The Neglected 20 Year Mortgage

Everyone talks about mortgages as either a 30 year or a 15 year fixed rate mortgage. The 30 year mortgage is for those who see mortgage debt as “good debt” and are fans of the mortgage interest tax deduction. The 30 year mortgage also allows for the smallest payments. A 15 year mortgage on the other hand comes with a lower interest rate but a much faster amortization. The 15 year is often used by people who are not fans of debt, and is often touted by Dave Ramsey as the only acceptable form of debt. 15 year mortgages typically have a substantially larger payment then a 30 year mortgage. It boggles my mind why the middle ground between the two is often ignored. I think the 20 year mortgage is a great way to finance a home.

By The Numbers:

Here is a breakdown between a 15 year, 20 year, and 30 year mortgage, using current interest rates and a $100,000 loan amount.

The payment for a 20 year falls almost exactly in the middle of the payment of a 15 year and a 30 year. For many people the monthly cost of a 15 year may be a bit too much, but a 20 year may be doable. Essentially with a 20 year mortgage you get 2/3 of the time off the mortgage for 1/2 the cost compared to a 15 year! A 20 year gives 5 more years to spread out principal payments, but still manages to cut off 10 years of interest. Although the interest rate on a 20 year mortgage is not as low as that of a 15 year mortgage it is considerably less than a 30 year mortgage.

Refinancing:

20 Year mortgages are great for people who are refinancing their home. Although there are a few lenders who will refinance for any length of time, in order to keep homeowners from extending their loans when refinancing, they are few and far between. It may be possible for someone 5 years into a 30 year mortgage at 5.25% to refinance into a current 20 year mortgage without increasing their payment. A $100,000 mortgage at 5.25% would have a payment of $552; 5 years in a total principal balance of $92,149 would remain. At a 3.875% interest rate on a 20 year loan the payment would be $552. Effectively performing this refinance would shave a total net of 5 years off a mortgage with no change in the payment. Home owners with a higher interest rate could even see their payments decrease when switching to a 20 year mortgage.

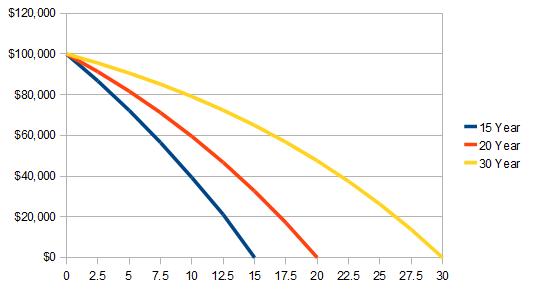

Amortization Comparison:

At 7 years into the loan:

- the 15 year has a balance of $59,782

- the 20 year has a balance of $73,368

- the 30 year has a balance of $86,305

Once again, the 20 year mortgage ends up exactly in the middle of the 15 year and the 30 year. Over the long term, the 20 year mortgage amortization hugs closer to the 15 year than to the 30 year, since it finishes closer to the 15 year.

What about the Mortgage Interest Deduction?

Since the 20 year mortgage amortizes at a faster rate with a lower interest rate, the amount of interest paid every year will be substantially less than that of the 30 year mortgage. For most middle class earners taking the standard deduction makes more sense than itemizing deductions. In order to get a tax break due to mortgage interest paid, the total for all itemized deductions for a married couple would have to be over $12,400, only the deductible amount over this level does the taxpayer any good. Due to this, the home mortgage interest tax deduction goes primary to high earners. Beyond the fact that the mortgage interest deduction does no good for most middle class workers, the deduction gives you a percent of what you pay the bank. If you are in the 15% tax bracket, for every $1 you give the bank in interest, you can get a 15 cent tax deduction, I think I’ll be happier with the dollar.

What are your thoughts on home financing with a 20 year mortgage?

Leave a Reply