What Is The Best Way To Pay Off Your House Early?

I’m often asked, “What is the best way to pay off your house early”. This is a tricky question because it depends on many factors, such as your current savings rate, the amount of home debt you have, and what your yearly cash flow situation is. In general, the more money you can put on the mortgage the earlier in the loan the better. Paying extra on the house should also be done AFTER all other debts are paid off, you have an emergency fund in place and are already saving 15%+ of your income into retirement. I’ve compiled a list here of some of the most common methods people use to pay extra on their homes.

Some Of The Best Ways To Pay Off Your House Early:

Bi-Weekly Payments: This method consists of paying 1/2 of your house payment amount every two weeks. This slightly speeds up the amortization and it adds in 1 extra payment per year because their are 26 2 weeks periods in a year and only 12 months. Typically this will take 4-5 years off of a 30 year mortgage at 4.5% interest. This method is a good starting point, but doesn’t move the needle a ton.

Refinance To A Lower Term: In my opinion this is the best way to “set it and forget it” Refinance your current mortgage balance from a 30 year to a shorter term like a 20 year, 15 year, or even a 10 year. The main downside to a refinance is that it can cost a couple thousand dollars to do so, still if you get a shorter term you will most likely have a lower interest rate and the refinance will eventually pay for itself.

Pay Like You Did Refinance: To avoid the costs of a refinance you could just do the math and figure out what your payment would be on a shorter term and add in that amount.

End of Year Extra Cash: I like to do this because we have variable income throughout the year and the end of the Calendar year is usually a low point for us. Any extra cash we have at this point in time is most likely not needed for immediate priorities and we can throw it on the house.

X% Of Income: For this strategy assign a percent of your income to go towards paying off the house. As your income increases you end up paying more total dollars towards your mortgage.

Invest The Money And Pay It Off At Once: A lot of people worry about “missing out” on investment returns while paying off their homes. Here’s one way to avoid that, keep all the money invested! Instead of sending the extra money to your bank keep it invested in a taxable brokerage account, and then once you have enough in that account sell your positions and transfer the money. Perhaps do this over a couple years to avoid paying capital gains tax. Currently if you are in the 12% tax bracket or below long term capital gains are taxed at 0%. If you are saving aggressively your total gains will be a relatively small portion of the portfolio. This strategy allows you to have easier access to the money if you need it for something else, which can be both a good or bad thing. Of course there is also the risk that during your time frame of investing the market could dip and it may take longer to pay off your home.

How To Come Up With The Money To Pay Off Your House:

Rent Out A Room: Make the house pay for itself! Finding the perfect tenant is key because you have to live with this person like they are a family member. In most markets you should be able to rent out a room for enough money to cover half of your mortgage. Although this is all relative to the market you are in, being in a more expensive market makes this a more appealing proposition. Homeowners in the Silicon Valley area often rent out an extra room for over $1,500 per month.

Rent Out Land / Parking Spots / Garages: I know several people who own large tracts of land that lease out their land to farmers or hunters. I also know a guy who has a pole barn on his property that he rents storage space out of. In bigger cities where parking is a premium you can also rent parking spaces out. Be creative and think of ways that your property can bring you in some extra revenue.

Buy A Duplex And Live In One Side: Some people go this route, which is very similar to the above mentioned plan, except that you get your own space and can sometimes rent out the other unit for about enough money to cover the entire mortgage payment. The biggest setback to this is of course that your tenants live next to you. Also multi-family houses tend not to appreciate over time as much a single family houses do. It may make sense to do this for 5 to 7 years, then sell the place and pay cash for a single family home.

Side Hustle: Is there some extra work you can pick up other than your day job? selling stuff on ebay, cutting hair, mowing lawns, tree trimming, car work, delivering pizzas, driving for UBER, or any other source of income can make a major dent in your house payment. What if you earn enough money from your side gig to effectively double your house payment every month? You could take a full decade off your mortgage!

Tax Refunds: Using your tax refund to pay extra on the house is a great strategy, especially if you find it difficult to save money throughout the year. Some people even chose to have the IRS withhold extra money from their checks so they can get a bigger refund at the end of the year. The average tax refund in America is $3,180 which can go a long way in paying off a house early, especially if it is a lower value house. This strategy is excellent for lower income people with kids who may own a low priced home and receive a very large tax refund.

Auto Transfer From Your Paycheck: If you never see the money to begin with it is a lot easier to save. This works very well for retirement accounts and can work well for your mortgage. Most employers are willing to split your direct deposit into multiple accounts. Have 1 account set up as the extra mortgage fund account and set up a certain percentage (that you increase over time) to go into that account.

The Best Way To Pay Off Your House Early:

The best way to pay off your house early is to buy an inexpensive house! Lenders will allow you to pay over 33% of your gross income per month as your house payment on a 30 year loan. With today’s current interest rates this can be as much as 5 times your yearly income for the price of the house. Live modestly and buy a house that is under 2 times your annual income. A lower priced house is much easier to pay off. Look at it this way, if you are approved to buy a $300,000 home, and instead you buy a $150,000 home, you’ve already saved yourself the hardship of paying off $150,000!

As an example, a family earning $50,000 could be approved for a house payment of $1,338 per month. On a 30 year mortgage at 4.5% interest rate, this would be a $264,000 loan. If this family instead buys a home with a $100,000 loan their monthly payment will be $507 per month. If they simply paid on this home the difference in cost of $831 per month this alone will pay off the house over 22 years early and save $64,838 in interest over the life of the loan. This doesn’t even address the much lower down payment needed and the ability to put that extra money saved on the lower cost mortgage.

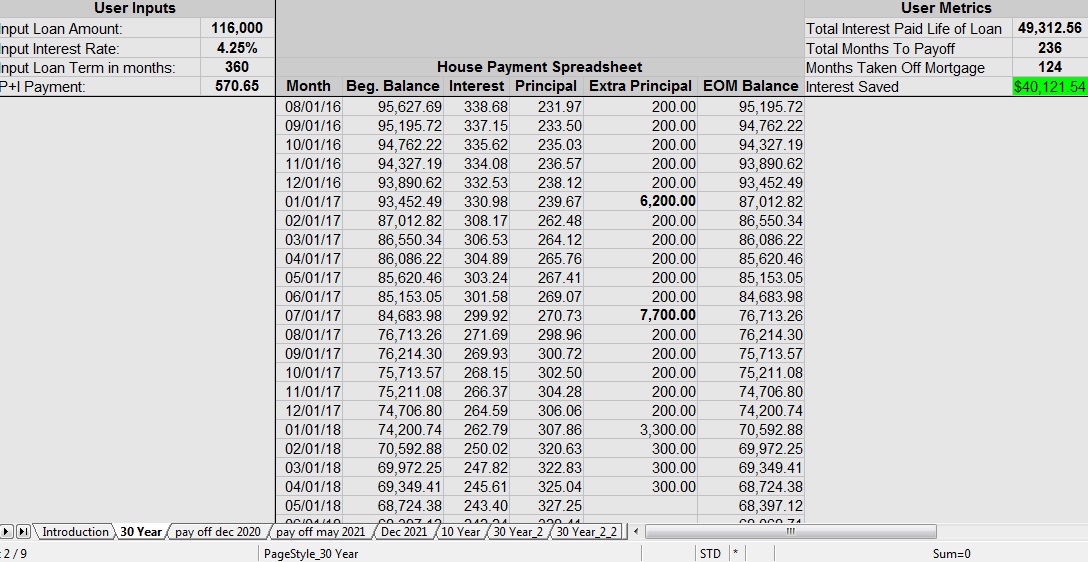

Buying a much cheaper house than what the banks would lend me has been a major factor in Mrs. C. and I being able to make so much headway on our mortgage. So far we have been able to save over $40,000 on our mortgage and have taken a full decade off of our loan.

Tracking Your Progress Paying Off Your House Early:

To me tracking is a major part of keeping up with motivation for such a big task. it gives me a sense of accomplishment to see how many months I’ve take off of my mortgage and how much interest I’ve saved. It also gives me goals to shoot for when I can run different scenarios to see how paying extra will affect my end payoff date. To do this I use my mortgage planning spreadsheet, which is optimized for 10 year, 15 year, 20 year, and 30 year mortgages. It also can compare all of these mortgage scenarios side by side. The best part of this spreadsheet is that for every month you can enter different amounts for extra principal, which is something online calculators can’t do.

What do you think is the best way to pay off your house early? What strategies are you using / have you used in the past?

Leave a Reply