Can Fast Food Restaurants Pay Higher Wages?

This is an article I’ve been wanting to write for quite some time. Fast food jobs are known for their low pay, with very few companies paying above minimum wage. We all know that McDonald’s and Burger King make billions a year, so why can’t they pay their workers more? The answer is complex and the data is difficult to extract.

For starters, McDonald’s corporation, even according to Ray Kroc, is not in the hamburger business, they are in the real estate business. The corporate McDonald’s does not own and operate stores, they own real estate and their tenants pay their rent by selling hamburgers (which they buy from McDonald’s corporate). Because of the franchise business model it isn’t an apples to apples comparison to look at McDonald’s Corporations financial statements and figure out how much more store employees could be paid, because McDonald’s Corporation doesn’t employ the workers at individual stores. The only way to get data concerning fast food worker pay and store profitability is to find a franchisee that is also a publicly traded company.

Business Models

In the fast food food world their are two primary business models, the McDonald’s model, which the vast majority of fast food chains operate on, which is a franchise model; and a private ownership model, which In and Out burger and White Castle are primary examples of. With the franchise model the store licenses its products and charges an initial fee, an ongoing percentage of sales, and gives the franchisee rules, regulations and a proven business model to work with. Because Franchisee’s fund their stores with cash, and typically start out with only 1 or 2 locations, it is extremely rare for a franchisee to become a publicly traded company, this means that financial statements regarding these firms is unavailable. We run into the same problem with privately owned chains like In and Out Burger, which unlike McDonald’s owns and operates all of its locations, but since it is privately held, does not have to publish financial statements.

Luckily I stumbled upon a large franchisee that happens to be a publicly traded company, Carrol’s Restaurant Group. Carrol’s owns and operates 570 Burger King locations and employs 17,000 people. They are a publicly traded company, which means their financial documents are open to the public. By looking at their numbers we can make some determinations on pay and profitability.

Financials:

For the Year ended December 29, 2013 Carrol’s had revenues of $663.5 Million, Labor expenses of $208.4 Million, a Net Income of -$13.5 Million, and an EBITDA of $28.5M. As you can see this company has some slim margins. For a business generating $663.5 Million in revenue an EBITDA of $28.5M is only 4.3%. Net income is negative because of the non-cash expenses, mostly depreciation on physical assets.

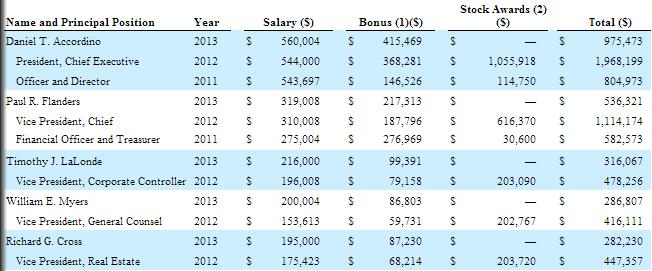

Executive Compensation:

The top 5 executives of Carrol’s were paid an aggregate of $2.4 Million for the year. This is certainly a lot of money, but at roughly 1% of total wage costs, does not provide an opportunity to increase workers wages by a substantial amount. If these executives were all cut down to $100,000 a year each and stayed (highly unlikely), the resulting $1.9 Million would only be able to increase wages for workers by .9%, effectively increasing pay from $7.40 to only $7.47. For this company, executive pay is not the problem.

Increasing Wages:

If we back out executive compensation first to leave it constant, increasing worker wages 10%, which would equate to a line worker going from $7.40 per hour to $8.14 per hour, labor expenses would increase by a total of $20.6 Million, resulting in the net loss for the year more than doubling. If workers received a 35% bump in pay, to get to the $10 mark, the loss would be $85.6 Million. Cash reserves would not be able to sustain this for even a quarter. The company simply does not have high enough margins to increase wages by a significant amount and still remain profitable.

The only way to maintain current EBITDA with a 35% pay increase would be for total revenues to go up by the same total dollar amount, without an increase in cost of goods sold, or other metrics, meaning price increases. In this scenario a total of $72.1 Million would have to be raised. As a percent of revenue this would be 10.8%.

What this boils down to is would you be willing to pay 11% more for a fast food meal to have workers paid $10 an hour? A better question is would you choose to pay 11% more to go to the restaurant that pays their employees slightly better than going to a different restaurant with lower prices?

After Thoughts:

The numbers may vary substantially between owners of different franchises and owners of differing sizes. It may be possible that a guy who owns 2 Subways may be able to do a lot more on increasing wages than a Burger King franchisee who owns 570 restaurants. The varied nature of this business makes it very difficult to analyze the numbers and make a blanket one size fits all statement.

I personally believe that if the company (any company) is able to attract workers at a lower price point who are capable of properly executing the position, then raising base wages does not make sense. For entry level positions if there is a supply of 10 people who want 5 jobs, the price will stay low. But if there are 5 jobs available and only 3 people turn in applications, then the firm will have to increase wages; simple supply and demand. I think that the base wages can stay at low levels, but for the few all stars who stay with the company for substantially longer than average and work efficiently, raises can and should be handed out. This may only represent 5 -10% of the entire population. Merit raises are effective and necessary in jobs like these.

Another option to retain key employees is to find other ways to benefit them. When I worked in fast food my employers were not able to increase my wage, but were able to give me a flexible schedule. They worked around my college schedule and because of this I was able to work close to 40 hours a week and still go to school full time. It is difficult to find a job that every semester will let you switch between having 2 days a week off, or only being able to work nights and weekends.

After viewing these numbers do you think it is likely that the fast food industry will be able to survive a $10 minimum wage?

Leave a Reply