What Should Rents Be? The Market Will Tell Us

Earlier this year I wrote about how rental rates will skyrocket in the coming years. Renters have already had significant increases over the last 5 years and so many people think that the only cause of increasing rents is Landlord greed. Many non renters also think rents are too high, when the objective reality is that rents are too low. Check out my post on Why Rents Will Skyrocket for debunking this claim.

Why The Disconnect:

It’s really easy for people to attack new listings for rent at these higher prices because people get stuck believing that their individual situation is reflective of the market. It rarely is. Here’s why.

For renters, most landlords don’t raise rent as they should to reflect the market. They allow their own profit margins to get squeezed in order to keep a tenant. They fear the turnover so would rather not raise rents by $50-$100 each year to ensure their tenant doesn’t move out. Compound this over 4 or 5 years and the unit is rented for far below market rent and the tenant has no idea how great of a deal he is actually getting.

For home owners, their costs are largely fixed. I often see people make comments such as “I have a 3 bedroom house that my mortgage is only $700 a month on, charging $1,200 for rent is robbery!” They fail to mention that they purchased that house 6 years ago with 20% down with a 3.25% mortgage. (200K house 40K down 3.25% interest $696 payment).

To get the same house today the price would be 100K higher and the mortgage payment would increase by $900/mo ($300K house 60K down 240K mortgage $1,637 payment) They also aren’t accounting for property taxes being almost twice as high for non owner occupied properties, or for insurance being higher, or for any maintenance costs.

It’s always frustrated me to list properties because of this. You only need about 6 people interested to end up with a great tenant, while hundreds to thousands will see the listing and have an opportunity to add a snide comment or laughing emoji. What’s interesting is that this happens regardless of the price. If the price is viewed as “too high” by some they will throw down the laughing emoji and a comment. If the price is “too low” someone else will laugh at it for appearing to be a scam.

How To Determine What Rents Should Be:

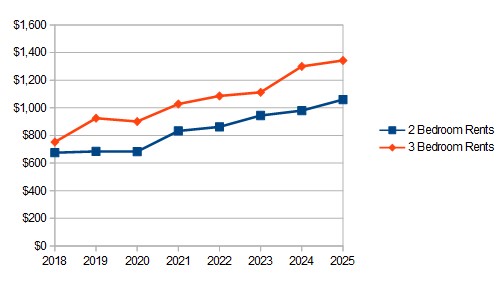

Actual data will tell us where the market should be. Services like Rentometer will show some excellent data, but you have to pay for it. What I have done over the last 6 years is consistently track every rental listing I can find between Craigslist, Facebook, Zillow, and Apartments.com. Today I am going to share that data with you. For anyone in the rental game, I would highly advise you to also do the same thing to keep track of rental rates in your area.

I am displaying averages, as there are some outliers in the data set. Some of the peaks are properties that may include utilities or are furnished. Some of the valleys are properties in significant disrepair and likely had hundreds or applications in hours of being listed. The real data that matters is the median trend line showing the increase over the last 6 years. All of these properties are in Benton Harbor, MI or Benton Township, MI. To my competitors reading this…You’re Welcome!

| Year | 2 Bedroom Rents | 3 Bedroom Rents |

| 2018 | $675 | $753 |

| 2019 | $685 | $925 |

| 2020 | $683 | $901 |

| 2021 | $833 | $1,028 |

| 2022 | $863 | $1,086 |

| 2023 | $945 | $1,113 |

| 2024 | $980 | $1,300 |

| 2025 | $1,060 | $1,343 |

These are the median rents for renting single family houses of this size. I did not include 4 bedroom houses into this data set because there is not enough total data to get a meaningful average. 4 bedroom homes in this market are extremely rare and often only a couple come up for rent a year. The 3 most recent 4 bedroom homes were $1,900, $1,700, and $1,600 respectively.

What are the drivers of higher rents?

- Increased price of housing: Housing prices have doubled, of course rents will have to increase.

- Increased interest rates. Interest rates while below their peak are still over twice what they were previously.

- Increased property taxes (increase with the price of housing)

- Increased overall demand, People priced out of higher cost areas come to the lower cost areas, further driving up the prices of these lower cost homes.

- Decreased overall supply. With the increases in valuations it makes more sense for most landlords to sell their rental properties over maintaining them as rentals.

Hud Fair Market Rents:

To some degree HUD does the same thing. They survey rents for 2 bedroom dwellings (without differentiating houses vs apartments) and add in what they feel utility costs will be. So the HUD FMR is not what they believe total rent is, it is total rent, plus utilities.

Currently the Hud FMR is $1,152 for 2 bedrooms and $1,488 for 3 bedrooms. There are too many variables involved in the utility allowances to give a 100% accurate cost, but I will give a rough rule of thumb that they are often around 20% of the FMR. This would put their cost for a 2 bedroom at around $921. This is about 15% below what current actual market rates are.

An Income Based Approach:

An income based approach is a possible method of trying to figure out what rents should be, but this gets skewed terribly in both high income and low income neighborhoods. The goal here is to be a gut check on what the affordability of the market is. Since the median household has around 2.5 people in it, then a baseline would be can the median household income afford a 2 bedroom rental home? The data below is for 2023, the most recent figures I had available.

- In Benton Harbor the median household income is $29,652, while the per capita income is $19,108.

- In Benton Twp, the median household income is $39,169, while the per capita income is $24,918

- In Berrien County the median household income is $63,152, while the per capita income is $37,747.

Applying the 30% of gross income standard for housing to be considered affordable, this standard looks at household income and not per capita income.

- Benton Harbor City: $29,652 X 30% = $8,895 / 12 months = $741.30

- Benton Township: $39,169 X 30% = $11,750 / 12 months = $979.23

- Berrien County: $63,152 X 30% = $18,945.60 / 12 months = $1,578.80

A Benton Harbor city household earning the median amount can not afford to rent a 2 bedroom house, and likely not a 2 bedroom apartment either, as the rates for apartments are almost identical to those of houses. Many of these houses are receiving rental subsidies through the Section 8 program or other state and federal housing programs. It’s a chicken/egg situation as well because in order to stay in rent subsidized housing, your income must stay below a certain amount, so there is a large incentive for people to keep their income low. Landlords can also give credit for other sources of income, including things like food stamp assistance. A family receiving $400/mo in food assistance effectively has $4,800 more in total gross income.

A Benton Township household earning the median is right on the bubble with the 30% affordability threshold equaling the exact average for a 2 bedroom rental in 2024. Looking at the Township level vs. the city level certainly provides a better indicator of where rents are or should be.

Adjusting For Apartments:

I’ve often thought that apartments should be less expensive than houses to rent, after all they don’t have a yard or the privacy that comes with a house, so a house should cost more. Well maybe. With a house generally the tenant is responsible for lawn mowing and snow removal. Generally with a house utility costs are higher as water/sewer/trash are paid by the tenant instead of covered by the landlord. Apartments often have more amenities as well, such as appliances provided by the landlord, on site laundry, and sometimes free wifi.

Apartments generally are also smaller than houses with an equivalent bedroom count. One thing we have done with our apartments is require a lower multiple of the rent for gross income needed to rent our apartments. For houses we require 3 times the rent, and for apartments we require 2.5 times the rent. This is effectively adjusting for the utilities that we cover with the apartment buildings, that the tenants do not have to pay.

In general, I would like to be able to offer similar bedroom count apartments for 80% of the rate we would charge for the same size houses. Currently we are charging $800/mo for a 2 bedroom apartment while 2 bedroom houses are renting for around $1,000/mo.

The 2 bedroom house would require a total income of $3,000, while the 2 bedroom apartment would require a gross income of $2,000. In Michigan the minimum wage is currently $12.50/hr. Someone working a full time minimum wage job would therefore qualify for one of our apartments. $12.50/hr X 40 hours per week X 52 weeks per year = $26,000 / 12 months = $2,167/mo gross income.

What do you think rents should be? What factors did I miss that should go into determining the pricing of rents?

Leave a Reply