Affordable Alternatives To Traditional Housing

American housing expenses are insane. I first wrote about this almost a decade ago back in 2014 when the median home sale price was $200,000 and the median interest rate was 4%. Today the median home sale price is $375,000 and the interest rate is 7%. For someone making a 10% down payment this is an increase from $20,000 to $37,500.

This is an increase in monthly P+I payments on a 30 year mortgage from $859 to $2,245. The problem of course comes in with the median income only increasing from $61,468 per year to $70,784 per year in the same time frame. This is a 161% increase in monthly payment for a home, with only a 15% increase in median income.

For a household earning $70,784 a year, after taxes, which we will estimate at 20%, we have a net income of $4,719 a month. The median home would cost the median income earner 47% of take home pay. This isn’t going to work.

How Did We Get Here?

We have 4 major drivers to the increase in home prices, which I have written about here.

- We didn’t build enough housing over the last 50 years. And the houses we did build were typically custom high end housing or Class A apartments.

- Nimby rules and regulations have prevented multifamily housing and mobile home parks from being built, and in many areas has resulted in them being demolished.

- We decreased the median household size over the last 50 years substantially, while increasing the square footage of the homes that are built.

- The US government and the Federal Reserve artificially kept interest rates low for a decade, then skyrocketed them in recent months, slamming a massive increase in interest on home mortgages. People locked in a 2.5% to 4% mortgages either through purchases or refinances, will not stay in their homes far longer than the historical norms, because they won’t trade a 2.5% mortgage for a 7% mortgage. We have artificially squished the market for homes being listed for sale, at a time when the demand for housing was already outpacing supply.

On a macrolevel we need to get rid of ALL local zoning rules regarding housing. No minimum square footage, no use restrictions. We need to build tens of millions of housing units. We need to kill the Federal Reserve and let the free market determine the cost of money.

But, alas, Joe Biden and Gretchen Whitmer haven’t asked me to solve this problem on the macro level, so with that being said, what options are there for affordable alternative housing on an individual level?

Geographic Arbitrage:

Although the national median home price is $375,000, there are plenty of areas in this country where the median home price is significantly less. There really isn’t a national real estate market. Real estate is local. I recently wrote an article showing move in ready houses across the country for under $60,000. Moving to less expensive areas may be dependent on having a remote job. Many of these cheaper areas to live have smaller job bases. Apart from remote workers, these are excellent places for retirees to move for a less expensive standard of living.

I live close to Benton Harbor, MI, where you can often find very nice 3 bedroom homes in the sub $100,000 range. Cincinnati Ohio is far more affordable than Austin, TX, and Fort Wayne, IN is more affordable than Washington DC. Going outward 20 minutes from the city will also greatly reduce the price of homes. Pull up Zillow and search across the country, it is amazing the deals that can be found out there when you move towards smaller towns in the Midwest.

While there are massive gains to be made from geographic arbitrage in the United States, many people are finding geographic arbitrage opportunities outside of the U.S., but that will be another article.

Buy A Smaller, Older House:

The median house in 2022 is 2,300 square feet. Millions of homes exist in this country, mostly older homes, that are under half of that square footage. I bought a 2 bedroom 1 bath 770 square foot house in 2018 for around $20,000. That was a killer deal in a distressed neighborhood, but still, getting a 700 square foot house will typically be far less expensive than a 2,300 square foot house. Smaller homes will also be less expensive to maintain and to heat and cool. Property taxes will also be lower, because the value of the home is lower.

House Hacking / Multi Generational Housing:

Apart from moving to a low cost of living area, the primary method to combat the increase in housing costs is to increase your household size, specifically your household size per adult worker.

One of my favorite housing strategies is to use a 3.5% down FHA loan to purchase a 4plex and rent out the other 3 units. Most of the time 2 of the units will cover the bills and the 3rd unit will fund your next down payment while you live for free. After a year, you can get a new FHA loan to purchase another 4plex, as long as you live in that one for a year. Then repeat.

I tell my kids all the time that this is the best strategy to follow. The first fourplex might be a lower end property and they might live in a studio apartment in it. Then a year later buy the 2nd fourplex and move into a 1 bedroom in that one. Then a year later buy the 3rd and move into a 2 bedroom. Upgrade with each deal.

Of course you can also buy a normal single family house and rent out a bedroom or 2. This should take a big chunk out of the mortgage. My nephew is in a situation like this right now. His friend purchased a house, and my nephew and another friend are renting 2 of the 3 bedrooms. His rent is dirt cheap (I think around $300 or $400 a month) and the 3 of them are taking up 1 housing unit, instead of 3 separate housing units. This option is also great for retirees. Think of “The Golden Girls” who all lived together and made their living situation very affordable by sharing housing.

This is easy to do and it surprises me how few people do this. I know 2 people who live alone in 3 bedroom houses who are broke and a $500 influx of cash from renting out 1 bedroom in their home would change their situation substantially and they choose to live alone. It’s madness. In my low cost of living area $500 per bedroom is about the going rate and I see about 1 to 2 listings a month looking for a room mate.

Another option is generational housing. It seems silly for Grandma to live alone in a 3 bedroom house and Junior to rent an apartment in the same town. All 3 generations could live together and split expenses, at least for a short period of time. This may not work for everyone, and could be beneficial for a short term arrangement of 1 to 2 years to a long term arrangement of 10+ years. Currently our oldest child who is 19 is living at home. Rather than having him split in the bills though we have him banking all the money he would otherwise be spending. Living on his own he would likely be paycheck to paycheck, maybe saving $50 to $100 a month. Currently he is saving around $2,500 a month. American culture views this as odd, but for most of the world, multigenerational households are the norm. Think of the Disney movie Encanto.

Mobile Homes: In Park and Out of Park:

Mobile homes generally are a less expensive housing option than single family housing or apartment rentals, however the devil is in the details and it all depends on the structure of the deal. Many mobile home parks have been sold to large investors who have been greatly increasing lot rents. Even so, around me the average lot rent is $400 per month, while the average 2 bedroom apartment is around $850 a month. If the mobile home itself can be purchased for under $450 a month, then you are money ahead. Living in a mobile home park also tends to be more pleasant than an apartment building, at least from my experience.

How do you get the mobile home for under $450/mo? Often the best method is to make a deal with someone in the park who is looking to move. Very few people ever move their mobile homes out of the park, as this is expensive. I have seen livable homes sold for as little as $8,000 in local parks. The problem tends to run into financing options. Very few lenders will loan on a 20 year old mobile home that needs TLC. The best option is to make a seller financing deal. In this case I would say $2,000 down, $6,000 financed over 18 months at 10% interest would make for a $360 monthly payment. Add in $400 for lot rent and we have $760 a month, that after 18 months will be just the lot rent of $400 per month. Less than half the cost of an apartment. Sure you are responsible for the maintenance, but still, this is very affordable and you have much more control than as a typical tenant.

The 2 best negotiating spots for buying a trailer in an existing lot and getting seller financing are duration of the loan and the interest rate. The seller will certainly want a short duration for the loan, so 18 months is a great offer, and 12 months is even better. This brings us to the interest rate. For such a small loan over a short term, a major increase in interest rate sounds good on paper to the seller, but makes very little difference. A $6,000 18 month loan at 10% is a $360 payment. Increasing the loan to a crazy interest rate of 20% increases the payment to just $388 a month. This $28 a month difference for 1 year makes very little difference to you as the buyer, but the terms on paper showing a 20% interest rate will make the seller think they are getting an amazing deal.

In this video Brandon from Investment joy talks about the value of mobile homes as affordable housing options. He’s in the middle of talking about the 2nd mobile home park he purchased after a park he was buying mobile homes from was demolished to make way for luxury apartments. He breaks down that in the last twenty teens the lot rent and trailer rental for these units around Columbus OH was around $575 a month combined, which was around 40% less than a 2 bedroom apartment rental.

On Your Own Land:

This gets a bit pricier on the front end, but is much less expensive over the long haul and varies wildly based on where you live. Owning a mobile home on a chunk of land you own with a well and septic means there is no lot rent, and once the land is paid off you are all good. A new well and septic could run around $10,000, while an acre of land in the rural Midwest could be found for around $2,000 to $5,000. Add in a $10,000 mobile home plus delivery of another $2,000 and we are all in at around $25,000 on the low end.

Generally speaking, most areas that will allow you to put a mobile home on your land are not going to be bothering you. This lack of government involvement means that adding onto your home can be done by yourself, when you have the money and time, following the “Swanson code“. If it works, it works.

You could actually combine this strategy with the one above. Buy the mobile home in the park and live in the park for 3 to 4 years. The mobile home is paid off in 18 months, and then you pay yourself the $388 payment every month and save up an additional $200 a month. Purchase the land 6 months later. Drill the well and have the septic installed a year later, and then 6 months after that have the trailer moved. Now we are at most 4 years into this and you have a paid off trailer with no water/sewer bill or lot rent.

With no house payment or water bill there is a ton of money left over for other improvements. Save up for another year or two and add solar panels and a battery to get rid of the electricity bill.

Eventually you could upgrade, by selling the mobile home, someone else pays to transport it away, and buying a new one. A brand new 3 bedroom 2 bath mobile home can be bought for around $75,000. Loans for new mobile homes are typically chattel loans, which are much more closely related to an auto loan than to a home mortgage, they have shorter terms, higher interest rates, but lower down payment requirements and credit requirements. Conventional mortgages can be gotten on mobile homes that are on your own land.

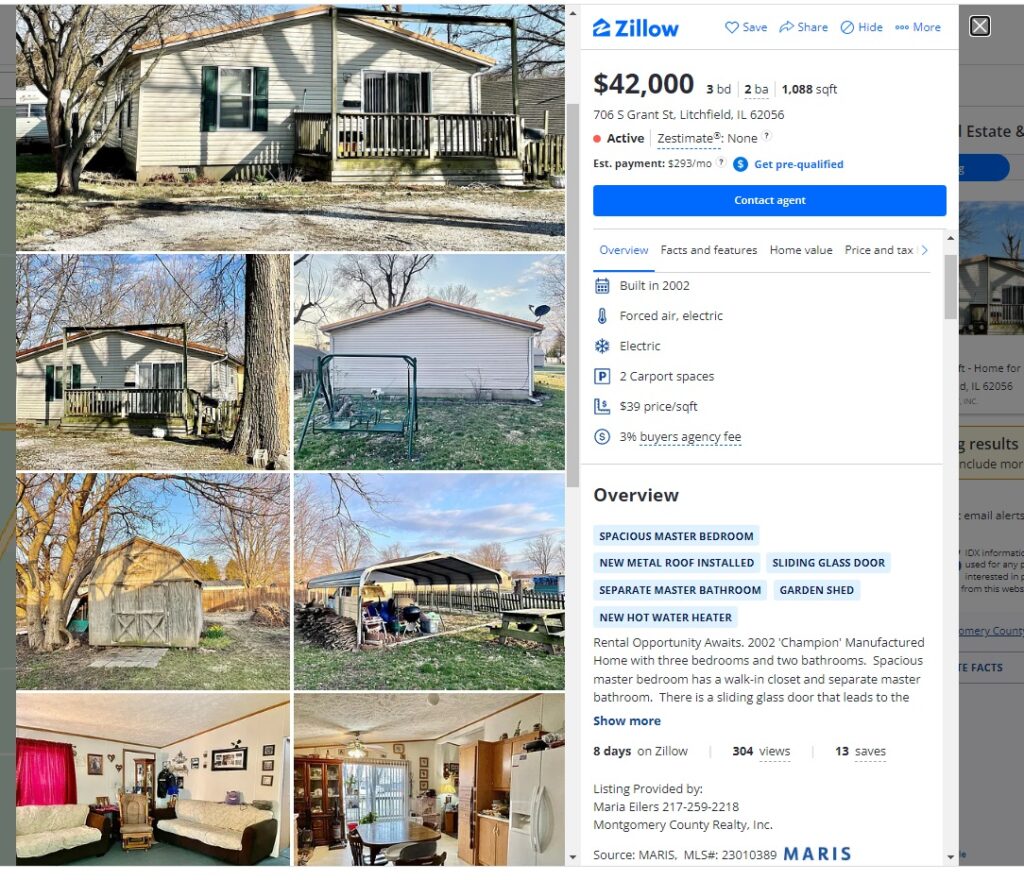

Rather than doing all the setup yourself, buy an existing mobile home on its own land. The work is already done and you can get a loan for it relatively easily. Here’s a nice 3 bedroom 2 bath double wide for only $42,000. It’s easy to search Zillow for houses like this, just check the box under “home type” for “manufactured” and uncheck the other boxes. Make sure you read the descriptions to ensure they come with the land as there are some listings for mobile homes inside of parks.

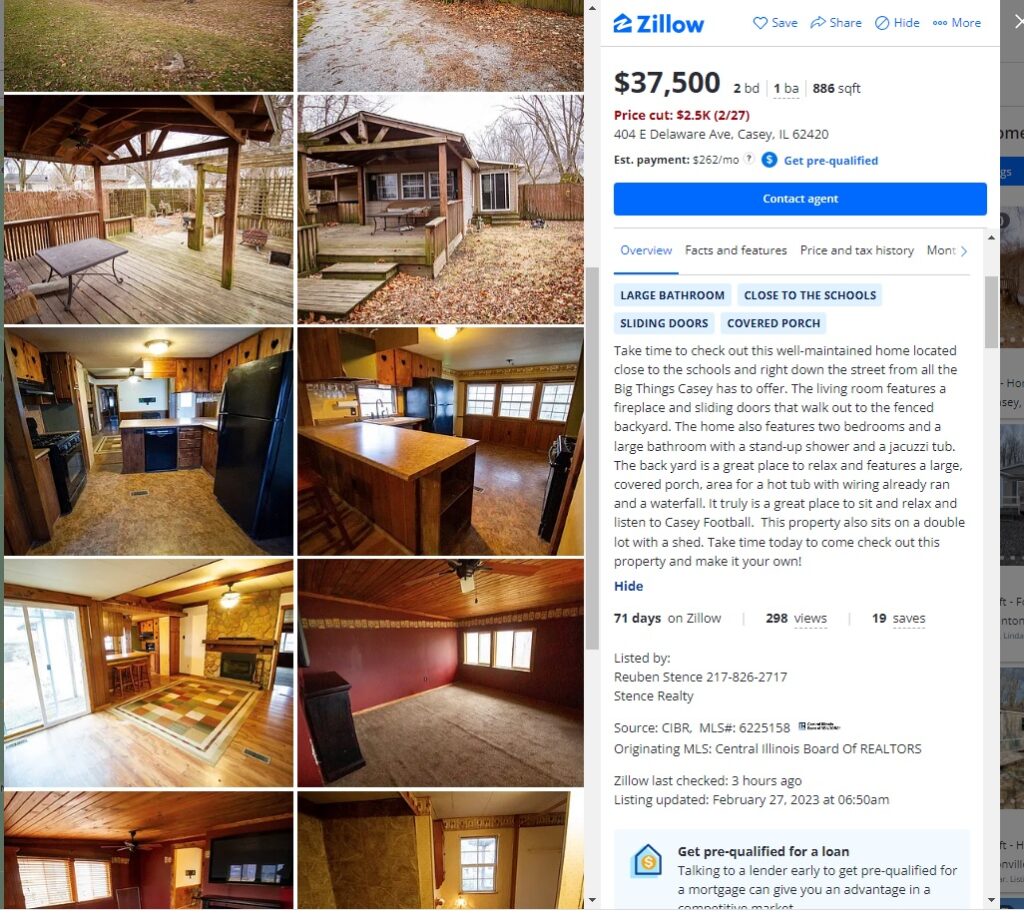

Here’s a 2 bedroom for only $37,500.

RVs and Van Life: Living on the road: BLM land, parks, etc.

RVs and conversion vans can run the gambit from $1,000 to $300,000. I have a buddy who lived in a conversion van for years, and that hunk of rust only cost him around $1,500. That’s pretty darn extreme. You can absolutely buy a clean, safe, functional RV for under $20,000 and finance it like any other car loan. My credit union offers up to 100% financing and 180 month payments. Many loan options are restrictive on model years. Currently they are offering up to 60 month financing on all model years for an interest rate as low as 6%.

Putting down 20% on a $20,000 RV would then be a $16,000 loan. At 6% over 5 years would be $309 a month.

The basic idea here is to not have a permanent land home base, but to live within the mobile home. Typically you can camp out on government BLM land at no cost for up to 2 weeks at a specific location. There are over 245 million acres of BLM land. Many camp grounds across the country charge under $40 a night to pull up to and hookup water/sewer/electric. The same campgrounds give massive monthly discounts, and you can find some places to stay for around $400 a month. Swapping between BLM land and paid campgrounds can certainly be an inexpensive way to live, provided that your income is earned remotely. Spend 14 days on BLM land, then 1 night at a campground for 40 bucks to empty waste tanks and refill fresh tanks.

Check out boondocking for more information on living on government land.

And check out the Wild Thornbaileys to learn about how a large family lives in an camper on the road.

@wildthornbaileys This is how much it cost US to start rv life. It can be way more expensive or even cheaper based on what you choose! #rvlife #rv #rvcosts #rvfamily #rvlifestyle #rvtips #rvtiktok ♬ original sound – Cassie Bailey

@wildthornbaileys Welcome to our home! This is the 367 bhs open range RV and it fits our family of 6 perfectly! #realrvlife #realrvtour #realrvfamily #rvtour #rvlife #rvfamily #wildthornbaileys #tour #rv ♬ Super Mario Bros Main Theme – Geek Music

Thousand Trails:

Thousand Trails is an interesting concept for low cost camping as well. For a set fee you get access to several camp sites all year long. Thousand Trails has several tiers:

“Zoned camping” is the entry level tiers which allow access to the program, but has shorter booking windows and time out of network requirements. Zoned camping options are perfect for someone wanting to test the waters to see if Thousand Trails is right for them.

Regional: $495: There are 5 regions and the camping options vary significantly by region. In the Midwest there are only 8 campgrounds, while the Southwest has 19 campgrounds. Additional regions can be purchased for $90 per region per year. Bookings can be done 60 days in advance, and stays are limited to 14 days then require 7 days out of Thousand Trails parks between all stays. Stays of 4 nights or less require no time out of network.

Trails Plus: $370: For an additional $370 this membership unlocks an additional 100+ camp grounds across the country. There are about a dozen of these campgrounds that require an extra $20 fee per night.

Cabin Pass: $1,495 / year: The Cabin pass allows you to stay in cabins instead of RV sites. This appears to be a great deal, and effectively falls into the gym membership category, that it is worth it…As long as you actually use it. For the entry level cabin pass you can book up to 7 nights in a location, but then need to be out of network for 2 weeks, regardless of the length of stay. For someone optimizing their time, this could result in a maximum of 121 days spent in cabins in the program, a nightly rate of only $12.36 cents. For more details on this program read this article.

This program could go a long way into making living in an RV or van a doable solution.

Thousand Trails also has lifetime memberships. To me this is really interesting since I am fairly young (36 at the time of this writing). For someone starting out in their early 20s the value of a lifetime membership is really high. The above camping packages are referred to as “zone camping” and have the most restrictive rules on time in network/out of network. All other memberships are lifetime memberships. This article breaks the details down well. Essentially if you are a full time RVer and plan to be for many years and ACTUALLY USE IT, then the lifetime memberships make sense. I personally would not look to do these without spending at least a year with the much less expensive “zone camping”. Like Gym memberships, the business model of Thousand Trails relies on people buying memberships and not using them. I would venture to guess 80% plus of people with these memberships go camping only 1 to 3 weeks a year, and/or they retired and planned to do it, but decided it wasn’t for them after a few years, but the upfront cost was already spent, and now they barely use the parks, if at all. The people who get the real benefit from this program are probably 5% of users who primarily live in these campgrounds and spend 50%+ of their year in the camp grounds.

Elite Basic: The cost is $9,000 up front, and then $670 per year. For this level you can stay up to 21 days at each camp ground, with NO time out of system required. Bookings can be done 120 days in advance, rather than the 60 days in zone camping. Can buy 2 extension weeks for $29 per week.

Elite Connection: The cost is $11,345 up front, then the same $670 annual dues. The main difference here is that the booking window extends to 180 days. Honestly, the $2,345 difference for something you may use for 30+ years to get that 30 day early booking window makes sense. Can buy 2 extension weeks for $29 per week.

Adventure: The cost is $17,595 up front and the same $670 in annual dues. This one allows you to buy 4 extension weeks, book 2 holidays at a time instead of one, and gives 5 free weeks in standard cabins and 10 free weeks in upgraded cabins. The booking window of 180 days stays the same.

Stepping back, to me, if someone plans to use Thousand Trails as their main place to live in their RV / Camper, then the Elite Connection makes the most sense. Having the largest available booking window means you get first dips on sites. Even cheap camp grounds with no virtually no amenities cost $400 a month. That’s $4,800 a year. It stands to reason that the payoff period is then right around 2 to 3 years if living full time in network. Once you consider the $11,345 to be paid off, then $670 a year for the benefits is a super good deal. Thousand Trails does offer financing. For the Elite Basic membership it is roughly $145 a month for 60 months with $625 down. The Elite Connection should be around $180 per month for 60 months.

@wildthornbaileys Replying to @user70431414 I share because I know it helps those looking for more community and affordable campgrounds! #thousandtrails #fulltimerv #realrvtips #realrvcommunity #realrvlife #rvfriends #rvcommunity #cheapcamping ♬ original sound – Cassie Bailey

The pricing above is of course subject to change, as I have read several older articles that show lower prices. Memberships can be purchased on the used market, but it is important to pay attention to the details as over time the deals have changed. Buying an older membership may have different restrictions and benefits than current memberships.

Escapees RV Club:

The escapees RV club is an RV membership that provides a lot of support for people who are living in RVs, which includes significant discounts on stays in Escapee parks. Membership is $50 per year.

For example, at the RV Park in Branson, MO. Escapes pay 20% less for camp spots at roughly $20 a night or $360 a month, and receive a bigger discount on dry camping, which is only $7.50 a day.

There are several Escapee Co-op retirement communities where you can purchase a lifetime lease in the campgrounds. My parents got a lifetime lease at SKP Saguaro last year. An entry lot costs around $20,000 for a lifetime lease. You can sell your lease effectively back to the park for what you paid for it, plus documented improvements at any time, as there is a waitlist of over 300 people to get into the park.

RV or Camper on Your Own Land:

Alternatively you could go a similar route as described with the mobile home above and find a township with no use restrictions, buy an acre of land and add a well and septic, and live out of the RV there most of the time as a home base.

This property in Texas has room to pull in your camper or RV and leave the existing camper there. Listed at $15,000 It’s been on the market a while and a good negotiator could probably get this place for under $10,000.

I just came across a really interesting property in Mississippi. This guy took a 100 X 200 city lot and installed 5 campers on it, with 2 shared septic tanks. The property has city water and electricity, which the landlord pays.

Anyways he rents out all of the campers and one is currently vacant. Someone could buy this property and live there, or better yet, copy the idea and live very cheaply.

Anyways he rents out all of the campers and one is currently vacant. Someone could buy this property and live there, or better yet, copy the idea and live very cheaply.

- List Price: $129,900

- Gross Rent: $2,925 (provided no vacancies) Avg $585 each

- Electric: $350

- Water: $150

- Maintenance Estimate @ 10% Rents $250

- Property taxes $100 (estimated)

- Net Income: $2,075 / mo

OR live in one “for free” and $1,500 total net income.

We need to base the value of the location off of the total net income assuming the owner doesn’t live on the property.

At $2,075 of net income and a 20% cap rate we arrive at a value of $124,500, which is pretty close to the list price of $129,900. I used such a high cap rate because the length of life of the campers is relatively low compare to stick built houses.

How much did it cost to put together?

Land cost: The land cost with the septic tanks I would estimate at around $10,000.

Adding common utilities, electric and water I will add another $10,000, which I think is on the extreme high side for this situation, since there is city water. But let’s say we develop a lot that isn’t in the city and put in a well for $6,000 and pay $4,000 to get electricity ran to the lot from the street.

Camper cost: A decent camper (nicer than the ones on this site) can be purchased for $10,000. Now we are $30,000 in and have a decent place to live with free water and sewer.

Add in $10,000 per camper and another $5,000 in misc. costs to get them hooked up to your water/sewer/electric and to add 4 more campers on your lot we get to $60,000.

For $90,000 total all in, you could build a similar location and have $1,500 a month in total net income, while providing affordable homes for other people.

Going a step further these campers could be seasonal weekly rentals on Airbnb and far out earn the $1,500 a month total. If buying a large enough property adding units as you have money is another option. This guy has 5 units on under a quarter acre lot. On a 1 acre lot it would be possible to get 20 units.

Shed/garage conversion:

Converting a portable shed into a home has become a fairly common endeavor. Once again the main barrier to this is local regulations. Be sure to check with your city or township before investing the money in one of these.

These portable sheds can range from around $5,000 to $30,000 and typically come unfinished, bare studs. People use these as ADUs (accessory dwelling units) on their parents land, or as a primary home on a vacant plot of land they purchased.

Interior renovations run the gambit from people doing all the work themselves with scrap material from Habitat For Humanity Restores, to people who spend $50,000 customizing every square inch with high end furnishings.

Which one to get:

Me personally I would go for one that has a lofted area, looks more like a house on the outside, and has a large amount of square footage. These sheds typically come in 10, 12, and 14′ widths. I would go with a 14′ width by 40′, which is typically the longest you can get. the 14′ width feels much roomier than a 12′. The more square footage you get the lower price per square footage. Even the largest of these sheds is less than a quarter the size of a typical home, so going big makes sense.

A friend of mine sells these locally. If I were to buy one to turn into a home I would purchase the “Lofted Casita Value” Series, which comes in a 14 X 40 size for $13,825. The pricing on these typically includes deliver within a 40 mile radius The pricing for all 14 footers in this model are as follows:

- 14 X 24: $9,495 Sq. Ft: 336 Price per Sq. Ft: $28.25

- 14 X 28: $10,695 Sq. Ft: 392 Price per Sq. Ft: $27.28

- 14 X 32: $11,800 Sq. Ft: 448 Price per Sq. Ft: $26.34

- 14 X 36: $12,965 Sq. Ft: 504 Price per Sq. Ft: $25.72

- 14 X 40: $13,825 Sq. Ft: 560 Price per Sq. Ft: $24.69

These sheds effectively follow the same logic as mobile homes do. To be self containing you would need a well and septic on land with no building code restrictions.

Some manufactures offer already finished models, although it seems most people buy the shell and do all the finishing themselves. Here’s a video of a finished one ready for a customer.

In this example, this finished shed house is $39,000. Compared to the shell my friend sells of a similar model at just under $12,000. The question becomes, can I finish the shed out for under $27,000? For me personally, the answer is yes, but that is because I own a lot of tools and have been rehabbing homes for the last half decade. For someone who has never used a drill, maybe not. A lot of the finishes in this house can be toned done to a cheaper range, and a lot picked up off of FB marketplace or Habitat for Humanity Restore. I think I could finish one of this size, to a clean, safe, functional degree, with 100 hours of my labor and $7,000. Still we are talking about roughly a $20,000 difference, which when comparing to a $375,000 house doesn’t matter a bit.

Conclusion:

Don’t believe the doom and gloom from the talking heads on the news station. It is possible to live in the US affordability. You may not be able to live in the neighborhood your parents did, or live in the middle of a top 10 city, but there it is absolutely not true that there are only $300K+ houses in the country. With the advent of remote work the ability to choose where you live has increased dramatically over the last few years. Keep an open mind and you will create the right housing solution for yourself.

Check back next month for Affordable Alternatives To Traditional Housing Part 2: Extreme Situations

Leave a Reply