How To Save Money on Car Insurance

Michigan has some of the highest premiums in the country for car insurance. This is largely due to the unlimited protection for personal injury through our no fault system. Originally the no fault system with unlimited protection was put into place to keep car accidents out of the court system. Over time, the costs associated with the unlimited protection factor have become enormous.

Michigan has some of the highest premiums in the country for car insurance. This is largely due to the unlimited protection for personal injury through our no fault system. Originally the no fault system with unlimited protection was put into place to keep car accidents out of the court system. Over time, the costs associated with the unlimited protection factor have become enormous.

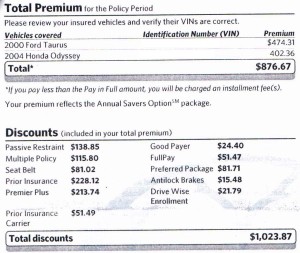

Michigan is the only state in the country to have an unlimited personal injury protection limit. There is a current proposal in the Michigan legislature to change this limit to $10 Million, which would make Michigan’s rate be only 200X higher than the $50,000 limit that New York has, the next highest in the country. Because we as individuals have little control over what happens in the legislature, here are some tips that have worked for me to lower our premiums. Currently Mrs. C. and I pay roughly $42 per month per vehicle on our insurance policies, but we have had it as low as $36 a month (as shown in the image above).

1. Shop Around: It is truly amazing how much quotes can vary between carriers. Running the same scenarios on the same vehicles we have had quotes of over twice what we are currently paying.

2. Multi Policy: By having both our vehicles and our home insured with the same company we are saving $115 a year. I think we also get a discount on our home insurance for having a bundle policy.

3. Run a new credit check: According to the insurance companies having stronger credit relates to fewer claims. Most likely your insurance carrier doesn’t update their credit inquiry every year you renew. Asking for them to perform a new credit check can change your ranking with them and earn a decent discount. Our insurance carrier has 9 tiers for credit, when we asked them to rerun this number which hadn’t been updated for several years our score improved greatly and saved us around $200 a year.

4. Increase Deductible: Changing a deductible from $500 to $1,000 or even $2,500 if you don’t mind the risk can save several hundred on monthly car insurance premiums.

5. Install tracking software: Just for trying out their drivewise program we get a 10% discount. The program measures time of day, distance traveled, hard breaking events, and speed. We put a lot of miles on our vehicles so it is unlikely that we will continue to get a discount on this, Drivers who qualify can get up to a 30% discount using this program. I don’t like that even if we have an “A” rating in every other category, driving a lot of miles completely eliminates any discount. I suppose I “drive less” is another way to save some money on car insurance (and gas too).

6. Pay In Full: We save $50 for the year by going with the pay in full option. Some insurance carriers will also charge a billing fee for those paying monthly, which probably brings are savings closer to $100 for this category. I like to save as much money as possible by paying for things in full when I can.

7. Don’t get in an accident or get any tickets: In over 5 years we haven’t been in an accident or gotten any tickets, which gives us a large discount from our insurer, $363 to be exact.

8. Drop Full coverage: This makes more sense for people who don’t drive expensive cars, of course this isn’t an option for people with a loan on their vehicles, which is why I frequently hear stories of people paying around $300 a month for insurance for one vehicle; YIKES! Cheaper insurance rates might be an extra motivator to pay off a car loan, because this is another area where having a car loan increases other expenses.

9. Keep insurance coverage: I’m not sure when it the spectrum of time you get the best discount for this, but in 1 year our discount increased from $228 to $394 for prior insurance. keeping a car insured is the best way to get this discount. Instead of cancelling insurance on a vehicle we weren’t driving we had them change it to a storage policy.

10. Watch the discounts: From 2012 to 2013, having the same exact vehicles our discounts went up from $1,023 to $1,658, but our premium actually increased from $876 to $1,158. Just because they show a large discount doesn’t always mean you are actually saving that money. These places play games with the numbers so from time to time an extra phone call is needed to keep them in check.

What do you do to save money on car insurance? How much do you have to pay per vehicle per month?

Leave a Reply