Getting To A 66% Savings Rate

For 2016 I came just shy of hitting our 50% savings rate goal, which we missed due to needing to replace our primary vehicle and choosing to pave our driveway. Excluding the purchase of our vehicle, we hit a rate of 47%. For 2017 I want to hit 50%. For 2018 – 2020 I want to hit 60% and for 2021 and beyond 66%. Why does a 66% savings rate matter? It may “only” be a 16% increase in savings rate, but effectively it doubles the utility of our savings.

The Math Behind a 66% Savings Rate:

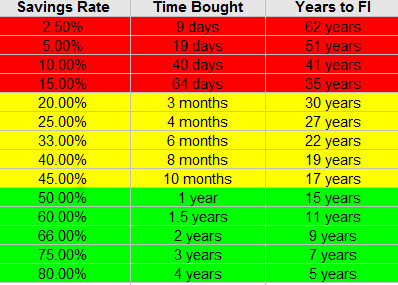

In my article How To Increase Your Savings Rate I talk about how much time different savings rates buy you. If you save 50% of your income, then naturally you saved 1 year of expenses because you spent half and you saved half. If you save 66% of your income then you spent 1/3 and saved 2/3. This means for each year you save 66% of your income you effectively buy 2 years of time.

How To Get To A 66% Savings Rate:

Going for a 66% savings rate means that reductions in spending count 2 for 1 against increases in income. Each dollar spent is 2 more I need to save. My major focus will therefore be on expense reduction.

Reductions In Spending:

Major one time expenses in 2016 that won’t repeat in 2017, or future years:

- Van Purchase

- Land Purchase

- Universal Studios Trip

- Driveway Paving

Areas we can cut normal spending:

Pay Off The Mortgage: This is scheduled to happen by the end of 2020. Once the mortgage is paid off our 2nd largest monthly expense is out of the way. If we didn’t have to spend that $6,840 per year our savings rate would jump up substantially. Eliminating our mortgage payment is the number one thing we can do to permanently lower our expenses.

Groceries: We currently spend around $700 per month on Groceries. With some better planning we could potentially save $200 per month, reducing spending by $2,400.

Taxes: This is a wildcard. Currently we do really well with our tax planning and have a negative federal tax liability of around $2,000 per year. If Donald Trump is successful in passing his tax plan, then our taxes could potentially be reduced by another $2,000 per year.

Increased Income

The second path to a 66% savings rate is an increase in income. In my case it will be several increases in income. Across all of our income sources Mrs. C. and I will take steps to ratchet up our income to meet or exceed a 66% savings rate by 2021.

1. Mrs. C. increased work hours: Mrs. C. started working more hours this summer and when the 2017 school year starts we will be putting our youngest nephew into daycare. This will free her up to work more hours and substantially increase her earnings. Daycare for 5 days per week will, after our tax credit cost $580 per month. As long as she works at least an extra 12 hours per week out of the 40 plus hours he will be in Daycare, we will end up ahead. Every year after that all of our kids are in school with no cost to us. After almost 15 years of having a kid under 5 at home this will be a big win, with her almost doubling her income from the last few years.

2. Increased pay rates: I am expecting to receive a small raise this year from 2 of my 3 employers, This won’t move the needle a ton, but could add up to over $1,000. It is possible I may get a sort of promotion from one of my employers in the not too distant future that would also substantially increase our income.

3. Website Income: In 2016 Action Economics earned just over $2,000. For 2017 my goal is to hit $3,000 in earnings. This is a wild card and I have no real substantial data to make a projection on.

4. Side Hustle Income: I’m planning to make a bit of money buying certain items at thrift stores and garage sales and selling on eBay. I will also be selling some of the railroad materials I have scavenged from my railroad property. In total I don’t expect to make a ton of money from this, but every bit helps. This will likely only contribute a few hundred dollars per year.

Overall once the expense reductions above take place, our spending will be reduced from $3,500 per month to $2,564 per month, or $30,768 per year. With a little extra padding we will call it $33,000 per year. In order to hit a 66% savings rate we would need an after tax income of $99,000. Before taxes we would need to be right around $110,000 in total income from all sources including Per Diem, blog income, and the boys’ Social Security income.

What If I Don’t Hit A 66% Savings Rate?

If I don’t hit a 66% savings rate I won’t be able to retire until 70 if at all and will die in poverty….Oh wait, no that’s not right. Even if I miss my target and hit a 60% savings rate instead I will still be retiring DECADES ahead of my peers. That’s what’s great about aiming high, even if you only get halfway there, you are still pretty damn far. Where I’m at now and where I will be at in 2021 is a trajectory that even if I miss my savings goal by 16% and only have a 50% savings rate each year my retirement date will only fluctuate by a few year between age 37 and age 40. Not too bad.

What is your current savings rate? Are you planning to increase your savings rate to at least 50%?

Leave a Reply