Betterment: Investing For Retirement Simplified

Over the years I have looked at several different methods for investing for retirement. I love numbers and analysis, but most people don’t. Most people will have glossed over eyes and be bored to tears at the first mention of mutual funds, P/E ratios and asset allocations. The investing world is full of options and you can find articles written by thousands of people suggesting thousands of different complex strategies, thankfully for the majority of people who aren’t interested or are apprehensive about building their own investment portfolio Betterment.com is here to help.

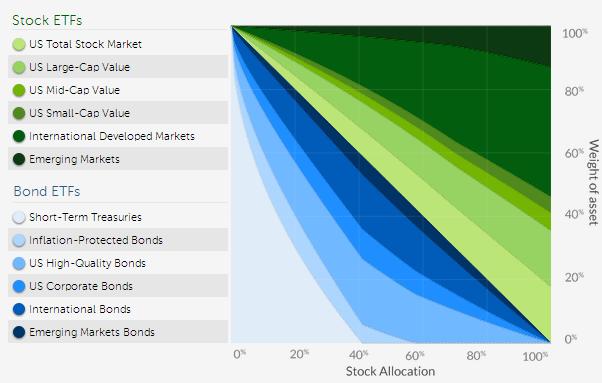

Betterment makes investing easy. With betterment you can set up a Roth IRA, traditional IRA or taxable brokerage account, set up automatic deposits and never have to worry about picking mutual funds or diversification again. The only choice to make is your risk level, which has a sliding scale of 0% stocks to 100% stock allocation.

Diversification through Betterment:

Betterment invests in a range of up to 12 different ETFs, which allows for a significant level of diversification with the first dollar invested. One of the major advantages of investing with Betterment is that none of your money is left sitting on the side lines. When you put money into your betterment account every cent is invested following the asset allocation strategy of Betterment. With a typical brokerage account, you would have to save up the amount each share costs before buying anything. In order to buy even 1 share of the 6 different funds that Betterment invests in in a 100% stock portfolio, you would need around $460 before you could invest, and even then your allocation would not be ideal.

The current asset allocation of a 100% stock portfolio with Betterment is:

- Vanguard Emerging Markets Index(VWO): 13%

- Vanguard International Developed Markets Index (VEA): 41%

- Vanguard US Small Cap Value Index (VBR): 5%

- Vanguard US Mid-Cap Value Index (VOE): 5.7%

- Vanguard US Large Cap Value Index (VTV): 17.7%

- Vanguard US Total Stock Market Index (VTI): 17.7%

I have been asked many times, why do I use an 8% rate of return on all my numbers? 8% is around the long term average for stock market returns. Betterment shows on their site that using a 100% stock allocation model, a lump sum invested in 2004 would have had 8% annual returns through June of this year. This doesn’t even include the gains that would have come through dollar cost averaging along the way. With Betterment you can get a solid rate of return through efficient investing and you don’t have to worry about any complex investing strategies.

Tax Loss Harvesting and TaxMin with Betterment:

Both of these programs offered through betterment can greatly reduce the taxes that are owed on taxable brokerage accounts and traditional IRAs.

Tax loss harvesting is a process in which assets that have lost value and sold, and then immediately replaced with a similar asset. By taking the loss, gains can be offset, and taxable income can be reduced by up to $3,000 per year. Tax loss harvesting through Betterment is automatic, occurs daily and starts once your account balance reaches $50,000.

With the TaxMin program instead of using a general FIFO (first in first out) accounting method on withdrawals, Betterment uses a unique algorithm to determine which share to sell in order to minimize the amount of gain for tax purposes. On their website Betterment demonstrates how with TaxMin they saved a client $3,883 on a $100,000 withdrawal, which equated to a 96.5% savings.

Fees:

When compared to managed funds, betterment is a great deal. Betterment charges a small percentage fee in addition to the fee charged by the individual ETFs. Betterment’s fee is on a sliding scale from .35% of assets to .15% of assets depending on the total value of the account. This fee is well worth it when you consider the hassle and stress that is reduced by going with a “set it and forget it” option, as well as the added efficiency of betterment. With the long term savings betterment provides through diversification and efficient tax management, they more than earn their modest fee. Investing with betterment provides a better investment mix than target date retirement funds as well.

Criticism:

My major criticism with Betterment is that in the 100% stock allocation only 5.7% is put into mid cap US stocks, 5% into small cap US stocks, and 0% into REITs. I think that Betterment is a great foundation for a portfolio, but I would additionally invest funds within my HSA into Mid Cap or small cap US stocks to provide a greater exposure to them in my overall portfolio. I think it also makes sense to have a separate IRA to have at least a 10% investment into REITs.

I recently opened up a taxable account at Betterment and it was increadibly easy.

Action Steps:

1. If you do not have an IRA or Roth IRA, or want to transfer an existing retirement account to Betterment, sign up today. A Betterment IRA is a great option for a 401K Rollover.

2. Set up an automatic draw from your bank account to your Betterment IRA to ensure you are taking advantage of dollar cost averaging.

3. Track your retirement savings to ensure you are on pace to hit your retirement goals.

Do You have any questions about Betterment?

Leave a Reply