When Is Life Insurance Taxable?

One of the primary questions I’m asked about life insurance is “Is Life Insurance Taxable?”. The IRS has very specific rules about how to handle life insurance payments and for the vast majority of people life insurance is not taxable.

One of the primary questions I’m asked about life insurance is “Is Life Insurance Taxable?”. The IRS has very specific rules about how to handle life insurance payments and for the vast majority of people life insurance is not taxable.

When we are looking into these details about life insurance it is often after experiencing a tragic loss. The last thing you should have to worry about is taxes, after all the life insurance was put in place to ensure survivors don’t have to worry about money. In the vast majority of cases life insurance is not taxable. It would certainly be a big hit, especially in high tax states to be taxed on life insurance benefits. Losing 1/3 to 1/2 the face value would be disastrous and certainly unexpected for most families.

Who Needs Life Insurance:

Anecdotally I have had a half dozen friends die in the past few years and every single one of them had the same thing in common: They didn’t have life insurance, despite being parents of young children. This has put a massive hardship on their families. If you have children and are not financially independent from work, you need life insurance. If you have a spouse that depends on your income, you need life insurance. If you are a stay at home parent and without you your family would have financial hardship replacing the thousands of tasks you do, you need life insurance.

37% percent of parents with minor children have NO life insurance at all. Half of the remaining parents have less than $100,000 in life insurance. Most financial experts advise having at least 10 – 15 times your annual income in life insurance coverage. So roughly a third of parents don’t have life insurance while another third is vastly under insured. Why? The vast majority of these people think they can’t afford life insurance. Life insurance costs have been going down for years and term life insurance is far cheaper than whole life insurance. For under-insured parents adding in the potential for life insurance to be taxed can add an additional financial hardship to the loss of a loved one.

When Is Life Insurance Taxable:

Life Insurance is taxable when the total estate is subject to estate tax (Only for people with a net worth in excess of $11 million). Even then this can be avoided by putting the life insurance into an irrevocable trust. Beyond that life insurance proceeds generally should be distributed with no taxes being owed. If you have a $500,000 policy, your beneficiaries will receive $500,000. For people with a net worth over $11 million who may be subject to the estate tax, they need to contact a tax planning attorney for detailed tax assistance. For the other 99.9% of us we don’t have to worry about the estate tax.

Life insurance can be taxable to the beneficiaries if the premiums are paid with pre-tax money, usually through an employer 401K plan. Some employers offer this as a benefit. This is a major risk, as saving your tax rate on a couple hundred bucks is peanuts compared to your family paying their tax rate on a large life insurance payout.

Is Life Insurance Taxable To My Heirs?

As long as your total estate is under $11 million your heirs will receive your life insurance tax free. The beneficial tax treatment of life insurance heightens the fact that overall term life insurance is an amazingly good deal. For myself, a healthy 32 year old non-smoking male, I was able to get a 15 year $500,000 policy for only $15 per month from Haven Life. I pay $180 per year and if I die my family will receive $500,000 of after tax money. A friend of mine in similar health recently died in a car crash leaving behind a wife and two young kids. The man worked 2 jobs for several years to support his family, but had no life insurance, something he could have easily afforded.

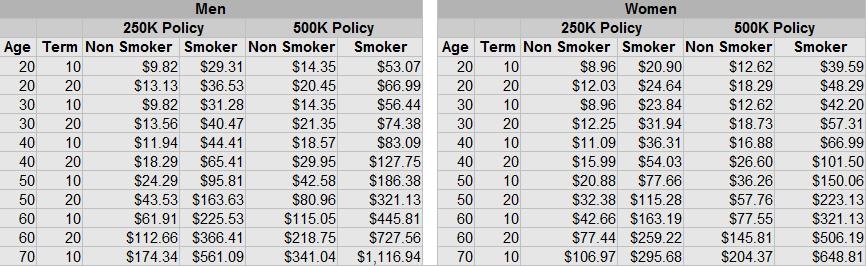

Don’t think you can afford life insurance? Here’s a table I created a couple years ago with rates from Zander Insurance. Even for smokers rates are surprisingly affordable. I’m also surprised how inexpensive life insurance is for people in their 50s and 60s.

Is Life Insurance Taxable If I Don’t Name A Beneficiary?

No. Although you absolutely should name a beneficiary for your life insurance (and a secondary beneficiary), failing to do so does not make the life insurance policy taxable, unless you have an estate valued at over $11 million. Failing to name a beneficiary will require your life insurance to go into probate, which will tie up the money for months to years and will cause the courts to decide where it goes and to deduct fees from it. You really don’t want this to happen though, so despite it not being a tax issue, not naming a beneficiary can have serious negative consequences.

Is Life Insurance Taxable If I Receive Installments:

Sometimes people choose to receive installment life insurance proceeds. In this case the face value of the plan is not taxable, however any interest gained is. The interest will be a small portion of your total payment so even though this is taxable it shouldn’t make a large difference in your finances. Receiving installments of life insurance money is perfect for people who know that they would struggle to keep the money from disappearing. The downside is that the insurance company issuing installments doesn’t have the money invested in stock mutual funds, the interest earned is comparable to a bank account.

Is Life Insurance Taxable If My Employer Pays For It?

108 million Americans have life insurance through work. It’s great that so many people are insured, but for the most part workplace policies leave the owner vastly under insured. Typically these policies are for $50,0000 or for 1 – 2 years of income, whereas most financial adviser recommend having between 10 and 15 years of income. This leaves a massive insurance gap.

Even though employer based plans leave people uninsured, they generally do not cause your beneficiaries to owe taxes. Here is the exception: For policies valued at over $50,000 IF the life insurance policy was paid for with pretax dollars, then the proceeds become taxable. This is something that anyone with an employer sponsored plan should look into, as well as ensuring that they have proper coverage.

Is Life Insurance Taxable If I Have A Whole Life Policy?

For starters, you shouldn’t have a whole life policy, they are terrible products. If you have a whole life policy get out of it today and buy term life insurance. When you die owning a whole life policy your heirs will receive a death benefit that is not taxable (once again, unless your estate is over $11 million.) Dividends paid are usually considered “return of premium” and are thus not taxed.

Is Life Insurance Taxable If I Have Multiple Policies?

Having multiple policies does not make life insurance proceeds taxable, unless the total of your life insurance policies and your estate add up to over $11 million, the current exemption level for the estate tax. When getting a life insurance policy the issuer will ask you about other policies and if you are substantially over insured for your income level it will raise a red flag. For example, if I earn $60,000 a year and I try to take out more than a couple million in life insurance it is quite probable I will be turned down long before reaching $11 million.

Is Life Insurance Taxable If I Donate It To Charity?

Donating a life insurance policy to charity is a great way to leave a legacy, especially if you don’t have children or they are already financially taken care off. Even if you have an estate subject to the estate tax the life insurance would pass to the qualifying charity tax free.

Could Life Insurance Be Taxable In The Future:

Is life insurance taxable in the future? Our tax laws change A LOT. In the past year the estate tax exemption has doubled, tax brackets have changed greatly, and the government threw out personal exemptions and doubled the standard deduction. Life Insurance policies can be for 3 decades, a lot happens in that time frame. Tax laws can and will change. I think it is highly unlikely that the U.S. Government will change the tax treatment of life insurance policies, but it is possible. Our nation is over $20 trillion in debt and despite a record breaking bull market and the lowest unemployment rate in over 40 years we are still spending over half a trillion dollars more than we bring in. At some point the Feds may see life insurance proceeds as a potential area for increased revenue. Due to this small, but serious risk it is important to err towards caution in choosing policies and look to get life insurance policies that would still be substantial enough even if they were taxed.

For the vast majority of people you don’t have to worry about the tax treatment of life insurance. What is really important is that people who are not financially independent and who have people who depend on their income, get life insurance. Term life insurance is extraordinarily inexpensive and it’s protection will provide your family with a different life if you get it.

My sister in law died 4 years ago when she was 21. Mrs. C. and I are raising her two young boys who were 2 and 8 months old at the time. She didn’t have life insurance and since she had a brief work history her Social Security survivor benefits are very low. No amount of money can make up for these kids not having their mother, and Mrs. C. and I are very blessed to be in a position where we can raise them without financial hardship. With that being said, even a 10 year $250,000 policy which would have cost her under $10 a month would have made a world of difference.

My sister in law died 4 years ago when she was 21. Mrs. C. and I are raising her two young boys who were 2 and 8 months old at the time. She didn’t have life insurance and since she had a brief work history her Social Security survivor benefits are very low. No amount of money can make up for these kids not having their mother, and Mrs. C. and I are very blessed to be in a position where we can raise them without financial hardship. With that being said, even a 10 year $250,000 policy which would have cost her under $10 a month would have made a world of difference.

If anyone in this world depends on your income, you need to buy life insurance TODAY. If you know someone who is struggling financially who has young kids, consider gifting them life insurance. I recently picked up a policy from Haven Life and the process was extremely painless; roughly 10 minutes of online paperwork and a 15 minute medical checkup, that’s a small price to pay for $500,000 of tax free life insurance money for my family.

Do you have life insurance? What concerns do you have about your policy? Do you think it’s possible in the future tax treatment of life insurance policies will change?

Leave a Reply