Is 70 The New Retirement Age?

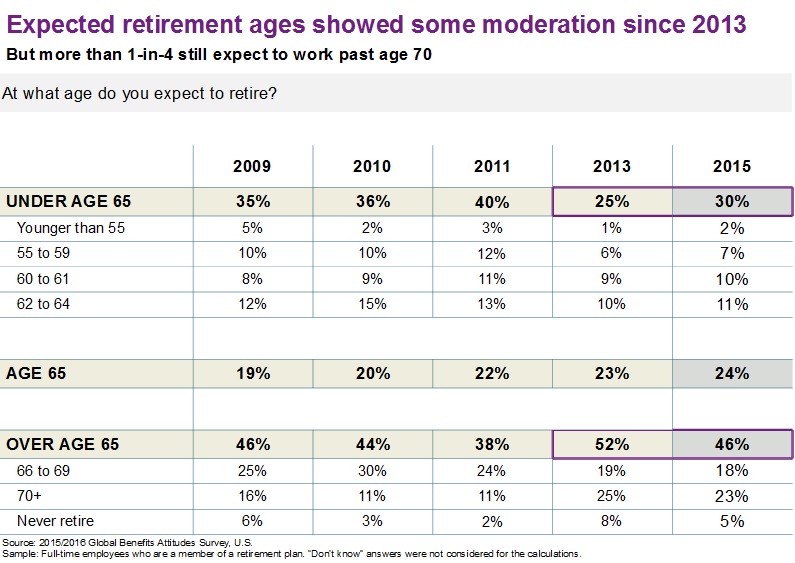

I just came across this article entitled “Is 70 the new retirement age?” and I imagined that it would be an article focused on baby boomers who didn’t save any money or on people who love their jobs and don’t plan to retire until they are essentially forced out. It turns out that neither of these assumptions were true. When I delved into the article I read that 25% of workers under 30, 28% of workers in their 30s, and 33% of workers in their 40s think they won’t be able to retire until after 70. WHAT? I could see people in their 50s and 60s who hadn’t saved anything thinking this, but people this young have several decades to change direction, why on Earth would they think they can’t retire until 70?

Worse yet, only 2% of workers thought they could retire by age 55. Admittedly, I’m in a bubble; I’ve had a goal of retiring early since I was 16. I view retiring at 55 to be a normal retirement age, and anything before 50 to be “early”. My goal is to retire by 45, but my stretch goal is to hit financial independence before 40. Other financial bloggers make up a lot of my social circle, so I understand that my viewpoint on this is skewed somewhat. I just couldn’t imagine thinking I would have to work until 70. Do you think you will have to work until 70?

American’s Don’t Like To Math:

I think this could be a big part of the problem with so many people not thinking they can retire until 70. The VAST majority of these people I’m sure have not ran the numbers. They probably are heavily reliant on Social Security and think they will need the delayed Social Security credits in order to have enough money to retire.

Let’s assume the average person in this study is 35, has $0 in savings and earns $40,000 a year. Let’s also assume that this person needs 75% of his before retirement income to live of of in retirement, this is $30,000 per year. This reduction accounts for having a paid off home, having grown children, and no longer saving for retirement or paying income taxes. $30,000 per year is $2,500 per month.

To Retire At Age 70:

If Bob earns the exact same amount of money he is now until age 70, he will have at least 35 years of $40,000 in income. With a $3,333 AIME, taking social security at age 70 will result in $1,900 per month in income. Bob then needs to come up with another $600 per month to meet his $2,500 goal. Using a standard 4% withdrawal rule, Bob would want to have $180,000 in savings to generate $7,200 per year.

To get to $180,000 in savings, with a 35 year time horizon, with 7% annualized returns, Bob would need to save $100 per month. That’s $25 per week, or only 3% of his income. Clearly this should not be a difficult target.

If Bob used a 6% withdrawal rate, he would only need $120,000 in savings. With a 35 year time horizon at 7%, he would only need to save $68 per month, or $17 per week.

To Retire At Age 62:

Retiring at age 62 instead of age 70 is a drastic change. That’s 8 more years of not having to work, which is a pretty big deal. 70% of survey respondents said they don’t expect to retire until age 65 or later.

If Bob takes Social Security at age 62, he would receive $1,070 per month. To make up the $1,430 per month difference with a 4% withdrawal rate, Bob would need $425,000, more than twice what he would need to retire at 70. That sounds like a big deal, but keep in mind, he still has another 27 years to get there.

To reach $430,000 Bob would need to save $450 per month every month for the next 27 years. This is a lot of money, but it is still only 13.5% of his income. For every $100 Bob cuts out of his budget that’s $30,000 less he would need to save in total, or $31 less per month.

If Bob used a 6% withdrawal rate, he would only need $286,000. He would need to save $250 per month for 27 years which is only 7.5% of his income

To Retire At Age 55

Retiring at 55 when already 35 and starting from a $0 net worth is not as easily done. Bob would not see Social Security income until age 62, so for the first 7 years of retirement Bob would need extra savings. There are two ways to calculate this out; with Social Security and without Social Security.

Including Social Security:

If Bob Includes Social Security, then he only needs to have $430,000 at age 62 using a 4% withdrawal rate and $286,000 using a 6% withdrawal rate.

To have that amount left over we need to make some assumptions. Assuming 7% annual gains, and a withdrawal of $30,000 per year starting at age 55 with a goal of $430,000 (planned 4% withdrawal rate) to start at age 62, the portfolio balance would need to be around $450,000 at age 55. (7% returns throws off $30,000 a year). To reach $450,000 in a 20 year time frame would require saving $850 per month or 25.5% of income.

To reach $286,000 (planned 6% withdrawal rate) obviously a much lower amount would be needed initially. The starting balance at age 55 would need to be $350,000. This would require saving $665 per month for 20 years, or 20% of total income.

Excluding Social Security:

If Bob does not include Social Security in his plans, then he would need to have $750,000 in savings if he used a 4% withdrawal rate. To get to $750,000 in 20 years Bob would need to save $1,425 per month for 20 years with 7% returns. This would be 42.75% of his income.

If Bob used a 6% withdrawal rate, he would only need $500,000 to retire, and that would take $950 per month, or a savings rate of 28.5%.

Now what if Bob started saving at 25 instead of 35?

Using a 4% withdrawal rate, Bob would retire at 55 with only having needed to save $620 per month or 18.6% of his income

Using a 6% withdrawal rate, Bob would retire at 55 with only having needed to save $412 per month or 12.5% of his income. Bam! That sounds like a much better article “Retire At 55 By Saving 12.5% of Your Income For 30 Years.” Much better Than “DOOM!!!!! No One Will Retire Until 70!”

Bottom line:

Don’t believe doom and gloom. The newspapers, the magazine articles, the federal government, your employer, your friends, your parents, and even the internet don’t get to determine when or how you retire, YOU DO.

I just demonstrated how someone earning a modest wage and never receiving a raise, could save 12.5% of his income starting at age 25 and still retire by 55…And that doesn’t even include Social Security!

Live below your means, save early, challenge yourself to earn more and spend less every year, save and invest the difference, and you can easily be part of the 2% planning to retire before 55. I’m part of that 2% will you be?

Leave a Reply