My 14 Year Olds First Real Job

My 14 year old has been wanting to get a real job for the last couple years. The amount of disposable income he would like to have just doesn’t match the cost of the things he wants to buy (mostly video game systems and games). The problem is that NO ONE will hire minors because child labor laws are ruining our country. Thankfully he was actually able to find a job willing to hire 14 year old’s in December and started receiving his paychecks in January.

Why Child Labor Laws Are Ruining Our Country:

Child labor laws were formed with good intent. It was to prevent exploitation of children from very poor families from working in dangerous jobs such as textile mills and coal mines. The initial round of child labor laws put large restrictions on child labor and over time as these restrictions have increased, the opportunities available to teenagers have greatly decreased. Child labor laws have greatly increased over time, while the safety standards and type of work in our country have vastly changed. Rather than the average teen with a job working in a mine or textile mill, they are now much more likely to be working at a retail store or a fast food restaurant.

Here’s what the child labor laws in Michigan look like:

- Minors may not work during school hours while school is in session.

- Minors age 14 and 15 years old combined hours of school and work cannot exceed 48 hours in a workweek.

- 14- and 15-year-olds may not work before 7:00 a.m. or after 9:00 p.m.

- Minors 16 and 17 years old may work 24 hours per week when school is in session and 48 hours per week when school is not in session.

- 16– and 17-year-olds may not work before 6:00 a.m. or after 10:30 p.m. Sunday through Thursday and 11:30 p.m. on Friday and Saturday when school is in session and 11:30 p.m. 7 days per week when school is not in session.

- Minors are limited to working no more than 10 hours in a day with a weekly average of 8 hours per day.

- A minor may not work more than 6 days in a week.

- Approval may be granted for 16- and 17- year-olds to work beyond the starting and ending times specified in the Youth Employment Standards Act. Approvals can be obtained online from the Wage and Hour Division. 14- and 15-year-olds are not allowed to work beyond the times described in the act.

- BREAKS: Workers less than 18 years of age may not work more than 5 hours without a documented 30-minute uninterrupted break.

There are some exceptions, which are as follows:

The Youth Employment Standards Act does not apply to several groups of young people provided proof of exemption is on file at the worksite. These groups include, but not limited to:

- 16- and 17-year-olds who have completed requirements for high school graduation.

- 17-year-olds who have passed the GED test.

- Emancipated minors.

- Students 14 years old and older working under a work-study contract between an employer and a school

- district that provides supervision.

- Domestic workers at private residences.

- Minors working in businesses owned and operated by their parents.

- Workers who plant, cultivate, or harvest crops or raise livestock on farms.

So when we look at this list, the first thing that comes to mind is that hiring anyone under 18 and especially those under 16 is an administrative nightmare for scheduling. If there are any other options, those under 16 are not getting hired. The biggest problem though is the total hours restriction for those under 16. For 14 and 15 years olds the combined time between school and work can not exceed 48 hours in a week. This is absolute nonsense. School is mostly sedentary time, while most teen jobs are active. Furthermore government indoctrination camp, I mean government schools, typically require 35 hours per week of attendance, leaving only 13 hours available to work. Once they turn 16 they are still limited to 24 hours per week while school is in session.

The best work around to these unbelievably restrictive laws is to have minors work in their parents business, where there are no restrictions. For us, our main business is rental real estate, which doesn’t easily lend itself to having W2 employees, so we started selling used books on Amazon, however we never got into a solid rhythm with this.

For those who do employ 14 and 15 year old’s stepping outside of the bounds can result in hefty fines. This McDonalds franchisee was fined $57,000 for “overworking” minors. They sometimes worked more than 3 hour shifts and past 7pm. The horrors! What a monster! I’m sure he pointed a gun to their head and forced them to be there. What’s the result of this penalty? I guarantee he will never hire another 14 or 15 year old again, and any employer who read this article will certainly think twice before considering it.

Anyways child labor laws are stupid and they provide a massive disincentive for any employer to hire them. Only employers who NEED to pay minimum wage and can’t find any adults willing to work for it will hire teens. With very few employers willing to hire teens we primarily kneecap already economically disadvantaged citizens. I live near Benton Harbor, MI a city synonymous with poverty. The median household earns just $24,000 a year. Can you imagine how much of a help even a $100 weekly contribution from a teen child in this house would make? Also how much further along this teen is going to be when he or she enters adulthood with cash savings and substantial job history? Every fast food place in this town is hiring, but none are hiring 14 year old’s.

How My Son Got His First Job At 14:

All of our kids are active in Boy Scouts and a Scout that graduated around the same time as our oldest son is a manager in charge of multiple fast food restaurants. He also continues to be active in adult leadership with the Boy Scout Troop. A conversation about what he was doing led to him talking about the struggle for finding employees and the question was asked if he was willing to hire 14 year old’s. He talked it over with the Franchise owners and our kid was able to get a job. Most jobs come from networking. I’ve seen this first hand to a large degree in the nuclear contracting word, and it is also true in fast food and virtually every other industry.

Schedule and Pay:

Since our kid is in a homeschool / virtual program he was able to get scheduling leeway with his work permit, allowing him to work during typical school day hours, as long as total hours don’t exceed the maximum. He has typically been working lunch rush shifts. His initial shifts were for 2 hours each and now he is normally scheduled for 4 hours per shift. There is also a bit of leeway on hours in the school day since the actual requirement for a school day by the department of education is 5 hours, even though most schools are 7 hours. He is able to complete all of his work in this 25 hour time frame, so still following the law he could work a theoretical maximum of 23 hours per week. So far he was not hit that much. During spring break he did get up to 21 hours.

Driving him back and forth does become difficult since we are also driving our oldest to and from work and driving the other kids back and forth to school. This cuts up our day weird, but is in the end worth it. This would not be possible if both me and Mrs. C. worked regular jobs. We have flexibility because our main source of income is our rental properties and my nuclear contracting work. By the time I go back to work in the late summer our oldest will have a license and will be driving himself to work.

He is paid $10 per hour, which is a few cents over Michigan’s minimum wage, but he also earns tips, which has taken him up to an average of $12.50 per hour.

In addition to wages and tips the restaurant also provides a very generous employee discount while on shift, that is probably selling the meal below actual cost at roughly 1/3 of retail price.

The Work:

At his job he has been rotated into all of the roles available except for of course management. He has done start of shift food prep, packaged orders, taken orders, and rung up customers. All of these skills will help him get the next job. As a natural introvert, like myself, the customer interaction part is not a strong area for him so this job has pushed him a bit out of that comfort zone and worked on developing that skill set.

How My 14 Year Old Spends His Money From His First Job?

We require kids to save 50% of their income. Once he hit $1,000 in his savings account that 50% started going into his Roth IRA that we set up through Fidelity. Once he turns 15 at the end of the summer we will adjust this savings and he will redirect a good chunk of it towards a car fund. With a goal of a $3,000 car at 16 he will need to save $60 per week towards the car and anything over that $60 will go into the Roth IRA, then once he has the car the full 50% will go back to his Roth accounts. We will reserve the ability to match his Roth IRA contributions to get him up to the $6,500 maximum, since his yearly total income will be above this point. This is more likely for 2024 as 2023 is a light earnings year for us.

What about his 50%? That half is mostly going towards consumer electronics. His first purchase was a gaming computer with 32GB of Ram and an advanced graphics card. A Switch OLED and an upgraded TV are next on the agenda. Of course my kid also has the new Zelda game on preorder. At some point I think cash will just start piling up in his account as he won’t have roughly $100 worth of stuff to buy per week.

Why Contribute To Retirement As A Teenager?

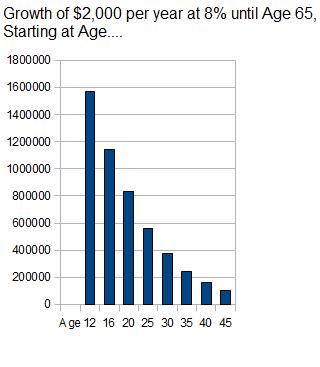

The earlier you start, the more compounding interest works. Saving $6,500 just once at age 14 with 8% annual returns will grow to $379,000 at 65. Waiting until 34 to save $6,500 just once will result in just $71,000. Alternatively saving $6,500 every year from 14 to 65 would result in just over $5,000,000. Starting at 34 would result in just under $1,000,000. Using the 4% rule that is a yearly income of $200,000 vs. $40,000. Teenagers typically have NO bills so saving in their teens is much much easier than saving for retirement in their 20s and 30s when they have home formation, babies, further education, and real bills taking most of their income. Having a large chunk of money in retirement will also reduce anxiety during his 20s because he won’t feel the economic pressure of being behind the 8 ball.

The average person in America starts saving for retirement at 31. Starting to save in your 20s is significantly better, and starting in your teens is exponentially better.

What’s Next:

This summer will be very busy for him. He is starting drivers ed at the end of school year, has a 1 week summer camp, and we are taking a 1 week vacation to Ohio. He plans to continue working for this restaurant until he turns 16.

This coming fall he will be able to start a work at your own pace high school program, with a goal of being able to graduate early. He just missed the birthday cutoff for starting school and he did a young 5s program so on his current schedule he would turn 18 right before his senior year and not finish high school until he is almost 19. By accelerating his high school program he will get that time back. At his previous school even though he was capable of skipping a grade forward it was not an option the school would allow. School has always been easy for him, and its possible that may change as we get further in. I do like that he has a job that has social interactions, as he does miss out on that aspect by not being in a typical school setting.

At 16 he plans to apply at Walmart where his older brother is working. They are currently starting out at $16 per hour and have great benefits including a Roth 401K option.

Disadvantages Of Working At 14:

The primary disadvantage of a teen having a job and saving real money is how FAFSA financial aid for college looks at student earnings and income. Dependent students are expected to contribute 50% of income and 20% of assets towards college expenses. What’s really important here is that money inside of retirement accounts, such as Roth IRAs and Roth 401Ks are exempt from this calculation. This is huge, and a big reason why having more money in retirement accounts instead of cash makes sense. Realistically due to our assets and income he won’t benefit from federal financial aid.

Driving back and forth is a major disadvantage. He doesn’t have a license yet and it is a bit far to bike. His schedule cuts up our day in a weird way.

- 0800 take kids to school

- 1000 take middle kid to work

- 1300 take oldest to work

- 1400 pick up middle kid from work

- 1600 pick up little kids from school

- 2200 pick up oldest from work

Ideally, our oldest will get his license within the next few months and that will eliminate the 1300 and 2200 trips, and it would also not be unreasonable for him to drive his brother to work as well eliminating the 1000 trip for us. That is the ideal situation.

Additional Thoughts:

His older brother got his first job right after turning 18 the summer prior to his senior year. Working the final year he was in high school gave him valuable work experience and allowed him to build a large nest egg by the time he graduated. I didn’t get my first job until I was 17 and 10 months old. I was 2 months away from graduating high school. I also only stayed at home for about a year after getting my first job. When I left the house I had roughly $3,000 in retirement accounts and $3,000 in cash. Adjusted for inflation my 14 year old is almost at that mark in wealth. I’m very glad that he decided to pursue getting a job this early and that we are in a position to arrange transportation to that job.

That $3,000 was cashed out of my retirement to go towards the down payment on our first home. We didn’t start substantially saving for retirement until I was in my late 20s in 2013.

All kids are different and need to be treated differently. While working a home school virtual program and a part time job are appropriate for this kid at 14, it doesn’t mean it is the right move for your kid. It wouldn’t have been the right path for his older brother, and possibly won’t be for his cousins either. His older brother struggled with school and did not get the appropriate accommodations from the school for his learning disabilities. Him working at 14 or 15 would have been to much stress and time constraints added to his plate. He often was doing school work until bed time, despite having a 504 plan that was to limit school work.

What do you think about teens working and pushing a substantial portion of their earnings into retirement accounts? Do you think our child labor laws are too extreme in the US?

Leave a Reply