Why You Should Consider An Adjustable Rate Mortgage

Wait a minute…did I just read that right? No WAY is John C. thinking about advocating for an adjustable rate mortgage! Well, at this point in time it actually makes sense to do in my situation and may make sense in yours as well. A fixed rate mortgage is always seen as the safest, most conservative option to finance a house, but is it? Does it always make sense to get a long fixed rate mortgage?

How Does An Adjustable Rate Mortgage Work:

An adjustable rate mortgage follows a 30 year amortization and for a set amount of years the interest rate is set, usually 3 years, 5 years, or 7 years. 5 year ARMs are the most commonly used. With a 5/1 ARM the rate is set for the first 5 years, then in year 6 the rate can increase by up to 2%. in year 7 it can increase by up to 2% again and in year 8 a final maximum of 1% increase. Today’s 5 year ARMs are around 2.25%. This is the interest rate you would pay for the first five years. In year 6 it would adjust to a maximum of 4.25%, in year 7 it would adjust to a maximum of 6.25% and in year 8 it would adjust to a maximum of 7.25%.

These numbers are the absolute most an ARM holder would have to pay. The reason the rates can adjust is to remove the interest rate risk from the bank. The interest rate adjustments are tied to an index. It is entirely possible that an adjustable rate mortgage can go lower (although unlikely) when the adjustments occur, they are simply capped at the percents denoted above. As an example, my credit union uses the weekly one year constant maturity treasury. At the time of this writing, this is at .55%. For adjustments the credit union has a margin of 2.75%, while the introductory 5 year rate is 2.375%. If the CMT stayed exactly the same, then in 5 years the interest rate would be 3.3%, which is below the 4.375% max. If the CMT decreased to .25%, then the rate would only adjust up to 3.0%. If the CMT increased to 2% the interest rate would be 4.75%, but because the increase is capped to 2%, the rate could only increase to 4.375%.

What Is The Advantage Of An Adjustable Rate Mortgage:

The real benefit to an Adjustable rate mortgage is that the interest rate is substantially lower than a 30 year fixed rate mortgage. Adjustable rate mortgages are great for people who:

- Have a very large loan balance

- Plan on selling in under 6 years

- Plan on paying off the house, or at least the majority of it in under 6 years

- Believe interest rates will stay the same or decrease in the next 5 years

Sam at Financial Samurai swears by adjustable rate mortgages and has saved over $500,000 in interest fees by using adjustable rate mortgages. He has refinanced his Adjustable mortgage multiple times when rates dip low, keeping the mortgage from ever adjusting up.

What If Mortgage Rates Increase?

It doesn’t matter, at least for the first 5 years. At the first increase for year 6 you will most likely be paying around what a 30 year mortgage was to begin with. You can always refinance and chances are rates in 5 years on a 5/1 ARM will still be lower than rates on a 30 year fixed mortgage are today, due to the spread of around 125 basis points.

What If Mortgage Rates Decrease?

If mortgage rates decrease you can always refinance again. Sam at the Financial Samurai has refinanced his mortgage several times as rates have fallen over the last decade. Refinancing multiple times can be costly because of the closing costs associated with each transaction. The higher your mortgage value is the less of a concern these fees are. For example, going from a 2.5% to a 2% loan will save someone with a $1 Million balance around $5,000 in the first year, more than enough to cover the entirety of the closing costs. For someone with a $100,000 balance the refinance will only save $500 in the first year, so someone with a lower balance might need rates to decrease by .75% or even 1% for it to make sense to refinance.

How And When Will I Pay Off The House?

An adjustable rate mortgage does not force you to save money quickly, of course neither does a 30 year mortgage. Yes a 10 year and a 15 year fixed rate mortgage do this, but when I’m personally paying off the house at a faster clip than a 10 year mortgage, the advantage of the fixed rate mortgage goes away. A fixed rate mortgage is perfect for people who don’t trust themselves to save or to put extra money on the house. Since I don’t have that worry, I no longer believe that I need to confine myself to this one option. My mortgage is currently .75% higher than today’s 30 year mortgages. Even with an aggressive payoff strategy I can still save some money on a refinance.

With that being said a 2.25% adjustable rate mortgage changes my strategy for paying off my house a bit. Currently I have a 4.25% fixed rate 30 year mortgage. For me to pay off my house in 5 years with my current mortgage I need to pay an extra $200 per month ($770 total) and $10,000 at the end of each year. The total interest I will pay over this time period is $10,778. In contrast I have paid $23,101 in interest on this mortgage to date. In 2021, the final year the extra payment at the end of the year will be $9,250 instead of $10,000. Currently I am actually motivated to try to pay even more extra than I already am because of the “high” interest rate. refinancing to a 5 year arm and giving myself the full 5 years takes away the need to try to make payments in excess of $10,000.

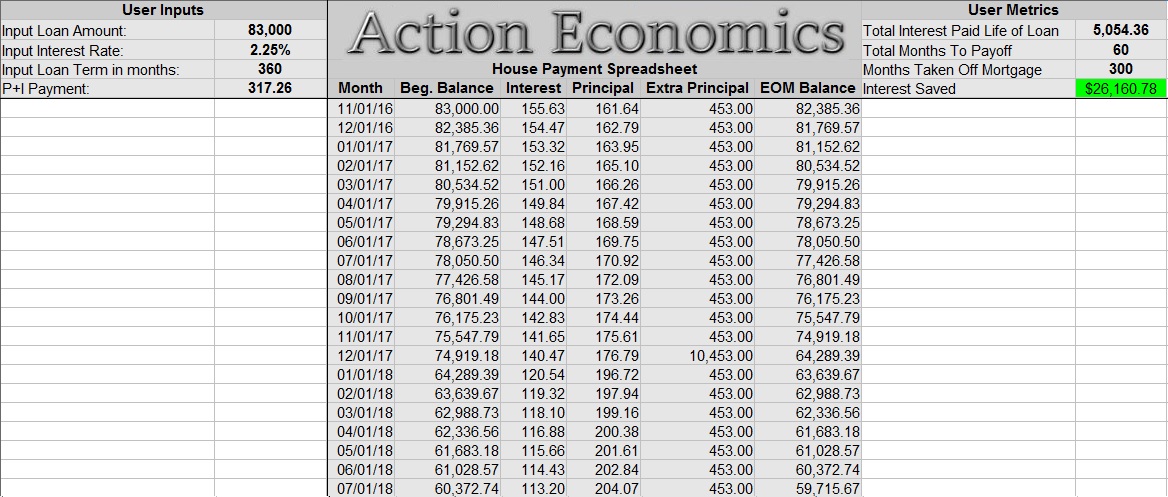

Refinancing to a 5 year 2.25% ARM and making the same monthly payment ($770 total) and paying $10,000 at the end of each year, I will pay $5,054 total interest and in the last year 2021 instead of paying $10,000 extra I will only have to pay $1,850 extra as the mortgage will be paid off, which would be great for cash flow.

After paying $2,000 in closing costs I would save only around $3,700 across 5 years. This isn’t a major savings, but to refinance it only takes around 10 hours of work, I would receive a payoff of roughly $370 per hour for this effort, so I think the refinance is well worth the hassle. The bonus of not having to make a large extra payment in the final year is also a big plus.

One of Mrs. C’s worries about this refinance was if I was unable to work, would she be able to make the house payments off her income, this is the primary reason we went with a 30 year mortgage instead of a 15 year mortgage when we purchased the house. Because this refinance will happen after I pay this years extra principal payment, our total monthly mortgage cost will drop from $570 (which she can afford) to $317. Even at the highest adjustment the payment will only increase to $566, still below our current payment, so even in a worst case scenario the minimum required payments are lowered. I plan on refinancing to an adjustable rate mortgage with LendingTree.com at the end 2017.

Do you have an adjustable rate mortgage? What do you think about refinancing to one now while rates are extremely low? To run different refinance scenarios to see how much money you could save in interest check out my House Payment Spreadsheet.

Note: This post was originally written in August 2016, but not posted until December 2016. During that time frame interest rates rose substantially. While virtually all of this article still remains factual, the actual interest rate used as an example has increased. Due to this I am not seeking a refinance to an adjustable rate mortgage at this time.

Leave a Reply