American Housing Expenses Are Insane

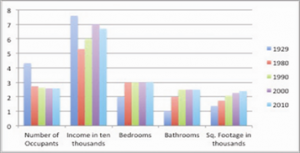

American housing expenses are difficult to comprehend. We buy McMansions with 30 year mortgages and spend an astonishing percentage of our income on housing. In 1950 the average American home was 983 sq. feet with 290 square feet per person. In 2010 the average American home was 2,392 square feet with 927 sq. feet per person. In 1929 there were 4.32 occupants per house, now this number stands at 2.58. House sizes have been steadily expanding while number of people per house has been steadily declining.

American housing expenses are difficult to comprehend. We buy McMansions with 30 year mortgages and spend an astonishing percentage of our income on housing. In 1950 the average American home was 983 sq. feet with 290 square feet per person. In 2010 the average American home was 2,392 square feet with 927 sq. feet per person. In 1929 there were 4.32 occupants per house, now this number stands at 2.58. House sizes have been steadily expanding while number of people per house has been steadily declining.

The Median house price in the US is just over $200,000; with a 20% down payment at 4.5% interest rate, this comes with a $800 a month payment for 30 years. Standard home buying advice is based on the monthly payment, not the total. FHA guidelines recommend a maximum mortgage payment ratio of 31% of gross income, this includes, taxes, insurance, and PMI. Let’s assume $2,400 for these costs, making the total house payment an even $1,000, (no PMI cost exists because the buyer put down 20%). Based on this, someone with $3,225 in monthly income could buy a $200,000 house, making the house price over 5X his annual income! 31% for housing expenses is just the number for gross income; this American worker will have to pay Social Security tax, federal income tax, and state income tax. Let’s assume all combined he is paying 20% of his gross to taxes. His net income becomes $2,580, now he is paying 39% of his take home pay just on housing expenses, and this doesn’t include repairs and maintenance!

So we spend money we don’t have by mortgaging our future to buy houses that are on a per person basis 3X the size of houses just 65 years ago. If in our example, the buyer purchased a home a third of the size, and price, he would be in an immensely better position. Why do we need these giant houses? Thankfully, to balance the insanity of our housing culture, there is a group of people preaching, and practicing the opposite. A move to a much simpler housing solution, called the Tiny House Movement.

I love the tiny house movement. Although I would not be comfortable living in a tiny apartment in say New York where there are 300 sq. ft. apts, I see the appeal of tiny houses when paired with a couple acres of land. I’m sure it is much easier to manage in a southern climate, in Michigan where it is winter 5 months of the year, being coupled up in 300 sq. ft with kids all winter would be a hard adaptation.

Obviously with a smaller house you save a ton on the cost of the home itself. But what else? The long term fixed expenses of property taxes are greatly reduced, since the value of the house is reduced. Maintenance and repairs are greatly reduced: fewer square feet, small roof, less windows, smaller utility runs, etc. The cost of utilities is also less, fewer rooms = fewer lights, fewer tvs, smaller appliances, and less cubic space to heat and cool.

Now the transition doesn’t have to be so extreme, I just used the tiny house movement as an example. I myself am a more “middle of the road” kind of guy. A modest 1000 square foot home can have substantial savings over a 2500 square foot home. Housing is one of the largest expenses in our country, and the housing costs we choose to undertake set the tone for the rest of our expenses. I think taking a step back and analyzing the numbers and what they mean to our lifetime expenditures on housing is very important. I would much rather own a smaller home that costs 10-15% of my pay per year, than a Mcmansion that I have to feed 40% of my salary to.

How am I doing? My house is officially 1,300 square feet. The lower level, while finished is partially below grade so it doesn’t count in appraisals, in total we have just under 1,800 square feet. With 6 people living in the house, that’s 300 square foot per person, about what the average was in 1950. Next year we should be back to 4, increasing it to 450 per person, a far cry from 927 square feet average of today. We will also save a ton of interest by paying the house off early.

Another major area of housing expense is that in our culture multi-generational households are rare. Our “rugged individualism” puts pressure to move out once high school is done, and to live independently. There is an argument to be made for groups of people to live together, so long as they can get along. I have done a lot of genealogy research and it is striking how just a couple generations ago it was very common for people to live in multi-generation households for long periods of time, for children to live with their parents well into adulthood, even after having their own children. And they did it in smaller homes, that cost less! I know it isn’t for everybody, but staying at home for a couple years, contributing some to bills and saving like crazy is an excellent way to get started in life.

So what action steps do I recommend:

1. Think!, question the social norms of house sizes and price.

2. Buy a house with a 15 year mortgage that is less than 1 weeks net income. This guideline of 25% of net on a 15 year mortgage is much stricter than the 31% of gross on a 30 year mortgage. In our earlier example, with a net income of $2580 per month, he could afford a $595 house payment, backing out the same 20% for taxes and insurances, leaves a principal and interest payment of $476, for a total loan at 3.75% and interest of $66,000. Paired with a 20% down payment, he would have bought a house costing about $82,500. Only about 2X his annual income! If a 15 year seems like too much of a stretch a 20 year mortgage is still a MUCH better option than a 30 year mortgage.

3. Consider living in multi-generation housing, at least for a few years. I am a big fan of the concept of allowing young adults who are responsible and making good decisions to live at home for a couple extra years to save some serious bank. Also consider living with a roommate for a few years to help pay down principal on your home. Not too many 20 year olds can buy a house, and this can help make that happen.

4. Think not just about the price savings of a smaller home, but the money, time, effort and stress saved with it as well. proportionally less cleaning, maintenance and repairs have to be done on a smaller home, and less income has to be earned to support it.

5. Already in a McMansion? consider downsizing to drastically reduce debt and the monthly drain from your house, run the numbers to see what you realistically can save.

What are your thoughts on how we as a society view and manage housing?

Leave a Reply