New Retirement Planning Spreadsheet

A few years ago I made a spreadsheet to track my progress paying off my home early (you can download a customizable copy here for free). When I made this spreadsheet there was 1 box that helped me more that any other with staying motivated, which was the box that showed how many months were taken off my mortgage so far. As of this writing I have taken off 121 months. If I never pay an extra cent on my mortgage from here on out I have taken a decade off my payments. I recently asked myself “What if I could do this for my retirement savings?”

Retirement calculators that you use online are typically too simplistic. You can’t easily compare multiple scenarios, you can’t input future withdrawals, and you can’t input different contributions for different years. These problems leave most online calculators with much to be desired. Several years ago when I first started this website I made a retirement tracking spreadsheet that solved some of these problems but it was ridiculously complicated. I stopped using it for my own tracking purposes for this reason. Since then I have put a lot of planning and effort into building an easy to use and extremely beneficial retirement planning spreadsheet.

Retirement Planning Spreadsheet Version 3:

My retirement planning spreadsheet version 3 has the following features:

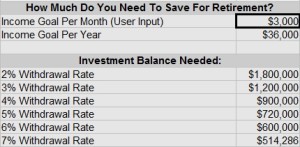

1. Calculate desired retirement amount: In the first sheet you enter how much money you would like to have available to spend per month. Then the sheet calculates how much of a nest egg is needed to reach that level of income based on differing withdrawal rates. This sheet also includes links to articles which talk about different withdrawal rates.

1. Calculate desired retirement amount: In the first sheet you enter how much money you would like to have available to spend per month. Then the sheet calculates how much of a nest egg is needed to reach that level of income based on differing withdrawal rates. This sheet also includes links to articles which talk about different withdrawal rates.

2. Allows independent inputs for contributions and withdrawals for each year: No two years are the same. Since I have started investing I have never contributed the exact same amount to retirement accounts across 2 years, let alone 30 or 40 years. The ability to have these numbers change with every year make this a much more powerful spreadsheet.

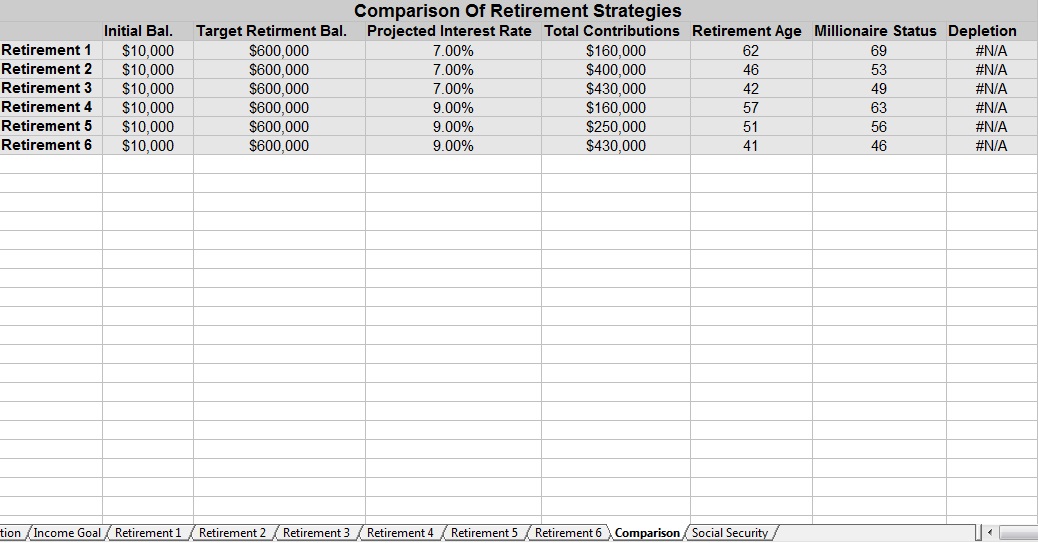

3. Compare 6 different retirement scenarios, with a separate sheet that lists them side by side. This sheet is extremely important in determining which method of contributions is best for you. It also makes it easy to compare scenarios with different interest rates. How I personally use this sheet is that I have 2 sets of 3 different contributions scenarios, I then use the 2 sets to model different interest rates.

4. Easy to use User Inputs and User Metrics section. For the User Input section the user only needs to put in their starting balance, estimated interest rate, retirement target balance, and age. The User Metrics section calculates what year you will hit your retirement target, what year you will become a millionaire, and what year, if any you will deplete your nest egg. It also adds up the total of all contributions made. What’s really fun about this section is that if you keep one sheet as a “to date version” you can see when you can retire without adding anything extra to your accounts. I think this section is a major motivational boost. With such a long term goal it is nice to see exactly when you should cross your retirement threshold and when you will pass the million dollar threshold.

5. Calculates Social Security benefits: This sheet is updated with all the numbers from the Social Security administration for 2018. There is a chart that shows exactly what someone’s benefits will be at age 62, 65, 67, and 70 with differing AIME’s (Average Indexed Monthly Earnings). There is also a spot to input your exact expected AIME and that of your spouse and the sheet will give an exact number for your retirement benefits. Your AIME can be retrieved from visiting SSA.gov and signing up for an account.

6.. Versatility: One of my primary financial goals is to assist my children with building a nest egg early in life. The primary mechanism for this will be matching funds for their retirement accounts. Depending on our ability we will match either 50 cents on the dollar, $1 for $1, or $2 for $1, with a max of $X per year for X years. Using this spreadsheet for our kids all I have to do is change the name on the withdrawals column to “matching contributions” and enter positive numbers instead of negative numbers to account for our matching contributions to our kids retirement accounts.

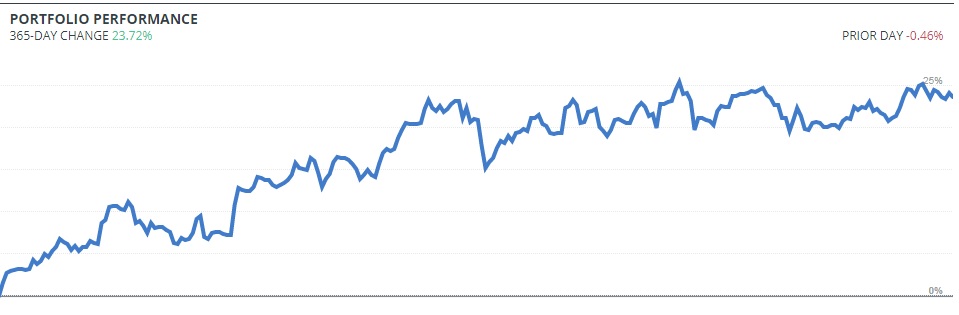

Any feedback on this spreadsheet would be greatly appreciated. I want to continue to improve this spreadsheet (as well as the federal income tax planning spreadsheet and mortgage payoff spreadsheet), and the only way to do that is to receive user feedback. In addition to using this spreadsheet I also use Personal Capital to track my wealth building over time. It’s a free tool and does an excellent job of bringing all my separate accounts to one place.

Do you track your financial future using spreadsheets, online tools like Personal Capital, or good ole fashioned pen and paper?

Leave a Reply