Investing In Individual Stocks

When I first started investing back in 2002 I didn’t know much about investing at all. My first investment was 100 shares of Red Hat, a linux company that my dad told me might be a good idea to invest in. I invested in a couple other individual stocks, and I actually did very well overall, out of shear luck. Once I accumulated enough money to buy into a total stock market index fund in my IRA, which was $3,000 at the time, I stopped investing in individual stocks, because by then I had learned that individual stocks carry much more risk than mutual funds composed of thousands of stocks do.

Deciding What Money To Invest In Individual Stocks:

I firmly believe that all retirement funds should be invested in index funds. I can’t in good conscious recomend risking retirement money on what a stock, or even a group of 10 stocks do. With that being said I would define retirement money and financial independence money differently. The money I need to live off of between age 65 and my death is retirement money and my risk tolerance for that money is relatively low. The money I need to live off of between age 45 and 65 on the other hand is a much different story. The odds are certainly in my favor that I will be physically able to work in those years, but I don’t really want to. The money I am investing for early FI can take more risks because it isn’t a necessity.

In practice how this is working out for me is that once my house is paid off, the money that I have been throwing towards the house (which is a SUPER conservative investment) will be free to invest in other avenues, such as individual stocks. Since I am already putting away enough money for retirement that cash flow can go towards individual stocks without my risk meter flying off the handle. I’m about 4 years out from achieving that goal, but I do have a plan in place for HOW I will invest in individual stocks.

How To Choose Individual Stocks:

The risk associated with individual stocks varies greatly depending on numerous factors surrounding the represented companies. You can certainly expect shares in Wal-Mart to be a safer bet than shares in Zanaga Iron Ore.

1. Market Cap: Market Cap is a measurement of how large a company is. A company with a market cap of $100 Billion is a huge company and is more likely to be stable over the long term. A company with a market cap of $100 Million is a small company that has a higher liklihood of both crashing and increasing in value rapidly.

2. P/E Ratio: The P/E ratio is the price to earnings ratio. This number tells you how many times yearly earnings investors are paying for the stock. Amazon, which has defied investing logic for years has a P/E ratio in the stratosphere of 463.23. This means investors are paying 463 times what the company earns for it. To be fair, Amazon agressively re-invests its money and has purposefully ran a low margin business to gain market share over the past 20 years. Apple Computers is on the other end of the spectrum, with a P/E ratio of 10.7. This means investors are only paying 10 times what Apple makes in a year for the stock.

3. Dividend Yield: Dividend yield is how much money the company returns to investors in profit. Dividend yield is a percentage of the stock price. If the stock price is $100 per share and the company pays a 3% dividend, then the shareholder would receive $3 for every share owned.

4. Percent Change: Percentage change is fairly straight forward, this is how much the stock price has moved in the past day.

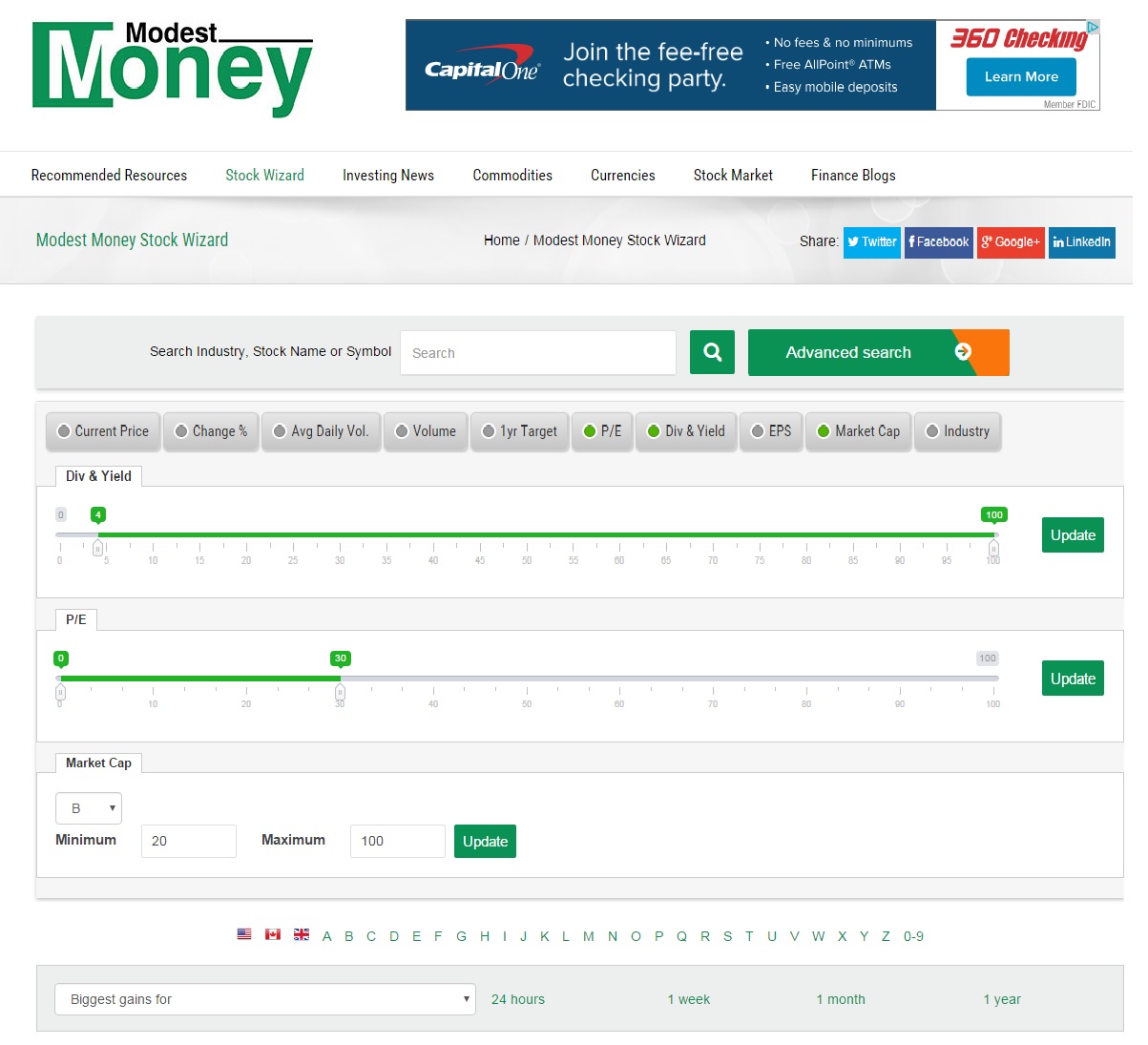

If I were to buy individual stocks I would look at a combination of all of these aspects and I would buy different stocks to balance each other out. For every $1,000 invested in small companies that have a chance to knock it out of the park like Microsoft, Google, Amazon, or Facebook when they first went public I would also invest $1,000 into larger companies that pay a large dividend. Recently I have been playing with Modest Money’s new Stock Wizard App, which allows investors to run screens on all of these different variables to find stocks that fit the metrics they are looking for.

By using this tool I can come up with a list of all the stocks that fit my criteria, but this is only the first step. After narrowing your list down to 10 or 20 stocks, it is VITAL to research each one. Look more deeply into these stocks to see how much ownership of the company the CEO has. Look at how the company has performed during the past 5 years. Look at products and services the company has on the horizon. Look at the dividend history to see how long they have been paying a decent dividend. This research should winnow the field further.

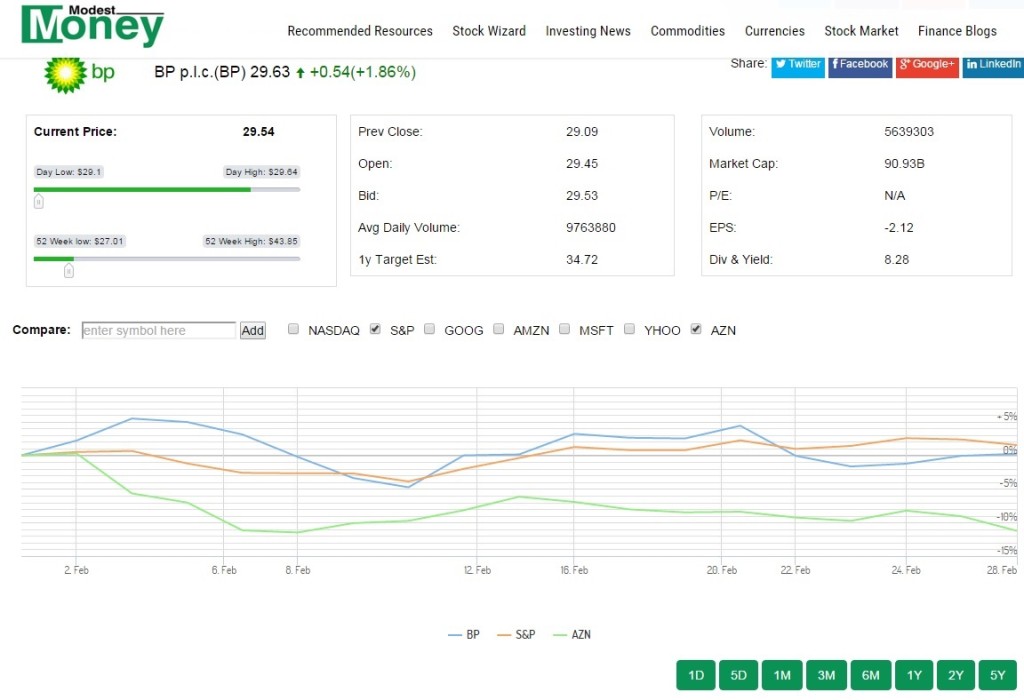

Another aspect I love about Modest Money’s Stock Wizard Tool is that it allows you to compare the performance of multiple stocks on the same graph together over time. You can also add is the S+P 500 Index and the Nasdaq Index as benchmarks for comparison in these charts.

After figured out which stocks would be both a great deal and in line with my overall investing strategy, I would then evaluate wether it makes sense to buy individual shares, or sign up for Motif Investing and create a Motif for the basket of shares I have selected. The major expense with individual stocks is trading fees. With Motif, an investor can put up to 30 stocks in a basket, assign percentages to each stock, and pay only 1 $9.95 fee every time he invests money in the basket of stocks. This essentially allows you to make your own mutual fund. Risk is spread across up to 30 stocks and it only costs 1 price per trade. If I had more than 2 individual stocks I wanted to own I think Motif would be the way to go.

Hazards When Investing In Individual Stocks:

Trading Fees: Most transaction of indiviual stocks cost around $7 per trade depending on what brokerage account you have. This doesn’t sound like much, but this can be a big deal depending on how you invest. Investing in individual stocks can not be done the same way mutual fund investing is done. If you were to contribute $100 per week out of your paycheck into mutual funds the trading fees would typically be non-existent. If you did the same thing with individual stocks you would end up paying 7% of your contributions in fees. When buying individual stocks it is best to deploy larger amount of cash less frequently to limit these fees. Investing $400 once a month would drop the total fee to $7 and the percent of contributions to 1.75%, Investing $1,200 once a quarter would drop the percentage down to only .58%.

Speculating: Speculating is when an investor doesn’t plan to hold a stock for very long. Typically they are expecting a company to have an outstanding earnings anouncement, or they are even just looking at the daily change of a stocks and hoping to ride that wave for a day or two to make a quick buck. Speculating can result in amazing returns in a short amount of time, but can also result in losing everything. A stock that goes up by 60% in a day can just as easily go down by 60% the next day. Speculating also increases commissions because speculators trade much more frequently than long term investors.

Company Stock: Company stock is something that people need to pay close attention to. Most employers offer an AMAZING deal on Employee Stock Purchase Plans, which I think most employees should take advantage of. The problem is that over time, say 10, 20, 30 years the stock position an employee has with his or her employer becomes extremely high, especially because the employee already depends on the company for his wages. If the employer has a bad year its possible he can lose his job AND lose a ton of value in his stock position. I personally would only keep money in an ESPP until the employer allows it to be sold and it has been held long enough to avoid short term capital gains tax. I would then re-invest it into other stocks.

Do you invest in individual stocks? What method do you use for choosing which stocks to buy? Have you tried Motif Investing?

Leave a Reply