The Cheat Sheet To Financial Independence

Personal finance seems to be very complicated and there are mountains of books to read on it. Heck, I’ve written 384 articles on personal finance! Personal Finance is rarely taught in school and for the most part people don’t know where to start. Retirement seems like a pipe dream to many and early financial independence seems like crazy talk. I’m writing this article because the basics of financial independence are really easy, and you can always fine tune later. The cheat sheet to financial independence is my way of showing that with just this article you can be on your way to financial independence without reading 25 books and taking a college course. The cheat sheet to financial independence will get you started on your journey.

Way back in the day before cell phones it was common for students to get by on an exam by filling out a small cheat sheet or crib note. I think the statue of limitations may be up on Jr. high exams for me, so I’ll go ahead and admit that I may have made a set a time or 2. Anyways the goal was to put an entire semesters worth of knowledge onto a small piece of paper that could be easily hid up a shirt sleeve and dropped into the palm of the hand. Typically around a 2″ X 3″ block. Summarizing so much information into this sheet was difficult, and of course you walked a fine line between writing super small and being able to read it at a glance without being discovered. While going through the process of trying to cheat on these exams I learned a few really important skills:

- I learned to prioritize. You can’t put everything on the cheat sheet. The textbook has 300 pages printed on both sides that are 8.5″ X 11″. My cheat sheet has a total of 12 square inches. It’s not all gonna fit. I learned to prioritize the items that were most important and the items that would spark me to remember details about other items. This type of prioritization has greatly helped me with financial planning and with my job at work. One of my jobs is to take the tasks that 75 people on my shift completed and worked on in a 12 hour period of time and condense it into half a sheet of paper that I can communicate in 5 minutes.

- I learned the material by prioritizing it and writing it down. First I had to read through the book, then think about what was important, then write it down, and often I made a 2nd draft of the cheat sheet for neatness or to reorganize it. Writing it down twice caused most of the information to get locked in my brain.

- I learned I didn’t need the cheat sheet. By only committing the big stuff to my long term memory I was able to pass the tests, without using my sheet. I would often score in excess of 80%, although I rarely got 100%. That’s OK. in personal finance most of us are getting 0-10%, so getting 80% puts us in an amazing position. This is the Pareto principle at work. The Pareto principle states that 80% of the results come from 20% of the causes. Doing 20% of the work, and the right 20% of the work towards financial independence will get you 80% of the way there. You don’t need to know everything, you don’t need a degree in math or finance, and you certainly don’t need to dedicate your life to money to make it happen.

What’s really great about personal finance is that there is no final exam. Every day is a quiz and we need to strive to do a bit better every day. I encourage you to after reading my cheat sheet, make your own and then ask yourself if you are doing the items on the list or are you just letting your money situation happen to you?

My Cheat Sheet To Financial Independence:

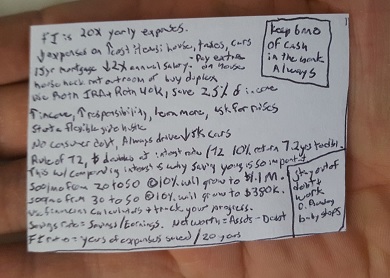

Cheat Sheet To Financial Independence Side 1:

- FI is 20X yearly expenses

- Lower expenses on high cost items houses, taxes, cars.

- 15 year mortgage less than 2X annual income, pay extra on house.

- house hack rent out room or get a duplex.

- Use Roth IRA and Roth 401K save 25% of income for 25 yrs.

- Increase income, increase responsibility, learn more, ask for raises.

- Start a flexbile side hustle.

- No consumer debt, always drive sub $5K cars.

- Rule of 72, $ doubles at interest rate divided by 72. 10% return 7.2 years to double.

- This with compounding interest is why saving young is so important.

- 500/mo from 20 to 50 @10% will grow to $1.1M.

- 500/mo from 30 to 50 @10% will grow to $380K.

- Use financial calculators to track your progress.

- Savings rate = Savings/Earnings. Net Worth = Assets – Debt.

- FI Ratio = years of expenses saved / 20 years.

- Keep 6 months of cash in the bank Always.

- Stay out of debt and work the Dave Ramsey baby steps.

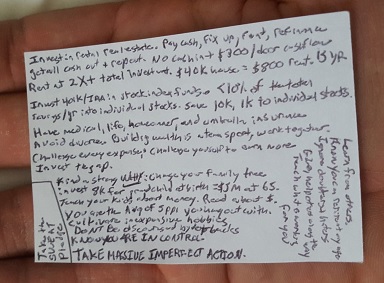

Cheat Sheet To Financial Independence Side 2:

- Invest in rental real estate. Pay cash, fix up, rent, refinance, get all cash out and repeat.

- No cash in + $300+/mo per door cash flow 15 year mortgage.

- Invest 401K / IRA in stock index funds. <10% of total savings.yr into individual stocks.

- $10K saved, $1K in individual stocks.

- Have medical, life, homeowner, and umbrella insurance.

- Avoid divorce. Building wealth is a team sport, work together.

- Challenge every expense, challenge yourself to earn more, Invest the gap.

- Find a strong WHY. Change your family tree.

- invest $8K for your grandchild at birth = $5M at 65.

- Teach your kids about money, read about money..

- You are the average of the 5 people you hang out with.

- Cultivate inexpensive hobbies.

- Don’t be discouraged by setbacks.

- KNOW YOU ARE IN CONTROL.

- TAKE MASSIVE IMPERFECT ACTION.

- Take the SWEAT pledge.

- Learn from others.

- Know you can retire at any age.

- Ignore doubters and haters.

- Give, help others on the way.

- Teach others what is working for you.

My goal is to help as many people as I can see that we don’t have to be wage slaves for 45 years to maybe enjoy 5 to 10 years of penny pinching retirement while living off of Social Security. There are ways to give ourselves more options and resources. It’s not easy, but it can be simple. What actions are you going to take this year, this month, this week, this day, this hour to give yourself a better life?

What do you think about this cheat sheet to financial independence? What important items did I leave out?

Leave a Reply