Systemic Changes To Address Racial Inequality Part 8: Retirement

Retirement Policy and Stock Market Participation To Address Racial Inequality:

I’ve already mentioned this, but it bears repeating; marriage status, home ownership, and stock market participation are the three strongest factors that determine wealth in our country. Fixing all 3 will greatly increase anyone’s wealth. To fix the wealth gap in our country that currently shows White households having 13X the wealth of Black households, we need to focus on the gaps in these 3 areas. I also want to reiterate that the level of White wealth that is being referred to here is woefully low, and we should all be aiming to have over 10X the wealth that the median White household has. We should all be shooting for millionaire + status.

Increase Stock Market Participation Rate: Black Americans with the same education level and same income as White Americans are 35% less likely to own stocks. I think this falls under the systemic challenges of not having parents / grandparents who owned stocks. I got interested in stock market ownership because my parents owned stocks. My children all own stocks that they have purchased with money they earned from doing chores around the house. My youngest is 7! They of course didn’t do this on their own, it was from me pushing them towards it and teaching them about investing. If we can get financial education in place, reduce mass incarceration, install a UBI, and rebuild families then I think stock market participation will follow. During the past 15 years access to the stock market has improved greatly which will ultimately help with this disparity. Today we can download apps on our phone and have our debit cards round up change from everyday transactions and invest it. We can buy fractional shares and open retirement accounts in under 10 minutes will less than $50.

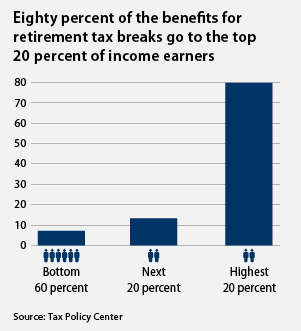

Change the Retirement Incentives: We do incentives for saving for retirement backwards. I strongly believe that this change will be a big factor in closing the wealth gap and having a much larger portion of our society ready for retirement. We highly reward people with high incomes for saving for retirement, while giving sometimes zero incentive for people with low incomes to save for retirement. If you are in the 0% tax bracket a tax deduction does you no good, and saving any for retirement is a really hard thing to do.

If you are in the 35% tax bracket saving for retirement is easy because you have a lot of disposable income, you get a 35% assistance from the federal government, AND you’re more likely to have employer matching. A dual earning household earning $300,000 a year and maxing their 401Ks at $38,000 per year will receive over $13,000 in retirement assistance per year from the federal government. These high earners are also more likely to already have an incentive to save for retirement in the form of an employer match. In this income bracket a 5% match would gain them another $15,000 in additional retirement savings. By saving $38,000 they received another $28,000 in incentives. By contrast, a single mom earning $30,000 a year and saving $3,000 will receive no tax benefit from saving for retirement and is less likely to receive a 401K match from an employer.

Retirement contributions are also deductible from state income taxes. In Michigan the high earning couple would receive a $1,615 tax benefit based on Michigan’s 4.25% income tax rate. In California, which has a graduated income tax with much higher brackets. Using California’s highest 13.3% income tax bracket this couple would get an additional $5,054 in state tax benefits. In total then, a CA couple earning $300,000 per year and saving $38,000 in retirement accounts would receive a total tax benefit of $18,354 and most likely a minimum match of 5% $1 for $1 which would add another $15,000. Saving $38,000 gave them an instant benefit of $33,354.

What about the existing retirement savers tax credit? The idea is good, but since it is not refundable there is no incentive for low earners with kids to save for retirement. With the doubling of the child tax credit this has become an unusable vestige of the old tax code. What we need to do is have a refundable retirement savers tax credit with incentives up to $5,000 instead of $2,000 and pay for it by reducing the tax deduction on 401K plans. I envision making the 401K tax deduction freeze at 20% for those in higher tax brackets. This flattening of the bracket will lower the benefit received by top earners, while still keeping a strong incentive to save in place. Low income earners would then be able to use a refundable retirement savers tax credit that is between 20% to 50% of the value of their retirement savings based on income, with a maximum benefit based off $5,000 in contributions, so a maximum of $2,500 of benefit per year.

What I would like to see is this integrated into tax prep software like Turbotax and H+R Block. When someone is filing their taxes a blurb will pop up before they hit submit stating that their current refund is X, however if they invest $X into a Roth IRA now, the refundable retirement savers tax credit will give them a 50% credit. Investing $1,000 will only reduce their tax check by $500. Also have a blurb about how $1,000 invested at 8% each year over 40 years will grow to $300,000.

Psychologically a low earner weighing the trade off of investing in a retirement account vs. not investing is seeing instead of $1 going into an account he or she can’t touch for decades, that $1 can go to an immediate need. “When resources are low or scarce, the rational decision is to take the immediate benefit and to discount future gain” -Mellisa Sturge Apple: The Color of Money.

A high earner who has all his or her immediate needs covered anyways will psychologically see not investing in a retirement account as throwing away between 35 cents and $1.485 (depending on the employer match and state tax rate). In the higher tax bracket its absolutely crazy to not max your retirement accounts, its an automatic minimum of a 35% return right off the bat. For a low earner its a break even game with where to allocate money, and with no incentives very few actually go with putting it away for the long term. Our incentives make savings for retirement a no brainer for high earners (who likely have more education and more assets than low earners) and a really difficult decision for lower earners.

For a high earner there is an instant gratification of both the employer match and the tax deduction as well as the long term reward of tax free compounding. For low earners there is no instant gratification, only the long term reward of tax free compounding. Since we are wired to think for short term, instant gratification, we are tipping the scales in an even greater direction to the high earners than what the tax code already is doing.

Expand 401K Availability and Automatic Enrollment: We also need to have automatic enrollment of 401K plans for ALL workers, regardless of age. We need setting up a 401K plan for employers to be a simple inexpensive process so that there are no barriers for the account to exist and for contributions to start automatically with 5% of earnings. 59% of American workers have no retirement accounts. There are several states working to make it easier for people to get into plans, including allowing multiple employers to have group 401K plans which spreads the costs out and makes the plans more affordable for employers.

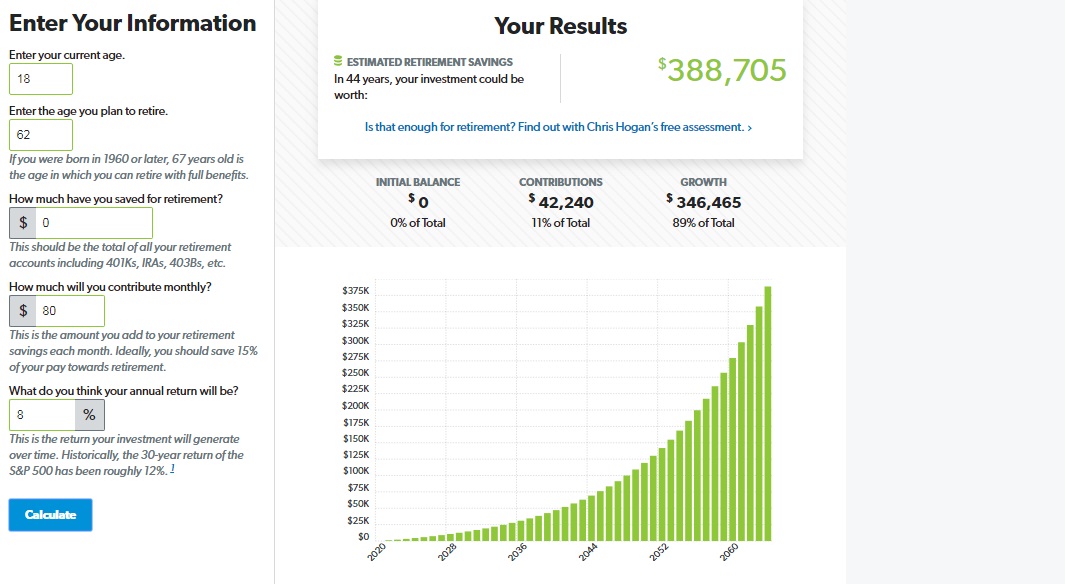

Automatic Investing: As part of the UBI in my plan, 10% of the total ($80 per month) is automatically invested in a Roth IRA for the recipient in a total stock market index fund by default, the other $720 is received in cash. The recipient can increase this amount, but CAN NOT decrease it below 10%, or take the money out until retirement. This will automatically increase by 1% per year until it hits 20% without opting out. Just like with a 401K there will be a choice of multiple different funds, including retirement date funds that balance domestic stocks, international stocks, and bonds, based on when the person plans to retire.

Even if they opt out of the automatic increases, from 18 to 62 at 8% annualized gains the account would grow to just under $400,000. At a 5% withdrawal rate this is $20,000 per year in income. Added to the UBI is around $30,000 per year. A dual earner household would then be at $60,000 per year, without counting any income from work or social security.

Cato’s 6.2% Social Security Solution: This is a proposal to reform the current Social Security system to give more control to the workers. Social Security is very progressive in its payout system. A synopsis of how Social Security benefits are calculated:

Social Security looks at the highest 35 years of earnings (420 months) and indexes them to inflation. Then these amounts are averaged by divided by 420 months to get the AIME or averaged indexed monthly earnings. This number is what all Social Security benefits are based off of.

- the first $960 of this amount is given a 90% benefit.

- Then anything between $960 and $5,785 is given a 32% benefit

- Everything over $5,785 is given a 15% benefit

This shows that Social Security replaces a much greater percentage of income for lower earners. This makes Social Security more important for low income people. According to Social Security almost half of retired minorities rely on Social Security for 90% or more of their income compared to 29% of Whites. Increasing Social Security benefits would therefore be more beneficial to minorities than to Whites.

I take issue with several of the aspects of Social Security, but the most pressing is how it is invested. All Social Security money is invested in US treasuries. US treasuries earn next to nothing in interest.

Cato’s 6.2% solution is to allow people to essentially opt out of the government control of the money and have the ability to invest the 6.2% employee portion. The 6.2% employer portion would continue to be part of the current system to pay current liabilities and disability and survivor benefits. Those who choose to opt out would give up any future Social Security benefits. Workers would be given a recognition bond from Social Security based on their work record as the starting point when they opt out. The overall plan has a lot more details, but overall this is the basics of it.

Investing 6.2% of earnings for someone who earns $960 per month in a stock market index fund at 8% would grow to $366,000 from 20 to 67. Taking a 5% withdrawal from this would give you $1,525 in income each month compared to $864 per month from Social Security. This is a 158% income replacement instead of a 90% income replacement. Compounding interest over the long term and being able to benefit from every year of earnings makes a big difference. With Social Security your benefits are based on your best 35 years, but if you opted out every years contributions would be invested in your account.

This makes investing Social Security money a net benefit even for those with the lowest incomes and highest percentage of benefit from Social Security. For higher earners, this market participation would provide a greater net return, since instead of the 158% income replacement being compared to a 90% replacement benefit, it is being compared to a 15% replacement benefit.

For a median income earner making $60,000 per year the 6.2% invested from 20 to 67 would grow to $1.925 million, giving a 5% withdrawal of $8,020 a month. Social Security would provide a benefit of only $2,157 a month.

For a high income earner making the Social Security maximum of $137,700 per year the 6.2% invested from 20 to 67 would grow to $4.417 million, giving a 5% withdrawal of $18,404 per month. Social Security would only provide $3,011. I know it would be a rare person to earn this much starting at age 20, but I wanted to compare the extreme side as an example.

The point is that for virtually everyone, even low earners, privatizing the employee contribution makes sense. Now for workers who are over 30, this may not be a good trade off because the early years would be given a credit based on their Social Security earnings so far, and they would have already missed out on the compounding of greater returns for over a decade. This system will work best for young workers, regardless of income, and for high earners who have several years left in their career. My calculations assume an 8% annualized return and a 5% withdrawal rate. Some financial experts think this return rate is too conservative, while others may think it is too aggressive, the same with the withdrawal rate.

An added MAJOR benefit of this option is that it turns Social Security benefits into an individual asset. If you die today, those Social Security benefits totally stop, your estate gets a $255 burial check and that’s it. If you were covered by the 6.2% solution and have your contributions invested for you, that asset is yours. The several hundred thousand to millions of dollars held into the account can then pass on to your heirs, creating and expanding generational wealth.

I think a major overhaul of the Social Security system is incredibly unlikely to occur, much less likely than changing the tax code around retirement accounts and even less likely than a Universal Basic Income. I think this idea is interesting and that the current Social Security system engages in the widespread destruction of wealth. Revamping it would turn it around and make it a creator of wealth instead.

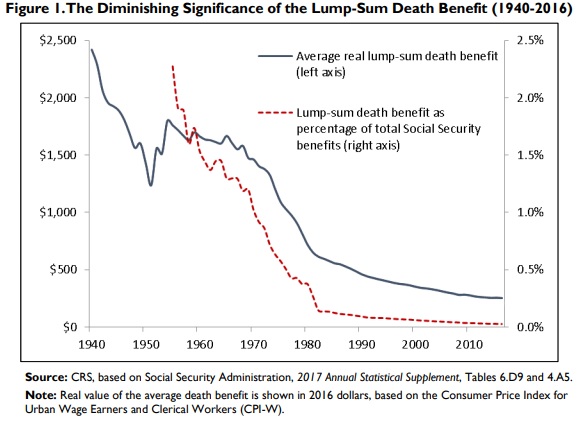

Social Security Death Benefits: While we are on Social Security, another major change that is needed regards final expenses. When someone who is covered by Social Security dies a $255 death benefit is paid. Originally the death benefit was 3X the workers PIA, which for the average worker today would be $4,500. In 1954 the benefit was capped to a maximum of $255 which was 3X the maximum PIA in 1952 and it hasn’t changed since. Indexed for inflation, this would be over $2,400 today. Today the typical funeral costs $9,000. Funeral costs have skyrocketed 1,328% in 40 years. This cost can completely wipe out someone’s savings and cause other family members to dip into their meager savings to help cover it.

At a minimum this should be adjusted up for inflation to around $2,400. This would be less than 2 months of the average persons Social Security retirement benefits. For someone who dies before every receiving benefits it seems extremely unfair for Social Security to not provide a significant benefit. I’d like to see some Entrepreneurial company upend the funeral business by making standard funerals substantially less expensive.

Conclusion:

We have a lot of work to do with addressing systemic racial inequalities. These societal overhauls are not easy from a political, financial, or structural standpoint, but they need to be undertaken. Our politicians constantly talk about making things better, but they rarely take real action. Currently the wealth gap is large as a percentage basis, but in total whole dollars compared to lifetime earnings it is very small. We are horrible at building wealth in this country. If we have financial education in our schools and enact at least some of the other proposals outlined over these 8 articles, the median net worth by age figures in this country should increase by 5 – 10 fold. I’m especially hopeful for something along the lines of the Baby Stock proposal. Even if a racial gap persists with these changes in place (I don’t think it will because opportunity will be much more equal), the gap as a percentage will be exceedingly small because we will all be building wealth at a much fast clip.

I know that not everyone will agree with these ideas, but I wanted to get these thoughts out there and start a discussion. There are so many aspects to this large problem and we need to look at multiple ways to take steps in the right direction. I also an not so naive as to think that our government can or will solve all or any of these problems. I think know that the human spirit is stronger than all of these obstacles. When the playing field is not level we just have to work 10X harder.

Actions YOU can take to make things a bit better, especially for Black Americans struggling to build wealth:

- Know that the future can be better than the present and that you have the ability to make it so.

- Develop your WHY for financial independence

- Spend 1 hour of the day reading about money and finances, in 3 months you will be an expert. Change your life at literally no cost.

- Follow the Dave Ramsey Baby Steps

- Teach your kids about money and start them a bank account and an investment account. Even a few dollars a week adds up to a lot over 18 years. This costs very little to do.

- Encourage entrepreneurship.

- Keep your circle motivated, in doing so you will stay motivated and everyone will build up together.

- Set long term goals: Having thoughts that are 1 year, 5 years, 10 years down the road help you to turn down short term incentives that while great for this month are bad for you for the long term.

- Write to your congressman or senator about adopting one or several of these ideas.

- Don’t get discouraged when it feels like the deck is stacked against you, keep running your own race towards success.

What do you think of the ideas I’ve talked about here? What are your thoughts on Systemic changes to address racial inequality? Please share any thoughts you have, even if you think my ideas are terrible! What are individual actions any of us can take to improve things?

Leave a Reply