My Oldest Son Bought A House At 20 Years Old, Here’s How

First time home ownership is perhaps the largest financial struggle for most young people. It takes a lot of effort to save up for a down payment, maintain a decent credit rating, and find an affordable home. Just in the last 5 years of investing in rental property I have seen entry level homes in Benton Harbor, MI increase from around $30,000 to closer to $75,000, while the total inventory has plummeted and interest rates have skyrocketed. I’m proud to say that our oldest kid was able to purchase his first home recently.

Kid #1 Profile:

Kid #1 graduated from high school in May of last year. He started working the summer before his senior year, just after his 18th birthday. He was required to put 50% of his income into his Roth 401K, and then the rest was his decision. He worked part time, roughly 20 hours a week until he finished high school, then immediately went full time. He spent some money on a couple guitars and a computer, but in general has been very frugal. His cash has been piling up with a goal to purchase a $5,000 vehicle when he got his license. As of June 1st he had around $30,000 in retirement accounts and $15,000 in cash. He earns under $20 per hour in an entry level job at a large national retailer.

Kid #1 graduated from high school in May of last year. He started working the summer before his senior year, just after his 18th birthday. He was required to put 50% of his income into his Roth 401K, and then the rest was his decision. He worked part time, roughly 20 hours a week until he finished high school, then immediately went full time. He spent some money on a couple guitars and a computer, but in general has been very frugal. His cash has been piling up with a goal to purchase a $5,000 vehicle when he got his license. As of June 1st he had around $30,000 in retirement accounts and $15,000 in cash. He earns under $20 per hour in an entry level job at a large national retailer.

For the past 3 months he has also worked as a part time substitute custodian at his old school. He started filling in for someone’s vacation, and then another custodian had some health issues. He’s been working 60+ hours a week for a good chunk of the last 3 months between the 2 jobs, which has allowed him to beef up his cash position substantially.

Kid #1 has some learning difficulties and getting through high school was a major struggle. Math is not his strong suit and he has ADHD. A major worry for myself and his mother has been him being able to afford life in general, if he struggles to increase his income over time. Housing costs in our area have risen dramatically over the last 5 years and the supply market has become ridiculously tight.

Buying a house checklist:

- 2 years of steady employment: Check

- Credit Score over 670: Check

- 10% of home value for down payment and closing costs: Check

Getting ready to buy a house, especially getting a down payment saved up, was greatly simplified by him living at home for a year after graduating high school and working while he was in high school. This allowed him to save virtually all of his money, instead of moving out and likely living paycheck to paycheck.

House Hunting:

Honestly, house hunting has largely not been on the radar. Getting a car was in line first. I look for houses every day for our own investing and to ensure I have an extremely detailed knowledge of our local housing market. In general, for someone working an entry level job in our area, Benton Harbor is the only option for housing. Our son loves playing guitar and living inside a city would be somewhat difficult. Being closer to us would also be a major benefit.

The Listing:

We live a few miles south of Benton Harbor in a very rural township. In general there are not a lot of houses out here and the ones that are tend to be higher priced. As an example, our neighbors 2 bed 1 bath house on 1 acre just sold for $255,000. This house was clean, but not updated. For comparison, In 2011 we paid $148,000 for our 5/2 on 3 lots next door (and we overpaid at the time). This massive increase in cost in our area is a major barrier for a first time home buyer. Houses here are expensive.

On a Friday night this house in our township was listed for sale for $58,000. In the last 5 years of consistently looking at every house listed I have not seen a house in this area listed for anywhere near this cheap. This house is just over a mile from our house. We scheduled to look at it Sunday at Noon and received a phone call at 830 AM stating they had received a cash offer that expired at noon so if we want a chance to see it and put in an offer, it needs to be now.

We went straight over and viewed the property.

The Land:

This house sits on 1.25 acres, with a newer well and septic tank, propane tank, a 5 year old furnace and a central air conditioner. There is also a large portable shed. The closest houses are 500 feet away. Just these items provide for over half the value of this home:

- Land: $20,000

- AC/Furnace: $7,000

- Well: $7,000

- Septic: $3,000

- Propane Tank: $1,000

- Shed: $5,000

Total: $43,000, without even evaluating the house itself!

The House Details:

This house has not been lived in for years. It is a mess and needs a lot of cleaning. 2 rooms need insulation and drywall added. In general the house needs new flooring and paint. It also needs all appliances, the bathtub, toilet, and water heater replaced.

The house is a 3 bedroom 1 bath 1,100 square foot house with a full basement. It has an extra room to turn into a small 4th bedroom, or better yet a 2nd bathroom in the future. There is a large mud room area that is also the stairwell to the basement. This area has a decent amount of unfinished storage space. Although this house needs a lot of work, there was nothing that scared us of. Of course your average home buyer wouldn’t have considered looking at this place.

Making A Compelling Offer:

Kid #1 was comfortable with me running the numbers and showing him what the options would look like. Since he was competing with a cash offer that had a tight deadline for acceptance, I rationed that that offer would have been a lowball. Even so, most people, unless there is a significant difference will take a cash offer over an offer with financing. I think if I had a cash offer of say $50,000 and a loan offer of full price $58,000 on this house, I would take the $50,000, which would reduce the risk of the sale falling through due to condition and financing concerns.

I recommended offering just over 10% over ask, which was $64,000. This would make the monthly payment about $20 more for a 30 year mortgage than a full price offer. In the grand scheme of things $20 is irrelevant. That $6,000 over 30 years is virtually nothing.

We included a clause to allow the sellers to take or leave anything on the property. The clean up of this property will probably take 100+ man hours of highly physical work, plus $1,000 in dumpster fees. By taking this hassle off their shoulders, we make the offer more compelling.

The only contingency was a financing contingency, allowing him to back out if he could not receive at least 20% down conventional loan financing.

Refinance later: We went over the interest rate trends and discussed how most economists think rates will drop significantly over the next 2 years. Rates dropping from 8% to 5% will drop his principal and interest payment from $375 to $275.

Why This House Is Perfect For Kid #1:

- Close to us: The house is 1.5 miles from our house. It’s only a 3 minute drive or a 6 minute bike away.

- Extremely Private: There are no neighbors across the street and the neighbors on each side are each around 500 feet away.

- Large enough for future family formation: A 3 possibly 4 bedroom home is certainly large enough for a family home.

- Large lot: The 1.25 acre lot is mostly wooded, but there is still room for playing in the yard and having a small garden.

- Close to both jobs: It is 4.5 miles to one job and 3 miles to the other.

- Low total cost for value: $64,000 for a home, even one that needs some work is a great deal.

- Stabilizes housing cost: Rents in our area have been steadily increasing. In less desirable Benton Harbor and Benton Township I rent 3 bedroom houses for $900 to $950 / month and have seen several listings pushing up to $1,200 a month. A 1 bedroom apartment with only water included in the rent is running over $800 a month right now and 2 bedrooms are renting for $1,000 a month. Getting a fixed rate mortgage for $375, plus $125 for insurance and taxes fixes his housing costs at around $500 per month. 2 years down the line with a refinance could drop this cost to around $400 a month. 5 years from now a 3 bedroom home will likely be $1,500 a month for rent.

- Great potential for value add: By repairing this home he will have the opportunity to build sweat equity.

Applying For A Loan:

Oh Man, when buying a house a lot can go wrong. Initially we contacted our credit union and our mortgage officer after looking at the pictures of the home stated that he did not think it would pass inspection and they would not be able to get him a loan. This surprised me because I always thought with a conventional loan as long as the total value of the appraisal came through the loan would go through. This apparently is not the case.

Mrs. C. looked into Rocket Mortgage (Mind you we had a 3 day clock to apply for a loan), and decided to go that direction. Rocket Mortgage has a new program for a 3% down conventional loan with no PMI. In addition to no PMI they also credit 2% of the loan at closing. This was exciting to hear that he would be able to get the loan and keep most of his cash in his pocket. They reassured us that if the appraisal came back low we could make up the difference.

Initially on this $64,000 house the loan paperwork looked like this:

- Loan costs (Including required 3.125% points) : $3,212

- Misc. Services Including Appraisal, Credit check, etc: $968

- Title Work: $855

- Prepaid Insurance and Taxes: $1,533

- Initial Escrow $250

- Down Payment: $1,920

- Total Cash needed before credits: $8,738

Rocket Mortgage Credits:

- Rocket Mortgage Credit (2%): -$1,280

- Rocket Mortgage points: -$390

Total Cash Needed: $7,068

$7,068 is still a lot of money. The closing costs were larger than I expected, largely due to the $2,000 required for paying points. Normally there are more options available, but with loan level pricing and the low value of this home, this was the only option. I am generally against paying points.

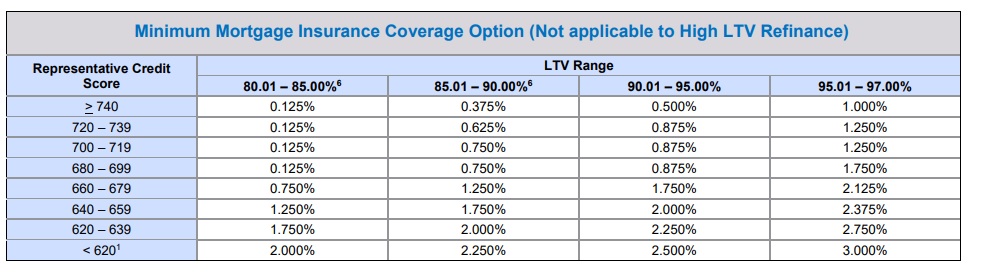

Loan level pricing is a way that in theory higher risk mortgages pay more money up front. For example, 1% of this is due to his loan being between 95% and 97% Loan to value. For someone putting down 20% with the same credit score this fee would be only 0.125% Look at this chart closely. For someone with a 620 credit score going through the Rocket Mortgage One+ program would pay 3% just on this one aspect of loan level pricing. For a $100,000 home this would be the difference of paying $1,000 or $3,000.

The Rocket Mortgage points are a rewards program Rocket Mortgage has on your online profile. They award points for reading articles about home ownership, searching for homes on their platform, and using their loan calculator. In total our son was able to max out the points available to him and ended up with $390 worth of credit.

I also hate how inflated appraisal charges are getting. I used to pay $300 to $500 for appraisals, now they are running $750!

The Appraisal Process:

It took Rocket Mortgage less than a day to move his loan into underwriting, and receive conditional approval. Then the waiting game for the appraisal. The appraisal was ordered quickly and conducted the same week. We had to wait another week for the results.

I failed to ask the mortgage company to exclude the 2 terrible appraisers we have had in the past, and of course our kid ended up with one of these hacks. The appraisal came back at $55,000, $9,000 short of the contract price. The good news was that he checked the box for “livable”, which should have meant we would not be required to make repairs before closing.

With the appraisal coming back low we could either ask the appraiser to reconsider based on factual evidence or pay the difference. With this appraiser on a property before he appraised ridiculously low we challenged his appraisal. He drug his feet for 3 weeks, then refused to adjust his appraisal. This was despite several factual, non opinion based errors in his report. Appraisers are not held accountable for shoddy work and we did not want to drag this deal out. On the property we challenged him on years ago we ended up switching lenders and got another appraisal which was about 60% higher than his.

In this case the main problem is how he adjusted the comps. He provided adjustments at the following increments:

- $1,000 per bedroom

- $1,000 per bathroom

- $2.50 per basement square footage

- $10 per finished square footage.

These adjustments are well below industry standard and skew smaller homes to appraise better and larger homes to appraise worse. He of course compared this home to much smaller homes. Industry standard for additional bedrooms is $10,000 and for basement square footage is $10. Those 2 metrics alone would have appraised the home well above the contract price. He also used no comps from the township this property was in.

One of his comps was a 2 bedroom 1 bath with 850 square feet and no basement, Vs this 3 / 1 with 1,100 square feet and a full basement. That property sold for $50,000 and his adjusted price was $60,600.

The difference in the extra bedroom to industry standard would add $9,000.

The difference in the basement to industry standard would add $8,250

That’s a $17,250 increase in the appraisal without touching the laughably low $10 per square foot for finished square feet.

What’s worse is that even according to his math that he provides, his opinion of value is below what the math would state:

“The Indicated Value by Sales Comparison Approach, $55,000, is calculated using the following weights:

19.3% – 10411 OLD 31; Sale Price $40,000; Adjusted Value $49,900; Gross Adj: 24.8%

19.1% – 8974 M-140; Sale Price $68,000; Adjusted Value $65,400; Gross Adj: 25.6%

17.4% – 58304 M-51 S; Sale Price $70,000; Adjusted Value $72,900; Gross Adj: 32.7%

23.8% – 593 WAVERLY DR; Sale Price $57,000; Adjusted Value $58,000; Gross Adj: 5.3%

20.5% – 30450 PEAVINE ST; Sale Price $55,000; Adjusted Value $53,600; Gross Adj: 19.6% ”

So I put these numbers into a spreadsheet and calculated out the value based on these weights and here are the results:

| Adjusted price | Weight Factor | # X Weight Factor |

| 49900 | 19.30% | 9630.7 |

| 65400 | 19.10% | 12491.4 |

| 72900 | 17.40% | 12684.6 |

| 58000 | 23.80% | 13804 |

| 53600 | 20.50% | 10988 |

| Weighted Value | 59598 |

So not only was the way he adjusted these wrong, but his valuation was not reflective of the math. Had his math been accurate, his appraisal would have been for $59,598. This still doesn’t get up to the full purchase price on this aspect alone, but would have been $4,598 less in cash our son would have to come up with.

Due to this appraiser our son’s cash needs increased from $7,068 to $16,068. It was our intention to provide a gift after closing to assist with repairs to match his down payment amount. Because the cash needed to close now unexpectedly exceeded his cash position we made a matching gift prior to close of a few thousand dollars. Had we not done this he still would have been able to purchase the home with a small loan from his Roth 401K.

After resigning to paying the $9,000 difference between the appraisal and the contract price, Rocket Mortgage still required repairs. They required a patch to a spot where siding was missing, a handrail outside a back door, and drywall added to a room that was missing wall covering on 1 wall and the ceiling. All in all we spent under $100 and roughly 5 hours on these repairs. The drywall was the most ridiculous because it will all be pulled off later, as that entire room needs new flooring, insulation, wiring, and drywall on all the walls to replace the old paneling.

We repaired these items within 24 hours of the notice, and that was the last barrier for being ready to close, or so we thought. Our loan officer told us that the repairs were good, then a full week after we had submitted the pictures stated that the railing was not an adequate fix. We then built a deck over those concrete steps that afternoon and the next day they accepted the repairs.

The Mortgage Results:

Our son will have a 30 year 7.125% mortgage with a $53,350 balance.

- Principal and Interest: $359

- Insurance: $71

- Property Taxes: $53

- Total: $483 /mo

With the siding fixed he should be able to get a lower insurance cost. We have had similar homes insured for around $50 a month.

He closed on July 7th and the way it works when you close on a house is you prepay the interest for the next month. His first house payment won’t be until September 1st, which will give him 4 2 week paychecks prior to needing to make his first payment. August is the only month where he ends up with 3 checks and it just worked out that this aligned well with his closing date.

As far as ratios go, his total house payment is roughly 15% of his monthly gross income. This is half the typical US housing expenditure, and he is early in his career, he will make more money over time.

The total cost of the house is < 2 years of income.

This house is 14% of the cost of the average US home price of $436,800.

This house is 29% of the cost of the average Michigan home price of $218,684.

When most people talk about home ownership being completely out of reach, they reference these figures. Your first home does not have to be an “average” home, or even a “median home”. It can be smaller, it can need some work, it can be in a less desirable area.

This house is less than half the square footage of the average home and it needs considerably more work than the average home.

Repairs needed:

Dumpster / Fire: This house has a lot of stuff left behind. A dumpster will be needed and all the wood items can be burned. We can also scrap all the metal. We may do a yard sale and then a free sale to reduce the dumpster size needed. Cost: $700

Flooring: All the flooring needs replaced. the back bedroom and a bonus room (that can be a 4th bedroom) will need the subfloor replaced. Cost: $2,500: We have tile for the kitchen, bath and hallway that was free and the bedrooms we can get carpet installed at $3/ square foot. We will put down roughly 200 square feet of OSB subfloor.

Cabinets: All kitchen cabinets need replaced: We find full sets all the time off of Facebook marketplace for around $200. We possibly could refinish these, Mrs. C. has gotten really good at this, but it is so labor intensive and when we can get cabinets this cheap, it makes sense to replace.

Paint: Whole house: Interior paint will run around $50 per room X 7 rooms $350. That’s if he buys new paint for every room. We have a massive stockpile of paint from all our rental houses and can donate some paint to the cause if he is OK with those colors.

Drywall: the same 2 rooms that need flooring need insulation and drywall: $500 between the two. We have already saved some money here. Rather than drywalling most of the walls we will do paneling. Normally drywall costs $11 a sheet and paneling is around $30 a sheet. We bought several sheets of really nice paneling on clearance at Lowes for $6 a sheet. This will also save on paint cost, as the paneling doesn’t have to be painted.

Utilities: The water heater needs replaced and likely the fridge and stove. $400 for the water heater and $700 for fridge and stove. We buy fridges and stoves from Bill Appliances in Niles MI. We have bought several great condition fridges for $400 and several great condition electric stoves for between $250 and $300 each.

Unboard windows: Free. The windows are not broken.

Siding scrape and paint: $300 in exterior paint. Scraping just takes a lot of time.

Bathroom/Plumbing: Replace shower/tub, sink, and toilet: Toilets are around $125, sinks around $200, and $500 for the shower/tub kit. All of the supply piping in the house needs replaced with new shutoffs. We will likely run PEX for everything. Add $500 for this, although this is likely high.

Rough total: $7,000. That $7,000 will go a long way. I’m sure some more expenses will pop up. There may also be some additional savings in these categories as well. We have bought fridges and stoves for much less money in the past, in fact I have a working but really dirty stove that he could clean up and use. Rather than paying $3 a square foot to have carpet installed he could buy new commercial carpet squares from Restore at 75 cents a square foot, plus another 25 cents a square foot between mastic and trim. This would save over $1,000. Sometimes we can score interior and exterior paint on deep discounts for wrong colors. If he isn’t picky on colors there is another few hundred bucks in savings.

This is what the carpet squares look like installed. We put these in our tax auction house 2 years ago.

This level of repair is also much easier when there is no rush to move. He isn’t getting evicted. He will still be living at our house while making repairs and this will reduce his food cost and utility cost. It’s also much easier when your parents don’t have real jobs and have a pole barn full of tools and materials and have rehabbed 10 houses in the last 5 years.

When these tasks are all complete he will have a total of around $75,000 all in invested in this property and it will be worth double that.

Why This House Is TERRIBLE For A First Home

In general a first house should not be a major rehab. Ideally he would have been able to get a home that was much closer to move in ready. This would keep him from having to do extensive repairs and allow for much less cash out of pocket before move in. The problem with that is in order to afford a move in ready home, he would have to make a major compromise on location, yard, and home size.

For example, this house was just listed at $69,000. Most likely it will sell for around $75,000, the same total dollar amount he will be all in on the house he is buying when the majority of repairs are finished.

https://www.zillow.com/homedetails/1284-Maynard-Dr-Benton-Harbor-MI-49022/120523476_zpid/

- The house is much smaller, 2 bedrooms 1 bath with 720 square feet.

- It is move in ready, which is a major plus.

- There is no basement.

- The closest neighbors are 15 feet away

- It’s on 0.15 Acres

- Does not have central air

If he accepted those trade offs he would be able to get into this house for much less cash. Note that a house can be cleaned out and refinished, but expanding a house, adding a basement, and gaining a bigger yard are generally not feasible.

A compelling offer would be $80,000 with the seller giving $2,400 cash back at closing, effectively paying $77,600 for the house, roughly 10% above ask just like the house he is buying. When putting down 3% the maximum seller cash back at closing is 3%.

- Closing costs: $4,500

- Prepaids: $1,900

- Down Payment $2,400

- Cash back at Closing -$2,400

- Rocket Credit: -$1,600

- Rocket points credit: -$390

Total Cash needed to close: $4,410

A move in ready home for $4,400 cash out of pocket, about a fifth of what our son will end up paying in total to get this house move in ready, even though total home cost will end up roughly the same. Note that since $1,900 of that is for prepaid home owner insurance and taxes, it’s really like only $2,510 for closing costs and down payment.

Add in a $2,000 parental matching gift and he would only need $2,000 out of pocket!

Compare this to the $1,000 2 bedroom apartment:

- First month rent: $1,000

- Security deposit: $1,500 (assumed maximum 1.5% X rent)

- Pet Fee: $200

- Cash needed to move in: $2,700.

(Side note the pet policy at this large apartment complex is as follows: “A maximum of two pets are allowed per apartment. A combination of cats and dogs are permitted. The weight of any individual dog or cat cannot exceed 75 lbs. The combined weight of any two animals cannot exceed 100 lbs. ”

I wonder if anyone has challenged this and showed up with a pet leopard, they average 68 pounds. A 75 pound cat is allowed lol!)

A first time home buyer could purchase the house above for under twice the out of pocket cost of getting an apartment.

Mortgage at 30 year 7.125%:

- Principal and Interest: $523

- Taxes: $107 (Higher tax rate area and higher assessment)

- Insurance: $50 (Lower square footage so lower insurance premium)

- Total: $680/ mo

Next Steps:

Over the next 6 months to 1 year we will steadily work on this property. Our son has dropped his 401K contribution from the 50% to 10% to rebuild his cash and to fund repairs. He still receives the full 6% employer match. In addition to repairing this house largely out of cash flow he will be focusing on rebuilding his cash position both for having a cash cushion and for his first vehicle purchase.

Likely move in will be next spring. After the mortgage payment he should have around $1,500 a month in income left over. If he averages $500 a month in supplies / repairs, this allows him to rebuild cash at around $1,000 a month. By the end of the year he should be able to purchase a car, and by April should have a decent cash cushion built back up. Around this time he will move into the property and he should still be able to cash flow at least $500 a month into building back savings. He can also bank additional savings from any side jobs he works during this time period.

I have always intended to do 401K matching funds, but the last 2 years have been cash crunch years for us and our matching has been very low. My intention going forward would be to match his 10% 401K contribution 50 cents on the dollar into his Roth IRA. Doing this for a total of 7 years will make a difference of around $300,000 at age 65 for him.

Future Refinance:

Sometime in 2025 interest rates are expected to drop back to around 4%. If this is the case doing a non cash out refinance with 75% loan to value or better should allow for a low closing cost refinance and make his loan payments about $110 less per month and saving around $30,000 in interest over the life of his loan.

What do you think of my son’s first home?

Leave a Reply