I’m 45 With No Retirement Savings…Now What?

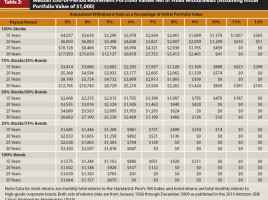

If you haven’t saved much for retirement and are past 40, you aren’t alone. The median balance of 401K savings for people 35 to 44 is right around $24,000. It is best to start a nest egg earlier, however we have no control over what has already happened and there …