Quarter 4 2016 Financial Update

Quarter 4 was an extremely busy quarter for us. For most of the quarter I was working 75 hours a week. Right around Thanksgiving I had a week off and then went to a 50 hour per week schedule.

Financial Update: Income

Our total income for the year came to $83,865, surpassing our $80,000 target. It should be $231 more, but because of some administrative issues my last check for the year was short, so I should see that income on my next check.

Financial Update: Savings Rate:

To calculate our savings rate we took our gross income, subtracted out income taxes paid, and added in tax returns. Social security income for our nephews is included in our gross income total.

- Gross Income: $83,865

- Payroll + State Taxes: – $5,295

- Net Income: $78,570

Here is a breakdown of our total savings for the year

- Monthly Extra On House: $2,400

- End Of Year Extra On House $6,000

- HSA Contributions: $6,000

- IRA Contributions: $11,000

- Increases in Savings Balance: -$2,200

- Taxable Account $1,200

- Van Purchase $10,000

- Land Purchase $3,000

- TOTAL +$37,400

For the year our savings rate came to 47.5%, including our van purchase and land acquisition as lateral moves with savings. Excluding the van purchase we hit a 35% savings rate. I include the van in our savings rate because we paid cash for it and it did not reduce our net worth. Despite not reaching our extremely ambitious 50% goal, we did manage to save more money than we earned combined in any of our first 4 years together (2005 – 2008).

This savings rate also shows that we exceeded our budget of $36,000. Since we saved $37,400 and had a net income of $78,570, that means we spent $41,170, which is $5,000 over our budgeted expenses. When you back out the $2,150 we spent to pave the driveway and another $2,000 for our Orlando trip (both outside of our budget) that takes us down to $37,000, which isn’t a lot of overspending.

I started a Taxable Betterment account to start taking advantage of historically low Long Term Capital Gains tax and the instant diversification Betterment offers. So far I have put in only $100 per month, but once the house is paid off I will be diverting all the extra money I was putting on the house into my Betterment account.

House Payoff:

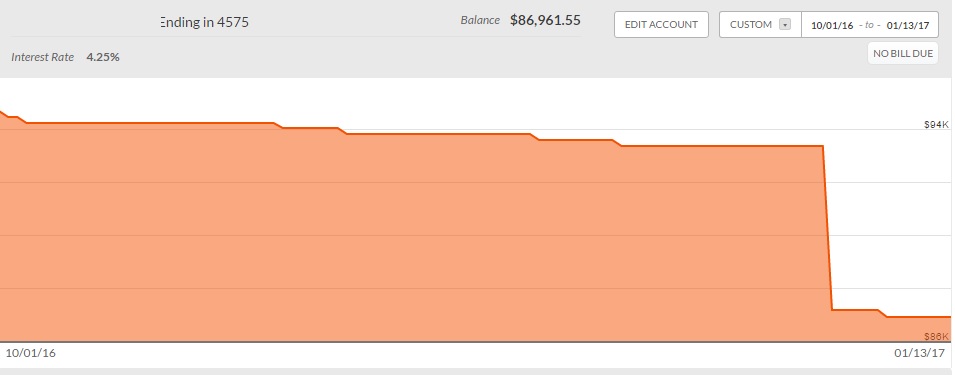

As I discussed in previous posts I fell short of my goal of between $10,000 and $12,000 for extra on the house. I paid $200 per month on the house all year and I made a $6,000 payment in December, for $8,400 total. I love seeing that large drop on my Personal Capital Chart. For 2017 I think we will have no problem achieving a $15,000 – $20,000 payment on the house. We should be paying off our house sometime between December of 2020 and December of 2021.

Financial Update: Retirement Accounts:

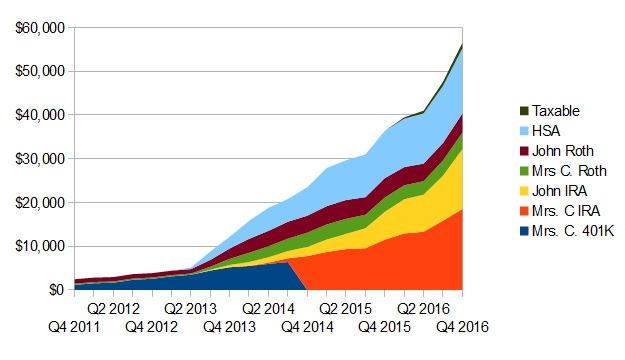

Here’s a snapshot of our retirement accounts over time. You can see the Quarter 2 2013 moment where we started prioritizing retirement savings. Since then we have increased our retirement savings from under $4,000 to over $55,000.

Action Economics:

Earnings: I will start to discuss this on a cash basis vs. accrual.

- October: $413.17

- November: $186.68

- December: $153.79

The majority of the earnings are from Amazon Associates. I made only $5 from spreadsheet sales this quarter. On average, each month the site is earning more money than the yearly cost of it, which is great, and will ensure the long term viability of the site. In October I received a payment from an advertiser that represented multiple months of commissions, so October was skewed higher than the other months. The 6 month trailing average for Action Economics is $232.81 per month. For 2016 Action Economics earned $2,011. For 2017 I would like to see that double to $4,000. I think this isn’t too far fetched. For 2016 revenue grew from $80.64 to $2,011, so a mere doubling should be in the realm of possibility.

Traffic: This quarter I published 13 articles with a total of 21,753 words. I typically build up my articles that are ready to publish during the summer to get me through my long work season of September – May. I’ve exhausted most of these articles, I currently have only 4 articles ready to publish so I need to get to work!

This quarter my google analytics account received a bunch of spam from both referral and social media. I can’t get a precise number on my actual real page views, but it appears to be close to 35,000. Organic traffic has been steady with 23,390 organic page views, an increase of just over 300 from the previous quarter. Our biggest article is still the one I wrote on Building A Monkey Bar Set This article accounts for just under 35% of our search traffic now. My post Living Large on $50,000 A Year: Why It’s not so hard for median earners to get ahead has risen sharply and now accounts for about 26% of search traffic. For the quarter 214 articles were found at least once in search engines.

Goals For 2017:

Keep Earnings Above $80,000: With the work schedule I have lined up for 2017 I think this is certainly achievable. Mrs. C. should be able to increase her hours substantially starting in the summer when I am off work for a couple months and continuing into the fall season as we will be putting our youngest kid into daycare/preschool.

Increase Savings Rate to 50%: We came SO close to hitting this in 2016, achieving a savings rate of 47.5%. In 2017 the savings will be more and it will be more focused with ALL of our savings going towards paying off the house and our retirement accounts. Our cash position is where we want it to be and we don’t plan on having any vehicle upgrades, land purchases, major home improvements, or big vacations. All of this should allow us to save at least $40,000 for 2017.

Our biggest challenges to this are getting braces for our oldest kid and paying for daycare/preschool for our youngest nephew. Phase 1 of the braces costs $3,800 with a $890 down payment and $190 a month for 14 months. Phase 2 will start roughly 10 months after we have paid off phase 1, and that is another $3,800. Daycare looks like this will cost around $2,000 in 2017 for September – December.

Work Fewer Hours: This seems to be counter productive to my above 2 goals, but I think it will be achievable. I plan to cut my hours for my lowest paying job and possibly eliminate it all together. It has proven to be a dead end job and pays 40% less per hour than my other jobs. It’s also night shift, which puts a large strain on our family. One option I’m looking at is insisting on a 4 day work week instead of 5 days when I go back next winter. This would cut my pay with that job by 25%, but would provide for a much better work/life balance. Since my total earnings from this job represent only 12% of our yearly gross this would only cut total income by 3% in 2018 and around 1% in 2017. This is because I work this job from December – February and will not make any changes until December 2017 when the job starts again. If I eliminate this job I will lose 4 weeks in 2017 and 12 weeks in 2018 and beyond. If I did go this route I need to find suitable replacements for 12% of our income, or be willing to go down to the $70 – $75K range in 2018.

Pay Down Mortgage By At Least $17,500: This is a major initiative for this year. My stretch goal is to pay down $22,500 on the mortgage. I think we can generate $40,000 in savings and if we do this goal will be achievable.

Cash Flow Braces For Kid #1: Our oldest needs to get braces in 2 phases. The first phase is to spread out his teeth and the 2nd phase is the actual braces. Phase 1 will start next month and will last for about 1 year, and phase 2 will start about 2 years from now, with each phase costing around $3,800.

That’s it for my 2016 wrap up. How did 2016 fair for you?

Leave a Reply