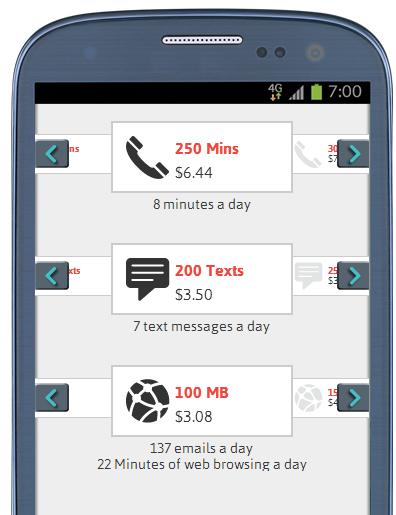

Save Money On Cell Phone Bills With Zact.com

Cell phone service is expensive, especially for those of us with a smart phone. I have months when I am traveling that I use my phone a lot, but when I am at home, I rarely use my cell phone, but I still have to pay the same price regardless. …