Investing In Home Solar Power

For the last several years the cost of solar power has been decreasing substantially, while the cost of electricity supplied through the grid has been increasing. The cost to install solar panels has now fallen to a point where payoffs can occur in under 10 years; coupled with a design life of 40 plus years, adding solar power to your home may be a home run in reducing expenses. When evaluating whether to install solar panels or not there are several factors to consider including what system to get, your current usage and energy costs, zoning regulations, and tax incentives. With all of these changes in the electricity market it’ time to figure out if investing in home solar power is right for you.

For the last several years the cost of solar power has been decreasing substantially, while the cost of electricity supplied through the grid has been increasing. The cost to install solar panels has now fallen to a point where payoffs can occur in under 10 years; coupled with a design life of 40 plus years, adding solar power to your home may be a home run in reducing expenses. When evaluating whether to install solar panels or not there are several factors to consider including what system to get, your current usage and energy costs, zoning regulations, and tax incentives. With all of these changes in the electricity market it’ time to figure out if investing in home solar power is right for you.

Will Solar Power Work in Your Location:

Space and Orientation: In the United States you will want to have your panels facing the South. For every 1 kW of solar panels installed you need about 80 square feet of roof. A 10 kW system then requires 800 sq feet of rooftop facing south. You can get systems that are mounted on the ground, but you will need a decent sized yard for this.

Geographic Location: Although solar panels are more efficient in areas that are sunny year round, such as California, Arizona, New Mexico, and Texas, solar panels can be cost effective in the Midwest and northeast as well. Every 1 kW of installed solar panels will produce about 1,500 kWh per year in the Southwest and around 1,000 kWh per year in the Midwest. Obviously sunnier areas will have a quicker payback.

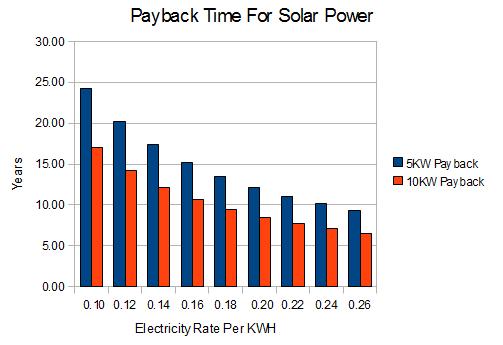

Price of Electricity: A major factor in determining if solar power will be cost effective is what your current power rates are. Electrical rates vary in the US substantially from lows of around 9 cents per kWh to over 30 cents per kWh. Many areas have tiered rate systems where lower electric usage amounts cost less per kWh and higher usage results in higher prices.

So you have the space facing the correct direction and you live in an area with relatively high power prices? A solar power system may be a good fit for you.

Deciding On a System:

A typical home installation is for a 5 kW or 10 kW grid tied system. In most areas that have 4.2 average hours of sunlight a day a 5 kW system will produce roughly 600 kW of power per month and a 10 kW will produce roughly 1,200 kW per month. Most homeowners go with a grid tied system. This takes away the large cost of battery backups and ensures that if you are not producing enough power to supply your home, you can still use electricity from the grid seamlessly.

Your energy usage is a major factor in deciding whether to go with a 5 kW or 10 kW system, if you routinely use under 600 kW of electricity per month or you are in a tiered system and 600 kW per month generated will take you out of the upper tiers, then a 5 kW system may make sense. Your utility may also limit the size of installation you can get. Indiana Michigan Power will only allow net metering customers to install systems that are in line with replacing their usage over the past 12 months.

As with most items, the cost is not fully linear, installing a 10 kW system does not cost twice what installing a 5 kW system does. A 5 kW system may run around $25,000 before tax incentives, while a 10 kW system may run around $35,000 before tax incentives. These are rough estimates, every installation is different. Prices will vary substantially based on location, installer, the exact hardware you purchase and the design and accessibility of your roof. What has been constant is the fall of the overall prices of a system. I just read this article detailing how an installer had quoted a 7.2 kW system at $49,000 in 2011 and in 2015 installed a 9 kW system on the same house for $26,000. Update July 2018: Since writing this article the price of installed solar has dropped to an average of $3.14 per kW. This means BEFORE tax credits the price of a 5 kW system should be around $15,700.

Because these systems require very little maintenance and have a design life of 40 years, a 10 year break even point is not a bad deal. I’d like to compare the installation of these panels to buying a bond. You spend $25,000 after tax incentives on a 10 kW system and it conservatively saves you $120 a month, which is $1,440 a year, this is the same as a 5.75% interest rate on a bond (and tax free). When you sell the house, since the solar panels added $20,000 of value to the house you get your money back, just like with a bond.

Another advantage a home solar power system has is that the system will save you the same amount of kWh regardless of what the price of electricity is. Do you think electricity prices will go unchanged over the next 40 years? As electricity prices rise, your monthly savings will rise. 10 years out the price of electricity in your area could easily go from 12 cents per kWh to 20 cents per kWh and instead of saving $120 a month you would be saving $200 a month!

Fiscal Benefits:

Federal Tax Credits: 30% of the cost of the installed system will be given as a non-refundable tax credit through December 31st 2019, then 26% in 2020, and 22% in 2021 the last year in which the credit is available. This is important because if you have little to no tax liability the tax credit doesn’t do you any good. This could be a major factor in whether it makes sense to go solar or not.

State and Local Tax Credits: Some states and local governments offer tax credits and incentives as well. DSIRE, the Database of State Incentives for Renewable Energy, has a searchable database for all state and local incentives. The City Of San Francisco offer up to $2,000 for a residential installation, with another $700 if it is installed by a city installer, and up to $7,000 if you qualify as low income! This can take a substantial bite out of how long it takes for the system to pay for itself. The state of Hawaii offers a 35% tax credit. Combined with the federal tax credit means you will barely have to pay for 1/3 of the total system cost! This is a good deal anywhere, but especially in Hawaii where the sun shines A LOT and grid electricity costs are roughly 3 times that on the mainland.

Net Metering: Every utility handles net metering differently. For my power provider, Indiana Michigan Power, any power I generate in excess of what I use is credited to my future bills. If I had a 10 kW system I would exceed my usage in May through August and then during the dark winter months where my system produced less than my usage, the credits would kick in, keeping my bill at 0 kWh used.

Other utilities will pay customers for any excess generation at the going rate of electricity or even at a premium. For people in high cost areas where electricity is around 20 cents per kWh this can add up to a decent check.

Improved Home Equity: Adding Solar Panels to your house adds the same value to your house as the panels cost. People are willing to pay a premium for the home for the same reason you are willing to buy the system originally; the cash flows make it worth it!

Unique Financing Structures: Companies like SolarCity recognize that the major barrier to Solar adoption is the upfront cost. SolarCity offers a program where they will install panels on your house at no upfront cost to you. Instead of paying a typical $120 electric bill to the electric company you will be paying probably $20 to the electric company and $80 for the system. You save money on your monthly bills and didn’t have anything come out of pocket. I love the idea of no cost down and lowering your electric bill, but in reality it is a 30 year amortized loan at 5% interest for a small dollar value item. They claim that there are no prepayment penalties, so this may be a great option for someone who doesn’t have the cash reserves to install solar panels.

When Should I Buy A Home Solar Power System?

I think it is unlikely that the Federal incentive will be renewed past 2021, therefore if installing a solar power system is on your radar, it would be prudent to do so before the end of 2021. I don’t think the credit will be renewed because the Federal Government has achieved it’s mission with the credit: Reduce the cost of solar power to the point where it is competitive with grid power. Since prices have been dropping quickly it may make sense to wait until next summer to try to save an extra $1,000 or so on a system, but by then all the installers may be booked up with thousands of people doing the same thing.

What Am I Doing?

Although I would like to switch over to solar power, at the time it is not economically viable for my situation. Although I have plenty of unobstructed rooftop facing south, there are a couple limiting factors that make solar power at this moment a no go for me. With our household income, our aggressive retirement savings contributions, and having four kids we expect no federal tax liability through 2021. Because of this the tax credit does us no good. In addition to not getting the advantage of the tax credit electricity rates in my area are relatively low at around 9 cents per kWh. Living in Michigan means we won’t get top efficiency from our panels as well. With all of these factors in order for a solar system to make sense for us, a 10 kW system would have to be priced at around $10,000 to put the payoff period at under 10 years.

Would you consider investing in home solar power? Do you think the US will have wide scale home power adoption in 5 years, 10 years, 20 years?

Leave a Reply