American’s Hit A 33% Savings Rate! What?!?!

A report issued last week shows that the US savings rate has skyrocketed to 33% for the month of April. This is an increase from the 13.1% it was in March and the roughly 7% to 8% throughout the past year. The savings rate is calculated on after tax income. OK, with such a large spike what the heck is happening here?

People are afraid: When people are afraid they stock pile cash. This is pretty simple. We don’t know if we will have a job next month, or even next year. Between the Corona virus itself, the lock downs, the protests, and massive bankruptcies across businesses of all sizes there is certainly cause for alarm. When future income is uncertain people save more money. Rather than investing it or spending it, we are storing it for a short term war chest, as we should be. In a country where the majority of our adult population can’t cover a $1,000 emergency this is great news to see us bulking up our savings accounts.

People can’t spend money: Restaurants are closed, attractions are closed, theaters are closed. Huge segments of our economy are shut down so for a lot of people who are still employed their opportunities to spend money are much less and they are accidentally saving money because they can’t spend it. I hope that people realize how much money they have been spending on frivolous stuff all along and when the Corona Virus is a distant memory will adjust their spending habits accordingly. I’ve talked to people who have retained their jobs, but due to not spending money have saved over $10,000 since the lock down began without trying! This is amazing.

Stimulus checks deposited: People deposited their stimulus checks in the bank. Not everyone ran out and spent the money right away. This is another good sign that we are delaying gratification and keeping that one time payment as an emergency fund to get through tough times if needed.

Keep Our Savings Rates At 33%!

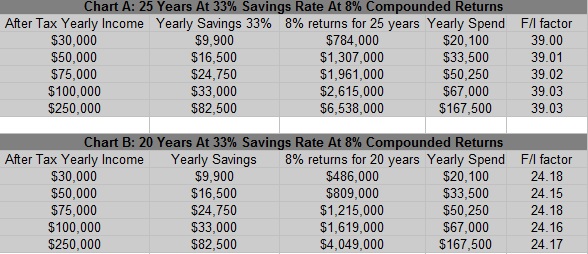

If we can do it for 1 month, why not try a year? 10 years, 25 years? I’ve advocated shooting for a 33% savings rate for a long time. If invested at 8% returns (typical for a total stock market index fund over the past 50+ years) For most people a 33% savings rate over 25 years would mean being financially independent and having plenty of resources for retirement. Here’s some fun charts I made:

Looking at chart A:

If you save 33% of your after tax income and invest it in something like a total stock market index fund earning an 8% compounded rate of return, after 25 years you will have amassed 39 times your annual spending. This is far more money that even the most conservative financial planners recommend. The FI factor here is how many years of annual spending you have saved. Most people follow what I believe is a hyper conservative 25X rule, where you save 25X your annual spending. With this model withdrawing 4% per year would replace your annual spending and it is highly unlikely you would ever run out of money. Since 39X annual spending is really high that means we can hit financial independence even sooner than 25 years with a 33% savings rate.

In Chart B I reduced the timeline to 20 years, leaving everything else the same. This resulted in 24X annual expenses, which is right on target for the 4% withdrawal rate. I personally am comfortable with a 5% withdrawal rate, which would be a 20X FI factor. Bottom line: Saving 33% of your income for 20 years should result in you becoming financially independent.

BUT WAIT, THERE”S MORE!

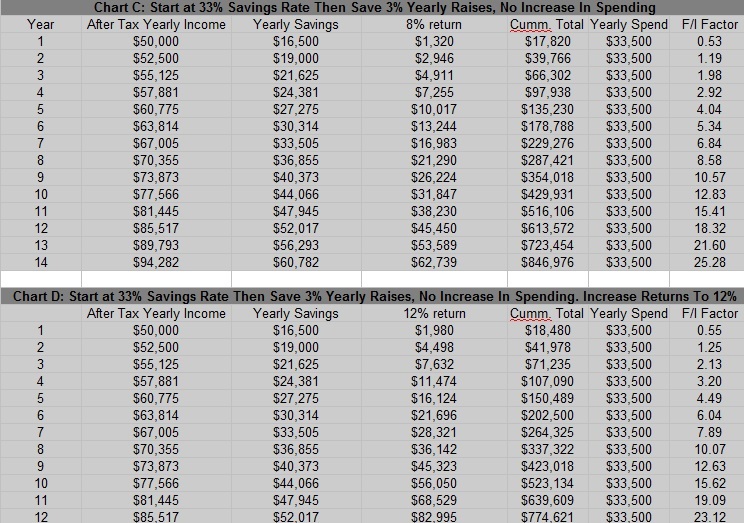

Who makes the exact same amount of money every single year? Most people have incremental increases in their pay every year. Unfortunately most people spend every bit of these increases, and sometimes more. If you are able to consistently save 33% of your pay falling into this wage slave trap is unlikely. I made Chart C to show the progression of this, with a starting after tax income of $50,000. If you earn 3% annual raises, and never increase yearly spending, then you will hit the conservative 4% withdrawal rate of 25X spending in just 14 years! 13 years if you are comfortable using a 5% withdrawal rate.

We have one more variable to look at on our way to Financial Independence and that is the rate of return. 8% is all well and good, but many stock market mutual funds have well outperformed this over several decades. If you also throw in a bit of cash flowing real estate rental investing into the mix, your combined returns could easily exceed 12%. I made Chart D to track this. Doing everything the same as above, but with 12% returns you will hit my FI number of 20X expenses in just over 11 years.

If you save 33% of your income over the long term you WILL BECOME financially independent, the question is only how long will it take. Most likely it will be somewhere between 11 years and 20 years. This is a very short time frame considering most people have a working career of 45 to 50 years. If you can do it for a month you can do it for a decade. Get motivated, find your WHY, and keep building your savings! Here’s another article on HOW to increase your savings rate and WHY if you are struggling to get there.

What do you think about this unprecedented drastic change in the US Savings Rate? Can we maintain it?

Leave a Reply