Is a 4% Withdrawal Rate Too Conservative?

I don’t believe that one size fits all when it comes to retirement planning. The standard rule of thumb that is generally accepted across the personal finance community and standard advice from traditional media is that in order to retire, you can assume a 4% safe withdrawal rate. This is so ingrained in us that I haven’t given it a second thought in over 3 years of blogging on personal finance. I’ve since read numerous articles advocating for far lower withdrawal rates and a few stating that in some circumstances rates well above 4% may turn out to be okay. The discrepancy between these withdrawal rates and how much money someone needs to save up are vast, so determining a proper withdrawal rate can not be left to guess work or feelings. Thankfully, some exhaustive research has been conducted on withdrawal rates by looking backwards at what would have been safe over a long period of time.

The Trinity Study:

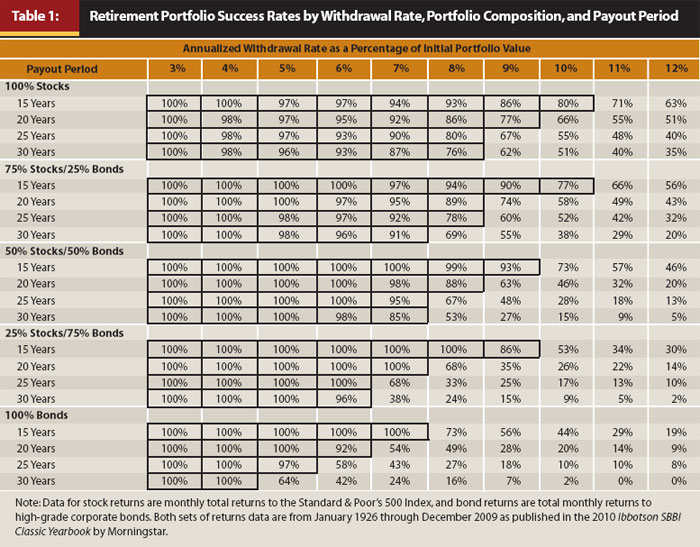

The trinity study looked at periods of 30 years starting from 1926 and ending in 2009 to determine what level of success portfolios with a variety of stock to bond ratios would have at varying withdrawal rates. The trinity study provides an amazing wealth of data, that became boiled down to a singular sound bite of “4% is the standard safe withdrawal rate.” This is because a portfolio with 75% stocks and 25% bonds, with withdrawals adjusted each year for inflation had a 100% success rate. Success meaning that at the end of 30 years, the number was positive. Note: The original study examined data through 1995, but an update was made with data going through 2009.

A few key aspects to keep in mind:

1. Past performance has NO correlation to future results.

2. The Trinity study took data for portfolios that adjusted for inflation each year, and for portfolios that did not. For the purpose of this article I am only looking at the data from portfolios that did not adjust for inflation.

3. The Trinity study assumes that regardless of what the market does, the individual will withdrawal the exact same amount of money.

4. There are 55 30 year periods in the data sample.

Without Further Ado, here are the charts concerning the Trinity Study.

For the data on inflation adjusted withdrawals, visit this site.

Why The 4% Rate May Be Too Risky:

What strikes me the most when looking at withdrawal rates is looking at the multiple of savings that it represents. a 4% withdrawal rate means you have 25 years of expenses in savings, meaning someone could spend 4% of an initial balance each year and with zero real growth would not run out of money for a quarter century. That’s pretty darn good. A 3% withdrawal rate would mean you could do this for 33 years, and a 2% withdrawal rate means you could maintain spending for 50 year; 50 freakin years with no adjustments and no gains.

For the most part the people who advocate such low withdrawal rates do so because they expect 0% real growth over multiple decades. This has literally never happened and is very unlikely to occur. If you truly believe that stock market returns will be flat for the foreseeable future, then invest in rental real estate or start a business instead of investing in the stock market or bond market. These levels of withdrawal rates are mostly appropriate for extremely cautious investors who have the majority, if not all of their money in government bonds and low risk corporate bonds.

Why The 4% Rate May Be Too Conservative:

As we discussed above, the 4% rate of withdrawal came from the Trinity study, which demonstrated that a portfolio with a 75% stock/25% bond allocation and a 4% withdrawal rate has been successful in 100% of the 55 30 year periods in the data set. This is with success defined as having a balance after 30 years of more that $0.

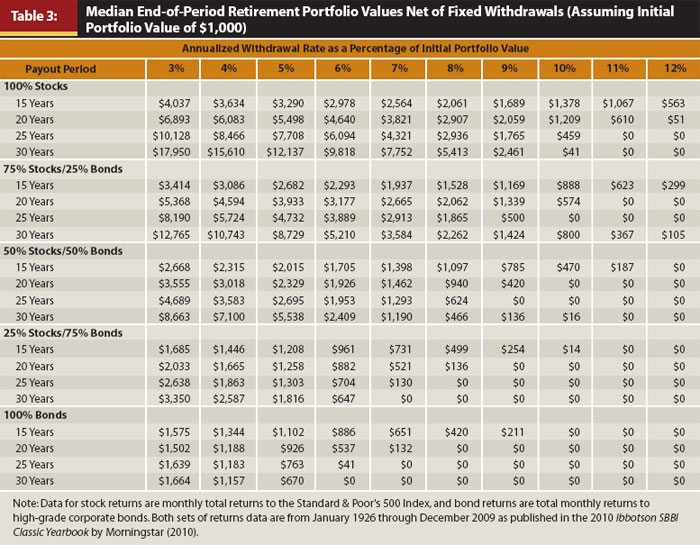

The median result from someone invested in 75% stocks and 25% bonds, would be a successful portfolio. Not only would it be successful, but after 30 years the median portfolio had $10,743 for every $1,000 invested. The account grew to 10 times what it started out as. This or better was true of half of the time periods observed.

With this data in hand I personally feel that a 4% withdrawal rate is EXTREMELY conservative. I think it makes sense to look at a higher withdrawal rate, but this only helps to a point…

The Point of Diminishing Returns on Higher Withdrawal Rates:

While taking a withdrawal larger than 4% can certainly lower the nest egg needed, and thus the time to achieve Financial Independence, as you get into higher withdrawals your risk greatly increases, while your benefit greatly decreases.

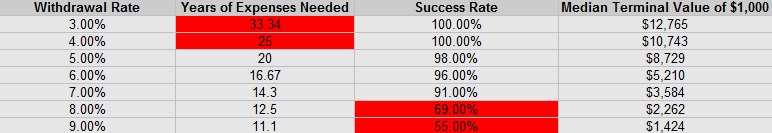

Assuming a 75% stock/ 25% bond split, and taking withdrawals not adjusted for inflation:

- Going from 3% to 4% There is a 100% success rate and you need 8.34 fewer years of expenses in savings.

- Going from 4% to 5% There is a 98% success rate and you need 5 fewer years of expenses in savings.

- Going from 5% to 6% There is a 96% success rate and you need 3.34 fewer years of expenses in savings.

- Going from 6% to 7% There is a 91% success rate and you need 2.3 fewer years of expenses in savings.

- Going from 7% to 8% There is a 69% success rate and you need 2.2 fewer years of expenses in savings.

- Going from 8% to 9% There is a 55% success rate and you need 1.4 fewer years of expenses in savings.

Now, as mentioned above, the Trinity study started with data in 1926 and covers 55 30 year periods. The difference between 100% success rates and 91% success rates is accounted for by someone retiring during the great depression and blindly withdrawing. Think about that for a minute.

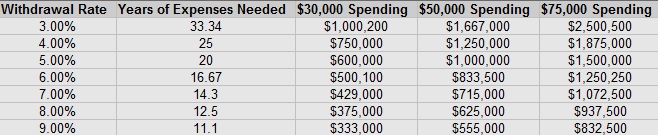

Now how does this actually affect your savings needed? The chart below demonstrates the amount of savings needed in order to reach financial independence based off of varying withdrawal rates and yearly spending.

Increasing the withdrawal rate you are comfortable with can greatly reduce the time it takes to reach financial independence.

Where I Stand On Withdrawal Rates:

From a risk reward standpoint, I feel extremely comfortable with a 6% withdrawal rate. In the Trinity Study a 75%/25% mix of stocks to bonds had a 96% success rate, meaning it was only NOT successful for 2 years in the study, (which would have been for retirements started at the beginning of the great depression). The median terminal value of $1,000 investment with a 6% withdrawal rate was $5,210. This means that 50% of the time, 27 years out of 55 years, the ending value was over 5X the amount the account holder had started with. I see a 6% withdrawal rate as being quite conservative.

I honestly think a 7% withdrawal rate, provided that if there was a market down turn at the start of the retirement period the account holder would withdrawal less, would be safe. Withdrawing 7% would still have a 91% success rate, and the median terminal value has been $3,584. 50% of the time the account holder taking 7% withdrawals would end with over 3X his original balance.

Withdrawal rates of 8% and above bring on substantially more risk. Just from 7% to 8% there is a 22% drop in percentage of periods that ended in success, and to what gain? The amount of money needed to go from an 8% to a 7% withdrawal rate is only 1.8 years of savings. It just doesn’t seem worth it. I personally am looking at a 6% to 7% withdrawal rate for my planning purposes.

Instead of needing to save $750,000 for my $30,000 budget in retirement, If I go with a 7% withdrawal rate, I only need to have $429,000. With my yearly savings rate, this adjustment in perspective can take over 5 years off the length of time it takes me to reach financial independence, and those are an important 5 years!

After reviewing this data, what do you feel is a safe withdrawal rate? Are you willing to make adjustments in down years?

Leave a Reply