Starting a Roth 401K For Your Children

If you want to build generational wealth, starting a Roth 401K for your children is a no brainer! I’ve written about employing your minor children in your business and opening a Roth IRA for them in order to get them access to Roth accounts. In this article I will take the journey a step further and investigate opening a 401K plan for your employees; aka your children. If you are serious about building generational wealth, then you need to start a Roth 401K for your children.

The Basics Of Starting A Roth 401K For Your Children:

You start a sole proprietorship business and your income and expenses are reported on Schedule C of your tax return. Any profits the business has are taxed at your tax rate plus the 15.2% self employment tax. Any economic activity can be a business. If you mow lawns that’s a business. If you babysit, that’s a business. It doesn’t have to be complicated.

You hire your minor children in the business. They must do actual work that is beneficial to the business and their compensation must be reasonable for the work provided. You can’t pay your 5 year old $10K for 1 hour as a social media manager. They are exempt from Social Security, Medicare, and unemployment taxes, and they will owe no federal income tax if their total income is under the standard deduction of $12,550. For your children or children for whom you are the legal guardian of, child labor laws, particularly those relating to age, do not apply. To hire them, you must file for an EIN, complete an I9, W4, and state W4. You also may need to report hiring them to the state.

You then have the majority of their earned income funneled into Roth accounts. A Roth IRA is easy to set up and has a maximum contribution of $6,000 per year, or total earned income, whichever is less. I set up out kids Roth IRAs at Fidelity.

It is a bit more difficult to start a Roth 401K for your children, but I will detail the steps and reasoning below.

Why Roth’s:

Roth’s are an insane wealth building tool. Contributions are made with after tax dollars and assets inside the Roth grow tax free and are tax free upon withdrawal in retirement. Contributions can be withdrawn at any time and you can also make withdrawals for first time home purchases.

Roth’s are especially powerful for young earners. Your children are in a low tax bracket AND they have no expenses. This combination is huge. They are in the 0% federal tax bracket for the first $12,550 of earnings, then in the 10% federal tax bracket for the next $9,950 in earnings. In fact it’s even better than that because they are exempt from Social Security and Medicare tax. 100% of their income could go into their retirement accounts. We personally are having our children contribute 75% of their income and we may do a 25% end of the year match into their Roth IRA accounts, up to the maximum of $6,000 in contributions.

Time for compounding is another major advantage. With 50 plus years before retirement, what they contribute will grow to massive amounts of money over time, money that will never be taxed. For example, a 10 year old contributes $6,000 and over the next 55 years that $6,000 earns an average 10% annualized return, at 65 the value will be $1.4 million. If it were in a traditional IRA any withdrawals would be subject to income taxes, which very likely will be higher in 50 years than they are today. Because your child is contributing to a Roth that money will never be taxed!

So Why Start A Roth 401K For Your Children?

You would want to set up a 401K plan for your small business IF your child is able to earn in excess of $6,000 per year in the business. Every dollar you can get into a Roth account is vitally important. With a 401K your employees can contribute up to 100% of their income to the limit of $19,500. Although employers can provide matching funds to 401Ks, these matches would go into a traditional tax deferred portion of the plan, rather than a Roth portion. For the purpose of building generational wealth Roth’s are highly preferred so it would be better to pay your children a higher wage and have them contribute to a Roth than to offer a match in the 401K. The expense to the business is tax deductible and treated the same whether its paying wages or paying a 401K match.

I recommend only starting a Roth 401K for your children after it becomes really easy for your child or children to earn over $6,000 in your business.

Another reason would be that you want to provide matching funds for your child’s contributions, and the $6,000 limit is too low for that. For example, say your child earns $6,000 for the year and contributes 2/3 to a Roth account. If the $4,000 went into a Roth IRA, you could only match $2,000 into it before you hit the cap. If your child put $4,000 into a Roth 401K, their Roth IRA is empty, you could contribute up to $6,000 in matching funds to the Roth IRA!

Time For An Example:

Jayden is 10 and has worked in the family business for 2 years. For the past 2 years he has earned $6,000 per year and contributed 75% of his income to his Roth IRA. His parents matched his contribution 25% and he maxed his Roth IRA for the past 2 years.

He has gained a lot of on the job skills and is worth more now, and he is able to concentrate better and work more hours. For this year he is projected to earn $22,500 and fills up the 10% tax bracket. He has to pay federal income tax of 10% on $9,950 in earnings, so $1,000 in total. He is still exempt from payroll taxes.

He contributes 90% to his Roth 401K, which would hit $20,250. Unfortunately he is limited to $19,500. He pays $1,000 in federal income tax and $1,000 in state income tax. He nets $1,000 in cash for the year. That’s OK, he’s 10 and he doesn’t need a lot of spending money, $20 a week goes pretty far. The earned income from the family business is about building wealth.

He can then have another $6,000 contributed into his Roth IRA by parents/ grandparents. At the end of the year he has $25,500 put into his Roth accounts. For JUST THIS ONE YEAR, the $25,500 he contributes at 10 will grow to $6.1 million by 65 assuming 10% returns. He was able to invest over 4X as much money into Roth accounts because this 401K exists.

Now multiply this across another 8 years for Jayden. He should have over 300K at 18 and will most likely be a millionaire by 25 if he continues to invest $25K a year.

Once your child employees hit 18 they will need to start paying Social Security and Medicare tax, otherwise nothing else changes and they can continue to work in the family business.

Cautions For Starting A Roth 401K For Your Children:

Means Tested Programs: When your child has earned income it counts as total household income which may affect your means tested program eligibility for things like food stamps, housing assistance, and medical coverage. If you are a participant in these programs you need to be aware of how your child’s earnings may impact your assistance. My initial searches have shown that as long as your child is under 18 and not required to file a tax return, then their income does not count against these programs, but please get clarification from your case worker for details in how your state views earnings of a minor child.

Exception: For children who are living with someone who is NOT their parent (typically legal guardianship), their income is more likely to count for these programs. For example, Mrs. C. and I are raising our 2 nephews. Any income they have, including their Social Security survivor benefits, counts against Medicaid earnings, even though their income does not count against ACA earnings.

Health Insurance: Their income should not affect ACA (Obamacare) eligibility until they earn over the standard deduction of $12,550. This is because their income only counts for the ACA if they are required to file a tax return and if W2 earnings are under the standard deduction they are not required to file a tax return.

FAFSA consideration: When filing out the FAFSA for college financial aid parental resources and child resources are evaluated differently. The expected family contribution based on parental assets is 5.65% of non retirement / non exempt assets, and between 22% to 47% of eligible income, which is income over a fairly generous base.

Student income is assessed at 50% and assets are assessed at 20%. BUT qualified retirement accounts such as Roth IRAs and 401Ks are exempt from the calculation, so they should be fine on assets. This is important because if you were investing money for the kids in a taxable brokerage account (UGMA) such as stockpile, those assets would be considered available for FAFSA and they would need to spend 20% of those assets on college costs. Check out the book Paying for College, 2021: Everything You Need to Maximize Financial Aid and Afford College for in depth FAFSA information.

Nondiscrimination Test Failure: If your small business has other employees than this may not work. The IRS looks at the percentage of income highly compensated employees and owners put into the plan and the percent the rest of the employees do. As children of the owner, your children will count as HCEs! So if you have 6 employees and 3 are your children, and those 3 children contribute 90% of their income to their Roth 401Ks, this could cause you to fail this test. Please consult your potential 401K plan administrator, a CPA, and read this horror story.

Why Not Get A Job That Offers A Roth 401K?

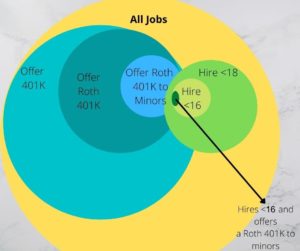

If you have older children this may be an option, but the Venn-Diagram of available jobs is small. In most states 14 is the youngest that teens can get a “real job”. The problem is that very few employers will hire them. Most employers don’t hire under 18 year olds, and those who do rarely hire <16 year olds. Let’s say your 14 year old finds a job that will hire them, great! What’s the pay rate? Chances are it is minimum wage, or even below, since minors can be paid less than minimum wage. In your business you can pay your child closer to what they produce. If they produce $30 in value per hour, you can absolutely pay your 14 year old $25 an hour.

So if we get past that, we found a job that will hire a 14 year old and will pay a decent wage, the next filter is do they offer a 401K? Many businesses, especially those that rely on teen labor, don’t offer a 401K. If they do offer a 401K does it have the Roth option? Then if it has the Roth option what is the contribution limit? some limit contributions to 75% or even 50% of gross pay. Then there is a final test, what is the age limit for participation in the 401K? Many employers set an arbitrary age for participation, which can legally be as high as 21.

Finding this employer is not easy. I’d wager that it will take less time for you to start your own business, hire your child, and open your own 401K plan than it will take to find this job. You also have the benefits of deciding the schedule for when work will occur to fit the rest of your life.

Another major benefit of starting your own business and employing your children is that you are setting up a framework that is repeatable for them. You become a subject matter expert on running a small business and employing minor children. You can provide a ton of help is getting your children set up to do the same thing when they have kids. And repeat.

I have been looking for employers that fill in this section of the Venn Diagram and have found ZERO, so let me know what you find. So far the best I have found is Walmart. They hire at 16 and you are instantly able to contribute up to 50% of income to a Roth IRA. They do 6% $1 for $1 matching at 1 year, and are starting at $14 an hour in many locations. My oldest is currently working at Walmart and taking advantage of the Roth 401K.

The Costs and Hassle:

I already did the hard part for you! I contacted over a dozen small business 401K providers about age limits. The IRS doesn’t put an age limit on 401K plans, but individual administrators can. The vast majority of small business administrators only allow the small business to choose between 18 or 21, obviously these places are a no go. This journey was honestly 12 solid hours of banging my head against a wall. It seemed everyone I contacted responded with the 18+ requirement!

Thankfully I found a provider in Ubiquity. Now when comparing plan costs it isn’t apples to apples. The plan I’m looking into with Ubiquity is $90 per month. Ubiquity has flat monthly charges, whereas many other providers charge a per employee fee and a percentage of assets fee to the employees directly. Ubiquity does not charge either, so while the base monthly cost may be higher than other providers, long term, it ends up being a better deal.

Although I’m looking at the $90 a month plan, Ubiquity has a $135 per month custom plan that may be required to be able to cover minor employees. This plan also allows for 401K loans, which we will get into later. $135 per month is just under $1,620 per year.

Tax Credits For Starting A Roth 401K For Your Children:

Keep in mind the Federal government will give you multiple deductions for setting up a small business 401K, which will most likely make the first three years of operation free or at least close to free.

The first tax credit is for 50% of eligible start up costs up to $500 per year for three years, a total of $1,500. PLUS there is another tax credit of $500 per year for setting up automatic enrollment.

The combined $1,000 a year in tax credits may completely offset costs for the first 3 years in your plan. Paying somewhere between $1,000 to $2,000 a year is a small price to pay to be able to shield an additional $10,000+ per child per year into Roth Accounts.

Any cost you pay for the 401K plan beyond tax credits is a tax deductible business expense. Any earnings the business has after paying its employees and other expenses is taxed at the owners rate, the owner being the parent. In my situation this would mean a 22% federal income tax, 4.25% state income tax, and a 15.2% federal income tax, for a 41.45% tax rate, meaning that the net cost isn’t really $1,000, it’s really $585.

Accessing Their Money Before 59 1/2:

It’s difficult to get children to understand the benefits of a Roth 401K when they won’t get proper access to it until they are almost 60. Delayed gratification is hard, it’s harder when the delay is for half a century, and even harder for someone whose brain is still developing. Luckily, the Roth 401K and Roth IRA have multiple methods to access them before hitting 59 1/2.

401K Loans:

Socking money into a Roth 401K or Roth IRA doesn’t necessarily mean they can’t get benefits from it until they are 59 1/2. One great option for leveraging the nest egg after you start a Roth 401K for your children is the 401K loan.

Having access to a Roth 401K in addition to a Roth IRA creates a massive opportunity for your children to purchase their first home, either for personal use or investment use. With 401K loans you borrow your own money from yourself and pay yourself back interest. The standard 401K loan has a maximum of $50,000 or 1/2 the account value, whichever is less, and must be paid back with a 5 year amortization. Longer duration loans are possible for home purchases. Most plans that allow 401K loans can process them very quickly and only require a small fee, usually around $100 for a loan.

Here’s the example:

Arthur put $6,000 into his Roth 401K at 10, then $12,000 per year into his Roth 401K from 11 through 18. With 10% annualized returns, he should have around $150,000 in his account at 18.

He wants to buy a $30,000 fixer upper duplex for his first home. The property wouldn’t qualify for a loan, and even if it did, loans of this value tend to carry high closing costs and interest rates.

Arthur borrows $50,000 from his 401K for a $100 filing fee. He is required to make monthly payments of $943 at a 5% interest rate. He spends 6 months and $20,000 rehabbing the duplex. He moves into 1 unit and rents the other unit out for $700 a month. He applies for a bank loan of 75% LTV (Loan To Value) and the house appraises at $80,000. His new loan from the bank is for $60,000. He has all of his money back and can either go after another property and keep repeating, or pay back his original loan, since there is no prepayment penalty. His house payment on a 15 year loan is $445 a month and his tenant’s rent covers the entire house payment, property taxes, and insurance. He effectively leveraged his 401K to live for free.

Using the 401K loan vs. taking a withdrawal has several advantages.

- No taxes or penalties are incurred. Yes I know you can also withdrawal your contributions at any time, as long as the account has been open for 5 years with no taxes or penalties owed.

- He can put it back. With a 401K loan he can put the $50,000 back in once he doesn’t need it any more. With a withdrawal he can not put it back and since he is maxing his 401K, that $50K loses the ability to ever be tax sheltered.

- He pays himself interest for his loan, not the bank. If he pays himself 5% interest instead of the bank, that 5% is a guaranteed return. Sure it comes from him, but it’s better than paying a bank 5%.

Effectively he is using a Roth 401K loan the same way I use a HELOC to execute the BRRRR method of real estate investing. Besides investing in real estate this could also be used just to get a 1st home or to launch a business venture.

Caveat: This works very well for children employed in your business. If they are employed in another business, you do not want them to take a 401K loan. If someone with an outstanding 401K loan loses their job, that loan gets called, and has to be paid back in 60 days, if not it is seen as taking a withdrawal. Taxes and penalties will be assessed. If they are your employees there is a very reasonable chance they will not face a job loss while having an outstanding 401K loan.

Withdrawal of Contributions:

Contributions can be withdrawn tax and penalty free at any time (after the account has existed for 5 years). Let’s say your child started making maximum 401K and IRA contributions of $25,500 per year from age 10 to 40. His account would be worth around $5 million with 10% annual returns, with $765,000 being contributions. Withdrawing $40,000 a year could certainly cause a big swing in his budget. Rather than saving $25,500 AFTER tax, which would probably cost $40,000 in actual income, he is withdrawing $40,000 in tax free income, for a $80,000 a year swing. He could do this for 19 years, then at 59 1/2 he would have access to the entire account. $40,000 per year is under 1% of the account value and by 59 1/2 he should have north of $30 million, all accessible tax and penalty free.

Standard Equal Periodic Payments (SEPP)

An SEPP for Roth Accounts is a last resort, this is because although the money is in a Roth account, it is treated as a regular IRA, meaning the money is taxed, however there is no penalty. This option could be worth exercising once all contributions are withdrawn tax and penalty free.

For example, if we go with the above example rather than withdrawing $40,000 a year, your child withdrew $60,000 a year and ran out of contributions after 12 years. During those 12 years your child may have still been working and had some earned income coming in. At 52 he fully retires, and is thus in a lower tax bracket. Your child sets up an SEPP and sets a low withdrawal rate, since you are allowed to set the rate at any number BELOW the current Federal Midterm Rate. The Roth withdrawals fill his lower tax brackets, given todays tax brackets if married, it would look like this:

- $0 – $25,100 0%

- $25,100 – $45,000 10%

- $45,001 – $106,150 12%

- $106,150 – $197,850 22%

The total amount the SEPP withdraws across 8 years would be a relatively small amount of the total portfolio. Paying taxes on <3% of your wealth to have access to it 8 years early could very well be worth it. If he pulled $80,000 out per year, his total effective tax rate would be only 7.7%, or $6,190 in federal income tax, and would owe any applicable state income tax. Social Security and Medicare tax would not be applicable because it is not earned income.

The Next Step:

If you go the distance and set up a Roth 401K for your children, you are a Rockstar! Now what happens when they are grown? Are you going to shut down the business? You put in a ton of effort into starting the business, refining it, and setting up a system where children / teens can make substantial material participation to the business. Why not consider hiring other people’s kids? We talked about how very few employers will employ those who are under 16, and virtually none of them offer a Roth 401K.

There would certainly be more hoops to jump through: work permits, working hour limitations, Social Security withholdings, etc. BUT you would be making a large difference for those kids, and very likely to make massive changes in the trajectory of their lives. Having work experience in your teens, and gaining the knowledge to invest it in tax sheltered accounts, is gold. If you are hiring family members kids, like your nieces and nephews you might be able to convince them to invest 75%+ into their Roth IRAs, but for the average kid, you might be hard pressed to get that level of participation. Perhaps 25% would be more likely.

Are you convinced? Do you plan to start a Roth 401K for your children?

Leave a Reply