Systemic Changes To Address Racial Inequality: Part 6 Banking and Credit

Access to Banking and Credit to Address Racial Inequality:

According to the FDIC 16.9% of Blacks, 14% of Hispanics, and 3% of Whites are unbanked. Not having a normal bank account greatly inhibits savings and prevents people from being able to even cash their paychecks for free, let alone obtain loans. A lack of access to credit is detrimental to anyone who is experiencing poverty. Access to credit is a major factor in people being able to get out of poverty. (Now instead of angering the Republicans and Democrats, my Dave Ramsey friends are gonna throw mud at me.) When people can’t afford a necessity and do not have access to credit, they make financially detrimental decisions based on their short term emergency. Although instating a UBI and some of the other solutions I have proposed will eliminate the need for taking credit in many instances, this will remain a problem as long as credit is not available. For further reading check out the book The Color of Money: Black Banks and the Racial Wealth Gap.

I recently completed reading The Color of Money and the history of Black banking in this country is fascinating. Black banks were started as a way to keep money in the Black community and to pave a pathway to land and home ownership for Black Americans following the end of slavery. Black banks faced structural problems that White banks did not. Because Blacks have less money they have smaller deposits, and the total amounts in their bank accounts fluctuated greatly. Due to this the Black banks had to be more conservative with their lending and investing, which lowered profits, and ultimately caused them to fail. Up until the creation of the FDIC Black bank depositors lost their money if a bank failed. Black Americans are for good reason, less trusting of the banking system than Whites. This is an extremely short blurb, and I encourage you to read The Color of Money. It’s extremely well written and for being a historical text on banking the author keeps the reader engaged.

The Banking Multiplier:

The reason why banking is so important to a community is the multiplier effect of banking. For historically redlined communities that are predominately black, keeping money flowing in the community can have a major multiplier effect on lifting the community up. Here’s how the multiplier effect works:

The “magic” of fractional reserve banking is that the total amount of money can increase in a given economic zone based on the deposits and loans.

People 1 – 20: Deposit $500 each into Bank 1, Bank 1 now has $10,000.

Bank 1 has a reserve limit of 10%, meaning they can lend out $9,000 of these deposits. Bank 1 lends $9,000 to Person B for a car loan.

Person B. takes the $9,000 and buys a car from Person C. Person C. deposits $9,000 in Bank 1.

Bank 1 can now lend $8,100 out based on these deposits.

This can keep on repeating itself, growing the amount of money in the system. The breakdown is when the money leaves a given area. What if the seller of the car uses Bank 2, which is based in another area? This is a massive problem that all Black banks have struggled with. When they loan out money, even to people in their communities, the proceeds of the loans tends to exit the community and the multiplier stops. On the macro level you can see why Black banks have not been overly successful. On an individual level not having a bank account, whether at a Black bank or any other bank has severe long term consequences.

Why Being Unbanked Is A Big Deal:

When someone doesn’t have a bank account accumulation of capital, building wealth, is next to impossible. Sure, many employers will pay their employees with a pay card, but this is no substitute for an actual bank account. These cards have use limitations and charge fees for standard transactions that are free for virtually every normal bank account. As an example, I use Cozy.co to manage my rental properties. My tenants can pay their rent for free with a bank transfer, however using a card costs 2.75% of the total amount. For a tenant paying $1,000 in rent this is an extra $27.50 per month.

For the next step of building wealth, which is getting credit, these pay cards fall woefully short. The card issuers are not going to give a personal loan, a car loan, or a home loan to the employees. With a bank account the bank can see the incoming and outgoing funds and having an established account for 2 years provides a large level of comfort for banks to lend. Not having a bank account ensures Black Americans are frozen out of the credit market and to access credit at all must pay extremely high fees as at a sub prime, or even payday lender.

The Scarcity Mindset: Building up a savings buffer of even a few hundred dollars to a thousand dollars can prevent the scarcity mindset. “When resources are low or scarce, the rational decision is to take the immediate benefit and to discount future gain” -Mellisa Sturge Apple: The Color of Money. Since long term planning is one of the largest keys to financial success, a scarcity mindset is one of the most dangerous locks to this success.

“A state of scarcity is such a heavy mental burden that it can lead to temporarily lower cognitive ability and shortsighted decision making. This does not mean that the poor have less capacity, but that their capacity is overburdened because living in scarcity takes up significant mental space and leaves less room for other mental processes. Those operating under the pressure of scarcity have been shown to eat poorly, parent poorly, make bad decisions, and even wash their hands less often. Scarcity also creates tunneling, which is a hyper focused mindset that homes in on the resource in scarcity.” – Mehrsa Baradaran: The Color Of Money.

A great example of people paying extra money for credit has to do with tax preparation. Every year at tax season the major tax preparers set up shop in our low income community advertising specials to get people in the door. The vast majority of their clients are single mothers with children and 1 to 2 W2 jobs. Their taxes are extremely simple and should take a preparer less than 30 minutes to do, honestly, probably less than 15 minutes. Since these people are getting large refunds due to the child tax credit and the Earned Income Tax Credit, the tax preparers offer to “rapid refund” their money to them, instead of waiting for the IRS. Typically the IRS will issue refunds within 2 to 6 weeks. Some of these tax preparers charge in total fees and interest several hundred dollars for these loans, which are extremely short term and 100% guaranteed by the federal government! They understand the scarcity mindset and are using it to their advantage.

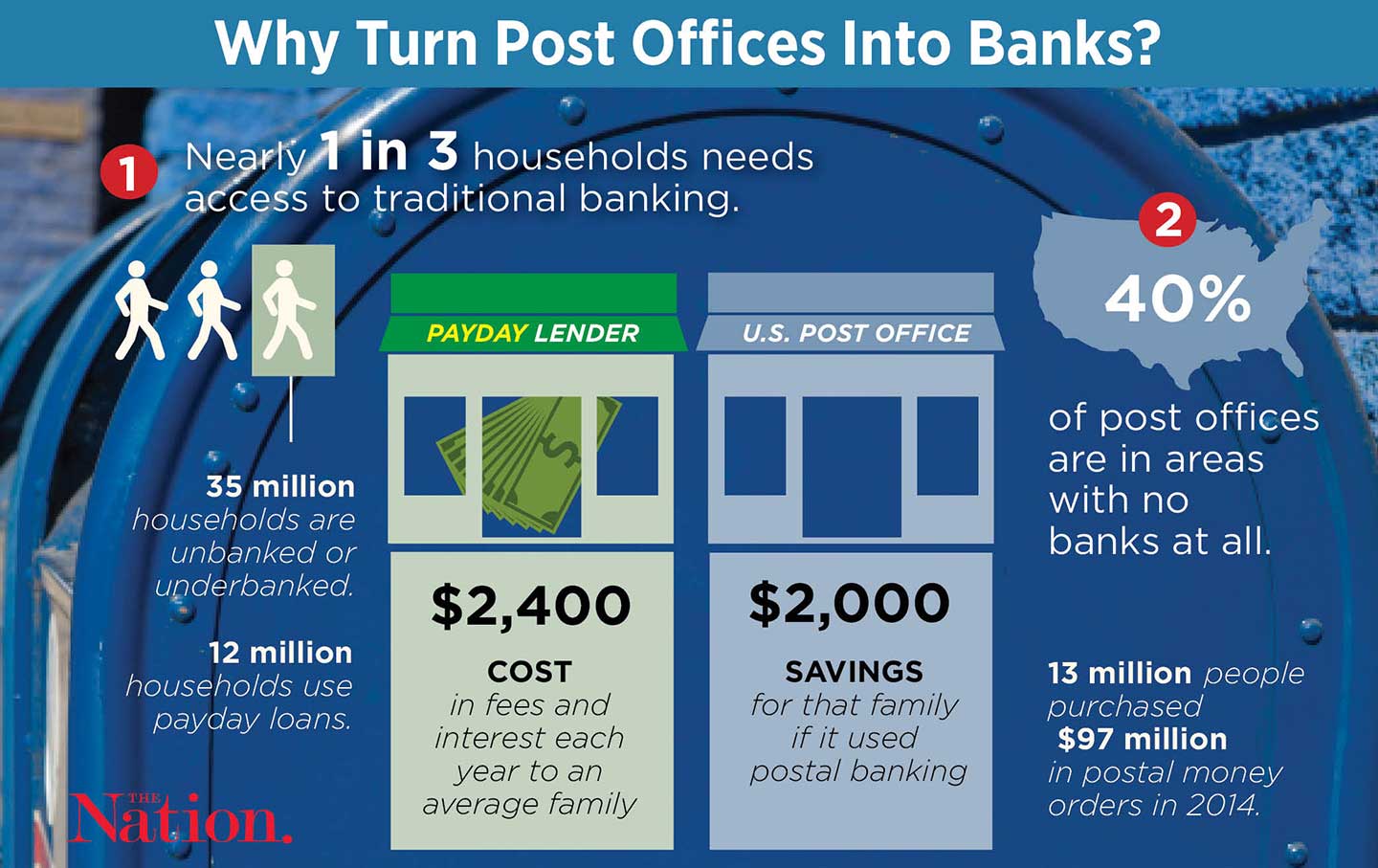

Reinstate Postal Banking:

This solution is has two major benefits. It gives another source of revenue to the postal system and it provides a service that is provided inefficiently in the marketplace. Additionally, most banks don’t want to give out small unsecured loans and they certainly don’t want to give out unsecured short term loans. This has led to the rise of the cash advance industry. Please follow the link to the page above about postal banking, it a really interesting concept and solves a lot of problems.

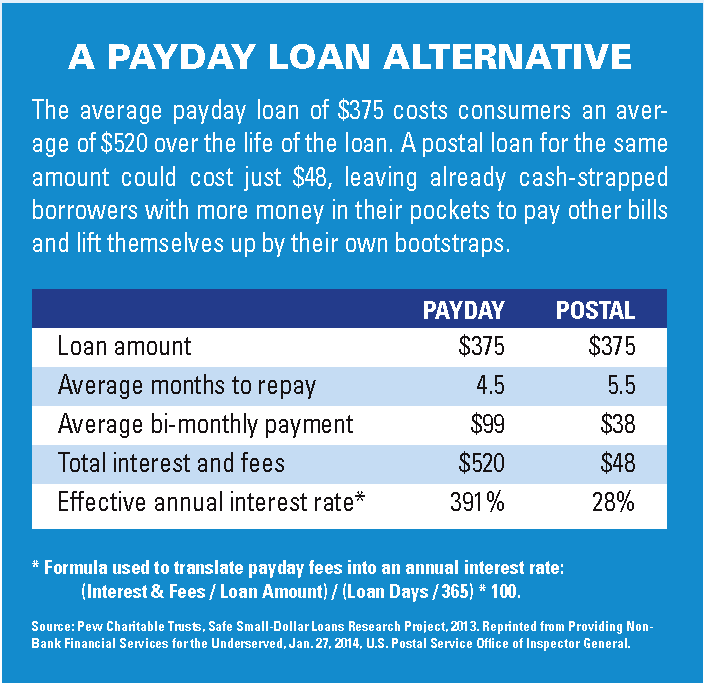

The cash advance industry has insanely high interest rates and costs of capital that absolutely traps people. It goes beyond risk level pricing. The Cash Store published their cost of credit online. For a 14 day cash advance in Illinois they charge a 404.11% APR. For a $400 advance $462 is due 2 weeks later. The risk of someone who has a job and is getting an unsecured short term loan is not 40X higher than the risk of me with my 10% APR credit card. People don’t go to these stores because they think its a good deal, they go there because in the market there is no other option.

The cash advance industry has insanely high interest rates and costs of capital that absolutely traps people. It goes beyond risk level pricing. The Cash Store published their cost of credit online. For a 14 day cash advance in Illinois they charge a 404.11% APR. For a $400 advance $462 is due 2 weeks later. The risk of someone who has a job and is getting an unsecured short term loan is not 40X higher than the risk of me with my 10% APR credit card. People don’t go to these stores because they think its a good deal, they go there because in the market there is no other option.

A lack of banking and access to credit also feeds the predatory Rent to Own sector: Talk about misleading advertising! The 3 rent to own places in my city advertise heavily. They claim the finance costs follow state laws and are not that high. Well the big thing they do is charge 2 to 3 times as much in list price for the same item you can buy anywhere else. So although the financing charge may be under the state law maximums, the purchase prices are ratcheted up to make up the difference. The true APR on these items is very close to what the cash advance places charge, except instead of it being a 2 week loan, its over the course of 1 to 2 years.

Banking is integral to building wealth. On an individual level a bank account is necessary to avoid fees for normal transactions, to build up savings to avoid a scarcity mindset, to get credit to buy a car or a home, to set up automatic payments at no cost, and to make automatic contributions to retirement accounts. Having a bank account is an extremely important step for an individual. For a community, having banking options that largely operate within the community is very important, especially from a money multiplier standpoint.

Actions You Can Take:

- Help an unbanked friend or family member set up a bank account at a local financial institution. This may end up involving pulling a credit report and resolving any past issues.

- Setup bank accounts for your children. This will ensure they start out in life fully banked.

- Read The Color of Money: Black Banks and the Racial Wealth Gap.

to learn in depth about this history of Black banking as it relates to the wealth gap. I barely scratched the surface in this article.

- Write to your congressmen and senators to support Postal banking.

Leave a Reply