Guide To The Michigan Homestead Property Tax Credit

I am a big fan of tax credits, but what I don’t like is when they are made unnecessarily complicated…like this one. If you can figure out the ins and outs of this tax credit, it is possible to save up to $1,200 per year. The Michigan Homestead property tax credit is designed to refund some of the property taxes paid by low to moderate earners. One of the great things about this tax credit that I bet very few renters are aware of is that renters are eligible for the credit as well as homeowners! You may want to open up the form (MI-1040CR) on the State of Michigan’s website to follow along. The Instructions for the form can be found on the State of Michigan website.

I am a big fan of tax credits, but what I don’t like is when they are made unnecessarily complicated…like this one. If you can figure out the ins and outs of this tax credit, it is possible to save up to $1,200 per year. The Michigan Homestead property tax credit is designed to refund some of the property taxes paid by low to moderate earners. One of the great things about this tax credit that I bet very few renters are aware of is that renters are eligible for the credit as well as homeowners! You may want to open up the form (MI-1040CR) on the State of Michigan’s website to follow along. The Instructions for the form can be found on the State of Michigan website.

Basic Requirements For The Michigan Homestead Property Tax Credit:

1. The person claiming the credit must live in the home. You can’t get a homestead property tax credit for a home you don’t live it, makes sense right?

2. Must own the home or be under contract to rent the home: Homeowners enter the total of their property taxes owed for the tax year on the form. Renters enter 20% of their rent. This follows the assumption that generally speaking 20% of the rent is to cover property taxes. I really like the concept that renters can also benefit from this tax credit.

3. Total Taxable Value of the property must be under $135,000. This means the market value of the home must be under $270,000. $270,000 buys a really nice place in most areas of Michigan. This high of a limit ensures that the majority of people who qualify on other aspects will not be disqualified based on home value.

4. Total yearly resources must be under $50,000. This is effectively Adjusted Gross Income, plus some other payments. The tax credit is maximized for people earning under $42,000 per year, but you can still get a credit with total resources at $50,000. I personally think that this is really low, especially for larger families and there should be adjustments made to meter the Michigan homestead property tax credit based on family size.

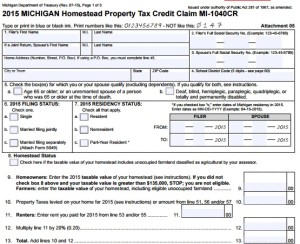

The Michigan Homestead Property Tax Credit Form

Section 1: Lines 1 – 6: Enter all your personal information, including name, address, social security number, school district code, residency status, and tax filing status. All pretty straight forward stuff.

Section 1: Lines 1 – 6: Enter all your personal information, including name, address, social security number, school district code, residency status, and tax filing status. All pretty straight forward stuff.

Section 2: Lines 8 – 13: Enter in the property taxes levied on your home for the year or the total of rent paid for the year. Renters then multiply their rent number by 20% to receive their property tax number.

Section 3: Lines 14 – 28: All household resources are added together to determine total gross household resources. Don’t worry if this number is over $50,000 to begin with, because there will be a deductions section. Household resources includes all wages, dividend income, business income, royalty income, rental income, pension, annuity, IRS/401K withdrawals, Alimony, Social Security, SSI, Child support, Foster care payments, unemployment compensation, gifts or expenses paid on your behalf, and FIP and MDHHS benefits NOT including food assistance. The total of all these income sources is added together on line 28.

Section 4: Line 29 – Line 35: Line 29 is carryover of the number from line 28. Line 30 is titled ‘Other adjustments’ which is for any adjustments to income you would have on your 1040 form, including IRA, 401K, and HSA deductions. Line 31 Asks for all medical insurance premiums you paid for the year. These two lines are added together, then subtracted from Line 29 to arrive at your total household resources. If this number is under $50,000 you are eligible for the credit.

Line 34: Multiply line 33 by 3.5%, Basically the state government believes you should pay up to 3.5% of total household resources towards property taxes. On line 35 This number is subtracted from line 13, which was total property taxes paid. If line 34 is higher than line 13, then you can not claim the credit.

After line 25 the tax form is broken into 3 segments: Senior claimants, Disabled claimants, and all other claimants.

The Michigan Homestead Property Tax Credit For Senior Filers:

Senior Filer take the number from line 35, which is the difference between 3.5% of total household resources and total property taxes paid, and multiply it by a reducing factor based on their total household resources. This number is entered on line 42, with a maximum of $1,200.

The Michigan Homestead Property Tax Credit For Disabled Filers :

Disabled Filers also take the number from line 35, but they do not have to reduce it at all, once again the maximum is $1,200.

The Michigan Homestead Property Tax Credit For All Other Filers:

All other filers take the number from line 35 and multiply by 60%, reducing the number by 40%. This also has a maximum credit of $1,200.

Part 2: Property Tax Credit Calculation: Lines 42 – 44: Enter the amount from line 38, 39, or 41. Once again, the number is reduced based on a table in the instructions. Households with resources under $41,000 receive the full credit, but with each subsequent increase of $1,000 in total resources, the credit is lowered by 10%. I’m surprised at how narrow this tax credit phase out ramps from $41,000 to $50,000

Michigan Homestead Property Tax Credit Examples:

Michigan Homestead Property Tax Credit Example 1 Best Case Scenario:

Bob Owns a House with a market value of $270,000. His taxable value is therefore $135,000. Bob lives in a median taxed district and pay a total millage rate of 25 mills. This amounts to $3,375 per year. Bob is 65 years old and retired and draws a total of $40,000 from his retirement accounts per year. He has no adjustments to income. Bob then multiplies $40,000 by 3.5% to reach $1,400. Bob then subtracts this from his yearly tax bill of $3,375 to reach $1,975. Bob then multiplies $1,975 by 60% because of where his income falls in Table A. This gives him a total of $1,185 to enter on line 42. Bob then needs to reduce the credit based on Table B, but since he is under $41,000 in total resources, no further reduction is necessary. Bob receives a tax credit of $1,185.

Michigan Homestead Property Tax Credit Home Owner Example 2:

Jason owns a house with a market value of $150,000, his taxable value is therefore $75,000. Jason lives in the same tax district as Bob and pays a total millage rate of 25 mills. This amounts to $1,875 per year. Between his income from work, some side business income, and a bit of rental income, Jason’s total household income is $50,000. Jason saves 25% of his income between his 401K and an HSA. He also pays $300 per month in medical insurance. This drops Jason’s Total household income to $33,900. $33,900 * 3.5% = $1,186.50. He then has to reduce this number by 60%. This brings it to $711.90. Because his income is under $41,000 it does not have to be reduced further. He will receive a $711.90 refund.

Michigan Homestead Property Tax Credit Home Owner Example 3:

Steve owns a house with a market value of $75,000. His taxable value is $37,500. He lives in a higher tax area with 40 mills being owed. His total property taxes are $1,500. He earns $45,000 per year and puts 10% into retirement accounts, dropping his total household resources to $40,500. $40,500 X 3.5% = $1,417.50. Subtracted from the property taxes owed takes us to $82.50. He then has to multiply this by 60%, which makes it $49.50. Since his total household resources are under $41,000 it does not get reduced further; Hey, an extra $50 ain’t bad.

Michigan Homestead Property Tax Credit Home Owner Example 4:

Ted owns a home worth $200,000, so the taxable value is $100,000. He lives in the most expensive tax district in the county, paying 46 mills, for a total tax bill of $4,600. He earns $70,000 per year, but saves $21,000 in retirement accounts, bringing his total household resources to $49,000. $49,000 X 3.5% is $1,715. Subtracted out from $4,600 gives him $2,885. This number is then multiplied by 60% dropping it to $1,731. Since the maximum is $1,200 it drops to $1,200. Since Ted’s income is between $48,001 and $49000, he must reduce it in accordance with Table B to only 20%. This drops his credit from $1,200 to $240.

How Do Renters File For A Michigan Homestead Property Tax Credit?

Renters use the same tax form as home owners. Renters enter the total rent paid towards the end of the form in Section 5. They then take this amount and move it up in the form to line 11 and then multiply it by 20%. The property tax credit is then calculated in the exact same way that a homeowners credit is calculated, with the 20% value of total rent paid being used in place of an actual property tax bill.

Renter Example:

Susan rents a home and pays $600 per month in rent. Her total rent payments for the year total $7,200. She then multiplies this by 20% to get $1,440, which will be used in place of a tax bill. If her income is $25,000 per year. She multiplies this by 3.5% to get $875. Subtracted out from the property taxes gives her $565. This is then multiplied by .6 to reach $339. Because her income is under $41,000 she receives the full tax credit of $339.

Other Options To Save On Michigan Property Taxes:

The Michigan Homestead Property tax credit is an excellent way to save money on your tax bill, however due to its narrow income requirements many people won’t qualify. If your property taxes are too high look into ensuring you have filed a principal residence exemption and challenge your property tax assessment if it is out of line.

Although the Michigan Homestead Property Tax Credit is overly complex, it is still a great credit to be aware of and can result in tax savings of up to $1,200 per year. There are very few ways to reduce state income taxes in Michigan, and this is a great option to look into. Other states may also have a homestead property tax credit as well.

Have you ever filed for a Homestead Property Tax Credit?

Leave a Reply