Paying For College For Four Kids

Mrs. C. and I have 4 children under our care with a 10 year age range between the oldest and youngest. In 7 years our oldest will be getting ready to start college and from then on we will most likely have kids in college for 13 of the next 14 years. Paying for college will be a steady outflow of cash, but with proper planning will be manageable.

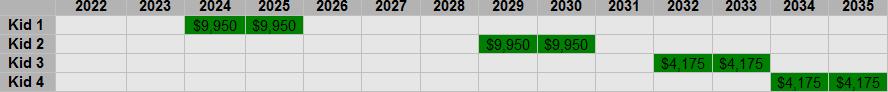

With a cost of $90,000 for a Bachelor’s degree from a public in state school, a worst case scenario could be $360,000 in total costs without any increases in rates, YIKES! Below is what the years they are in college will most likely look like.

Paying For College Through Strong Finances

To start things off, by the fall of 2022 Mrs. C. and I plan to have our home paid off, or at least be extremely close to having it paid off. I am using Personal Capital, a free App, to track my progress. So far the line has a steady downhill slope, but once my checks for this outage season start rolling in I should be able to make a substantial dent in it.

We will also have a solid nest egg saved up, so if necessary we will be able to reduce our retirement contributions without major long term consequences if needed. If our income stays the same without a house payment and without paying extra on the house we will have freed up $20,000 to $25,000 per year in cash flow. With being young parents we did not have time to establish a college fund for our kids and even at this point paying off the house and establishing a retirement nest egg take precedence over setting up college funds. $20,000 of cash flow should be able to completely cover a year at a 4 year instate public school including room and board and a meal plan. This would allow us to cash flow 10 of the 13 years without a problem if all of our kids attended a 4 year school.

Financing The First 2 Years: BH Promise Zone

All of our kids go to a charter school inside one of Michigan’s first promise zones. Kids who graduate from a promise zone school will have all tuition and fees for a 2 year associates degree at an in state community college covered. Whatever amount the kids do not receive in a pell grant, the promise foundation will pay for. This certainly tips the scales in favor of community college. No matter what school the kids go to after this, the final degree is only from that institution.

While going to community college they will be able to live at home, saving even more money. With the Benton Harbor promise zone covering the first two years, the total number of years we are paying for kids in college is greatly reduced, and the overlap we had for three years is now gone. This also delays the start of us having to cover college costs until the fall of 2024. We will use these two years to stockpile the cash that was going towards the house.

Another major plus from looking at this chart is that instead of only having 1 year between kid 1’s last year and kid 2’s first year I will have 3 years to rebuilt a war chest of cash. All in all, this cuts our maximum cost from $360,000 to $180,000, still a ridiculous amount of money though!

Another option is for the kids to attend an early / middle college program and earn an associates degree in high school. A new program in our county is now used in 15 school districts to help students do just that.

Financing the 2nd 2 year Chunk of a Bachelor’s degree:

Since all the kids will have the first two years covered I need to plan on how to pay for the following two years. Current expenses per year at an in-state public school are:

- $12,500 Tuition and Fees

- $4,800 Room and Board

- $4,250 Silver Meal Plan

- $1,200 Books and Supplies

- Total: $22,750

This adds up to roughly $45,500 per kid to finish a Bachelor’s Degree. We can’t do much about the tuition, and the book costs are relatively small, so as far as cost reduction goes our focus will be on room and board and food costs.

1. Room and Board: The cost of living in a double dorm room ends up being $595.50 per month based on a 4 month, 16 week semester. Looking at the housing ads on craigslist I found dozens of listing for between $300 and $350 per month. Many of these locations are close to school, have washer and dryers, and full kitchens. Renting a room in a large house like this is far more cost effective. A $350 per month rental cuts room and board per year from $4,800 to $2,800 per year, saving $2,000 per year, or $4,000 over a two year degree.

2. Food Costs: We have already started teaching our kids how to grocery shop competitively. One of the reasons kids in dorm rooms need to have a meal plan is because dorm rooms don’t have kitchens. By purchasing groceries and utilizing the kitchen in a rented house students can save a fortune. It is entirely possible for a college kid to eat well on under $50 a week. This brings food costs over a 16 week semester to $800 or $1,600 for a year. This saves another $2,650 per year, or $5,300 over two years.

These two major adjustments on how to approach college living cut the total yearly costs from $22,750 to $18,100.

Tax Credits:

The American Opportunity Tax Credit was made permanent in 2009. provided this stays in place we can cut $2,500 off of every year for the kids college costs, starting in their third year of school once the promise zone scholarship has expired. 2 years of school (September – May) actually covers 3 tax years, so most likely they will be able to use the credit for three years. This cuts $7,500 off of the total cost (assuming they have $4,000 in tuition and fees per calendar year).

Using the AOTC for 3 tax years, cuts the per year cost of college by $3,750. On top of the lifestyle changes made above the total yearly cost drops to $14,350.

Pell Grants: It is probable that our kids will not qualify for Pell Grants due to our income and assets. Since we are legal guardians of kids 3 and 4 (our nephews) our income will not count when applying for financial aid. Most likely they will be able to receive close to the max of $5,775 per year for the two years they attend college after earning associates degrees.

Using Pell grants will drop the younger kids total yearly cost to $8,575

With all of these methods of reducing costs, my expected outlays per year are:

This further reduces our total cash outlay to $91,700.

With the house paid off at the latest by May of 2022 all of this cash flow will be available to go towards college expenses. We will also have 27 months at a minimum to stockpile cash before Kid 1 starts his junior year of college. Paying roughly $15,000 per year for 2 years should be easily accomplished.

Once kid 1 is finished we have 3 years before kid 2 reaches the start of his junior year, where we will once again have two years of $15,000 in payments. We then have a gap of 1 year before kid 3 starts his junior year. We will have 4 years in a row between kids 3 and 4 of approx. $8,775 per year.

I plan on reaching financial independence in 2031 and may stop working full time at that point. If this is the case I may work a refueling outage or two to cover the college costs for the two youngest kids out of cash flow rather than dipping into our cash reserves.

Additional Way To Pay For College:

All of the strategies I mentioned above are rather solid. The rest of these plans fall into a perfect situation.

Kid Earnings: We expect our kids to work in high school and in college. An average of 15 hours per week across 2 years in high school and 2 years in college equals 3,120 hours. Even at $10 an hour this is over $30,000. If half of these earnings went towards savings they would have $15,000 saved up by the first semester of their third year and could cover the entire first year. Most likely if we asked them to cover any of the cost it would be for room and board and food. This way we could also keep it “fair” across all 4 kids. This would be $4,400 per year that they would be covering.

In the above data I only put the cost of rent and food at 8 months total to have a valid comparison against the semester prices listed by the university. Although they would have expenses every month, in the off season they could either work more hours to cover rent and food, or come back home for the summer.

If each kid were to cover $4,400 per year in living expenses, then our cost drops considerably to $9,975 per year for kid 1 and kid 2 and to $4,175 for kid 3 and kid 4. This brings our total cost to $56,500; we are a long way from that once scary $360,000 price tag.

Scholarships: I didn’t put any effort into obtaining scholarships and still managed to be awarded $5,000 over my college career. If I could go back in time I absolutely would have applied myself to earning scholarships. I wouldn’t be surprised if these kids on average could earn $2,000 each this way, for a total savings of $8,000.

CLEP Exams: I will encourage my kids to take CLEP exams. Taking just two exams worth 3 credits each will cost $200 and will cut $2,500 off of their tuition bill. Saving $2,200 for taking 2 tests is a big win. Across 4 kids adds up to $8,800. At Western Michigan University the CLEP exam worth the most credit hours is the Spanish Foreign language exam. Based on the student’s score, he will receive between 4 and 16 credits for the test. A score of 50 -55 earns 4 credits, 56 – 62 earns 8, 63 – 67 earns 12, and 68 – 80 earns 16.

Textbooks: By buying my textbooks used and reselling them on half.com I was able to drastically lower the total cost of books for my degree. My estimate is that I saved around $700 per year. Now there are also textbook rental services that can further reduce costs. If each kid were able to save $700 per year for two years, we would save a total of $5,600

These three methods combined could reduce costs by an estimated $22,400, bringing our total cost of all 4 kids to graduate college to $34,100, less than 10% of the original sticker price of a 4 year degree.

What About Price Increase?

I am using today’s prices to see what my total costs will be in a window of time 7 – 20 years in the future. Of course college costs will increase during this time period, but so will my income and savings. I personally do not believe that college costs will continue to rise anywhere near the rate they have in the past because the cost of a 4 year degree is passing the tipping point of being worth it. Current tuition and fees increases on average from 2004 to 2014 have been at 3.5%. Using this figure I can adjust our tuition costs to $15,366 in 2022 and $24,031 in 2035. If I use these numbers our costs for tuition and fees, after tax credits, pell grants, and the kids covering their room and board and food expenses our yearly outlays adjust to:

Even with these numbers, our highest cost year of $17,684 is still well bellow the $20,000 – $25,000 we will have in available cash flow. The total amount comes to just over $121,000, or an average of $30,250 each.

What If College Isn’t Right For My Kids?

While we are talking about uncertainties, I think this is just as important as the unknown future costs of a 4 year degree. It is possible that my kids may want to go into a trade or be entrepreneurs. The world is full of plumbers, electricians, pipe fitters, welders, and other craftsmen who are far out-earning their peers who went to 4 year degree programs.

They say that if you want to hear God laugh, tell him your plans. No matter what we plan, the reality will be somewhat different. There are large elements of chance and circumstance that are constantly changing the world we live in. All we can do is plan our best and take action based on the information we have now. Paying for college for 4 kids will be a major financial undertaking, but once everything is factored in it is completely achievable.

What are your plans for paying for college? Did you have any success stories or lessons learned about paying for college?

Leave a Reply