Retirement planning in your 20s is imperative to establishing a great retirement. Although the amount you can save in your 20s may seem small, starting early allows for many extra years of compounding growth. Starting in your 20s can mean retiring several years ahead of your peers who choose to wait. In your 20s there are many barriers that make retirement planning difficult. Educational expenses, establishing a household, and having children are all competing factors for our earnings, which in your 20s are lower than what they will be in your 30s, 40s, and 50s. In my 20s I have had all of these competing expenses and have done fairly well in setting up a good base for saving for retirement, of course I have made some mistakes along the way which also impacted my retirement savings.

Retirement Planning Actions I Took In My 20s

Setting up a retirement account in my teens: I started my

Roth IRA at age 16 with money I earned mowing lawns. I contributed to it fairly sparingly in my teens, but having a general idea of what a retirement account was and taking small steps made it easier to contribute more in my 20s. Setting up accounts for minors is much easier now than it was in 2002, and I think all parents should assist their teenage children in setting up a retirement account. Having all of the administrative leg work done before hand removes one major hurdle.

Establishing an emergency fund: Mrs. C. and I have been able to stay out of debt because we have always kept a cash cushion. Our

emergency fund is set at 6 months worth of expenses and at times has dipped to only 1 month of expenses following major unplanned expenses. My emergency fund was initially set up with the money I saved while working in fast food when I was 17 and 18 and still lived at my parent’s house. I saved 75% of my income and most of this went to either my emergency fund or my Roth IRA.

Living frugally and maximizing the utility of my income: Being a young parent and starting out making minimum wage I learned really quick how to live frugally. The vast majority of stuff we own we bought used at thrift shops and garage sales. We’ve driven beater cars and been very careful with improvements to our home.

Becoming a home owner quickly:

I bought my first home at Age 20. Getting established quickly in life is a big help towards building wealth. Even though being a home owner adds many expenses, it also helps with building wealth. Buying a home early on a 10 year or 15 year mortgage builds wealth quickly, and even if you pay nothing extra, buying a house at even 25 with a 15 year mortgage mean it will be paid off by age 40, how many 40 year olds do you know who are mortgage free?

What I Would Do Differently In Retrospect To Plan For Retirement

Negotiate Wages: In my early 20s I didn’t negotiate at all, I just took whatever offer a company made to me, It didn’t take me too long to realize that I was leaving money on the table. In one conversation with a co-worker I found out that I was making $5 an hour less than him, even though I had more experience. It’s still uncomfortable for me to ask for a raise, but in doing so I have increased my rates substantially.

Put more focus on earnings in my early 20s: The career I am in requires travelling a lot and when my kids were very young I avoided travelling as much as possible. I turned down over $100,000 of income in my early 20s, which would have made a big difference in where my retirement accounts are right now.

Waited to buy our second home: In 2011 at Age 25 Mrs. C. and I were in a position where we could have upgraded to a home that was our

dream house or paid off our starter home. We upgraded, and I love the house we bought and it is well bellow what most people in our income bracket could get approved to buy, but it added $100,000 of debt to our lives. Having a paid off home for even a few years would have helped with saving more money towards retirement, and who in their twenties has a paid off house?

What I’m Doing Now To Plan For Retirement:

Focusing On Income: I have started negotiating my pay better and have been harnessing my network to get more jobs, and better paying jobs throughout the year. This year it looks like I will have increased my income 30% over last year. I have recently taken some additional training and gained important certifications in my field to help me progress to higher paying positions as well.

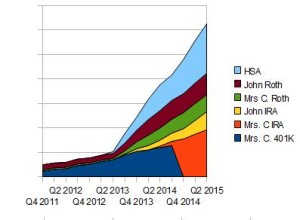

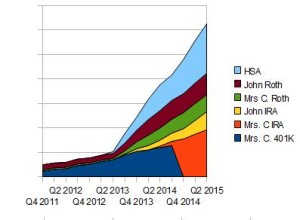

Maximize Retirement Accounts: Since I no longer have to save for a house down payment and our emergency fund is complete, I can put a lot of money into retirement accounts. Between our IRAs and HSA we are

saving 25% of our gross income this year. We are keeping our expenses in check, so as our income increases, so does our percent of income saved.

Tracking

Tracking: I am tracking my net worth progress using

Personal Capital’s Net Worth Calculator, a free app that allows you to easily group all of your accounts together. Currently my net worth chart isn’t too impressive because I just started using it last week, but a year out it will show a nice upward curve. Before using Personal Capital I kept track using a spreadsheet which took a decent amount of time to update and prepare on a quarterly basis. The major upward trend started 2 years ago at age 27.

My Ideal Retirement Plan

By following the steps outlined above I plan on being financially independent by age 45, and certainly by Age 65, thanks to planning for retirement in my 20s. Currently we are working on maxing out our retirement plans and paying extra on the house. Once our home is paid off we will contribute the money that was going towards a house payment into a taxable brokerage account. In retirement we will have multiple stages based on the sources of income we will have available.

Stage 1 Early Retirement Age 45 – 59 1/2: During this stage I may continue to work full time or work part time. In my industry I can earn about half of our planned retirement expenses in a 6 week job. Working one job like this would greatly reduce how much money we need to take out of our investment accounts. Additional living expenses may be covered by withdrawals from our taxable brokerage account.

Stage 2 Age 59 1/2 to Age 65: At age 59 1/2 we can access our retirement accounts with no penalty. Although we could use the SEPP (Standard Equal Periodic Payments) to access our IRA accounts early, we may choose to wait until 591/2 anyways, especially if I am still working.

Stage 3 Age 65 – Age 70: In addition to our traditional retirement accounts at age 65 we will also be able to use our HSA for retirement income. HSA funds are still tax free for health care expenses, but at age 65 withdrawals can be made penalty free for any reason. These withdrawals will be taxed as ordinary income.

Stage 4 Age 70+: We plan on delaying

taking Social Security until age 70 to have the highest guaranteed payments. Mrs C and I both take good care of ourselves and have several relatives who have lived into their 90s. I see Social Security as longevity protection, and will wait as long as possible to take it to take full advantage of delayed retirement credits.

Action Steps For Retirement Planning in Your Twenties and Teens:

1. Seek further education, but keep it cheap, go to community college, use

CLEP exams, and live at home as long as possible.

3. Seek out jobs that offer a 401K with a decent match. Even

McDonalds and Walmart have decent 401K matches for employees.

4. Negotiate Your pay.

5. Start a Roth IRA on Betterment.com.

8. Do your homework before buying a house to make sure you are setting yourself up to build wealth.

9. Don’t get discouraged. The amounts may seem small now, but as your income increases it gets vastly easier to save money. During the final year of my 20s I will be saving more money than I earned during the first year in my 20s.

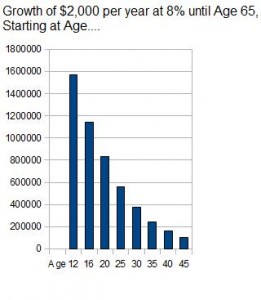

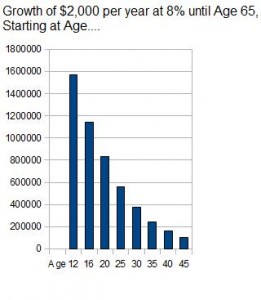

Starting early is the key to having a successful retirement plan. People should start planning for retirement in their teens. Ideally with my children I will help them out by giving them matching funds for their Roth IRAs to help them get started with savings in their teens. If they can save $2,000 and I can match them $2,000 each for the first 5 years from Age 16 to Age 21, then at 8% returns, even if they never add any more money to it, they should have $750,000 by Age 65. Of course they should contribute more as time goes on, but this shows how important retirement savings is early on.

What did I leave out? What do you think twenty somethings should do to prepare for retirement?

John C. started Action Economics in 2013 as a way to gain more knowledge on personal financial planning and to share that knowledge with others. Action Economics focuses on

. John is the author of the book

Retirement planning in your 20s is imperative to establishing a great retirement. Although the amount you can save in your 20s may seem small, starting early allows for many extra years of compounding growth. Starting in your 20s can mean retiring several years ahead of your peers who choose to wait. In your 20s there are many barriers that make retirement planning difficult. Educational expenses, establishing a household, and having children are all competing factors for our earnings, which in your 20s are lower than what they will be in your 30s, 40s, and 50s. In my 20s I have had all of these competing expenses and have done fairly well in setting up a good base for saving for retirement, of course I have made some mistakes along the way which also impacted my retirement savings.

Retirement planning in your 20s is imperative to establishing a great retirement. Although the amount you can save in your 20s may seem small, starting early allows for many extra years of compounding growth. Starting in your 20s can mean retiring several years ahead of your peers who choose to wait. In your 20s there are many barriers that make retirement planning difficult. Educational expenses, establishing a household, and having children are all competing factors for our earnings, which in your 20s are lower than what they will be in your 30s, 40s, and 50s. In my 20s I have had all of these competing expenses and have done fairly well in setting up a good base for saving for retirement, of course I have made some mistakes along the way which also impacted my retirement savings. Tracking: I am tracking my net worth progress using Personal Capital’s Net Worth Calculator, a free app that allows you to easily group all of your accounts together. Currently my net worth chart isn’t too impressive because I just started using it last week, but a year out it will show a nice upward curve. Before using Personal Capital I kept track using a spreadsheet which took a decent amount of time to update and prepare on a quarterly basis. The major upward trend started 2 years ago at age 27.

Tracking: I am tracking my net worth progress using Personal Capital’s Net Worth Calculator, a free app that allows you to easily group all of your accounts together. Currently my net worth chart isn’t too impressive because I just started using it last week, but a year out it will show a nice upward curve. Before using Personal Capital I kept track using a spreadsheet which took a decent amount of time to update and prepare on a quarterly basis. The major upward trend started 2 years ago at age 27.

Leave a Reply