Does “Project T” In Benton Harbor Make Sense?

In general I am all about development, especially development of new housing. The problem is that often when government has its fingers in new housing projects the cost greatly exceeds what normal economic conditions will bear. I would argue that Project T in Benton Harbor fits this mold. The cost per unit is far above what the market will bear.

What Is Project T?

Project T is a mixed use development consisting of three phases in Benton Harbor, MI located on the former Mercy Memorial Hospital site at the intersection of Empire and Pipestone. It includes 19 Duplexes and a large 4 story mixed use building with 39 apartment units as well as commercial spaces on the first floor. I hope this project is successful. I would in theory stand to gain if it was because I own real estate a block away from this project. I want to see Benton Harbor do well and there to be a greater supply of housing.

I will say the guys doing the work are certainly earning their pay. This early winter has been brutal and they have been making quick progress over there working in extremely unfavorable weather conditions. I also think in general there can be substantial cost savings when building several duplexes over single family homes and when building multiple homes side by side on the same plot of land at the same time, like an assembly line.

The Neighborhood:

This area would be considered a challenged neighborhood. The 7 unit mixed use building I purchased for $36,100 is in this neighborhood the next block over. There are 4 abandoned commercial buildings in eyesight of this location. Here are some examples of single family houses that have sold in this area recently.

680 E Empire: 3 Bedroom 2 bath 1,329 sq. ft $100,000: This is the upper end of home sales in this area. The home has hardwood floors and is move in ready.

970 Bishop: 3 Bedroom 2 bath 1,392 sq ft $84,900: This house has recently been flipped with new carpet, bathroom, and furnace.

1039 Hurd: 2 Bedroom 1 bath 792 sq ft $75,900: New paint and carpets.

813 Pipestone 5 Bedroom 3 bath 1,875 sq ft Duplex $100,000

The Numbers:

Project T is going to have a total of 19 duplexes and 39 apartment units for a total of 77 residential units. There will also be commercial space that appears to be 1/4 of the commercial building space, taking up the first floor of the 4 story building. The total overall price tag is estimated at $23 million.

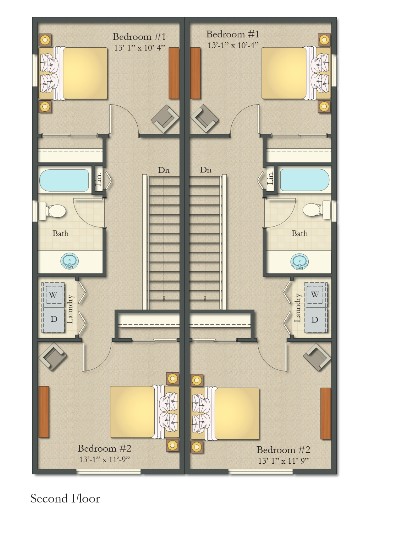

Phase 1 of the project is expected to cost $8.1 Million and includes the construction of the first 14 duplexes. Mathematically this is $578,571 per duplex and $289,295 per side of the the duplex. The total square footage for this phase is 34,130 sq ft, which would give an average of 1,219 square feet per unit and a cost of $237 per square foot.

If we use these numbers as a baseline for the remaining 5 duplexes that will be built, we have $2.9 million going to those, leaving $12 million available for the mixed use building. If we put 1/4 the cost on the commercial space this is $3 million and the remaining $9 million can be broken down across the 39 apartments. This works out to $230,769 per apartment.

These duplexes also face directly to single family homes that on average are worth around $75,000. It is certainly questionable to build $578,000 homes, or $289,000 homes however you want to look at it, in an area where the average home is $75,000.

Selling The Duplexes:

The plan is to sell the duplex sides separately. This is not a common model in our area. If we agree that no profit will be involved, then the cost for 1 side of a Duplex to purchase is $289,295. Closing costs on the low end will be around $6,000 so we are up to $295,295 for a 2 bedroom 1.5 bath side half a house. These homes do not have a basement.

Mortgage: Assuming an FHA loan with 3.5% down, and paying cash flor the closing costs, we have a down payment of $10,125 and $6,000 of closing costs with a loan balance of $279,170. Using a 30 year mortgage at today’s average rate of 6.25% we get a mortgage payment of $1,718.90. But wait, there’s more!

Mortgage Insurance Premium: FHA charges a .55% MIP for loans that a 30 years in length with a down payment of 5% or less. This is $127.95 per month.

Benton Harbor city has the highest property taxes in the county. A owner occupied home with a value of $289,295 would have a monthly property tax bill of $536.67. This is only if the taxable value is set at the purchase price. I purchased a home a couple years ago that the city set the tax assessments at over double what I paid for it. What if the city says these properties are worth $400K each? Several hundred dollars a month will be added to the payment.

I will add in $80 per month for home owners insurance.

- Purchase Price: $289,295

- Down payment and closing costs: $16,125

- Loan Balance: $279,170

- Mortgage: $1,718.90

- Mortgage Insurance: $127.95

- Property Taxes: $536.67

- Insurance:$80

- Monthly Payment: $2,463.52

Here’s what makes this worse. These are supposed to be homes to target “The missing middle” and are to be sold to families who earn between 60% and 120% of the area median income. 60% of the area median income for a family of 3 is $47,100 and 120% is $94,200.

A household with an income of $94,200, the top end of this range, and no debt payments at all, would ALMOST qualify for this loan, with 31% of debt to income being $2,433.50.

For someone at the lower end of this range with no other debt payments at all, they could only qualify for $1,216.75. This makes this only feasible for the top end of this range.

Now we have to ask ourselves, would someone who earns $94,000 a year, (which by the way is 3 times the median household income for people living in Benton Harbor city) want to live in this location? Especially with also having to pay city income tax of 1% on their income?

We will see what happens when they get listed. The most likely scenario here is that the sale prices will be greatly reduced and the tax payers will have ultimately paid a large portion of the cost to construct these homes.

Update: 1/28/2026:

As of today on the Project T Website they are advertising 2 bedroom Duplexes for sale for $173,990 and 3 bedrooms for sale for $192,990. This means that somewhere, someone else (taxpayers) is effectively paying $100,000 per unit to subsidize these. I still think even at these levels that the numbers don’t make sense.

Going after the 2 bedroom, the numbers would be as follows:

- Purchase Price: $173,990

- Down payment: $6,089

- Closing Costs: $6,000

- Loan Balance: $167,901

- Mortgage: $1,033.80

- Mortgage Insurance: $76.95

- Property Taxes: $322.75

- Insurance:$80

- Monthly Payment: $1,513.50

By comparison, this recently redone 4 bedroom house with a large private yard was just listed for $159,000

You can also look at the $165,000 3 bed 1 bath home in Sodus, MI on 3/4 of an acre this past summer. Oh and property taxes in Sodus, well property taxes everywhere in Southwest MI are lower than Benton Harbor city. For an owner occupant property taxes would be $164.25/mo in Sodus for this house, compared to the $322.75 for the Project T duplex.

What About The Apartments?

At a cost of $230,769 per rental apartment the numbers here are even more difficult.

If we assume no profit is sought here and the financing is arranged with $0 down, then the financing cost of the apartment on a 30 year amortization is $1,420.88 per month. We don’t have additional mortgage insurance, but property taxes are higher here because the property is not owner occupied. The property taxes are $602.92 per month. Let’s assume $50 per month for insurance. We are not calculating any landlord provided utilities, vacancy, property management, or maintenance, and we are already at $2,073.80 per month, and that is also with no profit for the operator. This is $300 more than the high end apartments Whirlpool built in Benton Harbor next to across from their Benton Harbor campus. Adding another 20% to account for utilities, property management, vacancy, and maintenance would bring the rental price up to $2,488.56/mo, and that is still with no profit.

What About The Commercial Spaces?

In the mixed use building we are looking at 13 apartments per floor for floors 2 through 4, and floor 1 would be commercial spaces. I will assume that each apartment is roughly 700 square feet. This gives 9,100 total square feet of commercial space. The $3 million cost for the commercial spaces on a 30 year amortization, would be $18,471 at the 6.25% interest rate. The $3 million valuation would result in $7,837 of property taxes owed per month. Just to cover the debt service and the property taxes the rent per square foot per month would need to be $2.89. Since commercial spaces are rented on a yearly rate this would be $34.68/sq. ft per year. This is more than twice what most turnkey commercial spaces in St. Joseph rent for, and more than 3 times what I have been able to get a block away.

The Bottom Line:

So NO. From a market perspective this project is absolutely mal-investment. It is not remotely possible for this project to be economically feasible. No one who would live in this area could afford $2,500 or even $1,500 for rent. Same for a $290,000 half a house. Economically it only works if someone else is paying for it.

Oh That’s Right: The Taxpayers Will Pay For It

In 2023 The State of Michigan Awarded $2.6 Million to this project. According to a Moody on The Market article, the over $2.5 Million dollar award from the State of Michigan was only for phase 1 of the project. If we subtract this cost from the $8.1 Million cost of this phase then we have $5,600,000. Across 28 units is still $200,000 per unit, more than two times what the average house in this area sells for.

Now let’s talk about how the State of Michigan got this money. The funding for the “Missing Middle” housing program came from the American Rescue Plan Federal Funds. It’s all part of the $2 Trillion+ the feds printed which caused the inflation which is why housing prices and rents (and everything else) has gone up in price.

What Will Happen With Project T?

It will be interesting to see what happens with this project as buildings reach completion. I will keep tabs on the listing prices and sale prices of all of these duplexes, as well as any development I can find on how the property taxes will be handled. I would expect the first listings for homes to pop up in the spring.

What do you think about Project T?

Leave a Reply