When I was 20 Mrs. C. and I wanted to buy our first home. We scrimped and saved for a down payment and paid off some bad debt that Mrs. C. had that totaled around $2,000. Both of us were working “part time” minimum wage jobs (we routinely got 39.9 hours). We applied for our loan and everything looked like it would go through. At the last minute the large bank our mortgage broker resells loans to denied us. Our broker offered to finance it in his own business. We got our mortgage for a $48,000 foreclosure house that had been on the market for a year with 20% down as a 1 year, 9.25% interest only loan, that we had to refinance in a year. When we did refinance we paid a ton of closing costs and we got a 15 year mortgage at 7.37%. The loan was expensive, but it allowed us to own our own home and build some equity. We still own that house, on a different loan (now 15 year 4.25%) and we now rent that house out.

Remove Barriers to Affordable Housing:

Affordable housing is housing that low income people can get that costs no more than 30% of their income. Luxury apartments cost only a small amount more to make than affordable apartments. There is no money in building low cost housing so it doesn’t happen. The cost of construction is too great. A big reason for this is that building codes drive up construction costs through the roof. Millions of affordable housing units have not been built because of over regulation and the relatively small incremental cost to make units high end over low end. I know the federal government can’t dictate to the states to take these actions, but what they can do is tie this to block grant funding for any number of federal programs that bring dollars into the state. If you want federal dollars, don’t stop people from building small affordable homes.

Reduce Zoning Laws and Building Codes: Building moderate priced housing will result in low income housing becoming available. Middle income people will move into the brand new apartments and the prices on the older existing apartments where they moved out of will begin to drop. In addition to building codes driving up costs, a major factor in driving up costs in larger cities is zoning ordinances. Silicon Valley is atrocious for this. Many municipalities in Silicon Valley fight tooth and nail against high rise apartment construction, wanting to maintain the feel and look of single family housing. They also have property tax provisions that provide a major incentive for homeowners to never sell and move. Combined with rapid job growth, this is why a 1 bedroom apartment can cost $2,500 in San Jose. If we look at another city that has experienced similar population growth, Austin, TX, a 1 bedroom apartment can be found for $600 a month. This is only a fix for high population, high growth areas with sky high costs of living. We need other solutions for the rest of America.

Reduce or Eliminate Ordinances on Housing Sizes. In my small township in a rural area the building ordinance requires new construction homes to be at least 1,000 square feet. Why? There is no reason for this, although some suspect these ordinances were originally targeting against mobile homes. There are hundreds of perfectly fine houses half this size. A 500 square foot 2 bedroom 1 bath home is much more affordable to build than a 1,000 square foot home. In addition to eliminating the square footage designation for traditional construction homes, ordinances also needs to be lifted for accessory dwelling units and tiny houses. Both of these appeal to a wide range of people and are much more affordable than stand alone housing. This should also happen for single room rental units, studio apartments, and hotel to permanent housing conversions. I just read an interesting article on a proposal for NYC to buy up vacant, empty hotels during this pandemic at rock bottom prices and turning them into long term low cost housing units.

Reduce or Eliminate Ordinances Against Establishing Mobile Home Parks. Mobile homes are one of the most affordable housing options, especially in areas where land is not at a premium. Unfortunately most municipalities have chosen to go the “not in my backyard” route and prohibited new mobile home parks from being created. This has resulted in their being a lower supply of mobile home lots than people who want to live there, resulting in higher lot rents. If there were more lots available the rent for all lots would face downward pressure and more people would have access to affordable housing. Although mobile homes in general depreciate over time, they are a more affordable form of housing than renting a house in most circumstances and can be a stepping stone to purchasing a single family home in the future. (My family lived in a mobile home park when we moved to Michigan for roughly the first 6 years of my life.)

Invest in 3D Printed Housing: Initial systems for 3D printed houses have shown great promise to deliver low cost affordable housing where traditional construction methods can not. I think our government should award an X-prize, similar to what they did with the commercial crew program with Nasa to developers to encourage 3D printed houses. This could be done with a relatively small amount of prize money, something in the realm of $100 million. The houses would need to be able to be connected to municipal water, sewer, and electric. Have 2-3 bedrooms, a kitchen, bathroom, and electrical outlets and lights, like every other home. There could be requirements based on total 100% complete costs and timeline to go from arriving at a new site to having a fully move in ready house.

Invest in 3D Printed Housing: Initial systems for 3D printed houses have shown great promise to deliver low cost affordable housing where traditional construction methods can not. I think our government should award an X-prize, similar to what they did with the commercial crew program with Nasa to developers to encourage 3D printed houses. This could be done with a relatively small amount of prize money, something in the realm of $100 million. The houses would need to be able to be connected to municipal water, sewer, and electric. Have 2-3 bedrooms, a kitchen, bathroom, and electrical outlets and lights, like every other home. There could be requirements based on total 100% complete costs and timeline to go from arriving at a new site to having a fully move in ready house.

The end goal should be a house that is printed in under 1 day (some claim to already be able to do this) and 100% finished in 2 weeks at a total price of under $30,000 and a printing system that can be quickly scaled. A $30,000 home with 10% down would result in a 15 year loan at 4% costing $200 a month. Add in taxes, insurance, and PMI and the total payment in most locations would still be under $400 a month. With 3D printed houses utility bills would also be lower due to the thermal mass of concrete construction. This same technology could also be used for building apartment buildings in areas where land is at a premium.

To receive funding from the government the houses made would have to be sold to owner occupants. Once a reliable system is developed and proves to be profitable, the construction loans would be backed by Fannie Mae/Freddie Mac. Thousands of printers would produce millions of units a year. In partnership with city land bank programs the land for the homes would often be free. Once again for this to work local ordinances on house size and construction would need to be scaled back.

Change the Tax Code for House Flips:

Currently there is a credit problem with homes in predominately Black neighborhoods. Houses in disrepair can’t be sold with a loan because they need too much work, and because they need too much work and the repairs would (according to the bank) cost more than the house is worth, they don’t get fixed up and fall further into disrepair, creating a cycle of blight, which in turn lowers the average property value further. Most appraisals are done by comparing the house someone wants to get a loan for to 3 or more houses of similar size, condition, and age in the same general area. If the majority of houses in the neighborhood are facing similar challenges, the comparables will be low, making qualifying for loans more difficult.

Once again, as a real estate investor I look very hard at the incentives that exist when deciding on how to invest in real estate. Right now rental real estate works best for me, however in the future I plan on doing some house flips, but the problem is, I have to wait a year to do them, which means I have to flip houses slowly. The current tax code requires assets held for under 1 year that are sold for a gain to be taxed at the individuals tax rate. For assets held for over a year, they are taxed at a lower rate, which is 0% for those in the 12% tax bracket or lower, and 15% for everyone else.

This tax rate makes a huge difference, which is why for a flip I would have to buy a house, rehab it and hold it, and most likely rent it our for a year before selling it. This slows down the velocity of my money to a crawl. If it takes me a month to rehab a property, a month to get it rented, I have to rent it out for a year, then it takes me another month to get it ready to sell and sold, it takes close to 15 months before I can flip my money. Alternatively, if I could buy the house, rehab it and immediately sell it, it would take me closer to 2 months from purchase to sale, meaning instead of rehabbing 1 house every 15 months I could rehab 7 houses! Doing only 1 house every 15 months also slows down my ability to learn from mistakes and to streamline my processes. Doing 6 a year may allow me to learn enough to increase my volume to 8, 10, or even 12 a year. These changes would instead of greatly influencing investors to become long term landlords, they would influence investors to flip houses to owner occupants. They would also encourage part time investors like me to go full time. If I could pay 15% income tax on my short term gains from flips, I would have a strong incentive to quit working my W2 day job and to concentrate on providing affordable housing.

Why does anyone care if a rich guy saves some money on his taxes? Well as I discussed above banks won’t lend for these properties. The primary way these properties get sold is with a cash buyer. In many of these neighborhoods people are not investing, and those who are have an unfortunate penchant for becoming slum lords. If I can buy a house with cash, rehab it so it can qualify for a loan, and sell it to an owner occupant, that repeated action can change communities. 1 guy doing 1 house every 15 months doesn’t make much of a difference. 1 guy doing 6 houses a year starts to move the needle, and when other investors see how well he is doing they may replicate the activity. To be clear, I’m not talking about gentrification and turning houses into high end luxury homes. I see some flippers doing this and a lot of them end up losing a ton of money, and it isn’t good for the neighborhoods. I focus on making the house clean, functional, and safe. I return it to being usable.

The only way these neighborhoods get rebuilt is with cash buyers rehabbing the properties and rehabbing them correctly to keep them affordable. The way to encourage this is through the tax code. Either make all real estate flipping transactions taxed as Long Term Capital gains, or assign renaissance zones where any flips done in a certain area will qualify as long term capital gains. Another option would be to make Capital gains of under $X per asset to fall into a lower tax category. People flipping Mcmansions don’t get the tax benefit, but those providing low cost housing would.

Actions You Can Take:

- Continue to learn about the housing market and the history of the housing market.

- Contact your local government officials to urge them to change ordinances against low income housing.

- Contact your state government officials to urge them to start or to promote existing programs that offer down payment assistance to first time home buyers.

- Contact your federal government officials to urge them to reform current lending programs.

- Encourage your family and friends to set goals of home ownership

Leave a Reply