The 15 Hour Work Week And How To Achieve It

Last year I wrote about the proposal for a 24 hour work week in Finland and that a 24 hour work week should become the norm worldwide. I briefly touched on an essay from John Maynard Keynes in which he postulated in 100 years from now (in 1930) mankind would be able to work only a 15 hour work week. Despite the fact that the majority of us still toil at W2 jobs for 40 hours a week or more a 15 hour work week is achievable with a concrete plan. How do I know? Well, in a way I’ve done it.

Last year I wrote about the proposal for a 24 hour work week in Finland and that a 24 hour work week should become the norm worldwide. I briefly touched on an essay from John Maynard Keynes in which he postulated in 100 years from now (in 1930) mankind would be able to work only a 15 hour work week. Despite the fact that the majority of us still toil at W2 jobs for 40 hours a week or more a 15 hour work week is achievable with a concrete plan. How do I know? Well, in a way I’ve done it.

Economic Possibilities For Our Grandchildren:

In 1930 Keynes published the essay “Economic Possibilities For Our Grandchildren“. Below are excerpts from this essay, with the bold emphasize being mine. My thoughts on each section are non italicized and in blue parenthesis. I highly recommend reading the entire essay as well.

“My purpose in this essay, however, is not to examine the present or the near

future, but to disembarrass myself of short views and take wings into the

future. What can we reasonably expect the level of our economic life to be a

hundred years hence? What are the economic possibilities for our

grandchildren?

What is the result? In spite of an enormous growth in the population of the

world, which it has been necessary to equip with houses and machines, the

average standard of life in Europe and the United States has been raised, I

think, about fourfold. The growth of capital has been on a scale which is far

beyond a hundredfold of what any previous age had known. And from now on

we need not expect so great an increase of population….

But this is only a temporary phase of maladjustment. All this means in the long

run that mankind is solving its economic problem. I would predict that the

standard of life in progressive countries one hundred years hence will be

between four and eight times as high as it is to-day. There would be nothing

surprising in this even in the light of our present knowledge. It would not be

foolish to contemplate the possibility of afar greater progress still.

(This happened. Reduction in extreme poverty and overall standards of living did increase to this degree.)

Let us, for the sake of argument, suppose that a hundred years hence we are all

of us, on the average, eight times better off in the economic sense than we are

to-day. Assuredly there need be nothing here to surprise us…

Now it is true that the needs of human beings may seem to be insatiable. But

they fall into two classes —those needs which are absolute in the sense that we

feel them whatever the situation of our fellow human beings may be, and those

which are relative in the sense that we feel them only if their satisfaction lifts

us above, makes us feel superior to, our fellows. Needs of the second class,

those which satisfy the desire for superiority, may indeed be insatiable; for the

higher the general level, the higher still are they. But this is not so true of the

absolute needs-a point may soon be reached, much sooner perhaps than we are

all of us aware of, when these needs are satisfied in the sense that we prefer to

devote our further energies to non-economic purposes…

(Absolute needs being food, water, shelter, heat, and clothing. Relative “needs” are a $400,000 house vs. a $40,000 house, a $40,000 car versus a $1,000 car, 70″ TVs, eating out every night, and designer clothes.)

Now for my conclusion, which you will find, I think, to become more and

more startling to the imagination the longer you think about it.

I draw the conclusion that, assuming no important wars and no important

increase in population, the economic problem may be solved, or be at least

within sight of solution, within a hundred years. This means that the economic

problem is not-if we look into the future-the permanent problem of the human

race.

Why, you may ask, is this so startling? It is startling because-if, instead of

looking into the future, we look into the past-we find that the economic

problem, the struggle for subsistence, always has been hitherto the primary,

most pressing problem of the human race-not only of the human race, but of

the whole of the biological kingdom from the beginnings of life in its most

primitive forms.

Thus we have been expressly evolved by nature-with all our impulses and deepest

instincts-for the purpose of solving the economic problem. If the economic problem

is solved, mankind will be deprived of its traditional purpose.

(This is very profound and I think there is a major cognitive dissonance of people genuinely not seeing how unique this time is. The masses criticize with great vigor those who achieve finance independence online, yet refuse to believe it is possible for them to achieve the same thing. A minimum wage worker can eat good for a month on a days wages. This transition is a major deal, even more than the coming AI revolution and population decline.)

Thus for the first time since his creation man will be faced with his real, his

permanent problem-how to use his freedom from pressing economic cares,

how to occupy the leisure, which science and compound interest will have won

for him, to live wisely and agreeably and well.

The strenuous purposeful money-makers may carry all of us along with them

into the lap of economic abundance. But it will be those peoples, who can keep

alive, and cultivate into a fuller perfection, the art of life itself and do not sell

themselves for the means of life, who will be able to enjoy the abundance when

it comes.

(Technological advances AND compounding interest are necessary for the standards of living to improve. Those who don’t invest can’t benefit from compounding interest. Invest early! Technological advances have rendered food cheaper and more plentiful, access to the worlds knowledge via the internet and instant communication with anyone in the world is virtually free. This allows people to work many more jobs remotely from anywhere in the world, allowing us to choose to live in low cost of living areas.)

Yet there is no country and no people, I think, who can look forward to the age

of leisure and of abundance without a dread. For we have been trained too long

to strive and not to enjoy. It is a fearful problem for the ordinary person, with

no special talents, to occupy himself, especially if he no longer has roots in the

soil or in custom or in the beloved conventions of a traditional society.

(The puritan work ethic. We as a society tend to look down on people who are not career minded. The first question at a party is often “What do you do?” and the answer is used to judge that person. I’ve heard many people listening in on conversations about “early” retirement and state that they wouldn’t know what to do with themselves. I worked with a really hardworking, smart man who had retired from a high paying job and worked a temporary job that most would find unpleasant to give himself something to do.)

For many ages to come the old Adam will be so strong in us that everybody

will need to do some work if he is to be contented. We shall do more things for

ourselves than is usual with the rich to-day, only too glad to have small duties

and tasks and routines. But beyond this, we shall endeavour to spread the bread

thin on the butter-to make what work there is still to be done to be as widely

shared as possible. Three-hour shifts or a fifteen-hour week may put off the

problem for a great while. For three hours a day is quite enough to satisfy the

old Adam in most of us!

Of course there will still be many people with intense, unsatisfied

purposiveness who will blindly pursue wealth-unless they can find some

plausible substitute. But the rest of us will no longer be under any obligation to

applaud and encourage them.

(I find myself being drawn to this. I can live comfortably for the rest of my life on a net worth of $600,000, but when I run the numbers and see that if I work 2 more decades I could amass a total net worth of over $100,000,000 in my lifetime I’m drawn to keep working to invest more.)

I look forward, therefore, in days not so very remote, to the greatest change

which has ever occurred in the material environment of life for human beings

in the aggregate. But, of course, it will all happen gradually, not as a

catastrophe. Indeed, it has already begun. The course of affairs will simply be

that there will be ever larger and larger classes and groups of people from

whom problems of economic necessity have been practically removed. The

critical difference will be realised when this condition has become so general

that the nature of one’s duty to one’s neighbour is changed. For it will remain

reasonable to be economically purposive for others after it has ceased to be

reasonable for oneself.

(This is the important part. It doesn’t happen all at once. It is a gradual change and more and more people are going to “get it”; first the high earners, then normal retirees, then the FIRE crowd, then their kids, then the masses will start as well. The concept of the masses retiring in their 60’s was not the norm in 1930.)

The pace at which we can reach our destination of economic bliss will be

governed by four things-our power to control population, our determination to

avoid wars and civil dissensions, our willingness to entrust to science the

direction of those matters which are properly the concern of science, and the

rate of accumulation as fixed by the margin between our production and our

consumption; of which the last will easily look after itself, given the first three.”

(Controlling population growth is pretty much solved. With the advent of children becoming liabilities instead of assets, the massive reduction in childhood death through vaccines, general health care, and nutrition, women entering the workplace en masse during and following World War 2, and extremely inexpensive access to contraceptives, population growth in the US and most of the world has flat-lined, with average births per woman below 2.0. World War 2, Korea, Vietnam, Desert Storm, and our 19 year “War on Terror” have hindered us here. They have allowed US military spending to increase to a “forever war” status and take an unimaginable amount of money from the nation, with the masses believing we NEED to spend over $1 trillion a year on military spending, more than the next 10 countries combined. The final point on us needing to produce more than we consume to accrue capital is where on the individual level and on the Federal Government level we are failing, which is delaying widespread reductions in working hours and increases in wealth accumulation.)

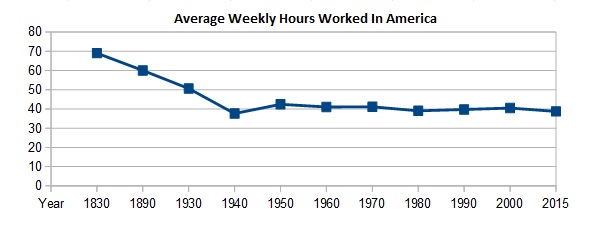

So….What happened? We still average the same working hours as someone did in 1940, despite a century long downward trend in work hours from a peak of 70 hours per week to the trough of around 40 hours per week in 1940. We are no where near a 15 hour work week. If you read the quote above he talks about some “needs” of man to be insatiable. The needs for competition and to feel superior to his common man. Ever hear of keeping up with the Jones’s? This is what he was talking about. The primary reason we are working more is that we as individuals are constantly buying “stuff” and live well beyond our means, never allowing capital for ourselves to accumulate. A good example of overall US increase in spending is the size of our houses. In 1930 the average new house was just under 1,000 square feet, today it is 2,400.

And whose working the most hours? It’s the highest paid among us. Elon Musk works 80+ hour weeks and is one of the richest men in the world. Much further down on the list are the people I work with at nuclear power plants. Not naming names or positions, but I know of multiple people who make well into the 6 figures who plan to work late into their 60s and 70s. One possibility for this is that the opportunity cost to stop is seen as too great. When you are earning $500 per work day it feels like a waste to miss one. Not only that but our work system is set up in an all or nothing mentality. Corporate jobs often don’t allow for more than 2 weeks of vacation, even unpaid vacation. It isn’t possible to serve in the same high paying positions, with benefits and work half the hours or less.

As our income increases we are more likely to move up in house and cars. It’s not uncommon for people with a 6 figure income to buy $500,000 houses in an area where the median house is $150,000 and to have 2 luxury cars in the driveway. This is exacerbated by financial planners presenting the rule of thumb that we need 80% of our pre-retirement income to retire. This means that as we make more money we need to have an ever larger nest egg. With a moving goal post we get trapped and never reduce work hours.

IF you chose to live a normal standard of living in 1930 then this could absolutely be done on a 15 hour work week. The average person lived in a rural area in a house that was put together with scrap materials. There were no building codes, and much of the nation didn’t have electricity or natural gas. There were 26 million registered cars in 1930 when we had a population of 123 million people. Today there are 273 million cars for a population of 328 million people.

By taking advantage of the scales of industry that have reduced the cost of our most basic needs, such as food, utilities, shelter, and transportation, we can live a comfortable life on 15 hours of work per week.

15 Hour Work Week Option 1: Live Cheaply:

Try to achieve a standard of living equal to that of people in 1930.

Live in a low cost of living area. Benton Harbor, MI is a perfect example. You can buy a decent livable house for $40,000. With a 5%, $2,000 down payment and a $38,000 15 year mortgage at 2.5% there would be a payment of $253 a month. Insurance is $31 per month and taxes on this house would be $54 per month for total housing costs of $338 per month.

Let’s add in another $150 per month to save towards capital expenditures, things like future roof replacements and furnace replacements.

Utilities: Many of the houses in this area are on a well and septic system, meaning no water and sewer bill. Electric and gas combined should average to under $150 per month.

Vehicles: A $1,000 vehicle has the same utility as a $40,000 vehicle. I’ve averaged 5 years out of each $1,000 vehicle I’ve driven. No car payments, and very little depreciation. A $1,000 vehicle that lasts 5 years and gets scrapped for $200 then costs $13.33 per month. Double this to cover maintenance and repairs and you get $26 per month for a vehicle. Add in $100 for fuel/oil changes and $50 for insurance and we have $176 total per month. A car is also not a necessity and biking could be a primary transportation method.

Groceries: Buy food in bulk and cook from scratch. Oatmeal for breakfast, rice and vegetable for lunch, and a small chunk of pork, fish, or chicken with rice and vegetables for dinner. Drink water. Most of what we spend of food is optional. Eating out is optional. Pop tarts, Doritos, and microwave pizzas are optional. A diet such as this per person can cost as little as $2 a day.

- Rice 25# bag $15

- 50# sack of potatoes: $20

- 5# carrots: $5

- 10# oats: $10

- 6 pounds of meat at $2 per pound: (3oz serving per day) $12

Total:$62 per month.

Clothing: Each year 5 pairs of discount jeans 1 5 pack of shirts, a pack of underwear, socks, and a pair of work boots: $300 for the year, divided by 12 months is $25 per month.

For a “low income” individual or family health care in this country is free through the Affordable Care Act marketplace. I’ll add in another $100 per month for dental expenses which are not covered by health insurance.

So far we have housing, transportation, food, utilities, medical care, and clothing covered at a total cost of $1,001 a month. Of these items for a multi-person household food and clothing are the only ones that will increase to any substantial degree. Adding $100 extra per person to this budget fills in these holes. A family of 3 could live this lifestyle on $1,200 a month. Note that 1 parent could be stay at home on such a low family budget so no child care is needed.

Taxes: On $1,200 a month in earnings no federal income or state taxes would be owed, only Social Security and Medicare taxes of 7.45%. This would require closer to $1,300 a month in total income.

Misc: $200: We want to have a bit of breathing room in the budget, so let’s arrive at a $1,500 per month total budget.

Work Hours to 15 per week per person: $1,500 per month is $375 per week. Because this household is made up of 2 adults and only 1 is working, the one working could work 30 hours per week so that as a couple they are averaging 15 hours. Working 30 hours per week would require a wage of $12.50 per hour. Anything over this amount and the family would have a surplus. There are plenty of jobs that pay much higher than this rate.

(Note: I realize I did this math based on 4 weeks per month, which shorted 4 weeks out of the calendar year, therefore our main character would have an extra $1,500 per year in earnings.)

Tax Returns: This family of 3 would receive a $3,500 Earned Income Credit tax refund and a $1,400 Child Tax Refund each year. This extra $4,900 would help the family with large expenses and to use some of their income towards wealth building.

Is this budget and lifestyle ideal? Not by our standards today, but it is POSSIBLE. It’s also still a much higher standard of living than what most people had in 1930, especially when you add in the time advantage. This is starting out with only $2,000 for a down payment. No family wealth, no high paying job. Just earning $12.50 an hour and never getting a raise. This family has to be focused on their budget but this is feasible. $12.50 is the minimum income to achieve this. If he focuses on increasing his wages over time any increase in pay rate will substantially change his standard of living. There are temporary and part time jobs, as well as small businesses that can be started that can pay over twice per hour what we are using in this example.

The point is that with thoughtful planning and some sacrifices it is possible to live inexpensively and thus to live off of working 15 hours per week if we choose to trade extra stuff and lifestyle for time. Don’t like this budget? Then shoot to earn $25 an hour to double it. There are plenty of jobs and small businesses where you can earn $25 an hour. Check out the book The Minimalist Budget BOXED SET – A Practical Guide On How To Spend Less and Live More.

What’s really great about this lifestyle is the built in check valve of being able to work more hours if needed. If your life is based on both spouses working 40+ hours a week, the ability to work more hours to earn more money if needed for a specific life event or emergency is severely hindered. If only working 30 hours total, there are far more hours available to use to increase income in such a situation.

Compound interest:

Let’s take this a step further and add in compounding interest to the equation. The US stock market for the last 100 years has returned right around 10%. There are many funds and sectors that have exceeding this by several percentage points. For the exercise of this article I will use 10% returns, which is more conservative than the 12% Dave Ramsey uses and more aggressive than the 6% financial planners that carry an umbrella with them if there is a single cloud in the sky recommend.

I’ve written a lot about compounding interest. The longer capital has to grow the more it compounds and the higher the amount of money is. Because we are looking at using the gains off of this nest egg at a young age to buy more time I will do all the math here with a 4% withdrawal rate. A 4% withdrawal rate is hyper conservative. I use the Dave Ramsey Investing calculator for coming up with the numbers I present below.

15 Hour Work Week Option 2: Build Wealth Quickly

Instead of moving out right at 18, buying a house, and starting a family, let’s assume the subject of our story lived at his parents home for 5 years while working 40 hours per week earning $12 per hour. This would equate to $25,000 per year in earnings and since he has no expenses he invests 75% of his income. After 5 years between his investments and their growth he will have $120,000. It has not been the historical norm to kick kids out of the house once they hit 18 or graduate from high school. This is a relatively modern development. In 1930 it was very common for adult children to live at home for several years. We do a great disservice to our children by not having them stay at home and bank cash like crazy for a few years.

He then buys his house at 23 and follows the budget outlined above, but works 40 hours at $12.50 instead of 30 hours. This is still a major improvement over the status quo which would have both partners working 40 hours for 80 total, per person they are at 20 hours per week average. Now, he invests the extra $500 per month he is earning and half of his tax return which equates to $204 per month. He does this from 23 to 33. At 33 his investment account will have grown to $469,000. A 4% draw from this would be $1,563 per month, enough to fully replace the families expenses, AND it would still be growing in value every year.

At 33 he tapers down to 30 hours per week of work, allowing compounding interest to have bought him more time. His nest egg is just fine without him adding more to it, so just stopping retirement contributions buys him 10 hours per week. At this point he is at just over $3,000 in total income and his family can start spending much more money than the bare bones budget they had for 10 years. 5 years later the house is paid off, eliminating $253 per month of expenses.

Because he has been drawing out 4% of the remaining balance at the start of each year, the growth in his investment account has slowed to 6%.

- At 40 he has $714,000 allowing him to withdrawal $2,380 per month. With a paid off house and substantially more in his nest egg he can cut back hours again, this time to 15 total hours. This would bring in $750 per week, allowing for a total budget of $3,130 per month. Remember the house is paid off, all retirement savings is done, and there are no federal or state income taxes owed.

- At 50 he has $1,300,000 allowing him to withdrawal $4,333 per month. At this point he stops working entirely. The $4,333 is enough income to meet his families needs.

- At 60 he has $2,365,000 allowing him to withdrawal $7,883 per month

- At 70 he has $4,300,000 allowing him to withdrawal $14,333 per month.

- Although Social Security will be negligible in comparison, him and his wife can both file for Social Security off of his work record. While this will be difficult to estimate due to no idea what the yearly inflation adjustments would be, if we assume constant dollars, his lifetime earnings would be $619,000/420 months = $1,473 AIME. This would give a monthly PIA of $1,028. Waiting until 70 for delayed credits would give $1,274 in monthly benefits. his spouses benefit would be half of this at $637. The total $1,911 would cover the majority of their expenses.

In this example our main character never got a raise, his spouse never earned any income, and he never sold his house and moved up, pocketing a capital gain.

Career Ark:

- 18-22: 40 hours Vs 40 hours

- 23-32: 40 hours Vs. 80 hours

- 33-39: 30 hours Vs 80 hours

- 40-49: 15 hours Vs 80 hours

- 50 – 64 0 hours Vs 80 hours

Lifetime work hours for our couple (assuming 2 weeks vacation per year): Across a 47 year working career our couple worked a total of 48,000 hours compared to the Jones’ who worked 178,000 hours. The Jones’ averaged 36.4 hours per week per person person year. Our couple averaged 9.8 hours per week across 47 years, and had $3.2 million at 65, whereas the median Jones’ would have $58,000. How on Earth is this possible?

The gains from investing a lot and investing early coupled with living well below their means.

15 Hour Work Week Option 3: Generational Wealth:

I plan to give my grandchildren $16,000 at birth to put in an investment account in their names. By 18 these accounts would grow to $96,000. I encourage all financially stable grandparents to do the same. If they can’t afford $16,000 then any amount, even $1,000 will make a big difference.

If their parents also contributed $10 per week from their cash flow plus 1/2 of the child tax credit they receive, they would be adding $126 per month, which would see the account grow to $171,000 at 18.

Now we repeat the same first step as option 1. Our main character stays at home for 5 years, works 40 hours a week and invests 75% of his income. Earning $12 per hour his investments would grow to $120,000 over 5 years. During that same time the $171,000 he already had at 18 would grow to $281,000, for a combined total of $452,000 at 23 years of age.

A 4% withdrawal rate would give him $1,500 per month, enough to cover all the expenses in the bare bones budget described above. Working 15 hours per week starting at 24 would allow him to bring in $750 a month, in addition to the $1,500 from his investments for a total income of $2,250 per month. Continuing to withdrawal 4% of the balance of his nest egg without investing any more money, his nest egg would grow at 6% to:

- At 30: $647,000, he can withdrawal $2,156 per month

- At 40: $1,177,000, he can withdrawal $3,923 per month. At this point working no longer makes sense. He can more than cover all his families expenses with a large buffer.

- At 50: $2,174,000, he can withdrawal $7,246 per month and easily fund large gifts at birth for his grandchildren, continuing the tradition.

- At 60: $3,898,000, he can withdrawal $12,993 per month.

- At 70: $7,092,000, he can withdrawal $23,670 per month.

- With $176,150 of lifetime earnings for Social Security his AIME would be $419. At 70 his benefit would be $467 per month. add in his wife’s 50% benefit and we have $700 a month.

In this example our main character never got a raise, his spouse never earned any income, and he never sold his house and moved up, pocketing a capital gain.

Career Ark:

- 18-22: worked 40 hours per week

- 23-39 worked 15 hours per week

- 40-64 worked 0 hours per week.

Lifetime total hours worked: 22,750. Compared to the Jones’ 178,000 hours. Across 47 years this is an average of 4.7 hours per week per person compared to the Jones’ 36.4. Our protagonist also has $5,258,000 in his investment account at 65, compared to the Jones’ $58,000.

15 Hour Work Week Option 4: The UBI

I talked about this in a previous article. A UBI of $800 per month could be had by changing our spending priorities and eliminating other social programs. Taxes would not need to be raised. If every citizen over 18 or 21 received $800 per month just from this program, then providing for basic needs off of working 15 hours per week and some accumulation of capital would be very easily accomplished.

Using the same $1,500 budget the $800 UBI leaves $700 left, which is $175 per week. Earning $11.67 would allow someone to meet this budget with a 15 hour work week. For a couple The UBI would total $1,600 and completely cover their budget. If they worked a combined 30 hours per week at $12.50 per hour in addition to the UBI they would earn $1,500 per month. That total income of $3,100 per month doubles the bare bones $1,500 budget.

If they invested half of their earnings at $750 per month and lived off of $2,190 after 30 years it would grow to $1,700,000. At 40 years it would be $4,700,000.

15 Hour Work Week Option 5: Rental Real Estate:

To get to a 15 hour work week as quickly as possible through rental real estate he should live at home for 3 years from 18 – 21. Doing exactly what we did above, saving 75% of his pay. At the end of 3 years he should have $65,000. Pay cash for a $60,000 duplex. Rent out 1 side and live in the other. The rental income should cover taxes, insurance, maintenance on the whole house and put another $300 in his pocket. He can now live off of $712 per month. He can get a home equity line of credit immediately on this house based off of the $60,000 purchase price for $45,000.

He can pay cash from his heloc for a $40,000 rental property that cash flows him $400 per month on a 15 year loan. Paying cash allows for a quicker close, a lower selling price, and the ability to buy houses that need some work. By adding value, after 6 months from the purchase he can do a cash out refinance on his property, take all his cash out and buy another one. Check out the books Buy, Rehab, Rent, Refinance, Repeat: The BRRRR Rental Property Investment Strategy Made Simple and Investing in Rental Properties for Beginners: Buy Low, Rent High

.

He started out when he turned 21 with buying a duplex and 1 rental house. At 6 months he has 1 more rental. On his 22nd birthday he is ready to buy his 4th house. The 3 rental houses bring in $1,200 per month in income and he makes $300 per month in income from his duplex that he lives in. This total income of $1,500 fully replaces his budget. He could completely stop working at 22, and never work again.

If he dropped to a 15 hour work week he would be bringing in $750 per month, every month in excess of his base needs. He could invest this money and by 40 would have $450,000. If married he could work 30 hours for $1,500 a month and still have a 15 hour average work week. He could also continue to build his real estate empire at 1 house every 6 months without adding in any new cash. His initial 4 houses would be paid off when he is 37.

My 15 Hour Work Week:

For this year I will work a total of roughly 810 hours, putting me at an average of 15.5 hours a week, just shy of a 15 hour work week. Combined with my wife who no longer has a job this puts us at an average of 7.8 hours per week, well under a 15 hour work week. I work as a contractor at nuclear power plants. I typically average around 60 hours per week when I am working and work a very limited number of weeks. This year I will work 14 weeks total. This does not include the time we have spent rehabbing our rental properties. We worked roughly 24 hours per week in January, February, and March to rehab these houses. In March I didn’t do as much as I was travelling for work and in January Mrs. C. didn’t do as much since she was recovering from surgery. If we take these 12 weeks and adjust the average to 20 hours per week each, then we worked a total of 480 hours on the 2 rental houses we bought. This puts us at 1,290 hours for the year or 24.8 hours per week on average. Divided by 2 people and we are right at 12.4 hours per week.

This schedule is actually better than a 15 hour work week because I have solid chunks of time off of work, as opposed to shorter work days. I worked 4 weeks in a chunk in the spring and I will work 10 weeks in a chunk this fall.

This work schedule is possible thanks to our income from rental properties, our Social Security survivor income for our 2 nephews, my average wage being north of $30 per hour, plus lots of overtime pay, and living well bellow our means.

So how do we occupy our time, the new permanent problem of the human race?

Although we are now at a 15 hour work week it hasn’t always been this way. I’ve historically been working closer to between 1500 to 1800 hours and Mrs. C. closer to 1,100 hours. Although this was still better than average we were averaging 27.5 hours per week each, and this included me travelling a lot for work and working a lot of night shifts. I certainly like this schedule more than our previous schedule and financially we are doing OK with it.

Mrs. C. quit her job last summer and I’m working less than I planned due to Corona, however going forward I think this will be closer to our real schedule as I cut out some travelling jobs and do more rental houses for a better work life balance. For the record I’m 34 and Mrs. C is 37. We don’t really have a “new normal yet” due to Mrs. C.’s health problems and the life changing issues of the Corona Virus. So far I will say we have been doing the following:

- We do a lot with the kids Boy Scouts/ Cub Scouts program.

- Mrs. C. volunteers at the kids school (when we don’t have the Rona going on).

- We build non-essential home improvement projects like my swing set and a pond.

- Mrs. C. makes meals for her grandfather.

- I write this blog (and am working on a book!) to help others with their journey towards financial independence.

- I read more, I’ve read 6 books this month, much better than the closer to 3 books I read last year.

- We go on adventures to the beach, to state parks, and to museums much more frequently than the average family. We also can do most of this at non-peak times allowing for less crowds and more fun.

- Mrs. C. and I have a well developed Animal Crossing island.

- We do watch more TV than we should, probably averaging 2 hours a day.

- We experiment with micro-businesses to make us more financially independent and to teach the kids how to start a lean business.

A 15 hour work week is not impossible. Keynes was right that the 15 hour work week would be possible for an ever growing segment of society. What actions are you taking to live a more purposeful life, be more efficient with money, and ultimately reduce your working hours? Consider checking out the book: Work Optional: Retire Early the Non-Penny-Pinching Way.

Leave a Reply