This Is The Income You Need To Afford A Home..Really.

I recently came across a viral article entitled “This is The Salary You Need To Afford A Home In Each Of The 50 States“ I decided to read it, because I knew it would be misleading, and designed to give an echo chamber to everyone who wants to moan and groan that housing isn’t affordable and they will never be able to buy a house. Following the link I discovered that it derived all of its data from an article titled “How Much Income You Need To Afford The Average Home In Every State“. Do you see a difference here? The first article states that you will not be able to buy a home without this income, the second article (using the exact same data) states this is the income needed to buy an “average home.”

The second article, which was the original article is completely honest in its thesis and methods and does a good job of showing just that, how much income you need to buy a house that sells at the state’s average sale price. The study assumed an interest rate between 4% and 5%, a 10% down payment, a 30% debt payments to income ratio and that the buyer has no other debts. Although this piece and its title are honest, they are not a true reflection on what most people who are first time home buyers are facing.

An Average Home, A Median Home, Or A Starter Home?

We need to ask ourselves, what is an average home? An average home doesn’t exist. This is the price determined by adding up all of the home sales and dividing by the total number of sales. Averages tend to skew high because a few high dollar homes will pull up the average from many moderate priced homes. If I’m in a room with 10 friends with a net worth of $100,000 each, and Jeff Bezos walks in the room, our average net worth is around $14 billion. Median is a much more accurate measurement of home prices, wealth, or really anything. Okay, so the difference between the average and median will also vary greatly between states. This means that generally speaking, most houses will be less expensive than the average, and exactly half of houses will be less expensive than the median. We also need to consider that real estate markets are not state wide, they are local. A similar home in Benton Harbor, Michigan and Grand Rapids, MI may have a price swing of $100,000.

My first house: Mrs. C. and I bought our first house based off income in a year where we earned a combined $23,839. The first article I found titled “This Is The Salary You Need To Buy A House In Each State” should not be looking at the median home, it should be looking at starter homes, because very few people buy a home that is average or even median priced as their first home. They buy a lower priced starter home, which is usually far bellow the median or average price. These homes may be older, smaller, and in less desirable neighborhoods than your average home.

This Is The Income You Need To Afford A Home:

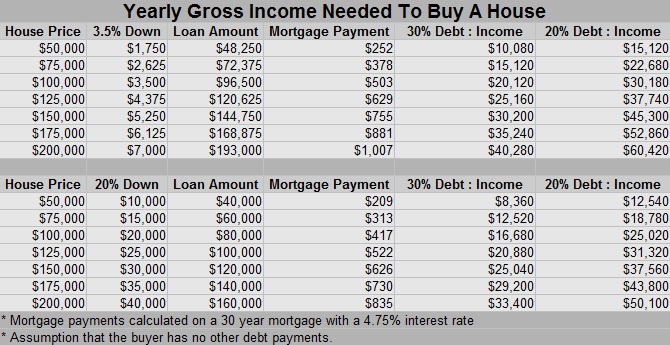

So here’s the income you need to afford a home with a 3.5% FHA down payment and with a 20% down payment. 60% of home buyers put down under 6% when purchasing a home and 26% of home buyers put down 20% or greater. Since these are the most likely down payments used, I utilized these in my analysis. I used both a 30% and a 20% debt to income ratio. Some lenders will allow up to a 36% debt payments to gross income ratio, while 30% is the most common, and 20% is a more conservative measurement.

Bet you didn’t think I would say you can afford a home with as little as $8,360 of income did you? Minimum wage in the US is $7.25 an hour. If you are working 40 hours a week (even if it is stringing together 2 part time jobs), you will earn $15,080 a year, enough to buy a $50,000 home with a 20% debt to income ratio with a $1,750 down payment. For a dual earner household, this doubles to $30,000 of income allowing you to buy a $100,000 home with a 20% debt to income ratio and a $3,500 down payment.

Keep in mind these numbers are total debt to income, which means I am assuming the home buyer has no other debt payments. I recommend (as do most financial advisers) getting completely out of debt before buying a home. If you choose to buy a home while maintaining car payments, credit card payments, and student loans, then you will have to back those numbers out of the calculations.

For example if you earn $40,000 per year and have a $300 monthly car payment instead of being able to get a $1,007 house payment, you would only be able to afford a $707 house payment, dropping you from a $200,000 home to a $135,000 home.

Can You Really Buy A Decent Home For This Price:

But do homes this inexpensive really exist or am I just playing around with spreadsheets? Well I bought my first home for $48,000 with Mrs. C. when we were both making around minimum wage at part time fast food jobs, it is possible, because I did it. Granted, that was 12 years ago, but there are still many affordable houses to be found, especially in lower valued neighborhoods. Yes I know in many major cities these amounts won’t even cover a down payment, but for most of middle America it is possible.

Examples of Homes:

These are all homes in Southwest MI.

$52,900: 1416 Rose Ave, Benton Harbor, MI This is a small home with 2 bedrooms and 1 bathroom in fairly good move in ready condition. The house has a large fenced in backyard and a new roof that was replaced two years ago.

$52,900: 1416 Rose Ave, Benton Harbor, MI This is a small home with 2 bedrooms and 1 bathroom in fairly good move in ready condition. The house has a large fenced in backyard and a new roof that was replaced two years ago.

$72,500: 535 Cherry St, Niles, MI: This 4 bedroom 1 bath home boasts 1,528 square feet with central air and a new furnace. This 2 story house has a full basement and is only a few houses from a public park. The home also has a 1 car garage and a fenced in backyard.

$72,500: 535 Cherry St, Niles, MI: This 4 bedroom 1 bath home boasts 1,528 square feet with central air and a new furnace. This 2 story house has a full basement and is only a few houses from a public park. The home also has a 1 car garage and a fenced in backyard.

$99,000: 664 Grant Ave, St. Joseph, MI This 2 bedroom 2 full bath home has over 1,500 square feet, an attached garage, and a dry finished basement. In move in condition in a desirable neighborhood. I was actually surprised to find this house at this price. This is a really good deal for the location.

$99,000: 664 Grant Ave, St. Joseph, MI This 2 bedroom 2 full bath home has over 1,500 square feet, an attached garage, and a dry finished basement. In move in condition in a desirable neighborhood. I was actually surprised to find this house at this price. This is a really good deal for the location.

Bottom line:

Just because an article on the internet tries to scare you into thinking you will never be able to afford a home doesn’t mean they are right. Before buying a home it is wise to pay off all other debt, save up an emergency fund worth 6 months of expenses, and buy a home on a 20 year or 15 year mortgage. For more information on buying a home, check out my other articles on Home Ownership.

My brother in law bought his first house last year when he was earning around 11 bucks an hour. He bought a house worth around $50,000 in South Bend Indiana and his house payment is almost nothing because he rents out an extra room to a friend, which covers most of the house payment. Winning!

Readers, how expensive was your first home and what type of income were you making when you bought it?

Leave a Reply