How To Become Financially Independent Super Early

I’ve always wanted to be financially independent. I remember talking about how I wanted to be a millionaire on long car rides to our grandparents houses when I was a little kid. When I became an adult we were in the middle of the great recession and I wanted more than anything to be financially secure. Add in that at the same time the plant I work at received a 20 year extension from the NRC to operate its 2 units until 2034 and 2037. These dates felt like a hard stop and that at the longest I had to be financially independent before the plant shut down. (The NRC has since clarified that a 2nd round of 20 year extensions can be issued and my plant is pursuing this.) As you can see I had a lot of motivation to build wealth and reach financial independence.

In 2013 I set a goal of reaching financial independence by 45. At the time I was 27 and Mrs. C. and I had a net worth of around $100,000, with the vast majority of it being in home equity. In order to get to financial independence in 18 years we needed to plan long term, increase our savings rate, and invest wisely. This year we hit Lean FI 11 years before our stated goal of full financial independence.

Setting Goals, Measuring Goals, and Thinking Long Term:

This is perhaps the most important part of achieving any goals, and especially of achieving a goal as large as financial independence. You have to clearly define what you want, define the action steps to get there and measure it constantly. You have to be thinking long term. If you are always focused on this weekend you will never build for the next decade or the next generation. Most people think very short term. You have to think differently. As a challenging exercise I recommend reading my recent article on the 15 hour work week to see different ways to set up your life to reach financial independence early without working like crazy to get there.

I track my net worth using a master spreadsheet as well as with Personal Capital. I track my income and my savings rate as well. Every quarter I sit down and update these sheets and have a meeting about where we are at, where are are going, what challenges we are facing and what moves we need to make to optimize our strategy going forward. Building wealth is a team sport and it is imperative that if you are in a relationship that you are not trying to do this alone.

Financial Independence is a number. You derive this number from working out a series of math problems. You are also in control of every variable in this equation, therefore you have control of whether you hit financial independence or not and if so how long it takes to do so.

- Your Income – Your savings is your yearly expenses.

- Yearly expenses x 25 is the amount of money you need to withdrawal 4% per year that should last forever.

- Your savings rate and interest rate determine how many years to reach your FI number.

- Take action to lower your yearly expenses so your FI number is lower.

- Take action to increase your savings rate so time to FI is lower

- Take action to increase your interest rate so time to FI is lower.

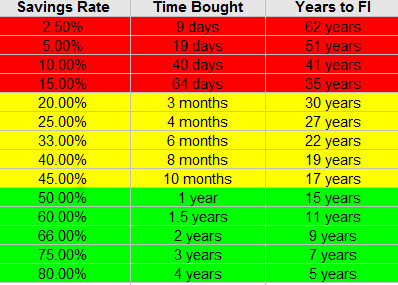

*A 7% annual rate of return was used to determine years to FI

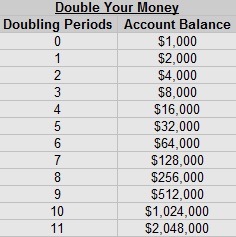

The Rule of 72: The rule of 72 states that if you take an interest rate and divide it by 72 you get how many years it takes for a lump sum to double. For example, to make the math easy, if you are getting a 7.2% return, your money will double every 10 years. If we start with a lump sum of $1,000 it would take 10 doubling periods to get to $1,000,000. The problem if course is that we don’t have 100 years to wait for our money to grow. This is why it is so vitally important to save up a large lump sum of money as quickly as possible. You have to do the heavy work up front so that compounding interest can do the really heavy work on the back end.

If you set a goal to save up $64,000 in 3 years you knock out 6 doubling periods from $1,000 to $64,000. Do it again and in 6 years you have knocked out 7 doubling periods. Now if you do nothing else it will take only 3 doubling periods to reach $1 million. If you are getting 7.2% returns, this is 30 years. If you are getting 10% returns this is 21 years.

If instead you work like heck and take 10 years to save up a nest egg of $250,000, then it will only take 2 doubling periods to hit $1 million.

Getting To Financial Independence is a Difficult Journey:

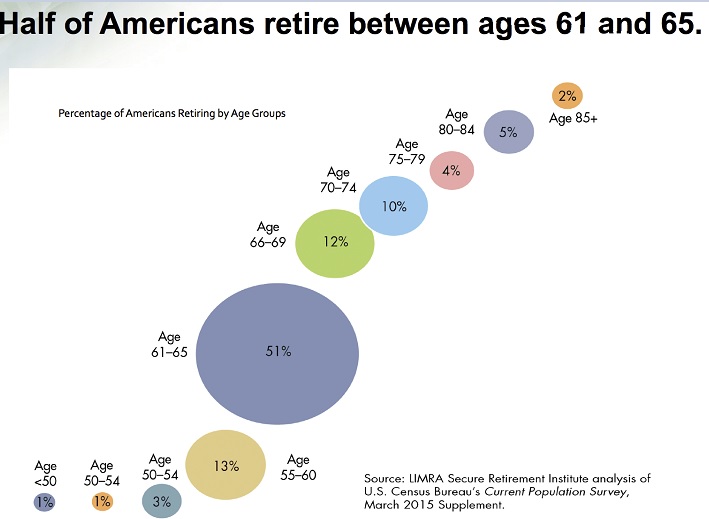

Most people never get to Financial Independence. Sure they retire, but they aren’t truly financially free. Someone who retires at 70 is living primarily off of Social Security, which ends up being a lot higher for them than it will be for an early retiree because they not only have 35 years of earnings, but have 35 years of higher earnings. The early 10-15 years where they probably earned less are thrown out of the equation. Someone retiring at 70 also only needs enough money to make it another 10 – 20 years, not 40+ years that most early retirees need. Also, as I mentioned with Social Security above, only about 1/3 of their expenses are covered by this nest egg. This is how many traditional retirees have far less than $100,000 in savings and are doing OK.

There will be doubters. People will call you crazy. They will say that “you could die tomorrow” or “you can’t get those returns” or “you’re reading too many books, those people only make their money off of selling people like you on this idea, not from saving and investing.” It takes mental toughness to ignore all of this and stay on the course. This isn’t everyone, but just know, not everyone will be a cheerleader for you and even fewer will imitate what you are doing.

I would like to say it will get easier the farther along in the journey you get, but it just doesn’t. Saving the money and staying on course is easier, but the social situation gets more difficult. 10 years in the friends and family that told you you were crazy are still struggling to get by weekly, while you are making 6 figure moves and approaching a 7 figure net worth. People will not understand your success and may even resent your success. I highly recommend practicing stealth wealth. When they see 25% of your success they may still resent you, imagine if they could see the whole picture! On this subject also know that you tend to be the average of the 5 people you hang out with. If you hang out with bums, their energy, their goals, or lack there of will infect you. If you hang out with driven goal oriented people, their energy will help you maintain and enhance yours. Less than 1% of people plan to retire at 50 or earlier, and the amount that plan to retire before 40 is a tiny fraction.

Save 25%+ of Your Income:

The common financial advice is to save 10% to 15% of your income. If you increase this to 25% plus, especially early on, you can hit financial independence way sooner. With this savings it is imperative to build up an emergency fund of 3 to 6 months of expenses. Our Emergency fund has helped us weather an insane amount of hardships that instead of being financial disasters were financial inconveniences. I highly recommend following the Dave Ramsey Baby Steps when you get started to get out of debt and build an emergency fund before you focus on early retirement.

To get to a 25% + savings rate we needed to keep all expenses, low, but with a primary focus on our housing expenses, vehicle expenses, and taxes. The average US worker spends around 24% on taxes, 30% on housing, and 12% on vehicles. All other expenses make up only 34% of the budget. Our primary focus was on these 3 big categories. The average US household saves 6% of their income, so any efficiencies we gain in these categories we want to shift into savings.

Housing: By living in a low cost of living area and buying a modest house we kept our housing costs down. We also put down 20% when we purchased our house to get a better interest rate, avoid PMI, and have a lower monthly payment. When we bought our house the mortgage payment was 14% of our income. Taxes and insurance added another 4% to put us at 18%. Just by getting our housing right we were saving 12% over the normal American budget. Getting a 15 year mortgage also ensures the house will be paid off in early retirement years. We got a 30 year mortgage but made extra payments like it was a 15 year. Additionally we paid extra each year. Currently we owe around $25,000 on it and should have it paid off in the next year. As our income has grown we have decided not to move up in house as the average American family does every 6-7 years. We will most likely live here for 60 – 70 years!

I highly encourage house hacking as the way to get into home ownership. Buy a duplex, rent out the other side and live in it for free. Then use that extra money freed up to build wealth!

Vehicles: We pay cash for our vehicles and drive them forever. I drove my last $1,000 car for 5 years. I’m currently driving a $1,200 Pontiac Montana. With no car payments we only have to pay for fuel, insurance, and repairs. All in this adds up to around 6% of our income, giving us another 6% we can save. A 15 year old vehicle does 99% of the things a new vehicle does and you do not pay interest or depreciation. You also don’t have a large chunk of your net worth tied up in something that doesn’t make you money. If your net worth is $20,000 and you’re driving a $40,000 truck you are in trouble. I think we should all follow the Financial Samurai standard of keeping our vehicles at <10% of our gross income.

Taxes: Guess what? The biggest tax deduction you can get, outside of having children is contributing to retirement accounts. With our 24% that we are savings between the normal 6%, 12% from housing, and 6% from vehicles, we could contribute $12,000 to our retirement accounts, which gave us around $2,500 in tax savings, bringing our savings rate up to a 29% savings rate.

Without touching ANY OTHER CATEGORY we got to 29%. This is 5X what the normal family saves. This is how you get to early retirement. Now we look at all other categories, especially Misc. spending. Psychologically ask yourself for every purchase does this help or hinder my goals?

Groceries: Instead of getting everything at Meijer, go to Save-a-lot for a good chunk of your groceries. It’s the same stuff at 2/3 of the price. Meal planning is another great way to save on groceries. This is a spot where we have failed at, but for many people it makes a big difference. We also routinely shop at a discount grocery store 15 miles down the road.

Insurance: Mrs. C. has a great relationship with our insurance agent. We keep a high deductible and pay 6 months if our premiums for our car insurance at a time and we pay our house insurance for the full year at once. This saves us a ton of money. Because we have rental properties we also have an umbrella insurance policy which costs us around $500 a year.

Utilities: We bought a house with well water and a septic tank. In 9 years we have paid $300 to pump our septic tank once and otherwise have had no cost for our water or septic. If we lived in the city we would be spending around $100 a month on the combined bill. That’s $10,800 in savings over 8 years! When we replaced our 1979 boiler we put in a super efficient 96% boiler, saving us over 25% on our natural gas bills. I changed all our light bulbs to LEDs in 2013. This led to saving around $20 a month on our electric bill. Long term I’m looking into solar panels and it looks like in about 2 years it may make sense to switch to solar.

With everything combined we are now looking at a 33%+ savings rate.

Now For Some Math:

If you are earning $60,000 a year, and save $20,000 a year, invested at 8% it will take 20 years to hit $1 million. Since you are living off of $40,000 a year you only need $40,000 a year to maintain your lifestyle. Using the 4% rule, you can withdrawal $40,000 every year, forever, and never run out of money with a $1 million nest egg. If we stopped right here, it would take 20 years to financial independence:

- Earn $60,000 a year

- Save $20,000 a year

- Invest at 8%

- Use the 4% withdrawal rule

- 20 years to Financial Independence

This is way better than the normal “save 10% of your income and work until you are 65-70 years old” method. Instead of taking 45 years we are taking only 20 years and it really isn’t that hard. Drive cheaper vehicles, be conservative with your housing, and use tax advantaged retirement plans to pay less in taxes and invest that savings.

But WAIT There’s more! We didn’t discuss the biggest factor, increase your income!

Increase Your Income:

Increasing your income is a major factor to hitting FI early. Over time we should get raises from our employer, however big increases in pay come from taking on a lot more responsibility and of course working more hours. Let’s say you go from working an average of 40 hours per week to 50 hours per week. This increases your pay by 25%, even if you don’t receive overtime pay or get a raise.

Using the example above, instead of earning $60,000 a year, you are now earning $75,000 and your spending hasn’t changed much, maybe an extra $1,000 to taxes. Now instead of saving $20,000 a year you are saving $34,000 a year! Now instead of 20 years it only takes 15 years to hit $1 million, which is still your retirement number based off of a 4% withdrawal rate.

Now ask for a raise and take on more responsibility. The guy always volunteering to work extra is often on a short list to become a foreman/supervisor/manager. The increases from a raise or promotion can go towards reducing those extra hours we were working to get to a 15 year time line.

How Can I Speed up Financial Independence to Faster Than 15 years?

15 years is kind of a magical spot for FI. It allows compounding interest to really hit a stride. I highly recommend using an investing calculator like this one from Dave Ramsey to calculate your growth over time and to run scenarios of different interest rates and contribution amounts.

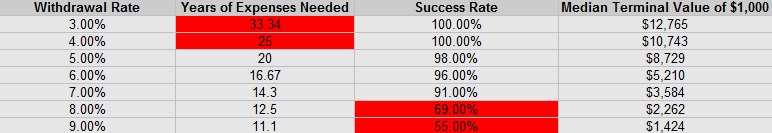

Option 1: Increase your withdrawal rate:

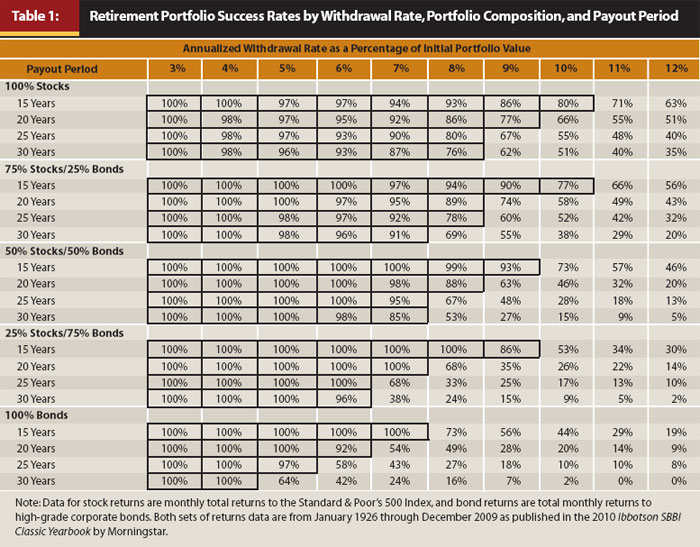

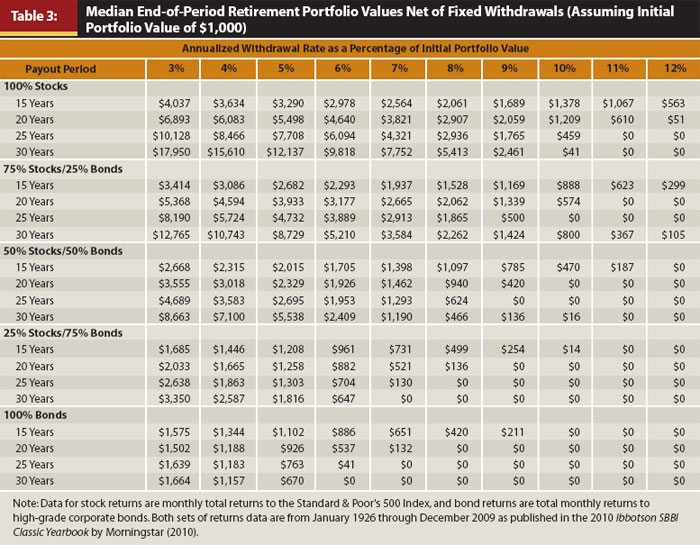

The 4% withdrawal rate was formed by the Trinity study that found that in 100% of real life historical scenarios ran that a lump sum invested with a 75% stock 25% bond split would not run out of money in any 30 year time block. In fact, the average account increased by 10X with a 4% withdrawal! I personally view the 4% rule as hyper conservative, but there are many others who think it is too risky. You need to decide for yourself. I will caution that for extreme early retirees it is important to think long and hard about withdrawal rates because if you only work for 15 years, your future Social Security benefits will be extremely small since they are based on your top 35 years of earned income.

I personally like a withdrawal rate of 5%. I think this gives the most bang for the buck as far as efficiency and risk trade off goes. (This is also the rate the author of this study Bill Bengen uses!) Using our above example of someone who earns $75,000 a year, saves $34,000 a year, and earns an 8% return, he would only need $800,000 to hit FI. Instead of taking 15 years to reach FI it would take 13 years. If you are comfortable with a 6% withdrawal rate, which may be appropriate for some people, it would be 12 years.

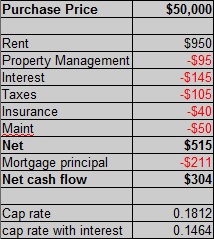

Option 2: Side Hustle: Now in addition to your normal job, buy 1 rental house every year. Buy houses that on a 15 year note with property management that will cash flow $300 a month each. Over time rents will increase and the loans will be paid off. 8 years in you have 8 houses that are cash flowing a total of $28,800, which is over 2/3 of your total retirement income goal. At the same time your investment account should be at around $380,000, allowing for a $15,000 pull per year. Using this method you would hit Financial Independence in 8 years. The cash flow you receive before you hit FI can be thrown back into your retirement accounts to accelerate further.

Following the BRRRR method with a heloc on your primary residence you should never have to use “new cash” for the houses and none of your cash is trapped in them. Now, how the heck do you make $300 a door with property management and a 15 year mortgage?

This is 100% doable. On my last house I paid $35,000 for it, I turned an extra family room into a 4th bedroom, and had a total of $42,000 into it. I rented it out for $1,000 a month. The taxes, insurance, and maintenance are in line with this example, and the mortgage is ran on a 15 year 3.5% mortgage at $50,000.

What’s really great about this strategy is that early on in retirement these houses start paying you a raise as they pay themselves off. $200 a month extra, or $2,400 a year extra in cash flow as each house pays itself off, 1 year after the next.

I really wish that we had kept investing in real estate when we started. Instead we let 1 bad experience put us off of real estate investing for a decade. I had heard the “buy 1 house a year plan” before and thought it was crazy because saving up a down payment each year would be too much work. In reality all you have to do is have enough equity in your primary residence to cover the down payment. Get a heloc, use that to pay the down payment when buying the house, get it fixed up and rented out, then after 6 months get a new loan that should appraise high enough to get a 75% Loan to value that covers all your rehab costs and the down payment. You recycle that down payment amount each time. You do lose $3,000 each transaction by having closing costs twice, but this is offset by the ability to get all or at least most of your cash back to do the next deal.

Option 3: Invest More Aggressively:

I recently wrote an article about why index funds are not the only way to go. Getting an 8% return is good, but it also isn’t marginally equivalent to 2/3 of a 12% return. Over the course of 30 years its less than half! Shooting to have a combined return of greater than 8% is important. As you can see from the above example, I’m looking at an 18% return in rental real estate.

Investing in individual stocks is one way to seek above average returns I caution to only do this with the extra retirement savings you have. Save the bulk of you retirement funds in relatively safe index funds, and then use that extra 10% you are saving to invest in individual stocks.

Here’s What I Invest In:

- Vanguard Total Stock Market Index Fund: Exposure to a weighted average of US stocks, heavy in Large cap companies. Large Cap companies are those valued over $10 Billion. (13.48% annualized return over 10 years)

- Vanguard Mid Cap Index Fund: Invests in middle sized companies valued between $2 Billion and $10 Billion. (11.97% annualized return over 10 years)

- Vanguard Small Cap Index Fund: Invests in small companies with values < $2 Billion. (10.95% annualized return over 10 years)

- Vanguard Total International Index Fund: Invests in stocks all over the world, excluding the US. (4.28% annualized return over 10 years)

- Vanguard International Growth Index Fund: Invests in non US stocks with rapid growth. (10.79% annualized return over 10 years)

- Vanguard Emerging Markets Index Fund: Invests in Emerging Markets, such as Brazil, Russia, Taiwan, India, and China. (2.26% annualized return over 10 years)

- Tesla Stock (58.91% annualized return over 10 years)

My plan is to continue to add money through my Roth IRA and Roth 401K into these index funds. As far as Tesla Stock goes, I invested $12,000 when the company had a market cap of around $30 Billion. I added in some more at the $200 Billion to $250 Billion range. I will not buy any more Tesla stock, however I do expect it to continue to grow at a pace far greater than the market as a whole over the next decade.

I will continue to invest approx. $5,000 to $10,000 per year in individual stocks, While investing $12,000+ in index mutual funds.

Note: I previously invested in the Vanguard REIT index fund, however I dropped this due to my large exposure to real estate with my rental houses.

The Most Important Rule; Be Flexible:

Being flexible is by far the most important rule when deciding to retire decades before everyone else. Being flexible means being willing and able to adjust your spending down in bad years and to be open to generating some active income. There’s no law written in stone that says once you leave your 9-5 you can never earn money again. For me personally this will look something like working an occasional nuclear plant outage to fill a budget gap. I can earn $10,000 in a month working 75 hour weeks. When you factor that in against a $30,000 yearly budget it makes a big difference. I may also continue with earning some money flipping toys on eBay and selling 3d printed items.

People get such high tunnel vision on the 4% rule. The 4% rule is a general rule of thumb. By withdrawing a little more in good years and a lot less in bad years you will greatly outperform the historical analysis of the trinity study. In a really bad year, like a 2009 repeat, being able to not sell any assets would be the ideal situation to be in. Live cheaply, make some active income and deplete some of your cash reserves. These moves would keep you from selling in a down market.

Build Generational Wealth:

Let’s say you follow my advice and it takes you 15 years to reach financial independence. You start at 25 and have achieved Financial Independence at 40. Great! Should you quit your job today? I think it stands to reason to stick on for a few more years and here is why:

You have done the seemingly impossible. In all of recorded history a very tiny sliver of mankind has been able to stop working for his sustenance at a young age, much less without being born into royalty or some other form of aristocracy. You figured out the code and you put in the work. Now let’s look back and remember the intense struggles you went through to get there. The overtime worked. The delayed gratification, the sacrifices made, the time spend learning how to manage your money to get there. Now look at your children and grandchildren. The compounding effect of money is greatly enhanced with a couple more decades of time.

Imagine if you will, that your passive income generates enough money to live off of, so 100% of your wages minus taxes are free to spend on building generational wealth. If you earn $75,000 a year, and pay 1/3 to taxes, this leaves you with $50,000 in 1 year. $50,000 per year is a ton of savings and it gets magnified greatly if it is invested on a 50-60 year time frame.

If you give $16,000 to your grandchild in the year they are born, and never a dime more, by the time they are 50 it will grow to $862,000 at 8% returns and $2.3 Million at 10% returns. Working 2 extra years could mean completely funding an early retirement for 6 grandchildren. Just as you traded 15 years of hard work to “buy your freedom” with only 2 more years you can buy the freedom of your entire family tree. You could also choose to as the rental houses pay themselves off using that additional $200 per month per house to add into the investment accounts for your grandchildren.

What do you think about the FIRE movement? Are you going to do what it takes to reach early financial independence?

Leave a Reply