Avoiding An Obamacare Penalty

It’s tax time and many supporters of Obamacare are now waking up to realize that the government take over of the health care system is costing them hundreds, if not thousands of dollars. I am extremely frustrated with this system, because it is very easy to end up owing a fee if you aren’t careful. Despite my planning, I ended up owing a fee for this year. I am taking action to ensure I will not owe a fee in 2016, and you should as well.

Paying An Obamacare Penalty #1: No Insurance

I have a total household of 6 people. All of us have insurance, HOWEVER, my oldest son, who was covered by Michigan medicaid at the beginning of the year had his case shut off, without any communication to us whatsoever. We had even taken him to the doctor and used his medicaid card without an issue. When we got custody of our nephews and had to add them to our insurance, we found out that our oldest had actually been without insurance for 6 months! We were able to immediately fix this and figured it would be no big deal….boy were we wrong.

Last month when we received out health care year end forms it showed him having 6 months without coverage. Obamacare allows up to 3 months of not being covered, but past that you will owe a fee. I knew we would have to pay a penalty on this, but I figured it would be prorated based on the number of people in out household, after all fairness was the ideal that Obamacare was founded on, right? Well, it doesn’t work that way. If ANY person in your household doesn’t have insurance, you are fined on your total household income, which means even though 5 out of the 6 of us had insurance all year, because one of us didn’t have insurance for over 3 months, we pay the same fee as we would have if all 6 of us didn’t have insurance, which is crazy.

How Is The Obamacare Penalty Calculated?

With the Obamacare penalty you either pay a flat fee based on the number of uninsured people in your household, OR 2% of your AGI, whichever is greater. I think this is a problem in how things are calculated because the first option recognizes that the penalty should be based on the number of people covered, but the second option doesn’t reduce at all based upon that. For 2015 the flat rate for an adult is $325 and the flat rate for a child is $162.50.

Obamacare takes your household Modified AGI and subtracts the minimum filing amount from it. This number is then multiplied by 2% to get a full years fee. They then multiply it by the percent of months that insurance was not held for, in my case since it was 6 months the multiplier was .5. For us the math was close to this

Gross Taxable Income: $67,973

– HSA and IRA contributions: -$14,920

Adjusted Gross Income (AGI): $53,053

– Minimum Filing Threshold: -$20,600

Income Subject to Penalty: $32,453

Multiplied by 2% : $649.06

# of months multiplier (6/12 = .5): $324.53

For 2016 the penalty rises again. In 2016 the flat rate is $695 per uncovered adult and $347.50 per uncovered child. The percent of income fee jumps to 2.5% as well. You DO NOT want to pay a fee in 2016.

Obamacare Penalty #2: Re-Payment of Excess Tax Credit Premiums:

Risk 1: Underestimating Your Income:

A major part of the Obamacare system is the pre-credit based on your projected income, in order to make the monthly health insurance premiums “affordable”. The problem is if you estimate too low, you will end up owing in at the end of the year a decent chunk of money. One of my friends mis-estimated by around $10,000 which ended up causing him to pay in over $1,200 at the end of the year. I think that the best solution, other than repealing the law, would be for the 2016 rate to be based on 2015 income. This would eliminate the need for people to estimate their income and potentially fall into this trap.

It is imperative to do a thorough job estimating your income for the Obamacare subsidies. I make a low and high estimate of my income, then subtract out how much I will be able to put into HSA/IRA/401K accounts based on those income levels and then give the highest projected AGI to the marketplace. This keeps me legal. For 2015 I estimated $53,500 for AGI and we came in a few hundred dollars under this. Because we earned more money than our projections, I did the math and made an extra contribution to our retirement accounts to be in line with the AGI we gave the marketplace so we would avoid the jump in premiums and the back premiums we would have owed at tax time. Despite doing all of this, I STILL ended up owing a $600 fee. How is that possible?

Risk 2: Having Insurance For Under The Full Year

Well all of the calculations that go into how much you are supposed to pay for insurance are based on a full year, and since we only had the Obamacare insurance through the exchange for 6 months, they made their calculations on a yearly basis, without taking into account premiums I had paid to a private insurance company.

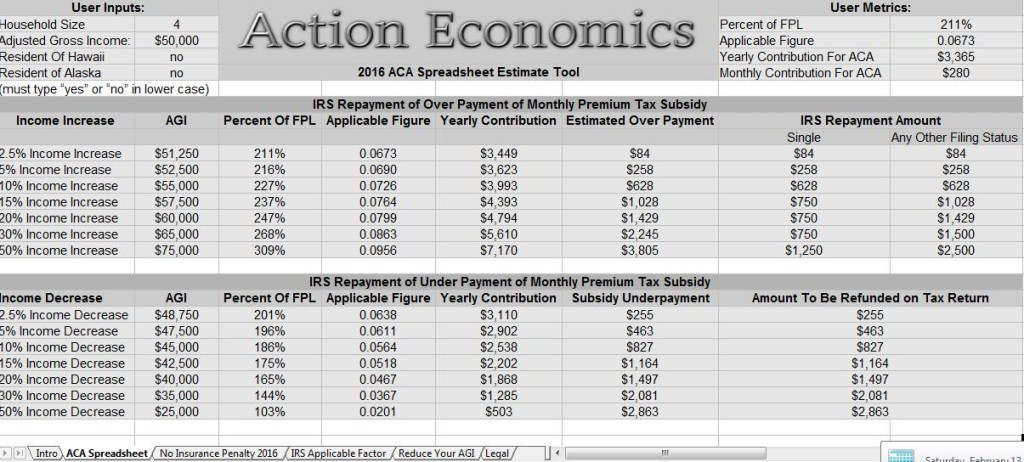

To determine your tax credit subsidy, the first thing the ACA does is look at your AGI and your household size to determine your income as a percent of the federal poverty level. Next they determine your expected contribution to premiums for the year based on this amount. If Obamacare shows that you are expected to contribute $2,400 across the year they will have you pay $200 per month in a premium and the rest will be covered by the tax credit pre payment, which is based on the second lowest cost silver plan. If you get a cheaper plan your premiums will be under $200 per month and if you get a more expensive plan your premiums will be higher. What happens when you have insurance for less than the full calendar year is that you don’t reach the expected contribution level. Using the above example of a $2,400 yearly expected contribution, for 6 months we would only pay $1,200, resulting in a $1,200 under payment, even if our income didn’t change.

The ACA limits the amount you have to pay back based on your percent of the Federal Poverty Level. For households under 200% of the FPL the maximum repayment is $300 for single filers and $600 for all other filers. For households under 300% of the FPL to maximum repayment is $750 for single filers and $1,500 for all other filers. For households under 400% of the FPL the maximum repayment is $1,250 for single filers and $2,500 for all other filers. For households over 400% of the FPL, there is no maximum repayment amount. Whatever amount is calculated as being owed is what has to be paid.

Chances are that if you owe an Obamacare penalty they will automatically adjust your information to reflect your earnings for the current year.

Action Steps:

1. If the Obamacare marketplace puts your children into a medicaid or CHIP program call every couple months to verify that they have coverage. I didn’t do this, because I didn’t think I needed to. Obviously this was a mistake. I think it is more likely to have a dropped coverage issue for children in a blended family, but I don’t know. It doesn’t hurt to call them. Make damn sure they have your proper phone number and mailing address as well.

2. Sign up for health insurance if you haven’t yet. Once you hit 3 months of being uninsured you owe the penalty, don’t let that happen to you! Try to keep your AGI under 250% of the Federal Poverty level to get lower rates, and look for a low cost bronze or silver high deductible health care plan to pair with an HSA.

3. Project your income, and report your AGI to them. Make sure you include the deductions of your 401K, IRA, and HSA when applying for coverage. Make a spreadsheet to give your best educated guess on your AGI to them. If something changes and it looks like you will earn more money, then update your marketplace profile to reflect this. Yes your monthly premiums will go up, but they will go up anyways! This keeps you from having to pay a big chunk at the end of the year.

4. Vote them out. Every single person who supports Obamacare needs to be removed from office. Every last one of them. Obamacare has caused millions of Americans to have their hours reduced from 40 hours per week to only 25 – 30 hours per week. Could you stomach a 25%+ pay cut? Obamacare has increased the cost of health insurance for all of us, complicated our finances and taxes greatly, and has made the whole country dependent on and obligated to participate in an expensive, unresponsive, and obtrusive government program.

5. Download our free ACA Health Care Spreadsheet to calculate out your estimated expected contribution and to see what will happen if your estimates on income are off either up or down, and to calculate the penalties that would be levied on you for having no insurance.

Did you have to pay an Obamacare penalty this year? How much did it affect your finances?

Leave a Reply