Paying A Large Medical Bill

Let me start this off with my aversion to doctors. I hate going to hospitals and to doctors. Generally speaking I will do anything to avoid going to the hospital. In my life I have gone to a doctor 4 times for an injury: When I was 12 and broke my arm, when I was 15 and broke my leg, when I was 19 and put a nail through my hand at work, and for the incident described below. I certainly am against using an emergency room as primary care, and in the long run it would be ideal to have 24 hour urgent care clinics.

How I Injured Myself

Back in November when I got off work one night I started making my plate for dinner and I tossed a roll of aluminum foil from one counter to the other counter. When I tossed it the serrated cutting edge ran across my pinky finger and cut a deep gash into my finger, most of the inside finger tip was hanging by just one side, basically the entire area where my finger print is. Needless to say it bled profusely, then the next two concerns were loosing that chunk of meat off my finger and infection. Sorry, I didn’t save any pictures from this.

Choose An Urgent Care Clinic To Avoid Paying A Large Medical Bill

In my town an Urgent Care clinic called MedExpress had just opened up that week, however they closed at 8pm and this event happened around 9pm, leaving me 2 options, go to the hospital or do my best to self care. I was fairly concerned about loosing that chunk of my finger and I really couldn’t afford to miss work the next day to go to a primary care doctor (12.5 hour shift all time and a half), so I decided to go to the hospital.

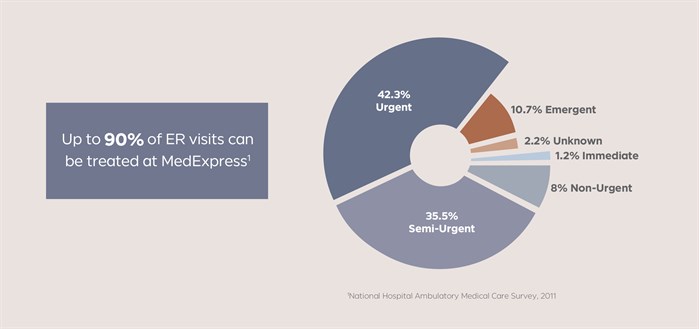

Urgent care clinics are extremely useful and can cut down medical costs substantially while alleviating pressure on hospitals and emergency rooms. In 2013 the average cost of an urgent care visit was $155, while the average emergency room visit was $1,423. According to the National Hospital Ambulatory Care Survey a full 90% of ER visits could be treated at an urgent care clinic. Too bad the one in my town closes at 8pm. It’s certainly a good idea to learn about the urgent care centers in your area, their hours, and what they are capable of treating.

My Visit To The Hospital

When the doctor came in to check out my cut he said that he would need to put in 3 stitches, which I had figured I would need some stitches. I’m not entirely sure how the hierarchy goes at a hospital, but he had a more senior doctor take a look at it. This doctor said that they could try to use steristrips instead of stitches. It might not heal as pretty, but would save me from having to go back to a doctor to get the stitches removed and would cost a bit less. I went for this option. They cleaned out the wound, put the strips in place and gave me a tetanus shot, as the last one I received was over 10 years ago (when I put that nail through my hand at work when I was 19).

How much do you think a tetanus shot, a couple sani-strips and some super glue costs? My total bill came to $854.95 The insurance got the cost knocked down to just over $561.01.

Paying A Large Medical Bill:

Because we have a fully funded emergency fund this is only a minor setback, but it wasn’t too long ago that this would have been a really difficult bill to pay. Hospitals want, and need to get paid for their services in order to remain in business, so they will work with patients in order to find ways to help them pay their bills. Although my bill states that I must pay in full by 2/5/17, I did some research and found some ways that if I needed extra help, they could provide some. Here are some of the options my local hospital offers:

1. Sign up for Medicaid: The hospital will help customers sign up for medicaid. Although you may think you don’t qualify, with the recent medicaid expansion in many states it is possible that you now do qualify. Medicaid is issued retroactively for 90 days, so treatment received for your hospital visit would be covered, even if you signed up after the bill came.

2. Payment plans: Most hospitals will offer 0% interest on a short term payment plan, generally 3 – 6 months. In my case a 6 month payment plan would be $93.50 per month. That is much easier to handle than a one time unexpected $561 expense, especially since 2/3 of Americans can’t cover a $1,000 emergency.

3. Outside financing: HELP: The Help Payment Plan offers 0% financing for 12 months, followed by 8% financing on the remaining balance after the initial 12 months. HELP Financial Corp. is essentially a credit company, but the interest is low. Spreading my payment out over 12 months interest free would make it $46.75 per month.

4. Financial assistance: part, or all of the payment may be waived by the hospital based on income as a percentage of FPL (Federal Poverty Level) and assets. The hospital doesn’t reveal what exact formula they use, but anyone can fill out the form, it never hurts to try!

Other Options:

Health Savings Account: I’ve built up a health savings account over the last 3 years, although I have dipped into it several times to cover dental expenses. I could have used our HSA for this, however I really want to preserve that money as a retirement account, and pay cash for current medical needs.

Credit Card Financing: This is a last resort, but it is much better than having a bill sent to collections because you can’t come up with the full amount. Many credit cards offer a 0% introductory rate for 12 months. For an already existing card chances are the APR is around 20%. On a $500 bill this would amount to $100 in finance charges across a year if no payments were made on the balance.

Lessons Learned:

If at all possible go to an urgent care clinic. They can handle 90% of ER visits. For things like head injuries, trouble breathing, chest pain, or amputations go directly to the ER. Virtually everything else the urgent care clinics can handle. I had no idea that they could handle broken bones until I did a bit of research for this article.

Keep your Tetanus shot up to date. The hospital charged $124 for my tetanus shot, which costs $25 at my county health department at full price. You should get a Tetanus booster every 10 years.

Keep Steri-strips at the house in your medical kit. These things are amazing. They held the wound closed really well.

Don’t get injured at the end of the year: This hospital visit counted for 2016 on my insurance even though I didn’t receive the bill until 2017, so it went towards the 2016 deductible, which we didn’t meet. For 2017 we have a lower deductible and it would have been nice to be able to have this bill go towards it.

Have you ever had to pay a large medical bill? How did you finance it?

Leave a Reply