Quarter 2 2017 Financial Update

This quarter has been intense. I was working upwards of 80 hours a week for a good chunk of the quarter and finished up my spring nuclear outage season in mid May. Since then I have been hanging out with the kids and Mrs. C. has been working more hours. During the 2nd quarter I worked at McGuire nuclear plant in North Carolina, I got to come home to work at the (potentially) final outage at the Palisades Nuclear Plant, followed by a job at Ginna in New York.

I haven’t been just kicking back since I finished up at work. I started a large garden (24 X 16, which is fairly large for me). I also have been working on clearing the trail we have in the woods. It doesn’t take long at all for nature to start reclaiming land you cleared previously. Mrs. C. has started working around 30 hours per week, instead of her normal 12 – 15 hours. The plan is for her to continue to work around this much going forward, as all the kids will be in school this coming fall.

Spending:

Combining Quarter 1 and 2 we have a savings rate of 47% for the first 6 months of the year.

We finished paying for Mrs. C.’s health issues stemming from being diagnosed with Graves disease in January. We paid a total of $2,165 out of pocket. There will still be yearly maintenance costs with this, but most likely nothing on the scale of the initial treatment. We are still paying for our oldest son’s dental appliance which is a precursor to braces at $191 per month. The payments on these should end around March 2018. In theory we should get roughly $565 of the $2,165 back since our max out of pocket is supposed to be $1,600.

In the fun column I paid out $184 for tickets to see Daniel Tiger live at the auditorium in our local community college. I bought 4 tickets for us to take the younger 2 kids to (ages 5 and 4). I could have waited and bought cheaper tickets for around $100 total, but these are great seats and I didn’t want to end up forgetting to grab them. We’re in the 4th row, all together, next to the exit and because of the layout we won’t have to worry about any tall people being in front of the kids obstructing their views.

Mrs. C. and I finally upgraded our phones, it had gotten to the point that the reduced function of our old phones wasn’t worth hanging on to them anymore. For the record, this is only my 3rd smartphone. Mrs. C. and I ordered the Samsung Galaxy Sky phones through straight talk. Using our ebates account we will be getting 10% cash back, plus a $25 gift card on her phone. This drops the true cost of our phone upgrades from $150 to $115. Mrs. C., bought a new one for $100 and I went with a refurbished for $50, which didn’t qualify for the $25 rebate.

We’ve been ratcheting up our discretionary spending, which has been kept to a minimum for several years. We’re saving enough money and earning enough money that it’s okay to utilize some of it. In addition to the above splurges, we also paid $200 to have a large dead tree cut down in our front yard and paid $100 for a new mattress for one of our nephews and $90 for a new computer desk for me. Currently we have the two nephews sharing a room and our plan is to re-arrange our house to turn our office into a 5th bedroom so that all the boys have their own rooms.

Net Worth:

Our net worth is up a total of $36,096 year to date. Our savings rate, a bull market, and our aggressive position in Tesla stock have fueled this big jump. The biggest change is that I am now counting this website as an asset, Since it is producing consistent income I figured it makes sense to count it. I am valuing my site at 3X annual earnings, which I think is actually a fairly low valuation. This accounts for just over $6,000 of that $36,096 increase in net worth.

Investment Breakdown:

- Total Stock Market Index: $7,127

- Mid Cap Index Fund: $7,510

- Small Cap Index: $13,866

- Emerging Markets: $7,296

- Total International Index: $7,490

- REIT Index: $6,646

- Betterment 100% Stock: $2,036

- Tesla Stock: $21,697

- Cash: $1,412

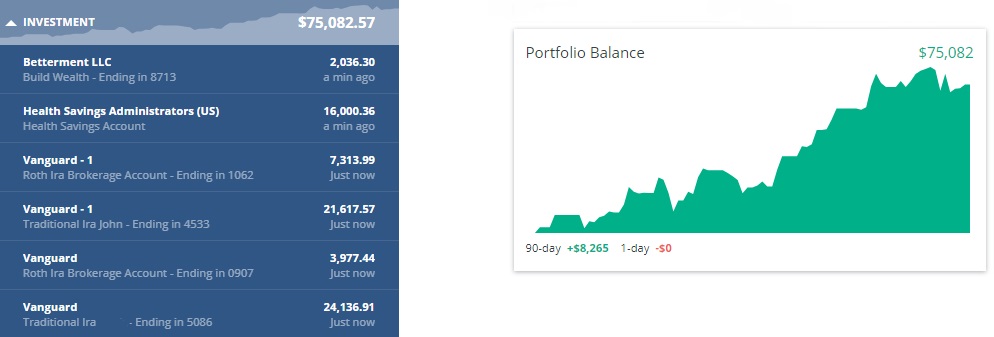

I use Personal Capital to bring all my accounts together. It is so much easier to keep track of my investments using Personal Capital because I don’t have to log into half a dozen different accounts to bring my entire portfolio together. Here’s a chart from Personal Capital showing all our accounts together and the combined growth over the last 90 days. If you want to track your investments like I do, you can sign up for Personal Capital for free.

It’s been just over a year since I purchased Tesla stock initially. It’s amazing how much it has increased since I got in. My average share price is $200, the stock is now trading at around $360, and with the Model 3 launch looming around the corner I think we will see fairly sharp gains over the next 6 months. Long term I think Tesla is in an amazing position for extreme growth, and every single competitor is several years behind. cars will transition to electric from fossil fuels, and not only does Tesla make the best performance and lowest cost practical EVs, they also own the ONLY fast charging network in the world. Imagine if Ford Motors owned all the gas stations early in the 20th century.

Although the current Tesla roofs are incredibly expensive for my tastes and don’t make sense to install on homes that aren’t high priced and in good sunny areas; I think Tesla is very well positioned to lead a transition from centralized power plants to decentralized production. In addition to the home power aspect, what Tesla did on the island of Ta’u in America Samoa can be repeated on many islands throughout the world and it makes a ton of economic sense to do so. With Tesla’s economic advantage in battery production Tesla can also produce many things besides cars, trucks, and power packs including power tools, motorcycles, bikes, and even the rechargeable AA and AAA batteries we use at home. Over the next 10 – 20 years I see Tesla becoming one of the largest companies on Earth.

With that being said, I really don’t like owning individual stocks because they are inherently much riskier than index funds. Right now Tesla is a huge portion of my portfolio thanks to its huge run up this year. I don’t plan to sell any shares, but I am not buying anymore either. As our investment portfolio grows the percent of Tesla stock should shrink, as we are adding $20K+ per year to our portfolios.

This quarter I did some re-balancing and sold half my position in US Mid-cap stocks and invested it in the Vanguard Total International Index Fund. I was really heavy on US equities, and this move helped balance that out. From this wrap up I realize that I need to get my cash position invested as well. We have $1,000 sitting in my HSA account to use for medical expenses, but we stopped using the HSA for medical expenses last year and are paying cash and keeping receipts to cash in against our HSA at a latter date, allowing our HSA to grow. We also have over $400 “orphaned” between our other accounts. I will try to get as much of this invested as possible shortly.

House Payoff:

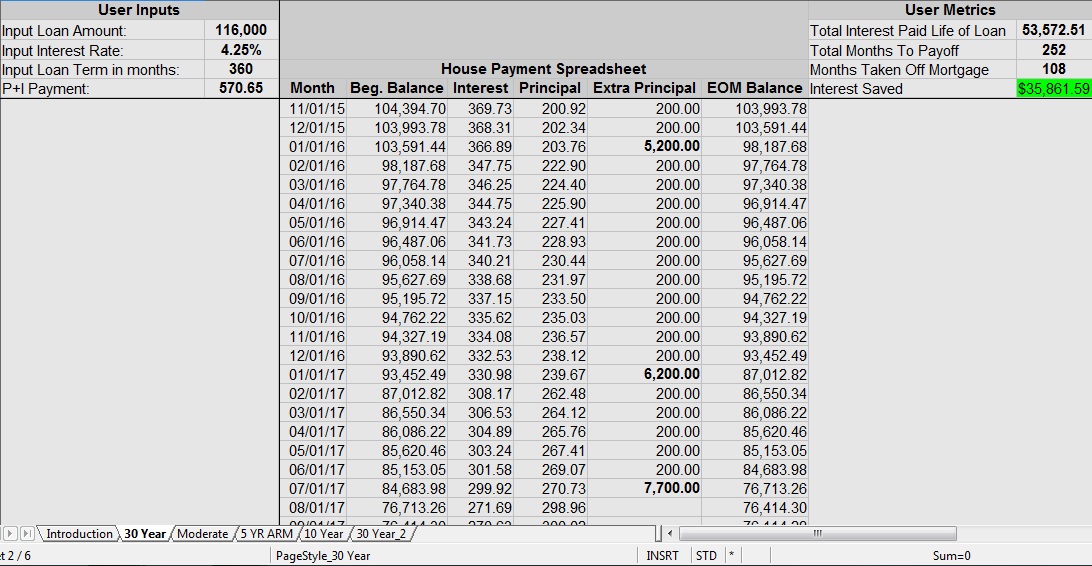

BAM! I just sent $7,500 extra to the bank, dropping our loan to under $77,000. So far I have made a total of $25,850 in extra principal payments, which has reduced total interest paid over the life of the loan by $35,861 and taken 108 months off the loan. I use my mortgage planning spreadsheet to track these extra payments. For a task that takes so long to achieve it helps that I have a way to track my progress and to see how many months I took of the mortgage already. Our cash position had swelled following a busy outage season, so now was a good time to add some on the house. I am also continuing to pay an extra $200 per month and I hope to pay a similar amount at the end of December. At this pace the house should be paid off by the end of 2020. Being 34 with a paid off house is not a bad place to be!

Skymiles and Points:

My Skymiles are at 162,500 and my Hilton Honors points are at 67,500. We just cashed in 10,000 Hilton Honors points for a stay at the Hampton Inn in Seymour, IN on our way down to visit my parents in Bowling Green, KY. There are only a few hotels in the Hilton chain that have such low redemption, it’s nice that this one is located in a good strategic location for us. With this room going for $134 on Hotels.com, our points for this redemption are valued at 1.34 cents a piece. Given that the average Hilton redemption is around .50 cents per point, this is a heck of a deal. One of my employers books us in Hilton Properties the majority of the time we are on the road so I am able to rack up a good amount of points.

I also have 14,120 IHG points, but those will be gone shortly as we are planning a 2 day Chicago trip to take our first trip to Chicago’s Museum of Science and Industry. I’m looking into maximizing the value of my points through credit card bonuses and spending and will have a few articles on that coming up in the near future. Valuing Skymiles at 1 cent a piece and Hilton Honors at .5 cents per piece, I have around $1,962 in points.

Action Economics:

Earnings: Originally I didn’t start this blog to make money, so I am thrilled to have some additional income streaming in. I highly recommend starting your own blog for around $50 a year at GoDaddy. I love having a platform to express my thoughts and running a website can be extremely inexpensive, especially compared to the possible rewards. I have friends who run other blogs that earn 10 – 20X what my blog is earning right now.

April Total: $83.41

- Flexoffers: $0

- Amazon: $83.41

- Adsense: $0

May Total: $98.23

- Flexoffers: $0

- Amazon: $98.23

- Adsense: $0

June Total: $236.87

- Flexoffers: $0

- Amazon: $134.21

- Adsense: $102.66

The changes from the Amazon Associates program have greatly cut into my expected revenue for the quarter. I probably would have earned over 30% more if Amazon hadn’t switched from volume based tiers to category based tiers. I know that I am affected to a much smaller degree than many other bloggers. Google Adsense revenue has been about the same, earning around $100 every 4 – 5 months. I turned down a couple opportunities for sponsored posts this quarter because both submissions were just really poor quality.

For the time being I am contributing 100% of my earnings from this blog to our family fun fund for a Disney trip in 2018. We are currently on track to be able to fully fund the trip with earnings from this blog and using skymiles/points for hotel stays.

Traffic:

April: In April I had 24,183 page views with 11,747 from organic search. In April my article Building Generational Wealth was shared on Rockstar Finance, which gave a decent bump over normal traffic for the month.

May: In May I had 17,694 page views with 12,113 from Organic Search.

June: In June I had 15,083 page views with 10,873 from Organic Search.

In Quarter 3 I will be returning to work in early August for a long project at my home plant working around 75 hours per week. I probably won’t finish up until shortly after Halloween, and then I might have to come back for a couple days in late November to tie up some loose ends that can’t be finished until the plant is ready to go back online. I won’t be working the snow removal job again, so for the first time in my adult life I will be off work with no small kids at home for a couple months! The 7 hours they are at school will allow me to get a lot of work done in our woods and on this blog.

How did Quarter 2 go for you? Any exciting plans for the next few months?

Leave a Reply