How To Employ Your Kids For Roth IRA Contributions

Investing early is important. Investing early inside of a tax advantaged account is even more important. A Roth IRA is an amazing wealth building tool. You pay taxes on your income now and in the future all gains are tax free. This is an especially good deal for children because their current tax rate is often 0% and they have several decades of time for compounding interest. Unfortunately, kids are not readily employable due to our child labor laws, with the glaring exception of a family business. If you want to give your kids a head start, find a way to hire them in your family business.

Investing early is important. Investing early inside of a tax advantaged account is even more important. A Roth IRA is an amazing wealth building tool. You pay taxes on your income now and in the future all gains are tax free. This is an especially good deal for children because their current tax rate is often 0% and they have several decades of time for compounding interest. Unfortunately, kids are not readily employable due to our child labor laws, with the glaring exception of a family business. If you want to give your kids a head start, find a way to hire them in your family business.

Our Family Business:

I started our family business in October of 2020. We are Amazon FBA resellers, primarily focused on used books. We scan used books at yard sales, thrift stores, and library sales, and then resell any that we can make a profit on on Amazon. This small business has taken off to a point where it would be useful to employ our children to give Mrs. C. and I more time, and to give them earned income. A family business does not need to be some goliath that takes up all of your time and energy. It only needs to be a series of systems that produces a few thousand dollars per year per child. Most people should have no problem starting a small family business while working a full time job.

Advantages Of Employing Your Children:

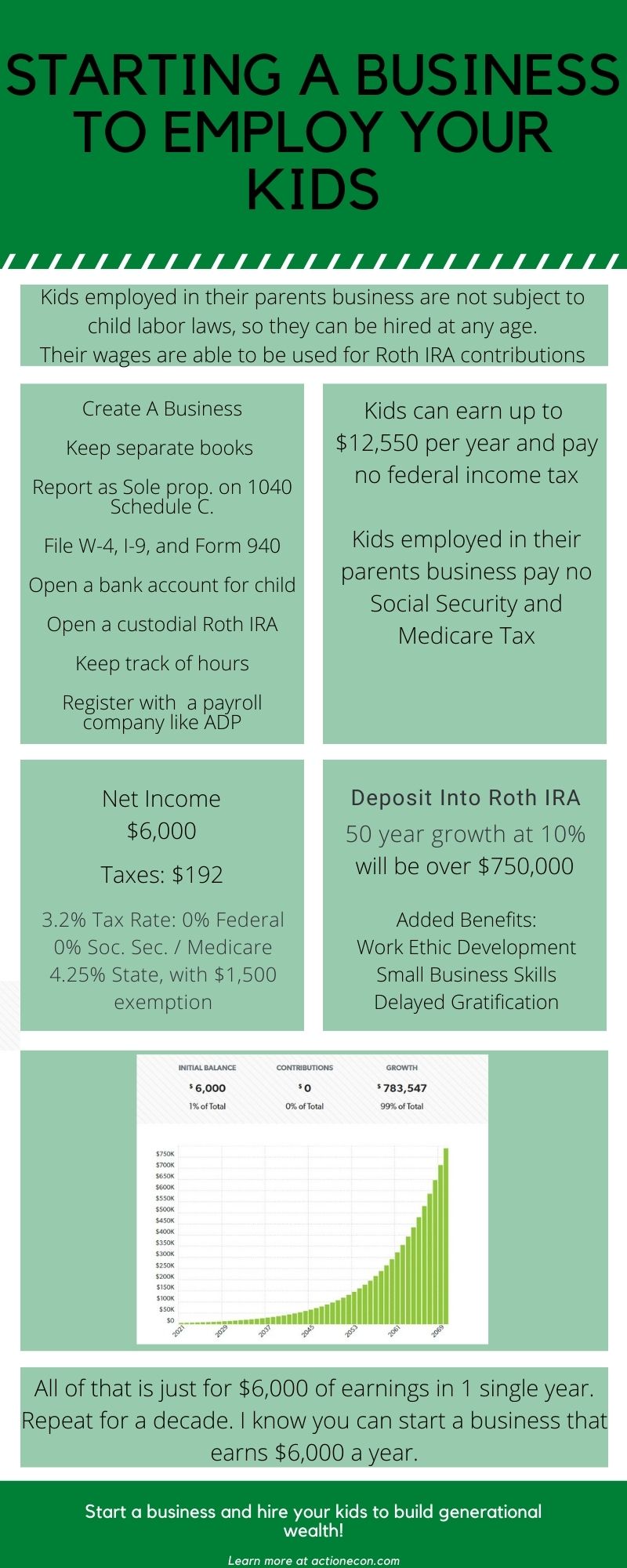

Tax Shifting: Our marginal federal tax rate is 22%. Add in 4.25% for state income tax and 15.2% for self employment tax and we are paying 41.45% in total income taxes. Children can earn up to the standard deduction of $12,550 and be in the 0% federal tax bracket. As a minor working in their parents business their wages are exempt from Social Security and Medicare, saving 15.2% combined. They only have to pay state income taxes, and in Michigan the first $1,500 of state wages is exempt. Their effective tax rate on $6,000 of earnings is 3.2%, this is a massive tax savings over the 41.45% we would be paying on the same income.

Roth IRA eligibility: Having earned income allows them to open a Roth IRA. Fidelity and other financial institutions offer what is called a “Custodial Roth IRA”. The parent is the custodian of the account, but the child is the owner of the account. Investing $6,000 a year from age 10 to 18 at 10% annual returns would be $75,000 at 18. If no money is ever added, the Roth IRA by age 60 will be worth over $4 million! Of course your children being responsible individuals and raised in a house where the values of thrift, hard work, and investing are regularly reinforced, they will likely be saving 20%+ of their income during their career. Your children building fortunes in excess of $10 million by retirement age is not out of the question, in fact it’s perfectly reasonable.

Work Ethic Development: Working in a family business is a great way to build on a work ethic and learn basic skills. Through our business our kids are learning how to perform manual labor, operate an e-commerce business, and work together to achieve a common goal. If we replace 10 hours per week of video game time with working I think we are moving in the right direction.

Business Expansion: Mrs. C. and I only have so much time to dedicate towards this business. If the kids take some of the more routine tasks off of our hands we are able to spend our time on our rental houses and on growing the business. Our time and efforts are able to be focused on higher dollar problems.

Obamacare Cliff: By reducing our income by up to $12,550 per child by employing them in the family business we are also shifting this income out of the total family income that the health care exchange looks at. My family has 6 total people in it. For 2021 the Federal Poverty Level is $35,580. At 400% of FPL there is a cliff which completely removes any cost sharing subsidy, this is $142,320. Making $1 more results in paying roughly $6,750 more for health insurance for the year. If we earned say a total of $180,000 with $50,000 of it being in the business, we could pay our kids $10,000 each and end up below that 400% of FPL. Our income is not yet approaching this but I think in the coming years we could get there. Either way, employing our children and paying them money from the business will reduce our Adjusted Gross Income, which will reduce our insurance premiums through the ACA. If children are not required by the IRS to file a return, their income does not count towards the ACA household income figure. Earning under the standard deduction, which is currently $12,550, they are not required to file. Even if they file by choice (which I recommend) their income is still not counted.

Actions We Need To Take:

Separate Books: We operate our business as a sole proprietorship. Our earnings and expenses for the business are kept separate from our general bank accounts and we report our tax information on IRS Schedule C. We don’t have an LLC or any other corporate structure. Amazon makes this fairly easy because all the shipping, Amazon fees, and payments are recorded on Amazon and we mainly have to worry about keeping track of what we spend on inventory, supplies, and wages. Our goal is to have the business able to earn $24,000 per year before paying wages. This would allow us to pay our 3 kids $6,000 per year and have $6,000 per year coming to us.

EIN Numbers: To employ our kids we need to file for an EIN (Employer Identification Number). We need to do this for both the federal government and state of Michigan.

Unemployment Exemption: We needed to file Federal Form 940 every year to show that we don’t have to pay into unemployment because the wages we paid for all our employees are our minor children, which makes us exempt.

Payroll Setup: People who like accounting can DIY this, but we plan to outsource to ADP. We can outsource to ADP and pay $10 a month per employee plus a small fee for each pay period (we will pay monthly to minimize this fee). For 3 employees we should be paying under $40 a month for payroll services. We will report hours worked to ADP and they compile and send out the checks as well as end of the year W4 forms. At the moment we are planning on employing our 3 youngest children. Our oldest is turning 18 this year and is able to get a real job paying more than what we can pay him in this business. I’m shooting for to start their employment once school is over this summer.

(Update July 2021: Because I am paying the employees monthly I am deciding to do payroll myself.)

Custodian Roth IRA: We will set these up on Fidelity for each child and link to their bank accounts. From chore money our kids have built up a decent buffer in their accounts. Each child will be earning $500 per month and we will have it set up to automatically draw $500 per month from their bank accounts. Yes we are requiring 100% of their wages go into their retirement accounts. As the business earns more money we will consider increasing their wages and anything above $6,000 they could put into spending. In the summer they will be working more hours and thus can earn over the $500 a month. The money they earn from chores that used to be split 3 ways between spending, savings, and investing will now have 80% going to spending and 20% to savings.

Develop Systems: To make this work we needed to invest in repeatable systems and job descriptions. With scouting books we have the 2 middle kids setup on their phones with Scout IQ. when we go scouting the four of us split up and all scan different sections of a thrift store / book sale. This greatly reduces our time there. The youngest is responsible for organizing the books that we buy in the vehicle, transporting them into the house, and sorting them by condition. He also cleans the covers of the books. The 2 kids that scout for books then assist with the listing process. Pretty soon my only involvement will be driving the books to ship them out. If we grow a bit more it will make sense to pay UPS to pick up our boxes every week and then the kids can pretty much do 90% of the work in the business.

Paper Trail: It’s important that the work the children are hired to do is age appropriate and actually gets done. A horror story example shows how one family had to pay the IRS $210,000 due to a lack of paperwork. Most likely they were not actually doing the right things. There needs to be written job descriptions. Children should file tax returns, even if not required to. Hiring an outside payroll company greatly helps with document retention. Keep time cards for every week, forever. If the business requires adult activity, then the adult should be showing some income for their efforts. For example, my family business is largely composed of activities that children can do. Scanning and buying books, cleaning books, carrying books, listing books on Amazon, attaching stickers to books, packing books in boxes, and delivering boxes to UPS are all tasks children can do. Very little effort is needed outside of this. I have to spend some time on accounting to keep the numbers straight, but this is less than 10% of total effort. In the above linked case, the dad was a researcher and employed 5 of his kids as research assistants, and no one ever filed a tax return. The kids didn’t have money going into their bank accounts and without the “cash” they were paid, the household would not have been able to cover its expenses.

Following the above advice, the children will have time cards for all work performed, pay stubs for all wages, deposits into their bank accounts for all wages, withdrawals to their Roth IRAs for all wages, W2s for all wages, and tax returns for all wages. Their income will also be reasonably matched to the income the business makes. It would be unreasonable for the IRS or a judge to rule such payments as illegitimate.

Goals:

The overall biggest goal is to provide a way for our kids to build substantial assets early in life. This business is an excellent way to do that. It requires a lot of general labor, and also provides a blue print for them to later build their own businesses. Their tax rates are almost 0% and since they are kids they have no expenses and can save virtually all of their income.

The next goal is to reduce our lifetime taxation. Sure we could spend more of our time working on the business, not involve the kids and make more money. Keeping around 60% of our earnings after tax is still a lot more than the 25% we plan to retain while employing our kids. This money would ultimately be invested and most likely would be transferred to our kids when we die, and we would have to pay 40% inheritance tax on the much larger sum of money that has had 50 years to compound. It is much more tax efficient to have our kids pay around 3% in taxes on this money now and have the money be theirs now. No inheritance tax and since it is going into a Roth IRA, no taxes on growth or withdrawals in the future, and under current laws can pass to their heirs tax free.

To achieve these goals we need to have this business earn a substantial profit. I’ve sold books from $9 up to $150, with an average buy cost of $1.20 each. On average we earn about $8 per book sold after shipping costs and Amazon fees. To reach our goal of $24,000 in total income we need to sell 3,000 books per year or 57 books per week. If we sell 20% of our inventory per month, then we need to keep an inventory of around 1,140 books. This isn’t all or nothing. Let’s say we only reach half of our goal and earn $12,000. The kids would get paid less and earn $3,000 instead of $6,000. At 18 they would have closer to $36,000 instead of $73,000. That’s still an excellent start in life. It’s still worth doing.

Taxation Thoughts:

The IRS is clear that minor children working in the business of their parent or guardian are exempt from paying Social Security and Medicare tax. I looked into if I can elect to have them pay this tax, however it appears that the IRS does not allow this. Why on Earth would you want to do pay extra in taxes?

Well, although Social Security is a ripoff, it is a fairly good deal on the lower end of the totem pole. I think it’s possible my kids won’t be W2 employees for their entire careers and establishing a head start in Social Security Credits could have substantial value. This is especially important in a worst case scenario, such as an early in life disability or death, with dependents.

Another factor to consider is current proposed changes to Social Security by our President. Joe Biden’s plan calls for introducing a minimum benefit of 125% of the federal poverty level for people who work for 30 years. If my kids become early retirees like I plan to be, having roughly 10 years of earnings before they become adults helps them qualify for this. Our youngest is 8 and so he in theory would be fully and permanently insured by 38 if we allowed his wages to be taxed on Social Security.

On $6,000 of wages payroll taxes would amount to $912 per year. One way to do this, instead of employing our kids we could treat them as independent contractors and issue them a 1099-Misc. No payroll company, no W-4s, and no I-9s. This would simplify the process greatly. They would receive a 1099 and file a tax return that reports that income as Self Employment Income requiring the 15.2% Social Security tax. Even in doing this, we have still cut the total tax rate in half.

From an Obamacare standpoint though issuing a 1099 to your child is not ideal. The healthcare exchange only counts your child’s income towards total household income IF they are REQUIRED to file a tax return. Under current tax law as a W2 employee they can earn up to $12,550 (the current standard deduction) and not be required to file a tax return. As a self employed individual, which is what someone receiving a 1099 would be, they must file if they have over $400 in earnings. This is certainly not ideal as it could throw your family over the Obamacare cliff.

For us, it doesn’t make sense to do the 1099 route unless I have a job that provides health insurance or total income that is always greater than 400% of FPL. While jumping through the Obamacare hoops, issuing 1099s to our kids would not be an ideal solution.

The Big Picture:

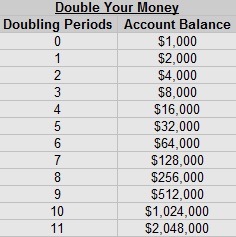

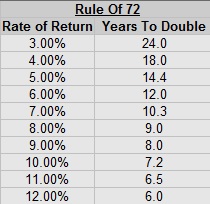

Wealth building is exponential. The more time you have for wealth building the better. Most people don’t get started until their 30s. Starting in the single digits or teens gives an amazing head start. The money gets 2 to 3 more “doubling periods” where the money will double. $1,000 invested at 10% starting at age 30 will grow to be just over $28,000 at 65. $1,000 invested at 10% starting at age 10 will grow to $190,000 at 65. Starting early is super important.

As children, they have no expenses. They don’t have to pay rent, pay for college, pay for children, pay for vehicles, pay for food, or virtually anything else. Every dime they earn is disposable and can be used to invest. In their 20s, its the opposite. They have expenses for all of these things and saving any money is really really difficult. Aiming to fill their Roth IRA’s to the maximum of $6,000 per year could ensure they become millionaires. $6,000 at age 10 will become $1.2 million at 65. Another $6,000 at 11 will grow to another $1.1 million. $6,000 per year from 10 to 18 will be $7.1 million at 65.

The Roth IRA is an amazing wealth building tool. After tax money is put in and it grows tax free and is withdrawn tax free. Contributions can be withdrawn at any time with no penalty. Roth IRAs can be passed to heirs with no taxes due and they have a decade to pull the money out. To be able to use a Roth IRA you must have earned income. The value of a Roth IRA is maximized when the person contributing is in the 0% tax bracket. It’s even greater when they don’t have to pay Social Security tax!

Work ethic and investing are two muscles that take a long time to build. If my children work 600 hours per year that’s 4,800 hours between 10 and 18. That is a lot of hours for building a good work ethic. Investing $500 a month, every month for the better part of a decade is also extreme training for saving and investing muscles.

The price I’m paying to do this is relatively low. The biggest thing I had to do was build up a framework of a successful business. I built the system that makes the money, which I spent a couple hundred hours on and invested about $1,500 to get off the ground. Going forward with the help of the kids I should be spending well under 10 hours a week on this business. Is 10 hours a week worth it for my kids and therefore my grandkids to be financially stable? Absolutely.

What do you think about employing your kids for Roth IRA contributions?

Leave a Reply