We Just Bought An Apartment Building! Rental House 7 (or 7-12)

We just closed on a 6 unit apartment building! For a while my wife and I have discussed getting into mutli-family properties and Airbnb properties, and this property can serve as both. We have a large cash cushion for “upcoming deals” and when this property came on the market we were ready to execute.

The Property:

This is a large 2 story house that has 3 units on the main level and 3 units on the upper level. On the main level there are 2 1 bedroom apartments and 1 2 bedroom apartment, with 3 studios on the upper level. 2 of these studios have 2 full rooms, while 1 is quite a bit smaller.

This is a large 2 story house that has 3 units on the main level and 3 units on the upper level. On the main level there are 2 1 bedroom apartments and 1 2 bedroom apartment, with 3 studios on the upper level. 2 of these studios have 2 full rooms, while 1 is quite a bit smaller.

The property also has a 20 X 30 garage. It borders airport property on 2 sides and a church on the other side. It is in Benton Township which does not have any ordinances against short term rentals.

The main downside to this property is that all utilities are included. This property was originally a 4 plex and 2 additional units were carved out at some point. There are 3 electric meters, but all are paid by the owner. The property has well water, which helps, but still covering the variable costs of electric and gas is an unknown I’m not in love with.

The property appears to originally have been setup as a 4 unit building. At some point the porch was enclosed and a 2nd story was put in above the porch. An additional single story bump out was also added on.

This property is zoned “Industrial”, but has an exemption for residential use. The property is extremely close to both the fire department and the police station. It is under 5 miles to several Lake Michigan public beaches and only 2.5 miles to the Golf Club at Harbor Shores.

The Preparation:

I already had our documents in order because I was prepping to file for cash out refinances for rental house #5 and rental house #6. We talked with a commercial lender at our bank earlier in the week to get a letter of intent and get the ball rolling prior to the showing. We provided all the documents needed to apply for a commercial loan. Typically anything over 4 units requires a commercial loan. With a commercial loan typically interest rates are higher and the rate is only fixed for 5 years, but the amortization can be done for 10, 15, or sometimes 20 years. They also require a larger down payment, we are looking at a 30% down payment.

The listing agent stated the seller would want proof of funds with any offer, so we made sure to have the letter of intent ready, as well as recent bank statements and retirement account statements to show our financial strength and ability to close.

Having cash available is also a major piece of this. We spent 3 months getting our Heloc reset to current market rates, putting our total heloc at $200,000. Currently we have $85,000 of liquidity in our heloc and this will increase once we complete 2 cash out refinances that we are due for that should, pending appraisal value, bring in around $100,000 in cash.

The Price:

The property was listed at $164,900 and we saw the listing 3 hours after it hit the market. We normally work with a buyers agent, however our agent just moved to Florida, so we decided to work through the sellers agent on this one. We have worked with him before and purchased 3 homes from him with a buyers agent in the past. My original strategy for home purchases was to look for bank repossessions that have been on the market at least 60 days. This strategy has become void with the Corona virus. There are no bank repos, and even if there were, virtually nothing stays on the market for a month, let alone two. We decided we wanted to compete for this property and knew there would be other bids.

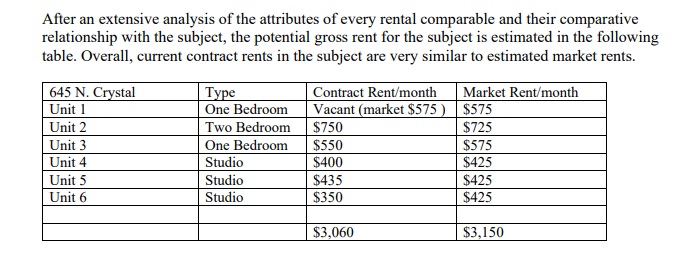

Documents provided showed gross rents of $3,110 with monthly expenses of $1,400. This leaves a gross profit of $1,710 per month before financing. This is fairly good for a $165,000 investment. With the exception of 1 unit, all of these units are WAY under market rate, especially for utilities included. For example, the least expensive is rented at $350 per month, with utilities included, a tenant can’t beat that deal!

The Showing:

The agent and seller set up to do showings during a 2 hour window 4 days after the property was listed. When we arrived there were 2 other buyers there, out of 5 expected.

The seller unlocked the doors and showed us all of the units with the exception of 1. You could tell from how he talked about the building and the tenants that he genuinely cared about people and the property. He did a lot of the maintenance himself and the place appeared very well maintained. He had recently remodeled 2 of the units and they looked fantastic. We chit chatted a bit and I told him how it shows he cares about his tenants and the property. Normally I am looking at properties that have suffered years of neglect and are virtually uninhabitable. This property has been well cared for and I was excited to be looking at a house that I don’t need to do a major rehab on.

Our Offer:

I like to offer all cash, but this is way out of our ability to do so. A normal property for us is around $30,000. We just don’t have the ability to do all cash on a property in this price range.

We offered $171,000 (just over $5,000 over list price) with an escalation clause offering to beat any other written offer by $1,000 up to $201,000. We also offered to pay him 2 months rent for a currently vacant unit for him to leave it vacant. He had a ton of miscellaneous items in the garage and we offered that he can take or leave anything he wants to.

We had our offer typed up and in hand at the showing, all we did was fill in the pricing blanks and write the blurb about the garage contents, so we were the first offer in.

Getting The Property:

The seller planned to review all offers at noon the next day. I was very anxious waiting. Around 2PM we received word that we had won. Mrs. C. had talked to the agent and he explained that we were the highest priced offer, however there was a full price cash offer the seller was considering but he wanted to go with us because at the end of the showing I shook his hand, looked him in the eye and thanked him for showing us the property. This was a moment that I hadn’t given any thought to, I was just trying to be courteous. I was surprised that this was the tipping point, and for only a $5,000 difference I can see most buyers wanting to take a cash deal over waiting 30 to 60 days to get their money. I’m excited and very thankful that the seller chose to go with us.

Plans For The Property:

The first thing I want to do is replace the furnace. There is a furnace that is probably 40 years old in this property, so likely it is 50% efficient at best. We will get this replaced with a 96% AFUE furnace that will cut the heating cost per BTU in half. We will then increase the temperature settings. I think the electric bill is really high here because tenants run space heaters to supplement the heat. With gas being a lot cheaper than electric, especially with a new furnace, I think this will ultimately save money. I also will replace the hot water heater system at the same time. Currently the building has a single hot water heater. I will either plumb in 2 hot water heaters with 1 serving upstairs and 1 serving down stairs, or install an 80 gallon water heater.

I want to transition the units to short term rentals, and will do this as graciously as I can with the current tenants. They have been having their rent subsidized by the landlord for so long that adjusting to market prices will be difficult. My current plan is to give them a 60 day notice, rather than the 30 day notice required, waive their rent for those 60 days and give them $500 for relocation. We may incentivize leaving earlier than 60 days in this offer as well. I will do this for the 3 studios and 1 1 bedroom that are rented out. The 2 bedroom is on a new 12 month lease, so we will cross that bridge when their lease is coming up.

We will then update all the units, provide means of heating/cooling in the rooms, replace the fridges and stoves, and set them up for short term rentals. Our summer tourism season is fairly strong from May through September and we have nuclear plant outage workers around from March to May and September to November. This property will allow us to provide cost effective short term stays for groups of 1 to 4 people. I think most likely it will be the end of June before we have any units listed. If we don’t have any early takers we are looking at June 1st for a move out date, and then taking roughly a month to get everything rent ready.

We may add coin laundry to the basement and put one of our vending machines on the porch. Our vending machines are combo machines and we can set them up to vend more than just snacks and drinks. Anything that can fit in a spiral will work, so stuff like laundry soap and OTC medicine. The basement is massive and although I think other than laundry I will not be able to monetize the space, it does have value to us from a storage standpoint.

The garage will be useful for storing building supplies for this property and others. It is also split in 2 parts, and I may be able to find a way to generate some revenue from the garage, either renting it as storage space or maybe putting in a small game room as a bonus to attract people to stay with us. It is a 20 X 30 building, with approx. 20 X 10 on 1 side and 20 X 20 on the other. Market rates in the area for storage are approx. $180 for a 400 square foot space and $120 for a 200 square foot space. I have not decided yet it it will be worth the hassle for roughly $300/mo in income.

Long term I would like to investigate adding in solar panels to the building. I would not need a battery backup system because I think with 6 units enough electricity would be being used during the day that the property will consume all the power it produces. I only have 660 sq. feet of south facing roof on this property, which would support a 10KW system. This would produce roughly 1,200 KWh per month, which currently costs around $190 per month.

I used the Tesla website and found that I can get a 9.8KWh system installed for just under $20,000, however they are not currently installing in my area. Add in the solar tax credit of roughly $5,000 and my total cost would be $15,000. A $2,280 yearly benefit from a $15,000 investment is a 15.2% ROI.

The Appraisal:

This was another big learning experience on the commercial side. The lender put out 3 bids for appraisal and had 1 not call back, 1 decline, and 1 offer for $1,850! Yikes. That was a bit of sticker shock. They offered to go back and try for 3 more estimates, but this would delay the process another week. It was frustrating that the emails I was sent showed that the contact with these bid results was given to our loan officer on Tuesday and we didn’t know about the results until Friday. I feel that this process could have happened more expeditiously and immediately after receiving a decline they should have automatically solicited another bid. I will say I also had sticker shock on my single family house refinance appraisals. One was $750 and the other was $1,050!

The appraiser was quick to come out to do the appraisal, but then took 2 weeks to turn in a report. Here’s where it gets good. The appraisal came back at the EXACT same price we paid for the house. $171,000. That’s interesting. With commercial properties the main approach used is the income approach and I was curious as to what mental gymnastics were used to get us to a $171,000 valuation.

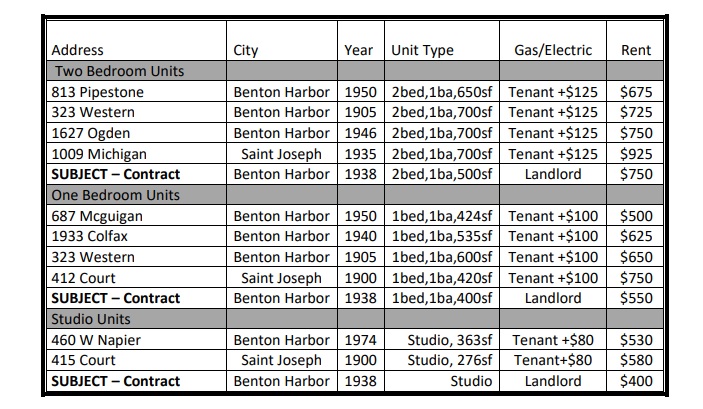

Step 1: Compare other units. The appraiser listed other apartments that are in converted SFHs and compared those prices to the rent prices in this unit. He then added in an estimate for utilities because the rent at this place currently includes utilities, while the other comparable units do not. He put in adjustments of $125 for 2 bedrooms, $100 for 1 bedrooms, and $80 for studios. This is an extremely low adjustment in my opinion. With current utility costs combined electric and gas should be at least $50 more for each of these. That doesn’t sound like much, but adds up to $3,600 a year in income.

Now we look at the rates he did have for comparables:

Using his numbers had he taken an equal weighing of the comps he used, including the subject property, the market rate results would be:

- $765 / 2 bedroom

- $615/ 1 bedroom

- $503/ Studio

I have no idea how he got to the market rates being as low as he did. Adjusting to this average I ran would change the monthly income for this property to $3,504 per month.

Add in the $50/mo / unit for the utility allowance being too low, and we get to $3,805/mo in income. This would be, with utilities included:

- $815 / 2 bedroom

- $665 / 1 bedroom

- $553 / Studio

Charging these rates with utilities included in the current market I would have people beating down the doors to get in.

That’s an increase in yearly income of $7,860.

Next we look at operating expenses:

The operating expenses included I could agree with except for one. He used an “industry standard” rate of 15% for the yearly repair/maintenance budget. This would mean subtracting $472 per month or $5,664 per year for maintenance using his numbers, or $570 per month or $6,849 per year using my numbers. 10% is a much more common and realistic number.

Now we add all the expenses together and subtract out to get our Net Operating Income.

Using his numbers we arrive at $15,241 per year in NOI.

Using my numbers of $3,805 in monthly gross income and adjusting for a 10% maintenance budget, we hit $20,602 in yearly NOI.

Now we get to determining CAP rate, which I agree with his valuation on here and don’t want to dive into editing the math. He arrived at an 8.9% industry area cap rate. Then the formula Value = Income / Rate is used. Using his number $15,241/8.9% = $171,000.

Using my number of $20,602 NOI / 8.9% = $231,483

I strongly believe that $231,483 is a much more solid number than $171,000 in this instance. Yes the property is not making that today, but increasing the property to true market rates will put it in that range, especially since 1 unit is vacant and 4 units are on month to month leases. For the purpose of this loan the appraisal is fine, because it only needed to appraise at what we were paying for it, so it isn’t worth trying to argue for an appraisal adjustment.

The Loan:

Commercial loans are different from residentials, and for the most part anything greater than 4 units is classified as commercial. Our lender is requiring a 30% down payment with a 15 year amortization on a 5 year loan that balloons at the end of the term, meaning after 5 years we are required to refinance. The interest rate is at 4.75%. We had to do a commercial loan application where they look at our balance sheet and statement of cash flows. They still do a hard pull on our credit. I already talked about the appraisal requirement and the cost of the appraisal being about 3X the cost of a normal residential appraisal.

The loan is much easier to qualify for in terms of providing documents. I needed to provide 3 years of W2s and tax returns, my balance sheet and statement of cash flows, a statement of rent rolls for our rental properties, and of course the offer on the property. This is far less documentation that I have needed for residential loans. I did find out at closing that I need to provide yearly updates on tax returns and balance sheets to the bank.

Future Numbers:

With all units as Airbnb: There are few comparable properties in our area for short term rentals, however looking at the market I think the following rates would be conservative:

- Studio: $65/night

- 1 bedroom: $75/night

- 2 bedroom: $100/night

These rates do not include the cleaning fee which will be flat per stay regardless of stay length and get passed through as an expense. The crappiest hotels in our area are charging $65/night, and these studios are about twice the size of a standard hotel room and include a full kitchen.

Using a 60% occupancy rate, which I also believe to be conservative given our strong tourism season and nuclear plant outage seasons, I believe this not only is achievable, but can be beaten.

This puts us at total gross income of $97,000. What a difference doing STR makes over LTR!

One great thing about STRs is that you can adjust the rental price quickly, whereas with long term rentals, you are typically stuck at a rate for 1 year. Small changes can yield massive results. If we get to a point where we can increase each unit by $10/mo and increasing our occupancy rate from 60% to 70% it would result in gross income increasing from $97,000 to $129,000.

Expenses:

The utility bills will go down substantially because in the winter we will have a higher vacancy rate, most people will be in the apartments less than long term renters are, and we will be updating the furnace from a 50% efficient 1970s version to a 96% efficient new model. We need to add in Airbnb fees but we will get to rough ongoing expenses of around $25,000 a year. The cleaning expense will be high, however as already mentioned that is a pass through expense to the guests.

This drops us to $72,000 per year in income before financing costs. Our mortgage expenses including interest and principal drops us roughly $1,000 a month to $60,000 a year in net total cash flow. Total principal payments add another $5,500 in benefit to us.

With depreciation and the QBI deduction we will be taxed on about $52,000 per year of income. This income is still Schedule E real estate income and we will not owe Social Security / Self Employment taxes on it, so it will only be taxed for state and federal income. This property is outside the Benton Harbor city limits so it will not owe city of Benton Harbor income taxes.

Initial Expenses:

We plan to spend roughly $5,000 per unit on setting them up for AirBnb. This includes redecorating and furnishing each unit. This is a fairly low budget and we may end up needing to go a bit higher.

Replacing the furnace, replacing the water heater, and putting air conditioning in each unit will cost us another $10,000. We will spend around $40,000 on this property to get it fully ready, putting us at $210,000 all in.

Conclusion:

It will ultimately take about a year for us to have this fully squared away. I think we will have most of the units ready shortly for most of the summer season, however the 2 bedroom lease won’t expire until early 2023. We most likely will offer the current tenant a fee to buy them out of their lease. For 2023 I am anticipating this property producing over $50,000 in true positive cash flow and increasing from there as we go up the learning curve on STRs. This would cover 100% of our yearly expenses and then all our other properties are “gravy”.

We are currently on the lookout for at least 1 single family house that we will also set up as a STR. In our market we should be able to get a move in ready 3 bedroom house for $80,000 that will be able to rent at $150/night at a 60% occupancy rate for gross income of $33,000 per year. After expenses it should net $20,000 a year, about 4X what a long term rental for us does.

Do you manage any multifamily properties or Airbnb units? What has your experience been like?

Leave a Reply