2017 Quarter 3 Update

Quarter 3 has been a great quarter financially for us and it has also been incredibly busy. For most of the quarter I was working 75 hour weeks, Mrs. C. was working 20-30 hours, and all the kids started school, even the littlest who is four. Add in doctor appointments, boy scouts/cub scouts, field trips, etc, and life is very busy.

I contributed to my 401K at work and deposited between 33% and 50% of my gross pay to my 401K for my most recent outage ( I changed the percentage twice). There is no employer match, but its nice to be able to put money in tax deferred, since we max our IRAs, and were not eligible for an HSA this year. I was apprehensive to hear that congress was proposing to limit 401K contributions to $2,500 per year, thankfully that looks like it will not be happening now. The last thing this country needs is to take away incentives to retirement savings. If that did happen we would have to adapt and would shift our savings to our taxable brokerage account.

Spending:

Year to date our savings rate is at 43.4% and most likely will stay around this percentage, it is highly unlikely that we will meet our goal of saving 50% this year. Health expenses for Mrs. C. and our oldest kids braces were the two driving factors that reduced our savings rate year to date so far. So far this year we have spent $37,612, an average of $4,179 per month. About 12% of that total is on health care expenses.

Big expenses for this quarter were property taxes and back to school shopping. Our total property taxes in the fall come in right at $2,000 for all our real estate combined. For back to school shopping we have to buy uniforms for 3 of the 4 kids. We do a lot of hand me downs for clothes, but typically end up buying a few hundred dollars worth of clothes, shoes, and supplies. We get all the kids a new backpack and lunchbox each year as well. I used our ebates account and bought some of their school clothes through Walmart.com, and got 2% cash back, not a ton of money, but it all adds up. ebates is free and you can get $10 for signing up and making your first purchase.

Winter is starting up here in Michigan and we’ve already seen some snow flakes. I’m working on winterizing our house and my mother in laws home right now. I typically use the indoor heat shrink plastic kits on all our windows. I also replaced the damaged weather striping on the bottom of my mother in laws door with a heavy duty draft dodger.

Investments:

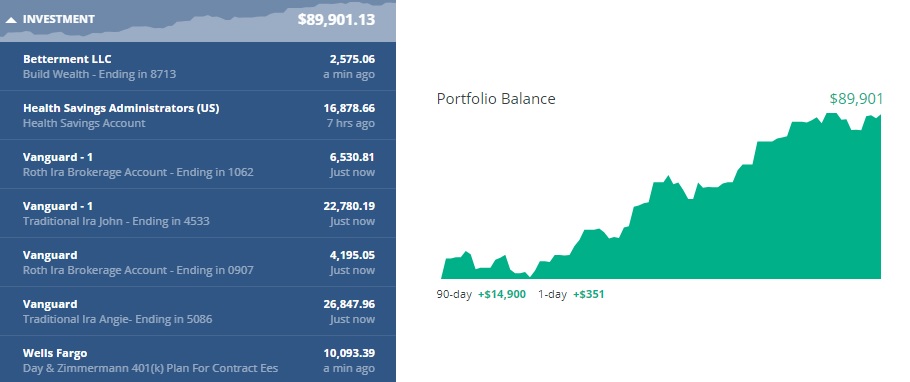

I use Personal Capital to bring all my accounts together. It is so much easier to keep track of my investments using Personal Capital because I don’t have to log into half a dozen different accounts to bring my entire portfolio together. Here’s a chart from Personal Capital showing all our accounts together and the combined growth over the last 90 days (note this chart is through Oct 31, since I didn’t take a screen shot at the end of the quarter, oops. If you want to track your investments like I do, you can sign up for Personal Capital for free.

House Payoff:

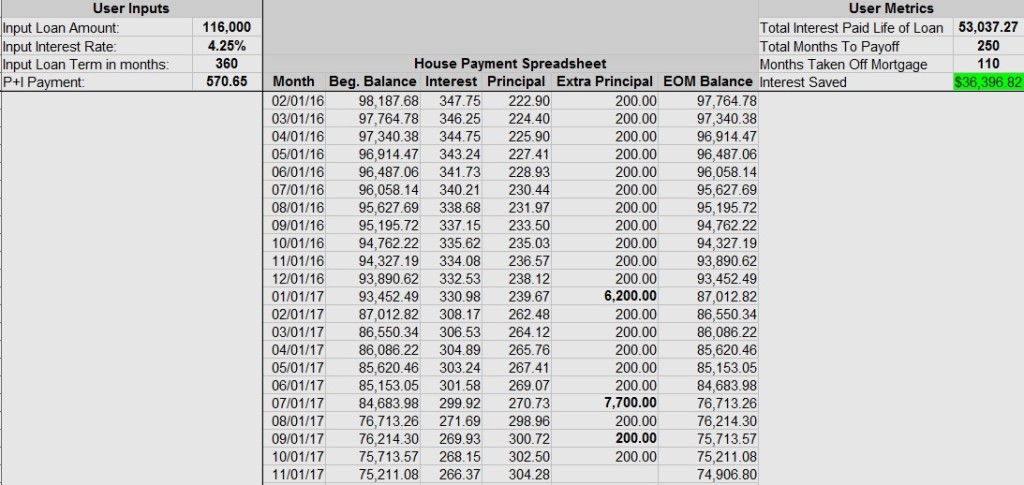

This quarter I have continued to pay an extra $200 per month on our primary residence. Either at the end of next quarter or the start of Q1 2018 we will pay another large chunk, in excess of $5,000 on our primary mortgage. We are still on track to pay off our home by December 31 2020, just over 3 years from now. Our rental house will be paid off around 6 months later.

Skymiles and Points:

I don’t include these in my net worth, but they do have some value, so I figured they are at least deserving of being mentioned here. When I travel for work I primarily fly delta. I have accumulated 162,000 sky miles, which I value at around 1 cent per mile, for a total value of $1,620. I plan to cash a good chunk of these in next summer to pay for hotel/house rental stays in Orlando, FL while we visit Disney World.

When travelling for work my employer typically has us staying in Hilton Properties and I now have a Hilton Credit Card. I have 122,000 hilton points, which I value at .5 cent each, for a total value of $610. There are a few hotels located in convenient places for us that are only 10,000 points per night, most hilton properties are 20,000+ points per night and multi-room suites are outrageous.

I acquired a Choice hotels credit card and have so far racked up 48,000 points. For the most part Choice does not charge extra points for multi-room suites, which is a major win for us with having a family of 6. There are several hotels that are in the 10,000 – 12,000 point range that we plan on using in the future. Currently I am putting the bulk of our spending on our Choice Visa card to rack up points for future vacations. I value these points at 1.25 cents each, for $600 total.

All together our points are worth over $2,800.

Action Economics:

Earnings: Originally I didn’t start this blog to make money, so I am thrilled to have some additional income streaming in. I highly recommend starting your own blog for around $50 a year at GoDaddy. I love having a platform to express my thoughts and running a website can be extremely inexpensive, especially compared to the possible rewards. I have friends who run other blogs that earn 10 – 20X what my blog is earning right now.

July Total: $294.47

- Flexoffers: $100

- Amazon: $194.47

- Adsense: $0

August Total: $169.69

- Flexoffers: $0

- Amazon: $169.69

- Adsense: $0

September Total: $196.28

- Flexoffers: $0

- Amazon: $196.28

- Adsense: $0

Action Economics is still averaging a little over $200 per month, even with the changes that have been made to the Amazon Associates program. Currently I am saving all the earnings from this site and putting them towards our “family fun fund”, and it looks like we will be able to completely finance next summers trip to Disney from earnings from this blog.

Traffic:

July: In July I had 15,809 page views with 11,143 from organic search.

August: In August I had 17,643 page views with 10,682 from Organic Search.

September: In September I had 19,536 page views with 11,038 from Organic Search.

I expect to have a bit of a drop off in traffic for October / November. For the last couple years I’ve published at least 1 article a week. In October I skipped 2 weeks due to the long hours I was working. I plan to get back to weekly publishing now.

This quarter has been crazy for our family, thankfully our busy season is wrapping up. I just finished my job that had me working 75 hours per week, and I am now off work for just under 3 months! Doesn’t get any better than that. How has quarter 3 been for you?

Leave a Reply