Rental House #10 The Brick House

At the end of quarter 1 of this year one of our major plans was to not buy any properties for the rest of the year. We have been non stop working on properties since March of last year when we purchased our 6 unit apartment building. Since then we had a rental that came back to us requiring a full rehab, as well as 2 other rentals that both needed some work. We spent several weeks finishing up the final unit in our apartment building, as well as the arcade and patching and painting after having insulation added to the interior walls of the apartment. We also have a property we bought last fall that needs an extensive rehab. We are tired and really need a break from rehabbing properties. But the situation arose where it made sense to buy another house, so here we are. This is our 10th total rental house giving us a total of 15 units.

The Situation:

A good friend to Mrs. C. who is like a sister to her, is in a tough spot. She is 7 months pregnant and her housing situation was not in a good place. She lives in a big city a few hours away and has been steadily employed her entire adult life. She has been unable to find housing where she is at. She was best friends with Mrs.C ‘s younger sister who passed in 2014. She initially was not planning to move up here, she wanted to find housing in her city, but could not find anything and asked if we had anything open up here, which we did not at the time. In her city she has limited family support, up here she has her sister, her father, her aunts and grandmother.

We have also been wanting to move her other sister from a 2 bedroom house we have (our first rental) into a 3 bedroom house which will be more practical for her since she has 3 kids. We searched the MLS and found this house that we figured didn’t need a ton of work and if we would get it for the right price would allow us to move her into the 3 bedroom and free up the 2 bedroom house for her sister expecting a baby. The clock was ticking and we would need to do this expediently.

The House:

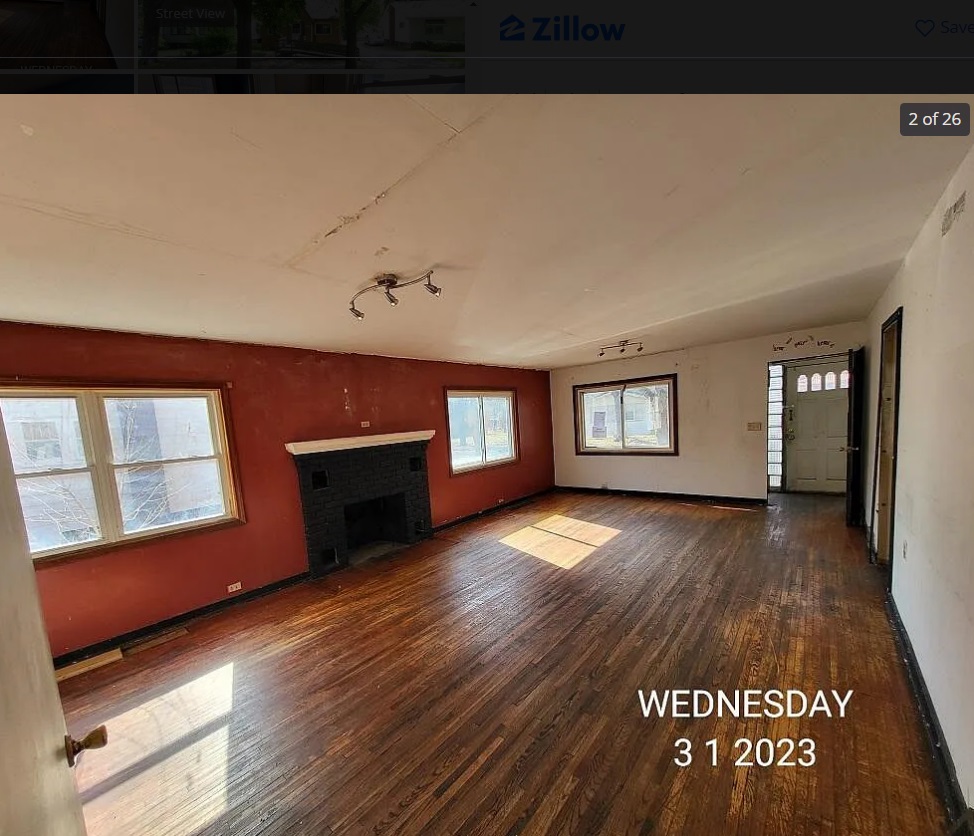

This house was listed at $39,900. It had several negatives, but all things within my ability to fix relatively inexpensively. These negatives are things that would scare off many potential home buyers. The house was bank owned and was being sold “As-is”. The furnace condition was unknown, there appeared to be a previous roof leak, a plumbing leak on the 2nd floor, and significant damage to the back porch roof. The yard was over grown and the downspouts were missing, which has led to water intrusion into the basement. There were several exposed electrical connections, ranging from bare wires, to ceiling fixtures, to broken plugs.

This house was listed at $39,900. It had several negatives, but all things within my ability to fix relatively inexpensively. These negatives are things that would scare off many potential home buyers. The house was bank owned and was being sold “As-is”. The furnace condition was unknown, there appeared to be a previous roof leak, a plumbing leak on the 2nd floor, and significant damage to the back porch roof. The yard was over grown and the downspouts were missing, which has led to water intrusion into the basement. There were several exposed electrical connections, ranging from bare wires, to ceiling fixtures, to broken plugs.

This is a brick construction house with 2 bedrooms and a full bath upstairs, and a master bedroom with a half bath that is set up jack and Jill style on the main level. The house has a large living room, a full basement, and a 2 car detached garage. It also has a large enclosed back porch. Brick houses are relatively rare here, maybe 1 in 20 are brick in this area, and a 2nd bathroom, even a half bath is extremely rare. Most of the housing stock was built in the 1950s or before and 1 bathroom was common.

Buying The House:

We initially offered $29,900 for the property and unfortunately this bank haggled with us and we ended up at $34,900. Although I would have loved to have got this house for $30K, $35K is still a great deal. Houses in worse condition have been selling for mid 50s. I thought we had a chance at getting the lowball offer through because NO ONE else had visited the house and it had been listed for 30 days. We put in a quick close, no inspection, no contingency cash offer (financed by our HELOC). 2 weeks after putting in the offer we had the keys. We had just started working on our large rehab for the house we bought in the Fall of last year, and pushed pause on that house to flip this one quickly.

Rehabbing The House:

Mrs. C. and I took ZERO days off on this house. Typically when working on a rehab we take the weekend off and only work while the kids are in school. Many nights I was there past 6pm and we worked both weekends. We spend a total of just under $4,000 on the rehab of this property. The goal was to make it clean, safe, and functional. We do not flip houses to make them loo like perfect brand new HGTV houses. That doesn’t work in this market. The median home value is around $80K and houses rehabbed to that standard with perfect tile flooring, new drywall, and granite countertops end up loosing a ton of money. They just don’t make sense here, so there are still going to be some rough edges, most notably the floors. The hardwood floors have many scratches and scuffs, but they have character and the timeline did not make sense to attempt to sand and refinish the entire house. I also did not replace the the linoleum in the kitchen and bathroom with tile. We may do that in the future, but not this time.

Heat: The furnace turned on, but would cycle off after less than 30 seconds. We got it repaired and paid our normal service tech $642 for the fix. We also spent $60 to swap out the old thermostat. I’m glad we were able to save the furnace.

Electric: I had about half a day of electrical trouble shooting. Several light fixtures were disconnected, and there were circuits mislabeled on the breaker box. I did find 2 live wires out in the open in the basement that I put in boxes. I replaced the light fixtures in the kitchen and living room. I replaced half a dozen sockets that were either broken or 2 prong, and replaced all of the faceplates. The stove plug had been busted and needed replaced. I spent $211 on light fixtures, and probably around $20 total between new outlets and covers, some of these I had in stock.

Drywall: I didn’t have to replace any drywall, but I did need to do a ton of patching. There were several spots where previous patches were done poorly. Once upon a time there was a roof leak above the kitchen and above the stairwell and they replaced the entire kitchen ceiling and patched above the stairwell. The mud jobs here were atrocious. I was able to take them from an F grade to a C+. I also had many holes to patch and the living room all of the joints had separated. There was evidence of water leakage onto the drywall and we found it was from the old bathroom sink. Drywall mud was $40 for 2 buckets.

Painting: Mrs. C. allowed her sister to pick the paint colors, so we bought all new paint, rather than using our basic colors that we use on all our houses. I also painted all the ceilings. If you want to make a room look brighter, paint the ceiling! (especially if someone else painted it grey!) Painting took the majority of the time. Several of the rooms needed a full coat of primer followed by 2 to 3 coats of paint. I also had to scrub all the walls and ceilings twice as the previous occupants were smokers. Painting and mudding was even slower because it was the 5th day before we got heat to the house. Total paint and paint supplies cost around $700.

Construction: We got a permit for the soffit, fascia, and roof patch on the back porch. This enclosed back porch was heavily rotten and needed significant repairs. I spent a full day fixing this. I also replaced 2 doors and removed a non needed door frame from the front porch. We added trim to the ceiling in the kitchen and the living room to hide the poor drywall ceiling transitions. We had to frame up wood for the floor air duct returns because they don’t make large air duct returns anymore. We replaced 2 cracked basement windows and 2 broken window segments on the back porch. The front door had been kicked in at some point and I had to splice in new wood for the deadbolt and lock to go into. I also had to replace all the locks and deadbolts. We got 3 panel boards, 1 to cover the fireplace and 2 for closet walls. All these items added up to roughly $640. Note: get trim at Menards, It’s often half to price or less than Lowes or Home Depot.

Exterior: I repaired all of the gutters on the house and added extensions to all the new down spouts. I scrubbed all of the brick around where water has been falling for years that has turned the brick green. I also scrapped and painted all of the trim on the house. We did a can of paint match and it matched perfectly. There were tons of overgrown trees and bushes that I cut back and did 3 van loads of brush to our burn pit. The concrete steps to the back door had 2 massive holes in them which I had to patch. Roughly $320 here.

First 3 pics are before last 2 are after.

Plumbing: We replaced both bathroom sink vanities and repaired a leak in the kitchen faucet. The water meter had been disconnected so we needed the city to come out and reconnect it to start water service. $436 total.

Kitchen: We painted all of the cabinets and doors and drawers, we also replaced all the cabinet handles. It’s hard to see in this picture but the ceiling drywall was done very poorly. I mudded/sanded a ton and improved it greatly, but it is still rough. Painting the fake brick paneling made the room look a lot better. We purchased a used stove and fridge from Bill’s Appliances in Niles, MI. Their stuff is super clean and inexpensive. We were under $650 for the set. The cabinet handles were another $40 ish.

Safety: We bought 6 10 year sealed smoke detectors from Home Depot and a carbon monoxide detector for $158. I only buy these sealed smoke detectors because the battery versions end up either getting the batteries taken out for something else, or the battery dies and the tenant never replaces them. I don’t want to risk not having proper smoke detectors installed.

Future Improvements:

Fencing: In the very near future I will be fencing the backyard in from the alleyway and the side yard in from the front yard in order to make the house safer for the little kids. This fencing is essentially free. I got a ton of fencing from previous projects that I bought used for a stupid low amount of money.

Garage: The garage needs attention and the building inspector advised that we board it up and tear it down in an email. I am going to see what path I can take to keep the structure. The roof was replaced probably 10 to 20 years ago and was built without the horizontal bracing, but I should be able to add that in and solve the structural concern. 10 20 ft 2X4s should cost me just over $100 and 10 8 foot 2 X 4s another $40. Add in $20 for some nails and screws. The garage has power ran to it from the house, but is disconnected in the house at a junction box. For $100 in wire I should be able to hook it back up. I would need to rewire all the electric in the garage, which could be done for under $100 in wire and components.

Attic: There is also a scuttle attic space that was finished at one point in time and has electrical ran to it. I would like to open this space up and turn it into useable space. It would likely take me around 20 hours and $100 to make it right. I need to pull out the wall boards that are there, install new drywall, mud and paint, clean the floor, and throw down remnant linoleum or carpet squares. Anytime I can add usable square footage I want to do that. This would add a space of roughly 4′ X 12′ with a sloped ceiling that is 8′ on one side and drops to 4′ on the other.

Add A Shower: In the distant future I would like to add a shower to the downstairs half bath. In theory there is room for a tiny shower stall there and that would greatly increase the utility of that bathroom. It would be a royal pain in the ass to do, but is doable. The shower itself is about $300 at Menards, I would estimate I would need another roughly $150 in supplies and whatever a couple valium cost. I’ve replaced 2 of these showers recently and neither was a pleasant experience, and the plumbing was already ran. The added shower probably wouldn’t increase rent any, but may increase tenant duration, and cut down on turnover cost.

Fourth Bedroom: After accomplishing everything above, I would add another bedroom to the house. How? By converting the back porch to a bedroom. A bedroom must have at least 70 sq. ft, a heat source, 2 plugs, and an egress to outside. This room has all of that except heat. I would need to either A run duct work to it, which should be relatively easy since it is on a shared wall with the basement, OR I could give it an electric stand alone heater. I would need to at a minimum swap out the large picture windows that are single pane glass with several panes into a couple small windows and board/side the rest.

A final part to turning this porch into a bedroom would be to build a wall between the bedroom and the entrance to the house, and add a door to the exterior of the house for egress. I could utilize the existing window space and only cut the brick the approx. 3′ from the bottom of the window to the floor.

Would it be worth it? Well for section 8 rentals going from 3 bedrooms to 4 bedrooms increases rental income by $140 per month, that’s $1,680 per year. If I expect a 10% return, then spending up to $16,800 to make this happen would make sense. I strongly believe I could make this happen for under $3,000.

The Numbers:

We paid $34,900 for the house with an additional $1,423 in closing costs. We spent $3,968 on the rehab for a total of just under $40,300. This house if we were to list it for sale would go for around $75,000 right now, so we added $35,000 of equity in 2 weeks. This house is a good indication that we could be successful flipping houses in the future. I would like to get away from my W2 job more and doing a flip or 2 a year that could net us $25K per house would go a long way towards making that happening.

In 6 months we will get an appraisal done and apply for a loan on the property. As long as it appraises for over $55,000 we will be able to get all of our cash back. With interest rates where they are I do not plan to do a full 75% LTV (loan to value) loan, rather I will only borrow the $40K to get our money back. At a 7% 15 year loan our payment (P+I) will be $339 a month. Taxes should be another $90 a month and insurance around $60 a month, putting us at around $510 in base expenses. The market rate for rent is around $900 to $950 and in the future as a section 8 rental we should be able to get around $1,000 since the FMR for a 3 bedroom in our area is about $1,250 before utility deductions.

What do you think about this house? Are you doing any rehabs?

Leave a Reply