Is A Self Directed IRA A Good Option?

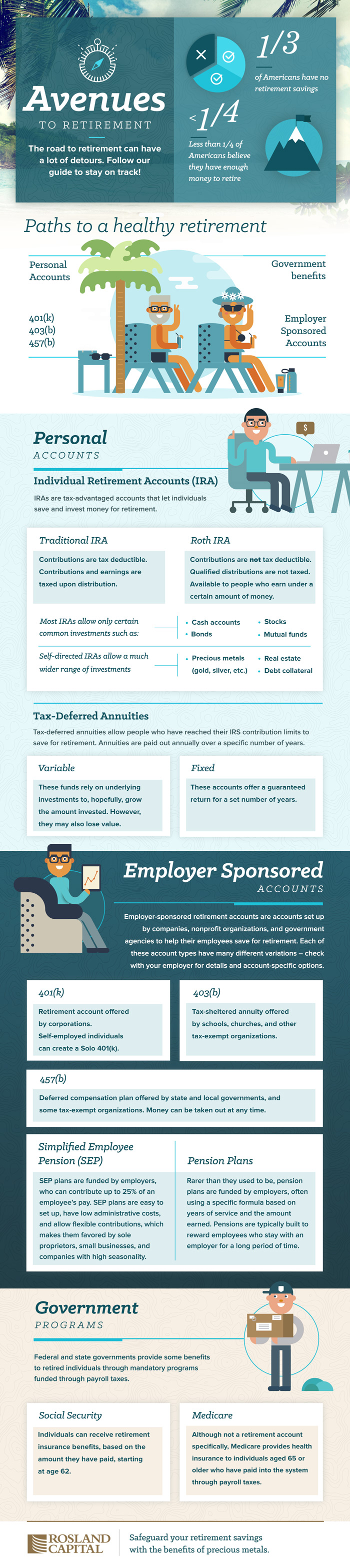

A self directed IRA is just that, an IRA that you, the individual are in charge of what investments are placed in it. Typically most investment firms allow you to invest in stocks, bonds, mutual funds, and that’s about it. With a self directed IRA you have far more options. I first learned about self directed IRAs a couple weeks ago when an infographic was shared with me that got my wheels turning. The infographic shows the problem that the vast majority of Americans are not saving money and then shows all of the different retirement options, including self directed IRAs. Rosland Capital created this infographic (and no this is not a sponsored post).

What Investments Can You Put In A Self Directed IRA?

When people use self directed IRAs one of the key investments is real estate. You can purchase rental real estate, vacant land, or even commercial buildings and put them inside your IRA. When investing in physical real estate there are a few very important rules that must be followed. All money paid for the property and any maintenance or ongoing fees must be paid with funds from the IRA. The owner of the IRA should not be doing any work on the property, which would effectively increase his yearly IRA contribution. The owner of the IRA also can not receive any income from the property until age 59 1/2 and that income would then be treated the same as withdrawals. Any income or gain generated from the property must stay in the IRA. You also can not have your IRA buy real estate from yourself, your spouse, or other close family members. Here’s a great article on investing in real estate through a self directed IRA.

Another investment option is precious metals. With a self directed IRA you buy actual gold and silver coins, which a precious metal company will store for you. Their storage option allows you to own physical gold, but also keeps you from having to worry about storing it yourself, which can be a pricy and risky endeavor. Investing in precious metals is perhaps the easiest and most straight forward alternative investment available to self directed IRA owners.

A third and less common option is investing in businesses. Once again, there are some very strict rules governing the ownership of businesses in an IRA. Any income gemerated from business activites will likely result in UBTI or Unrelated Business Taxable Income. Just because the business is inside of an IRA does not mean the business doesn’t have to pay taxes on its income. I would highly recommend consulting with an attorney before doing any complicated deals such as investing in a business inside of a self directed IRA.

Self directed IRA owners can also invest in other items as well. Tax liens, business debt, and even show horses can be purchased inside of a self directed IRA.

Self Directed Vs. Self Managed IRAs:

Self Managed IRAs are the IRAs most of us use. These are directed by an investment company like E-trade, Betterment, or Vanguard. Self directed IRAs are directed by you, the individual, which gives a lot more options, but also a lot more responsibility. One of the most important aspects to understand is that you aren’t faced with an either or proposition, You can have as many IRAs as you want. If you want to have 20 IRAs, that’s perfectly fine, as long as the total amount contributed across all of them does not exceed the federal contribution limits, which for most people is $5,500 per year. The bottom line is you don’t have to chose one over the other. A key point on self directed IRAs is that it is extremely important to keep track of all documentation and keep an eye on what you are doing to be able to verify you don’t end up on the worng side of the regulations, which could result in steep tax penalties and fines.

Do you have a self directed IRA? Have you ever considered getting one?

Leave a Reply