Do I Need Life Insurance?

As J$ pointed out at Budgets Are Sexy, September is Life Insurance Awareness Month. I come across people all the time who either think they don’t need life insurance (and do need it), or think they have enough (when they are substantially under-insured), or think that they can’t afford it (when they can). Life insurance is a gift to not only your dependents, but also to yourself. In 2010 only 44% of U.S. households had life insurance. Do you have the life insurance necessary for your dependents?

What is Term Life Insurance? Term Life insurance is an insurance policy which pays your beneficiaries the value of the plan upon your death, tax free. The policy is good for a set number of years with a fixed premium. As an example, a 20 year term policy of $500,000 would pay $500,000 to assigned beneficiaries in the event of the death of the insured during the 10 year period. The payments are the same every month. With life insurance policies it is extremely important to name beneficiaries and keep the beneficiary form up to date, as well as inform beneficiaries of the existence and amount of the policy. A life insurance policy does no good if your survivors don’t know about it.

Who Needs Term Life Insurance:

Primary Earners: If anyone in the world depends on your income, then you need to have term life insurance. Whether it is young children or a non working spouse, or aging parents, if anyone else needs your income to survive term life insurance is important. A standard rule of thumb is to have 10 to 12 times your annual income in term life insurance.

Loan Co-Signers: If you co-sign for someone else’s student loans, you need to have that person take out a life insurance policy naming you as the beneficiary. The world is filled with horror stories of parents and grandparents who co-signed for tens or even hundreds of thousands of dollars of student loan debt with their children, and had their child pass away unexpectedly. In addition to the hardship of loosing a child they now have an enormous amount of debt that they are on the hook for, without the degree and education to pay it off. A 10 year $100,000 term life policy can be had of an 18 -22 year old for as low as $7 per month.

Stay at Home Parents: What is the value of a stay at home parent? Think about all the things that a stay at home parent does, from child care, to driving kids to and from school, to house work, etc. How much do you think it would cost to hire someone to take on those tasks? Even though stay at home parents have no income, they add an enormous value to the household. Additionally, the Social Security survivor benefits that would be received by the survivors of a stay at home parent likely would not be very much, due to low earnings. Instead of utilizing the 10 – 12X earnings rule of thumb, after factoring in Social Security, I would suggest getting 15 – 20X the value you put on a stay at home parent in term life insurance.

Extra Spousal Protection: With children grown and a large enough nest egg to cover a comfortable retirement, people become self insured and no longer NEED life insurance. Just because it isn’t necessary doesn’t mean it might not be a good idea to have it. Life insurance for non-smoking people is cheap. Let’s say a couple in their 50s has a decent nest egg of $600,000. Using the 4% withdrawal rule would allow for an income of $24,000 per year in retirement. Not bad, but wouldn’t it be nice if one of the partners passed away to give a gift of a much more comfortable life to their spouse? I can see leaving behind an extra $500K to my wife as a present just because the protection is cheap, I think even after being self insured the $40 a month would be worth paying to know she would have that extra cash.

Life Insurance Rip Offs:

Mortgage Life Insurance: Have you ever gotten a letter from your mortgage provider offering mortgage life insurance? Typically after purchasing a home home owners will get these letters for several months. The pitch is that because you have a home with a mortgage debt on it, you should buy term insurance to pay off the house, and they are offering you a sweet deal where you just have to complete a form to get it. The problem is that although they are essentially writing a term life insurance policy, they are charging substantially more than a standard term life policy would charge. The second problem is that over time, your mortgage balance goes down, but they are still charging the same amount per month for coverage! The third problem is that paying off the mortgage isn’t always the top priority for beneficiaries to spend money on when facing a loss of a loved one.

Final Expense Life Insurance: This is the most heavily marketed life insurance product I see. These ads are geared towards people ages 50 to 85 and guarantee that their premiums will never change. They charge a flat $9.95 fee per unit of life insurance and the value of that unit of life insurance is based on the age and gender of the insured.

Colonial Penn offers a 50 year old male a permanent insurance benefit of $1,786 for $9.95 per month. In order to cover a modest $7,000 funeral, he would need to pay for 4 units, a total of 39.80 per month. If a non smoker, he could get a 10 year term policy that would pay out 100 Times the amount for about the same premium! These are a complete ripoff.

Colonial Penn also offers a term life insurance product, but does not divulge the length of the term in their online quotes. For a 50 year old male, they give a quote of $56.76 per month for a $50,000 policy. Once again, IF a non-smoker, a 50 year old man could get a 20 year 250,000 policy for $43.53, a benefit amount 5 times greater for a cost 25% less.

When people talk about being self insured in terms of life insurance, it usually means they have built enough wealth that their dependents will be fine without a large term life policy to replace their income. As far as burial expenses go, being self insured should be covered by a typical emergency fund. I think for the vast majority of people these type of policies are predatory and substantially over priced.

Life Insurance Through Work: Okay, this isn’t a ripoff, but it does provide a false sense of security. Most full time employees are provided with a life insurance policy through their employer, typically 1 -2X their annual salary. This is way less money than what is necessary to replace your income so to begin with this should not be seen as adequate coverage. What happens when you leave your job? that coverage is gone. It could be that in the time you worked for the company, your health has changed and getting insurance now is much more costly than it would have been had you bought it years ago in the private market. Employer provided coverage is a nice extra perk, but it is not enough by itself. Do not let the fact that you have this benefit through work give you a false sense of security about being protected. Another problem with life insurance through work is that if it is purchased through your 401K, which some employers offer as a benefit, life insurance proceeds will then be taxable to your beneficiaries because it was bought with pretax money.

Can’t Afford Life Insurance?

Most people think life insurance costs more than it does. Personally I have a $500,000 20 year policy that costs only $21 per month. For less than the cost of a family meal at McDonald’s I can protect my wife and children with a large enough policy to replace my income. There are three major factors that determine the cost for your life insurance, age, current health, and smoking status. Although the first factor we don’t have control over, the other two we do. Smoking is extremely expensive and unhealthy. Although it is extremely difficult to quit smoking it is possible. If quotes of life insurance are too high due to smoking it may be worth quitting to reduce the cost. By the way, there is a REASON the premiums are 3- 4 times higher for smokers, because smokers are that much more likely to die.

It is worth mentioning that SOME life insurance is WAY better than none. If you are a smoker and life insurance is cost prohibitive, while going through the process of quitting, still get some insurance now. Perhaps instead of getting a $500,000 20 year term which may cost around $75 a month for a 30 year old male, get a $250,000 10 year policy for around $30 a month. Then after a year or two of being smoke free, check to see if you can get a new policy at lower rates.

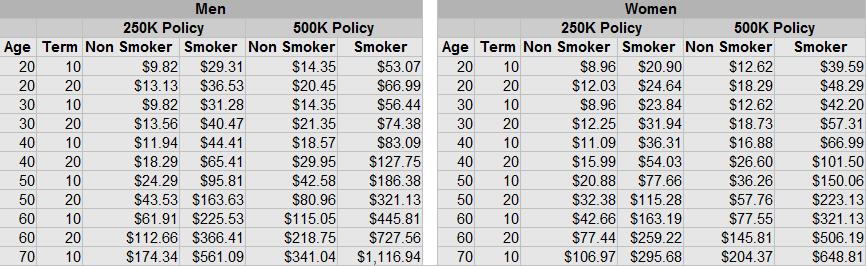

Here is a chart of monthly life insurance costs from Zander Insurance. They have a form online which allows you to run quotes without giving away any personal information. These quotes are for Michigan residents in good health.

It may seem like life insurance is prohibitively expensive in later years, but it may still be worth making the payment. For a 70 year old non-smoking man, $250,000 of coverage can be had for $174 a month, or roughly $2,000 a year. Most people at this age don’t have dependents or are self insured. As an extreme example, my grandfather is currently on his third family and is in his early 70s. His children are the same age as my children. It may very well be worth it for him to pay the equivalence of an average Comcast bill per month to ensure that his wife has a large sum of money to help take care of their children if he were to pass away.

Action Steps:

1) Go to Zander Insurance and price shop for life insurance. Fill out an application and schedule an appointment for a health check. When I got my life insurance they sent someone to the house and the check took about 20 minutes. She did a blood pressure test, took a urine sample and had me fill out a questionnaire, relatively straight forward and painless. 20 minutes of my time for 20 years of coverage, well worth it!

2. Upon getting life insurance fill out the beneficiary information, including secondary beneficiaries as well as the primary beneficiary, and put the policy in a “legacy drawer” so it is easy to access for survivors.

3. Keep tabs on your policy and when it is set to expire. If life conditions change, consider buying more protection.

4. Talk with loved ones to see if they are protected. If you have a sibling or nephew/niece or other relative or friend who truly can’t afford life insurance, consider gifting it to them by paying the premiums for a policy.

No one likes to think about death, especially when it comes to their own death or the death of loved ones. We tend to think that untimely deaths always happen to someone else, but we are someone else to someone else.

Do you have a proper amount of life insurance? If not what is stopping you?

Leave a Reply