I like the idea of having a community college. Having a place of higher education a few miles from the house is a great addition to our community. This support does not mean that they get a blank check to spend unlimited taxpayer resources. Over the years the value proposition of Lake Michigan College has fallen drastically and voters need to reject their current 20 year millage ask.

A major area of concern I have is in how the campaign for this millage is being handled by the college and local media. All of the media outlets in Southwest Michigan have published stories and interviews by the college about why the millage should pass, without publishing any stories about why it should not. The Lake Michigan College Board then wrote a letter (that also got picked up by all local media) stating that opponents of the millage are spreading “misinformation”, which is misinformation in itself. Lake Michigan College has painted a picture that anyone opposing them is anti-education and spreading lies.

What Is The Millage?

There are actually 2 millage votes on Tuesday, the first is a 20 year renewal of a .667 mill property tax levied on all property in the district for operations. The second millage is a 10 year .24 millage for capital spending.

The History of The Millage:

Despite LMC’s marketing the community has not always supported the LMC operating millage.

n August of 1987 the voters DID NOT approve the LMC Millage. LMC stated they might pursue a millage in mid June and the vote was at the end of August. The voters denied it by a 10 point margin, voting 55% to 45% to not allow LMC to have a new millage. It was a clear message. LMC then immediately stated that they would be back for another millage vote.

They formed “The Friends of Lake Michigan College” and spent $21,563 on the campaign. Over $20,000 of that was money that came from grants from Lake Michigan College directly. They paid for radio and newspaper ads, mailings, and a call center. $20,000 in the fall of 1987 is the equivalent of $56,000 today. LMC claimed that funding “The Friends of LMC” was legal because it was paid with non taxpayer funds.

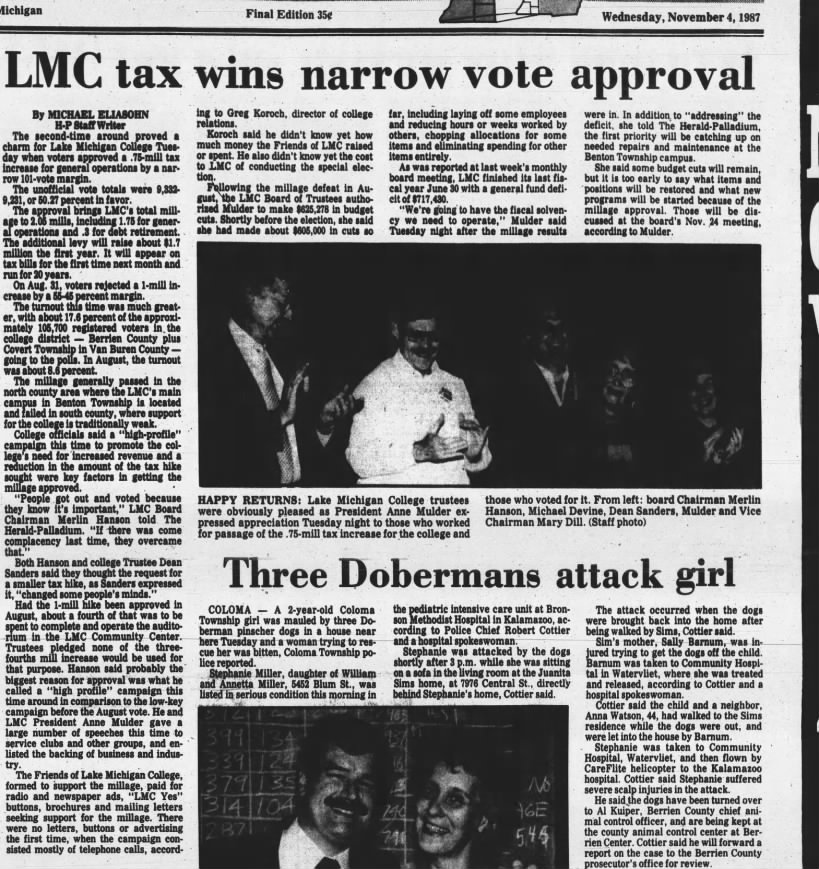

In the 2nd vote in November of 1987 the millage, which was reduced from 1.0 Mills to .75 Mills passed by half of one percent, 9,332 votes to 9,231 votes. It barely passed on a “do-over” vote.

Subsequent letters to the editor questioned why it was legal for them to get a “do-over” vote. Why should LMC have been able to get a new vote 2 months later because they didn’t like the outcome of the first vote. Why don’t the people of Berrien County who are against the millage get another do over vote and go best 2 out of 3?

No, because LMC got the millage passed, there would be no additional vote for the next 2 decades. It is misinformation for LMC to make it sound like the community overwhelmingly supported this millage from the beginning. When voters passed the renewal in 2006 (this time it did get substantial community support with 61% of the vote) there was also no new redo vote for those opposed.

Why Should Voters Be Opposed To The Millage?

Actual Student Outcomes:

The first major problem with this millage is the outcomes and misinformation LMC has stated about them.

LMC’s own data from 2023 used in the MiSchooldata database shows that people age 18-24 who graduate from LMC earn an average of $34,300 per year, the equivalent of $16.50/hr 1 year after graduating. At the same time and using the same study Al Pscholka stated that people with Associates degrees earn $23,000 more than people without, ignoring that that is heavily skewed by comparing older graduates already established in their careers (35-44) who earn an average of $66,700 to recent high school graduates working part time. http://Mischooldata.org/median-annual-wages-by-education… It is dishonest that LMC advertises to high school kids that they will earn $23,000 more by earning a degree from them, when their own data shows that these young adults will be earning slightly above what Walmart starts new hires at who do not need a degree, (currently $16/hr). I wrote about this in depth in 2024,

Do Associates Degrees Increase Earnings by $23,000 A Year, Absolutely Not.

Note: The 2024 report year was even worse, with the average wages of those in the 18-24 age range reporting earnings of $31,500 1 year after graduating LMC, which would be just $15.14/hr for a 40 hour per week 52 week per year job.

This data is accessible through downloading the entire database on the Mischooldata website.

Increased Taxpayer Cost Per Student:

The next major problem is the increased cost to taxpayers per student over time. In 2006 LMC had total enrollment of 6,166 students when the last 20 year operating millage was passed. At the time the total tax base of Berrien County was $3.917 Billion.

As of the Fall of 2024 Lake Michigan College serves 3,330 total students, which includes 1,203 early and middle college students. This is 54% the amount of total students served in 2006. For 2025 the property tax base for Berrien County is $10.612 Billion. Without the early college program enrollment would be at 34% of the 2006 numbers. This is while the tax base has increased 271%.

Excluding the early college students we are effectively paying 271% more in taxes today to serve 34% of the students. We are now paying 8 times as much per student as we were when this millage was first passed 20 years ago. In the recently published letter by LMC they claim they serve 3,910 students. If the discrepancy here does not include any early college and middle college students, then the total without them would be 2,707 students, still only 44% of the students served in 2006, in which case we are “only” paying about 6 times as much per student today as we were in 2006.

Increased Millage Cost Over Time:

It is also misleading to state that taxpayers with a $250,000 home would only save $143/year in taxes if this were not passed. In 1987 in the Herald Palladium they stated “a home with a market value of $50,000 the additional taxes would be $18.72 per year.” In 2006 LMC President Randall Miller stated in the Herald Palladium “For the owner of a home with a taxable value of $50,000, ($100,000 market value) the LMC levy will cost $33.49 per year“.

LMC states this is not a tax increase, it is “just a renewal”, but the tax increase is effectively baked into all millages every single year. That is why today they are saying the average home will be taxed $143 per year and 20 years ago they were saying the average home will only be taxed $33 per year. As home values rise over the next 2 decades, so will each home owners yearly bill for Lake Michigan College, while LMC continues to serve fewer students. The taxable value in Michigan is half the market value, so Miller was referring to a $100,000 house in 2006, which was about the median home then and in many neighborhoods is the $250,000 home today. Going from $33.49 per year to $143 per year is a 429% increase over the past 20 years.

Student Housing:

It is also misinformation to state that the student housing is not taxpayer funded. LMC built a large student housing building with 194 beds in 2014 and are currently planning to build another dorm building. While it is not funded through the millage funds, it is funded through federal income taxes paid by all taxpayers. Many of these students are awarded Pell grants. Because LMC tuition is lower than their total Pell grant, they can spend their Pell grant on the student housing rent. I would be surprised to learn that $0 of Pell grants has gone towards the rent payments at Beckwith hall.

Out of State Student Tuition:

Another point of contention: LMC is stating the positive aspects of out of state students being education at LMC, that they will stay in the area, get jobs here, and buy homes here. They say this because they believe it is the right thing to do to charge out of state students the same price local students are charged. Historically and across the country, it is the norm for out of district and out of state students to pay a higher price, because the local taxpayers are subsidizing the college. In exchange for the property taxes we pay our children pay less to go to school. They also state that affordable housing is hard to find in Southwest Michigan while defending Beckwith hall. With affordable housing being hard to find in Southwest Michigan, why would we want to subsidize the cost of college tuition for people who aren’t from here, who will live here long term and then compete for the same houses to live in as the children of the people who are paying these taxes?

Lack Of Resource Utilization:

Lake Michigan College has a satellite building in South Haven that is vastly under utilized, and should be closed down and sold to focus the funds on the main campus. The South Haven campus has 21 classrooms, it is a relatively small building. In the Fall of 2025, according to LMC’s online course catalog, there are a total of 7 classes being taught at the campus. 1 of those 7 classes only had 3 people sign up for it, in reality it is 6 classes. Each class meets 2 days per week for 1.5 hours. This is 18 classroom hours per week. With 20 classrooms available and stated hours of 8AM to 9PM M-Th and 8AM to 5PM on Friday, then the college has the following capacity:

Per classroom: Each classroom has 6 day time slots that can each have a class that meets 2 days a week, M,W or T,Th. Each evening the classroom can have a 3 hour 6-9 slot for a full class that only meets 1 day per week. This gives a total capacity of 4 classes per day per classroom.

With 20 classrooms the capacity is:

M: 40 classes

T: 40 classes

W: 40 classes

Th: 40 classes

Without having any classes on Friday or Saturday the college has the capacity for 160 classes and they have 6. This is a utilization rate of 3.75%.

The main campus also has a relatively low utilization rate for its size, especially when factoring in the college now has the Todd Center on the main campus as well.

Too Many Programs:

LMC touts having 80 programs as a major plus for it and that the average class size is 13 students. If the average class size is 13 this means we are vastly underutilizing each class we have. LMC would be much better served to have 40 programs and class sizes of 26. The economics don’t work for class sizes of 13 students.

Historic Asset Sales:

Lake Michigan College recently sold its Bertrand Campus for $1 to Berrien RESA. LMC is still able to hold classes there and the campus is used by Berrien RESA for other educational classes. The building had been noted in Lake Michigan College’s facility assessment from 2021 as being worth $7.6 million dollars with $1.6 million of furnishings and equipment in it.

LMC states that they saved operating costs by selling this property and still are able to use it for classes, so the sale of this asset was a win. I would challenge that thinking as they likely could have found another buyer who would have paid closer to what the building was worth, and found somewhere else in South county to host classes if we really needed a place in south county to do so.

LMC most likely could rent space from the county at the Buchanan Office Building, formerly owned by AEP. AEP sold this building for $200,000, well below market rate to the county. With the size of the building I am confident there is space that could be rented at a low rate if not free to LMC to conduct a few classes there.

High Paid Staff:

LMC, like most colleges, has extreme administrative bloat. As we continue keep in mind the median household income in Berrien County Michigan is $63,152. Lake Michigan College claims to have 264 total employees on their website. For fiscal year 2025 they claim a total of $26,547,000 in labor costs. Dividing that amount across the college means on average LMC employees earn $100,556 in compensation. Labor expenses are 64% of the colleges total budget. Property taxes are listed at being $21,145,000, making up 51% of the budget.

Not only is $100,000 per employee for a county where the median HOUSEHOLD earns $63,000 a year a tough pill to swallow, but then we have to compare the staffing levels to the enrollment levels. We have roughly 2,097 students excluding early college from the Fall enrollment numbers, this would be 8 students per employee.

If we use the total enrollment number that LMC released in their recent statement, instead of their fall enrollment numbers, and we include all early college students, then we have 3,910 students across 264 staff, which is still 15 students per 1 employee.

LMC Won’t Cease To Exist:

If these 2 millages don’t pass, LMC will still have funding. They will lose roughly half of their current taxation. If they make no spending cuts and push all of the tax costs onto the tuition costs, then tuition would double to about $374/credit hour. This is still about $200 per credit hour cheaper than Michigan State University.

The people are taxed enough. The actual tax bill keeps climbing, the administration keeps increasing, and the outcomes keep decreasing. It is time to stop funding LMC.

John C. started Action Economics in 2013 as a way to gain more knowledge on personal financial planning and to share that knowledge with others. Action Economics focuses on

. John is the author of the book

Leave a Reply