Maximize Your Employee Stock Purchase Plan

The employee stock purchase plan, also known as an ESPP is an excellent wealth building tool offered by employers to encourage employees to have a stake in the company. On average the plan looks something like this:

You select a certain amount of pay to contribute to the plan and it is taken out of your paycheck. The company then buys the shares at the end of the quarter, at the price of either the start of period or end of period, whichever is lower, and with a 15% discount. Typically ESPP plans limit the worker to a certain percentage of their income, usually around 10% to 20%.

Employee Stock Purchase Plan Example:

Jason joins his employee stock purchase plan with a $20 weekly draw from his paycheck. Over 12 weeks, he has contributed $240. On January 1 the stock price was $15 per share, by March 31 the stock price has risen steadily to $22 per share. Jason gets his shares at a price of $15, but he also gets a 15% discount, which takes the share price down to $12.75. He is able to purchase 18.8 shares on March 31st. Had he just saved up money on his own and invested at the end of the period, he would have only been able to buy 10 shares. This is even better than long term dollar cost averaging.

Taxes

Most ESPPs require you to keep the money in the account for at least a year. This works out great because if assets are held for a year or more those workers within the 10% and 15% bracket owe no capital gains tax. Because of this, I think it is a great idea to withdrawal the available balance every year to fund your Roth IRA, HSA or traditional IRA. Essentially you get a minimum of a 15% gain, and most likely a substantially larger gain since you get the added benefit of the buying at the lower price at either the start of the quarter or the end of the quarter.

My Experience With An ESPP

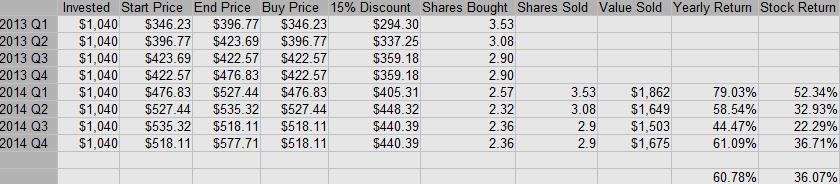

Mrs. C’s former employer offered an employee stock purchase plan and we participated in it for a short while. Using the data plan specs and the historic share price of the company, IF she contributed to the plan $80 a week in 2013 from Jan 1 to Dec 31, she would be eligible to start taking out invested money at the end of the 1st quarter on 2014. Here is a chart showing how well this would work:

As you can see each quarter she essentially invested $1,040. When she started to withdrawal the money a year later she had withdrawals of $1,862, $1,649, $1,503, and $1,675. These returns averaged 60.78%. Some of this return is from the 15% discount, some is from getting the lower price of start and end of the quarter, and some of the return was the appreciation of the stock. The stock average return for those periods was 36.07%. Utilizing the ESPP added a 24% return.

I personally am not a big fan of having money invested in individual stocks, but I am OK with doing so with a limited amount of funds for a limited amount of time. Since the stock is being sold every quarter, the total exposure to one stock is limited to a years worth of investing at the max allowed by the company. This should be a relatively small portion of total net worth, invested net worth, and weekly investments. In my example this is $4,160. The major caution with using an ESPP is to make sure that you stay on top of selling off assets as they become eligible for long term capital gains, and actually reinvesting them elsewhere instead of spending the cash. this is not something that can be set on autopilot. I would hate to set this type of account up, leave it alone and then over time realize that not only do I have a large position in a single stock, but it is also for the company that controls my income; talk about all your eggs in one basket!

Re-Investing:

The key to the re-investment part of this strategy is to use the money to fund a Roth IRA, HSA, or Traditional IRA, then any amount over the IRA/HSA cap into a taxable account. Take the money that was in the ESPP, that you sold as Long Term Capital Gains, owing no tax on, then invest it for the long term in stock index funds. The Employee Stock Purchase plan gives a large leg up in getting a decent first year return on your investment and can repeat itself every year.

Priorities:

Before contributing any money to an ESPP ensure that you are maximizing the 401K match provided by your employer and have an emergency fund in place. Even though an ESPP gives an excellent return, it is not as good as a 50% or 100% match that employers give for 401K contributions.

Action Steps:

- Contribute Max to ESPP

- Sell shares every quarter after they have been held for a year

- Re-invest the money in your IRA/Roth IRA/ HSA or taxable brokerage account

Leave a Reply